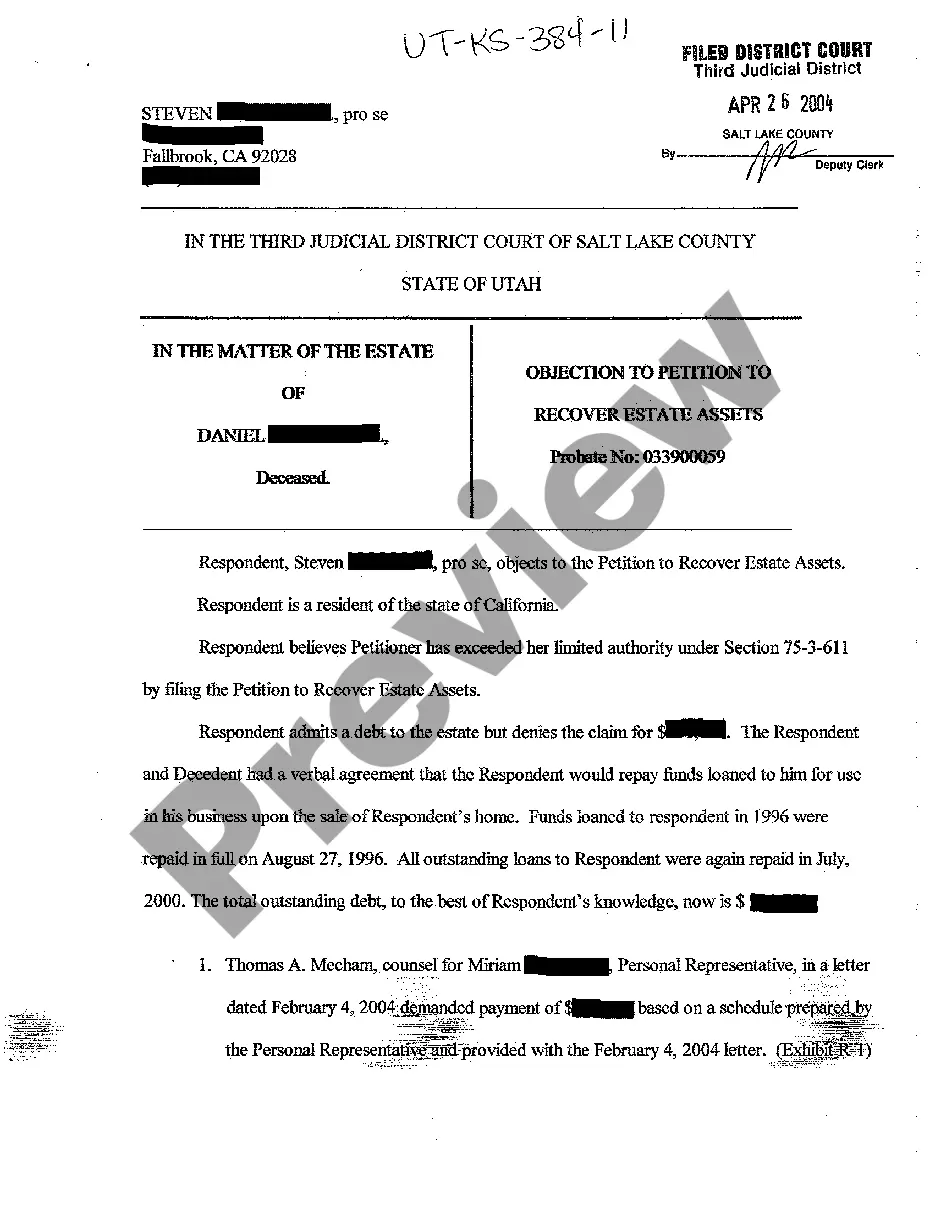

Title: Understanding Provo Utah Objection to Petition to Recover Estate Assets Introduction: When a person passes away, the distribution of their assets becomes a crucial aspect that their loved ones must address. In Provo, Utah, the legal process involved in distributing a deceased individual's estate assets is governed by specific rules and regulations. However, there may be instances where an objection is raised against a petition to recover estate assets. This article aims to provide a detailed description of the Provo Utah objection to a petition to recover estate assets, including its purpose, procedures, and possible types. Overview of Provo Utah Objection to Petition to Recover Estate Assets: The Provo Utah objection to a petition to recover estate assets is a legal mechanism through which interested parties can challenge the distribution of assets and the underlying claims made in a petition to recover estate assets. The objection aims to protect the rights of those who feel they have been wronged or have legitimate concerns regarding the proposed distribution plan. It helps ensure fairness and accountability throughout the process. Types of Provo Utah Objection to Petition to Recover Estate Assets: 1. Lack of capacity objection: This type of objection may arise if there are doubts about the mental capacity of the decedent at the time of creating the estate plan or making crucial decisions regarding asset distribution. It contends that the decedent was not of sound mind and, therefore, the petition should not be granted as it may not align with their true intentions. 2. Improper execution objection: This objection focuses on challenging the validity of the will or any other legal document supporting the petition. It alleges that the required legal formalities, such as proper witnessing or notarization, were not followed during the execution of the estate plan, which may render it void or invalid. 3. Undue influence objection: This objection claims that the individual who created the estate plan was unduly influenced by another party, leading to decisions that do not reflect their true desires. It argues that the distribution of assets as proposed in the petition is a result of coercion, manipulation, or pressure on the decedent, potentially benefiting the influencer disproportionately. 