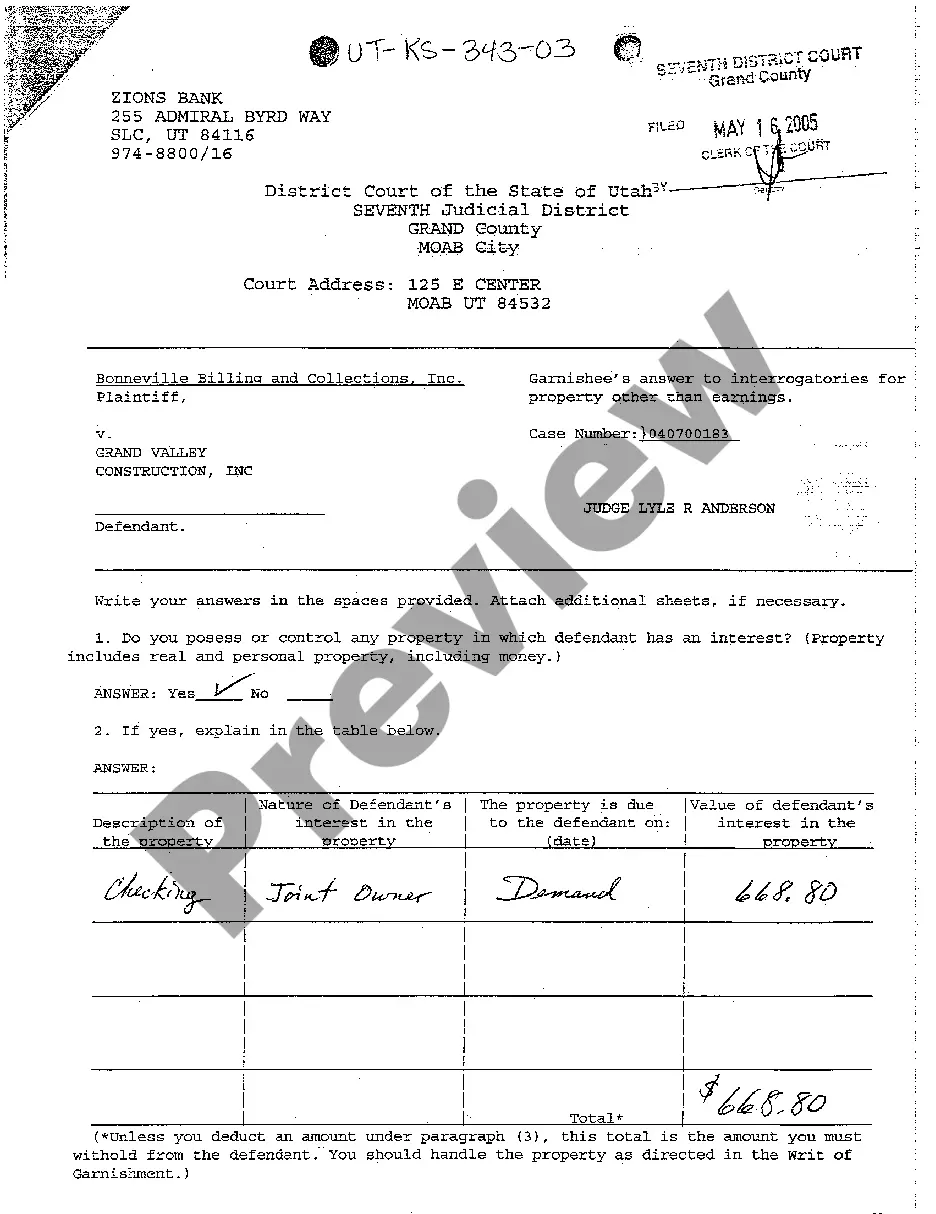

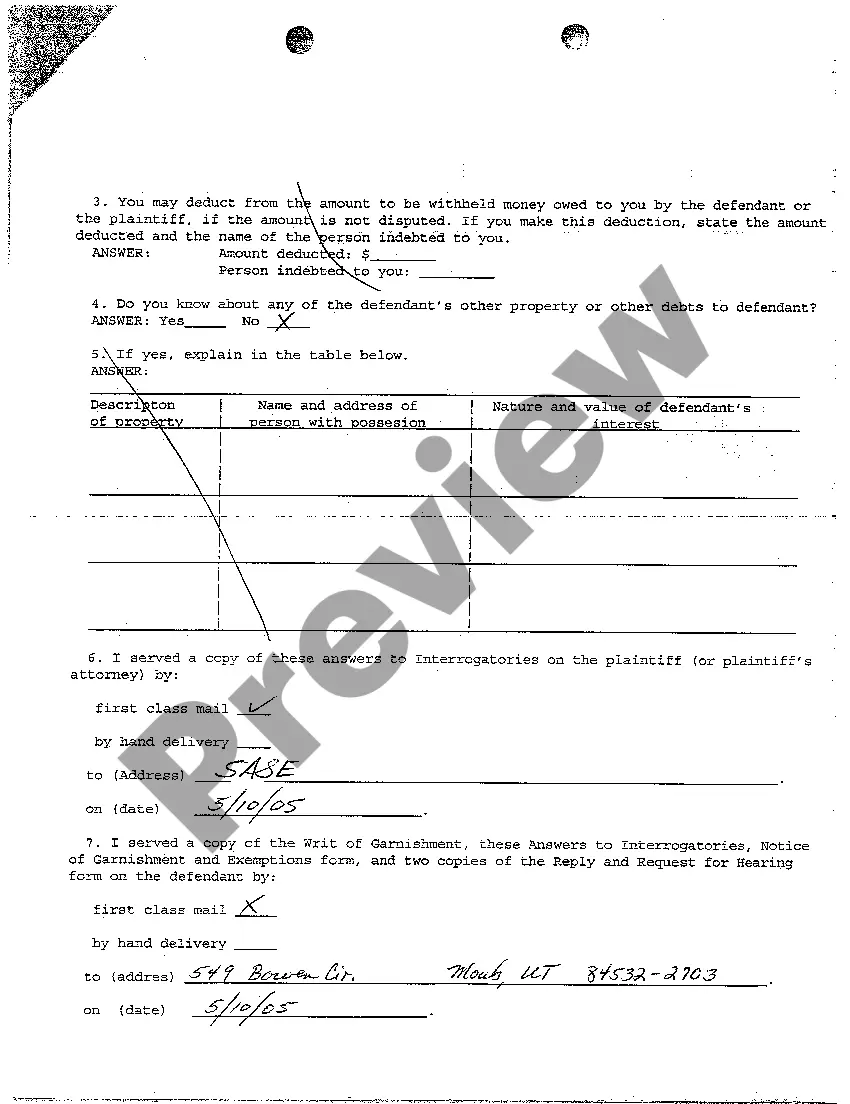

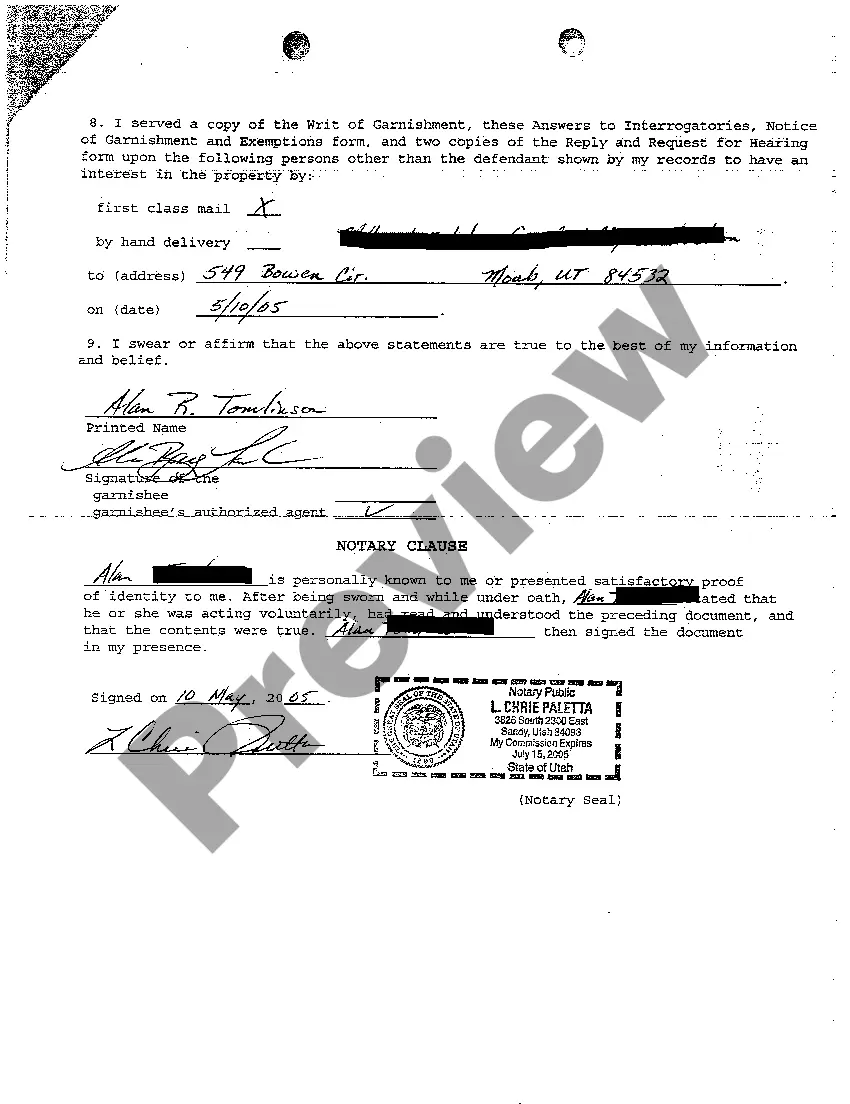

Provo, Utah Garnishee's Answer to Interrogatories for Property other than Earnings is an important legal document that provides information about the assets and property owned by a garnishee in a debt collection process. It is filed in response to interrogatories, which are questions posed by the judgment creditor seeking detailed information about the garnishee's non-earnings properties, such as bank accounts, real estate, vehicles, and other valuable assets. The Provo, Utah Garnishee's Answer to Interrogatories for Property other than Earnings is essential in determining the availability of assets and determining how much can be collected to satisfy the debt owed to the judgment creditor. By providing comprehensive information about the garnishee's non-earnings property, it assists in the effective execution of a garnishment order and ensures that the judgment creditor can recover the amount owed. In Provo, Utah, there might be various types of Garnishee's Answer to