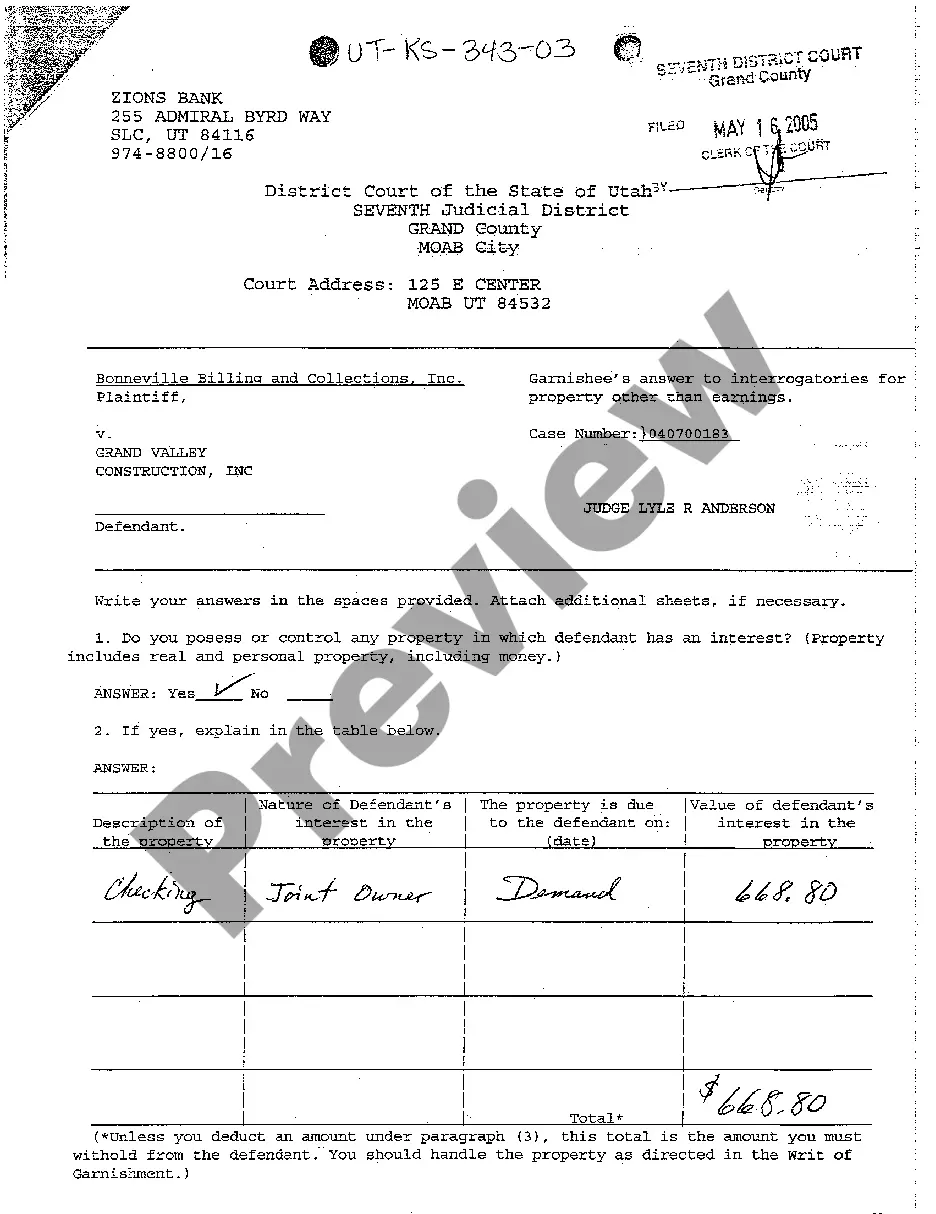

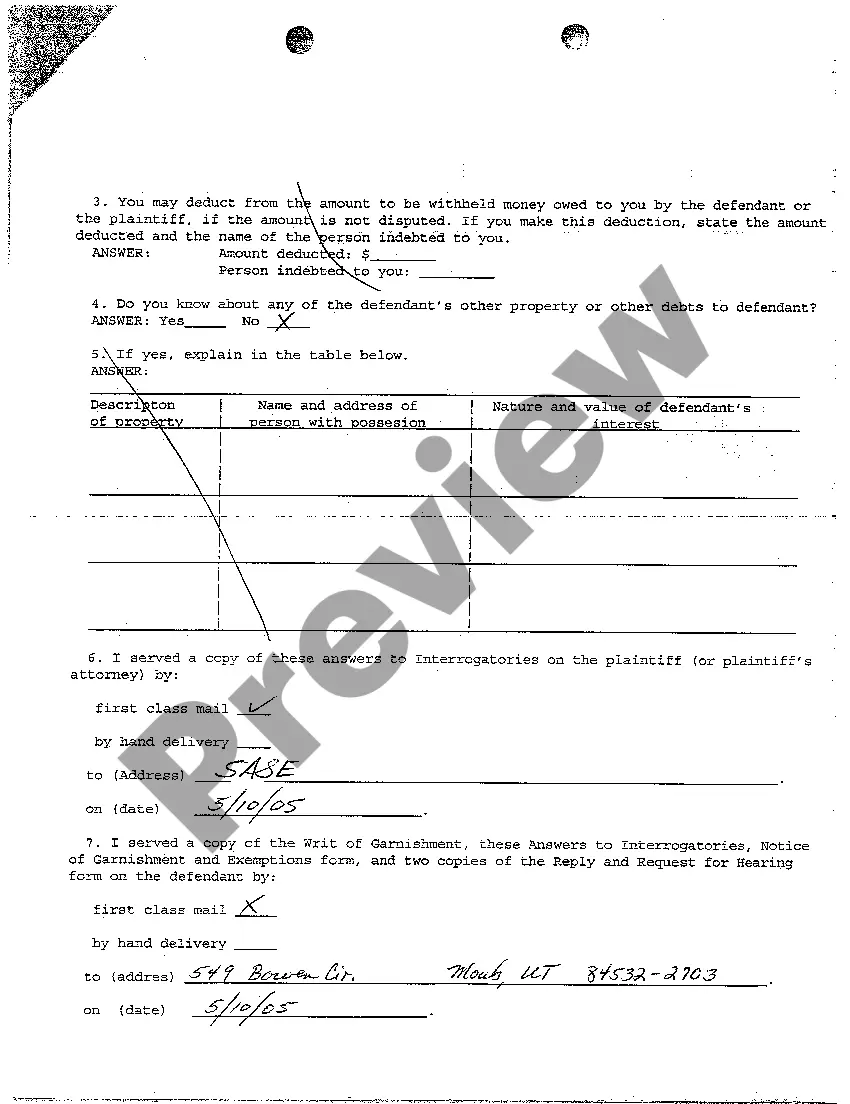

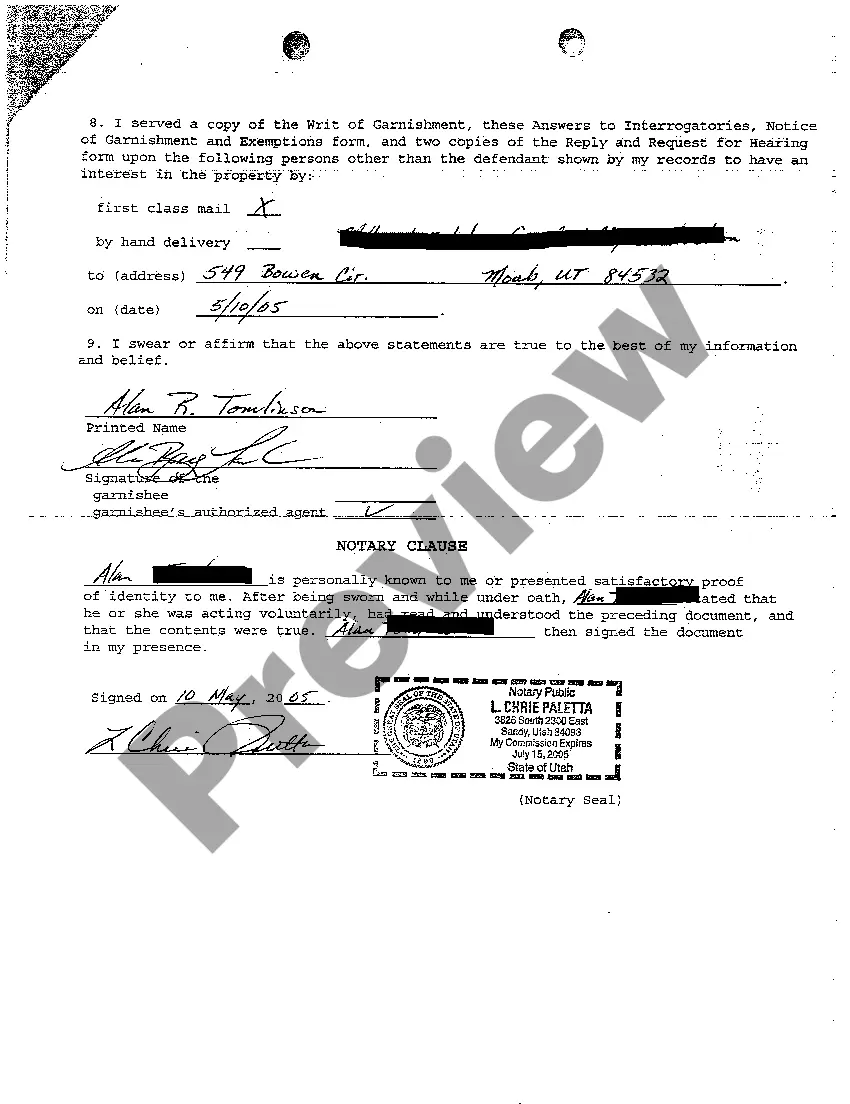

Salt Lake City, Utah Garnishee's Answer to Interrogatories for Property other than Earnings is a legal document used in the state of Utah when a garnishment order is issued against a third party (known as the garnishee) holding property belonging to the debtor. This document allows the garnishee to provide detailed information about the property they hold and any other relevant details regarding the debtor's assets. There are different types of Salt Lake City, Utah Garnishee's Answer to Interrogatories for Property other than Earnings, including: 1. Real Property Garnishment: — This type of garnishment applies to any real estate or immovable property owned by the debtor within Salt Lake City, Utah. — The garnishee is required to provide details about the property, such as its address, legal description, estimated value, and any mortgages or liens against it. 2. Personal Property Garnishment: — Personal property garnishment involves movable assets owned by the debtor, such as vehicles, furniture, electronics, and other valuable items. — The garnishee must disclose the description, approximate value, and location of the personal property in their possession. 3. Bank Account Garnishment: — This type of garnishment targets funds held in bank accounts belonging to the debtor within Salt Lake City, Utah. — The garnishee is obliged to reveal the name of the bank, account number, current balance, and any restrictions or encumbrances on the account. 