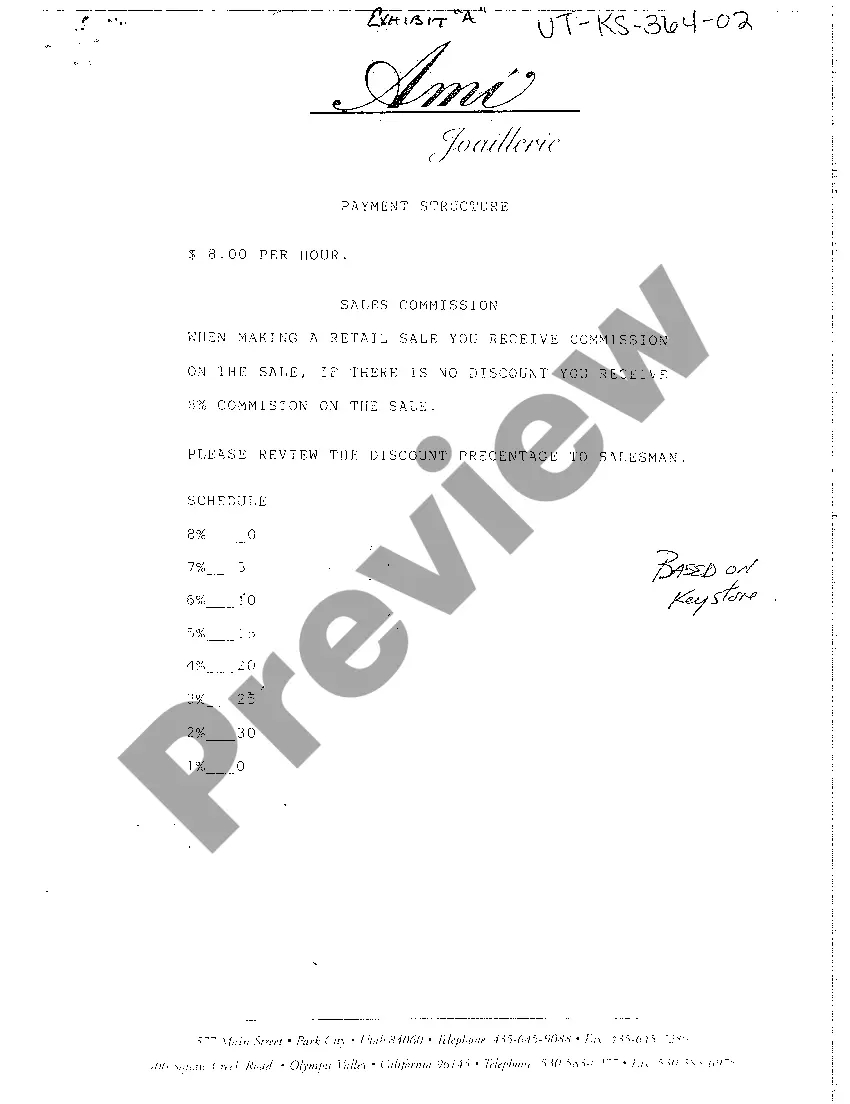

Provo Utah Payment Structure

Description

How to fill out Utah Payment Structure?

We consistently aim to reduce or evade legal complications when handling intricate law-related or financial matters.

To achieve this, we seek attorney services that are often quite expensive.

Nevertheless, not every legal matter possesses the same level of complexity; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always re-download it from the My documents tab. The procedure is equally simple if you're unfamiliar with the site! You can set up your account in just a few minutes.

- Our platform empowers you to manage your affairs independently without relying on legal representation.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to locate and download the Provo Utah Payment Structure or any other document promptly and securely.

Form popularity

FAQ

To cancel your utilities in Provo, you should contact the Provo City Utilities Department directly. They require you to provide your account information and may ask for your final meter reading. This process ensures that your account is closed efficiently and aligns with the Provo Utah Payment Structure guidelines.

In Utah, the living wage varies based on family size and location. As of recent data, a single adult needs to earn about $15.49 per hour to meet basic living expenses. Understanding the Provo Utah Payment Structure can help you determine the financial needs for your specific situation and support your budgeting efforts.

You can file the Utah TC-65 at the address provided for mailing tax returns, which is 210 North 1950 West, Salt Lake City, Utah 84134. Make sure to send it to the right location for efficient processing. For a better understanding of the Provo Utah Payment Structure, consider resources from uslegalforms to guide your filing process.

To file withholding tax in Utah, you need to complete the appropriate Utah withholding tax forms and report deductions periodically. It is important to stay on top of your withholdings to avoid penalties. Tools offered by platforms like uslegalforms can help you navigate the specifics of the Provo Utah Payment Structure and ensure compliance.

Yes, you can set up a payment plan for your Utah state taxes by contacting the Utah State Tax Commission directly. They offer various plans to assist taxpayers in managing their tax obligations. Understanding the Provo Utah Payment Structure may provide options that make handling your tax payments more manageable.

To file payroll taxes in Utah, first obtain the appropriate forms from the Utah State Tax Commission website. Then, calculate the total employment taxes owed based on your payroll records. Familiarizing yourself with the Provo Utah Payment Structure can help streamline your payroll tax filing process and ensure timely payment.

Yes, you must include a copy of your federal return when submitting your Utah state return. This practice helps the state confirm your income and deductions reported on your Utah forms, such as the TC-65. To maintain clarity with the Provo Utah Payment Structure, ensure your filings align with both federal and state requirements.

You should mail the Utah TC-65 to the Utah State Tax Commission at 210 North 1950 West, Salt Lake City, Utah 84134. It's crucial to verify you are using the correct address for the current tax year. Utilizing support from platforms like uslegalforms can ensure you have the right forms and mailing instructions for your Provo Utah Payment Structure.

To file taxes for an LLC in Utah, you need to obtain an Employer Identification Number (EIN) from the IRS. Additionally, you must complete the appropriate state tax forms, including the Utah TC-65 for partnerships or the Utah Form 990 for corporations. Understanding the Provo Utah Payment Structure can simplify this process, ensuring you meet all necessary deadlines.

In Provo, the average utility bill ranges between $150 to $200 per month, depending on family size and usage habits. This expense is a key consideration in the Provo Utah payment structure, impacting monthly budgeting for residents. Ensuring you account for these costs will lead to better financial planning in your new home.