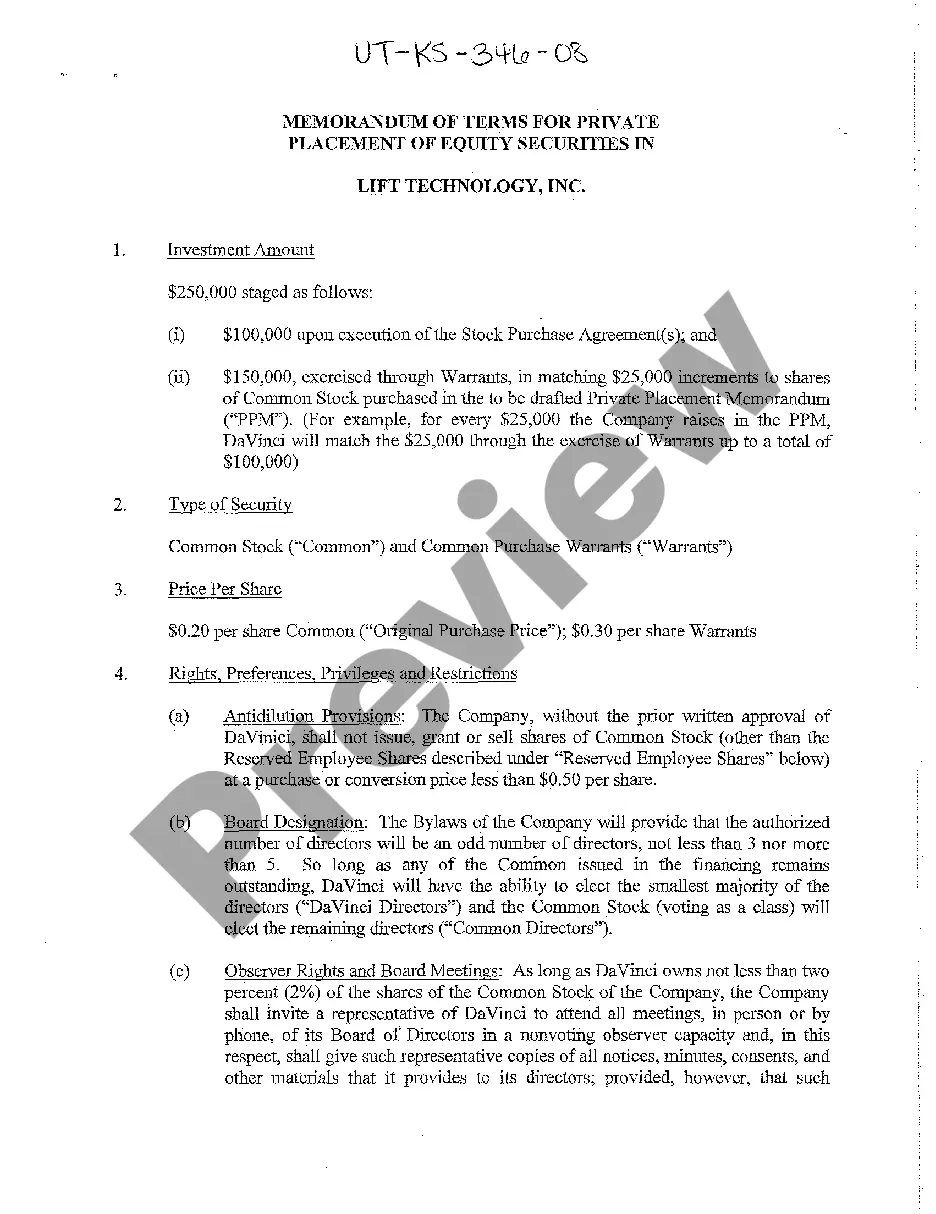

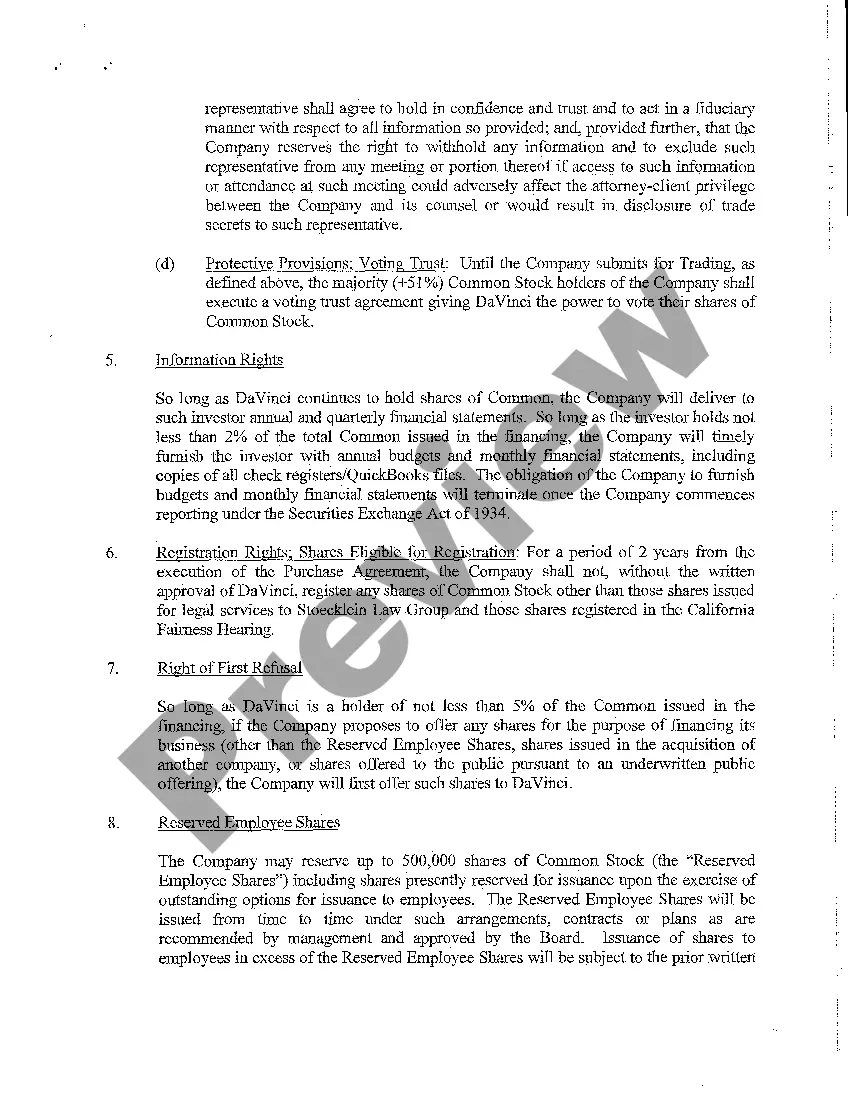

Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant is a legal agreement that outlines the terms and conditions for the private placement of equity securities in a defendant company based in Provo, Utah. This memorandum is essential for defining the rights and obligations of both the issuer and the purchasers of these securities. It provides a detailed framework that governs the offering and sale process, ensuring compliance with state and federal securities laws. Keywords: Provo Utah, Memorandum of Terms, Private Placement, Equity Securities, Defendant, legal agreement, terms and conditions, rights and obligations, offering and sale process, compliance, state and federal securities laws. Different types of Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant may include: 1. Preferred Stock Memorandum of Terms: This type of memorandum specifically focuses on the private placement of preferred stock in the defendant company. It outlines the preferences, rights, and privileges associated with the preferred stock, such as dividend preferences, conversion rights, and liquidation preferences. 2. Common Stock Memorandum of Terms: This memorandum pertains to the private placement of common stock in the defendant company. It highlights the voting rights, ownership privileges, and other rights associated with the common stock. 3. Convertible Securities Memorandum of Terms: This type of memorandum pertains to the private placement of securities, such as convertible notes or convertible preferred stock, which can be converted into equity securities of the defendant company at a later date. It outlines the terms of conversion, including conversion price, conversion ratio, and any other relevant provisions. 4. Warrant Memorandum of Terms: This memorandum focuses on the private placement of warrants, which entitle the holders to purchase additional equity securities of the defendant company at a predetermined price within a specified time frame. It outlines the terms and conditions of the warrants, including exercise price, expiration date, and adjustment provisions. 5. Restrictive Securities Memorandum of Terms: This type of memorandum deals with the private placement of securities subject to certain restrictions, such as lock-up periods or resale limitations. It outlines the terms and conditions related to the transferability and resale of these securities. Overall, the Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant serves as a crucial document that governs the private placement process and ensures compliance with applicable securities laws while protecting the rights and interests of both the issuer and the purchasers.

Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant

Description

How to fill out Provo Utah Memorandum Of Terms For Private Placement Of Equity Securities In Defendant?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Provo Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant is proper for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!