4. Fraud objection: This type of objection contests the authenticity of documents or claims made within the petition, suggesting that deliberate misrepresentation or deception occurred during the creation or submission of the estate plan. It aims to expose false information, such as forged signatures, misrepresented assets, or falsified debts. 5. Contestation of creditors' claims objection: In certain cases, creditors may submit claims against the estate during the distribution process. This objection challenges those claims, either disputing the legitimacy of the debts or questioning their priority, thereby impacting the amount available for other beneficiaries. Conclusion: Handling the distribution of an estate after someone's passing can be complicated, requiring adherence to legal procedures. Understanding the Provo Utah objection to a petition to recover estate assets is crucial for those involved in the process. Various types of objections may be raised, including lack of capacity, improper execution, undue influence, fraud, and contesting creditors' claims. These objections serve to protect the interests of those involved and ensure an equitable distribution of assets according to the decedent's true intentions.

Provo Utah Objection to Petition to Recover Estate Assets

Description

How to fill out Provo Utah Objection To Petition To Recover Estate Assets?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no law education to create this sort of papers from scratch, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Provo Utah Objection to Petition to Recover Estate Assets or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Provo Utah Objection to Petition to Recover Estate Assets in minutes using our trusted service. If you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps prior to obtaining the Provo Utah Objection to Petition to Recover Estate Assets:

- Ensure the template you have found is suitable for your location since the rules of one state or county do not work for another state or county.

- Preview the form and go through a short outline (if available) of scenarios the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Provo Utah Objection to Petition to Recover Estate Assets once the payment is done.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

Stopping probate after it has started can be challenging but is sometimes possible under certain circumstances. If you believe there are valid reasons for halting the process, such as a Provo Utah Objection to Petition to Recover Estate Assets, you may need to file a motion with the court. Consulting with a legal expert can clarify your options and help you understand the implications.