Interrogatories for Property other than Earnings, including: 1. Bank Account Interrogatories: This type of garnishee's answer focuses specifically on providing information about any bank accounts held by the garnishee. It includes details such as the bank's name, the account holder's name, account numbers, and balances. 2. Real Estate Interrogatories: This form of garnishee's answer concentrates on gathering information on any real estate or property owned by the garnishee. It includes details about properties' addresses, market values, outstanding mortgages or liens, and any co-ownerships. 3. Vehicle Interrogatories: In this type, the garnishee discloses information about vehicles they possess, including make, model, year, license plate numbers, registrations, and any existing liens or loans against the vehicles. 4. Investment Account Interrogatories: This garnishee's answer type focuses on investment accounts, such as stocks, bonds, mutual funds, or retirement funds owned by the garnishee. It provides details about account names, account numbers, balances, and any restrictions or penalties associated with withdrawals. 5. Other Asset Interrogatories: This category covers any other significant assets owned by the garnishee, such as valuable jewelry, business interests, intellectual property rights, or valuable collections. It requires the garnishee to provide comprehensive information about these assets to determine their value and availability for collection. In conclusion, the Provo, Utah Garnishee's Answer to Interrogatories for Property other than Earnings is a crucial legal document used in debt collection processes. It allows the judgment creditor to obtain a complete and accurate understanding of the garnishee's non-earnings property, helping determine the appropriate steps to collect the debt owed. Different types of garnishee's answers may include bank account interrogatories, real estate interrogatories, vehicle interrogatories, investment account interrogatories, and other asset interrogatories.

Provo Utah Garnishee's Answer to Interrogatories for Property other than Earnings

Description

How to fill out Provo Utah Garnishee's Answer To Interrogatories For Property Other Than Earnings?