4. Investment Account Garnishment: — Investment account garnishment applies to securities, stocks, bonds, mutual funds, retirement accounts, and other financial investments held by the debtor in Salt Lake City, Utah. — The garnishee must supply information about the investment account, including the financial institution, account number, type of investment, and value. 5. Business Garnishment: — If the debtor owns a business within Salt Lake City, Utah, their business assets may be subject to garnishment. — The garnishee is required to provide a detailed inventory of the business's assets, including equipment, inventory, real estate, and any other valuable belongings. 6. Miscellaneous Property Garnishment: — This category encompasses any other property not covered by the aforementioned types, such as royalties, patents, copyrights, or any other intellectual property. — The garnishee must disclose the nature, value, and any relevant documentation regarding the miscellaneous property. In conclusion, Salt Lake City, Utah Garnishee's Answer to Interrogatories for Property other than Earnings is a crucial document for disclosing information about various types of assets held by a garnishee regarding a debtor.

Salt Lake City Utah Garnishee's Answer to Interrogatories for Property other than Earnings

Description

How to fill out Salt Lake City Utah Garnishee's Answer To Interrogatories For Property Other Than Earnings?

Take advantage of the US Legal Forms and have immediate access to any form sample you want. Our useful website with a huge number of document templates allows you to find and obtain almost any document sample you require. You can save, complete, and sign the Salt Lake City Utah Garnishee's Answer to Interrogatories for Property other than Earnings in just a matter of minutes instead of browsing the web for hours looking for the right template.

Using our collection is a great strategy to improve the safety of your form submissions. Our experienced attorneys on a regular basis check all the documents to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you obtain the Salt Lake City Utah Garnishee's Answer to Interrogatories for Property other than Earnings? If you have a profile, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips below:

- Find the template you require. Make certain that it is the form you were seeking: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Select the format to get the Salt Lake City Utah Garnishee's Answer to Interrogatories for Property other than Earnings and change and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Salt Lake City Utah Garnishee's Answer to Interrogatories for Property other than Earnings.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!