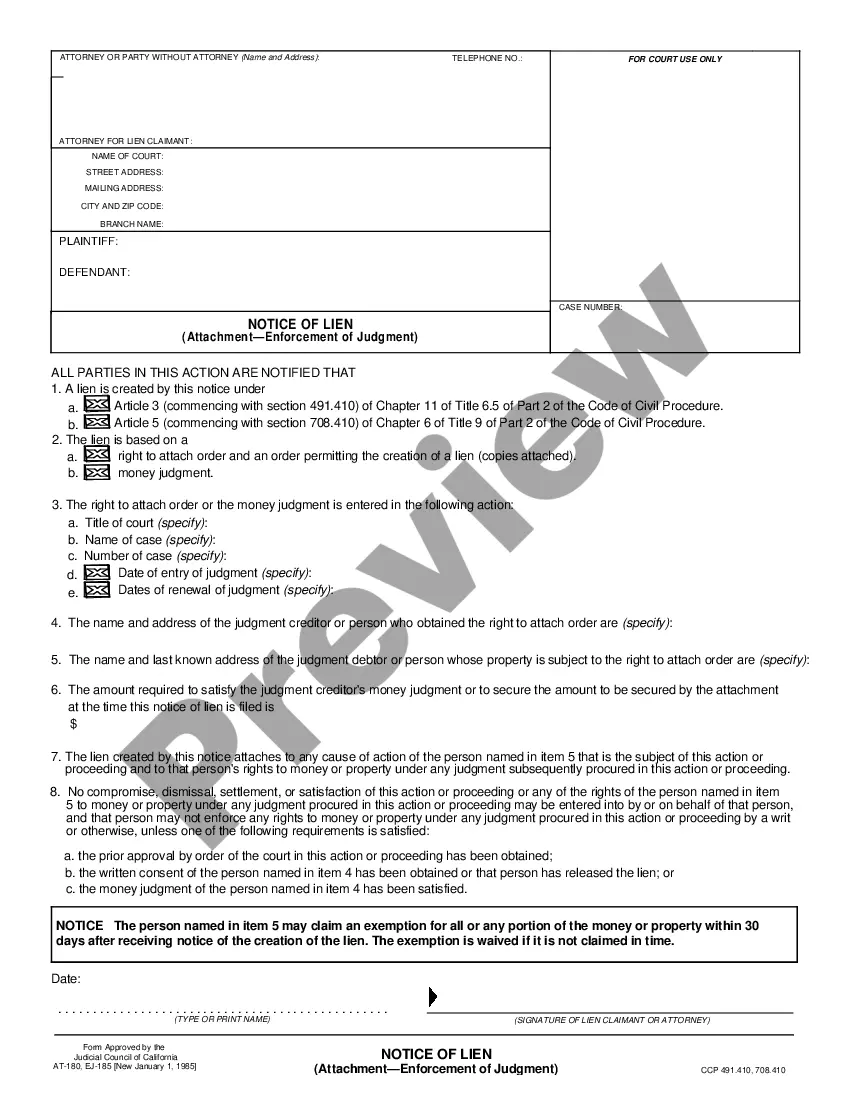

Yes, you can file a lien against an estate if you have a legitimate claim for an unpaid debt. This process usually involves filing a notice with the appropriate court to formally establish the lien. If you find yourself in a position requiring a Provo Utah Objection to Petition to Recover Estate Assets, it’s wise to seek legal counsel. They can provide the necessary guidance to navigate the legal landscape effectively.

While it is not required to have a lawyer for informal probate in Utah, having legal guidance can significantly benefit your case. A legal professional can assist in addressing any issues that arise, including a Provo Utah Objection to Petition to Recover Estate Assets. This support is particularly valuable if complexities emerge in the probate proceedings, ensuring you stay informed and protected.

To make a claim against an estate, you must provide written notice to the estate's personal representative, detailing your claim and supporting evidence. This step is vital in engaging the estate formally. A Provo Utah Objection to Petition to Recover Estate Assets may also be needed if disputes arise. Utilizing platforms like USLegalForms can help you navigate the claim process efficiently.

Suing an estate can occur for various reasons, such as disputes over asset distribution, unpaid debts, or improper management of estate assets. If you feel that your rights are being ignored, filing a Provo Utah Objection to Petition to Recover Estate Assets could be your path to resolution. Understanding your legal rights is crucial, and engaging with a legal professional can guide you through the process.

Yes, you can file for probate yourself in Utah, but it requires understanding the legal procedures involved. While the process may seem manageable, handling a Provo Utah Objection to Petition to Recover Estate Assets may be complex and nuanced. Using resources like USLegalForms can help simplify the forms and requirements, ensuring you follow the necessary steps correctly.

To file a lawsuit against an estate in Utah, you need to submit a complaint to the appropriate court, along with any required documents. It is important to clearly outline your claims and the reasons for filing a Provo Utah Objection to Petition to Recover Estate Assets. Recording your case accurately can strengthen your legal position. Consider seeking assistance from a legal professional to navigate the process effectively.

In Utah, you typically have three years from the date of the decedent's death to file a lawsuit against an estate. This timeframe can be crucial, especially if you believe you have a valid claim. Filing a timely Provo Utah Objection to Petition to Recover Estate Assets is essential to protect your rights and interests. Make sure to consult with a legal expert to understand your specific situation.

In Utah, you generally have three years from the date of the will's probate to contest it. However, if you were unaware of the probate or the will, you may have additional time depending on the circumstances. If you are thinking about a Provo Utah Objection to Petition to Recover Estate Assets, timing is crucial. You should act promptly to protect your rights and interests during this process.

When a person passes away without a will, Utah probate law determines how their assets are distributed under intestate succession. The court appoints an administrator to manage the estate. If you are contesting distributions through a Provo Utah Objection to Petition to Recover Estate Assets, understanding this process is crucial. This knowledge informs your approach in seeking fair outcomes in estate management.

Interesting Questions

More info

S. Div. L.N. 6 (July 6, 2011). ¶20¶21 The following steps were provided to tenants in the Rent Ordinance: 1. Inform the tenant of the terms, conditions, and limitations of the rental agreement; 2. If the conditions of the rental agreement permit, notify the tenant by mail of the date on which the rental agreement is to terminate; 3. Inform the tenant if the rental agreement or lease contains a written statement of rent and a notice of termination under the Rent Ordinance; 4. If the rental agreement or lease contains a written statement of rent, inform the tenant that notice of termination under the Rent Ordinance is included. A copy of the written statement of rent must be included in the notice of termination. 12 Utah 84058, ch. 99-10.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.