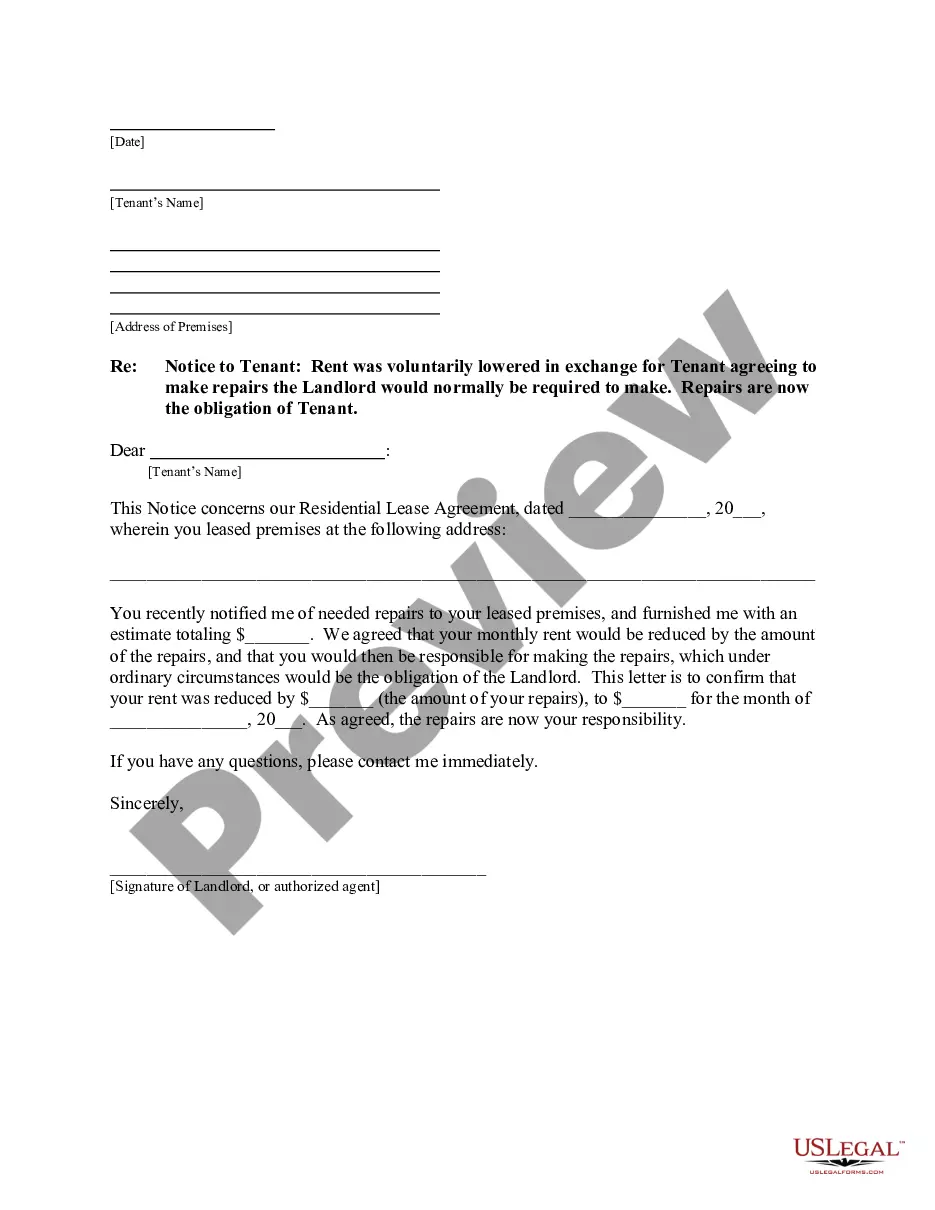

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Provo Utah Garnishee's Answer to Interrogatories for Property other than Earnings or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Provo Utah Garnishee's Answer to Interrogatories for Property other than Earnings complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Provo Utah Garnishee's Answer to Interrogatories for Property other than Earnings is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

Filing for bankruptcy can be an effective way to stop or prevent a wage garnishment. When your attorney files a Utah bankruptcy case, an automatic stay kicks in. The automatic stay acts like a court order that puts an immediate halt to garnishments and most other creditor collection actions.

How long can wages be garnished? Your wages can be garnished until the debt is paid. A writ of continuing garnishment is effective for one year after the date it was served, or for 120 calendar days if another writ of continuing garnishment is served. If the writ expires, the creditor can request a new one.

2. Respond to the garnishment notice. The notice you received in the mail may ask that you complete and return a form (usually a verification of employment) providing information about your business and employee. Return it by the date requested.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Statute of limitations on wage garnishment Some garnishments can run for 60 days, while others last for 20 years. However, the collector may only receive their money until when the debt is paid off. If the garnishment period ends before clearing the debt, the collector can have it renewed.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Description. A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

Respond promptly to the court order (if the order requires). The employer must return a statutory response form within the required amount of time (set by the court order). The form is typically sent to the employer with the garnishment order. Respond quickly to avoid the risk of a court-issued penalty.

The garnishee is the person holding the property (money) of the debtor. An employer may be a garnishee because the employer holds wages to be paid to an employee (who is a debtor).