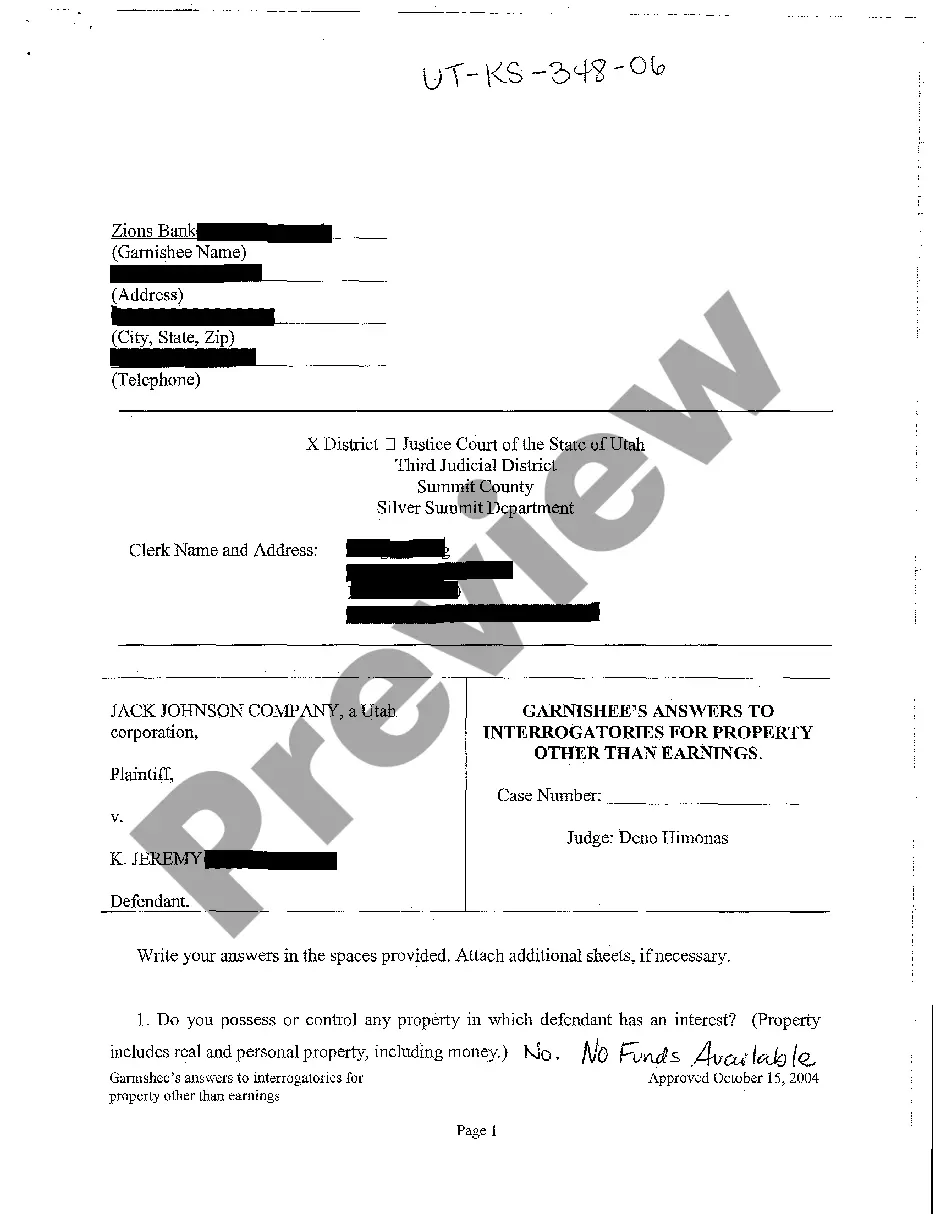

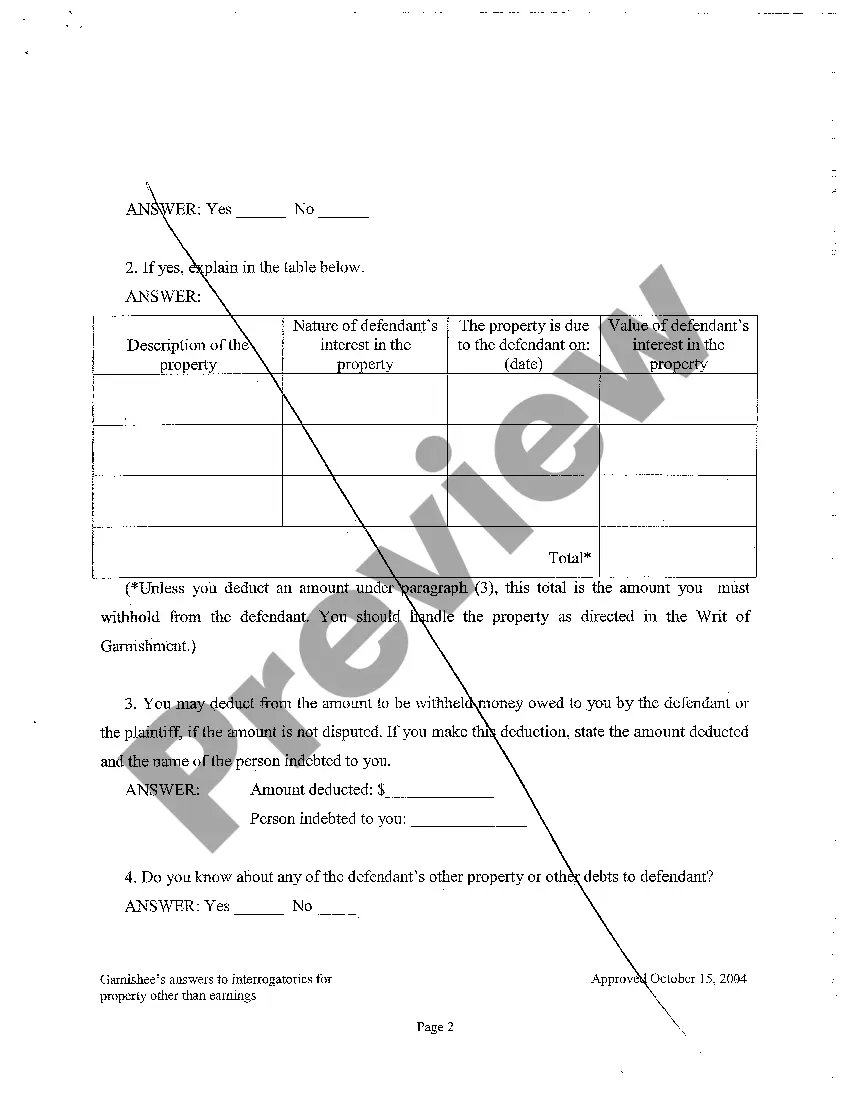

Salt Lake City, Utah is known for its vibrant economy and diverse range of businesses. In the legal realm, one crucial aspect is the process of garnishment, where a third party, known as the "Garnishee," is ordered by the court to withhold funds or assets from a debtor in order to satisfy a debt. When it comes to answering interrogatories in garnishment cases, Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning play a vital role in determining the extent of the debtor's available assets. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning serve as a way for the garnishee to provide detailed information regarding the debtor's non-wage assets. These assets can include real estate, vehicles, bank accounts, investments, and any other property that can be liquidated to fulfill the debt. The garnishee is required to answer a series of interrogatories, which are written questions posed by the judgment creditor or their attorney. These interrogatories are designed to gather relevant information about the debtor's non-wage assets. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning consists of detailed responses to these inquiries, providing crucial insights into the debtor's financial situation. There are different types of Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning, each addressing specific categories of assets. These may include: 1. Real Estate: This category encompasses any properties owned by the debtor, such as residential homes, commercial buildings, or vacant land. The Garnishee must provide details about the property's value, mortgages or liens on the property, and any other pertinent information. 2. Vehicles: Garnishment can extend to various types of vehicles owned by the debtor, including cars, motorcycles, boats, or recreational vehicles. The Garnishee is required to disclose information such as make, model, year, estimated value, and whether there are any outstanding loans or liens. 3. Bank Accounts: This category involves disclosure of any bank accounts held by the debtor, including checking, savings, or investment accounts. The Garnishee must provide details about the account balance, any joint account holders, and whether there are any restrictions or limitations on the account. 4. Investments: Garnishments can also reach investments made by the debtor, such as stocks, bonds, mutual funds, or retirement accounts. The Garnishee must furnish information about the type of investment, current value, and any restrictions or penalties associated with accessing these funds. 5. Other Property: This category encompasses assets that do not fall under the above classifications, such as valuable artwork, jewelry, antiques, or other valuable possessions. The Garnishee is required to provide descriptions, appraisals, and any relevant supporting documentation. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning are an essential component of the garnishment process, facilitating the discovery of the debtor's assets. By providing comprehensive and accurate responses to the interrogatories, the Garnishee allows the judgment creditor to assess the debtor's financial standing and potentially satisfy the debt through the liquidation of non-wage assets.

Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning

State:

Utah

County:

Salt Lake

Control #:

UT-KS-348-06

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Garnishee's Answers to Interrogatories for Property Other than Earning

Salt Lake City, Utah is known for its vibrant economy and diverse range of businesses. In the legal realm, one crucial aspect is the process of garnishment, where a third party, known as the "Garnishee," is ordered by the court to withhold funds or assets from a debtor in order to satisfy a debt. When it comes to answering interrogatories in garnishment cases, Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning play a vital role in determining the extent of the debtor's available assets. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning serve as a way for the garnishee to provide detailed information regarding the debtor's non-wage assets. These assets can include real estate, vehicles, bank accounts, investments, and any other property that can be liquidated to fulfill the debt. The garnishee is required to answer a series of interrogatories, which are written questions posed by the judgment creditor or their attorney. These interrogatories are designed to gather relevant information about the debtor's non-wage assets. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning consists of detailed responses to these inquiries, providing crucial insights into the debtor's financial situation. There are different types of Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning, each addressing specific categories of assets. These may include: 1. Real Estate: This category encompasses any properties owned by the debtor, such as residential homes, commercial buildings, or vacant land. The Garnishee must provide details about the property's value, mortgages or liens on the property, and any other pertinent information. 2. Vehicles: Garnishment can extend to various types of vehicles owned by the debtor, including cars, motorcycles, boats, or recreational vehicles. The Garnishee is required to disclose information such as make, model, year, estimated value, and whether there are any outstanding loans or liens. 3. Bank Accounts: This category involves disclosure of any bank accounts held by the debtor, including checking, savings, or investment accounts. The Garnishee must provide details about the account balance, any joint account holders, and whether there are any restrictions or limitations on the account. 4. Investments: Garnishments can also reach investments made by the debtor, such as stocks, bonds, mutual funds, or retirement accounts. The Garnishee must furnish information about the type of investment, current value, and any restrictions or penalties associated with accessing these funds. 5. Other Property: This category encompasses assets that do not fall under the above classifications, such as valuable artwork, jewelry, antiques, or other valuable possessions. The Garnishee is required to provide descriptions, appraisals, and any relevant supporting documentation. Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning are an essential component of the garnishment process, facilitating the discovery of the debtor's assets. By providing comprehensive and accurate responses to the interrogatories, the Garnishee allows the judgment creditor to assess the debtor's financial standing and potentially satisfy the debt through the liquidation of non-wage assets.

Free preview

How to fill out Salt Lake Utah Garnishee's Answers To Interrogatories For Property Other Than Earning?

If you’ve already used our service before, log in to your account and download the Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Salt Lake Utah Garnishee's Answers to Interrogatories for Property Other than Earning. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!