Salt Lake City Utah Department of the Treasury's Internal Revenue Service (IRS) offers a procedure known as the Withdrawal of Filed Notice of Federal Tax Lien. This process allows taxpayers in Salt Lake City, Utah, to have a notice of federal tax lien removed from their public records. The withdrawal of a tax lien can be particularly beneficial as it helps improve credit scores, simplifies property transfers, and opens up opportunities for financial growth. When a taxpayer experiences a federal tax lien, it implies that they owe unpaid taxes to the IRS, and their property becomes collateral for the debt. This lien is then filed as a public record to inform creditors and lenders about the government's claim on the taxpayer's assets. However, a tax lien can negatively impact an individual's financial prospects, making it essential to seek a withdrawal. There are different types of Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien: 1. Direct Tax Lien Withdrawal: This type of withdrawal is available when the taxpayer pays off the entire tax debt or enters into a successful agreement, such as an installment agreement or an offer in compromise, with the IRS. 2. Discharge of Property: In certain cases, the IRS may withdraw a tax lien from a specific property if it is deemed necessary for its sale or refinancing. This allows the taxpayer to clear the title and successfully complete the transaction. 3. Subordination: This option comes into play when a taxpayer needs to prioritize other creditors' claims, such as obtaining a mortgage or loan. By subordinating the tax lien, the IRS allows another creditor to have priority access to the taxpayer's assets. 4. Withdrawal for Administrative Reasons: The IRS may withdraw a tax lien if it determines that the filing was in error, the taxpayer has reached an agreement with the IRS, or the taxpayer's liability has been satisfied. It is important to note that not all taxpayers automatically qualify for a withdrawal of a filed notice of federal tax lien. Specific eligibility criteria must be met, such as complying with all tax filing and payment requirements, being up to date with tax returns, and demonstrating financial responsibility. In conclusion, the Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien offers taxpayers in the region an opportunity to alleviate the burden of a tax lien on their financial well-being. Through various types of withdrawals, taxpayers can remove liens, clear property titles, and explore financial growth possibilities. Compliance with IRS requirements and seeking professional assistance can greatly assist in navigating this process effectively.

Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien

Description

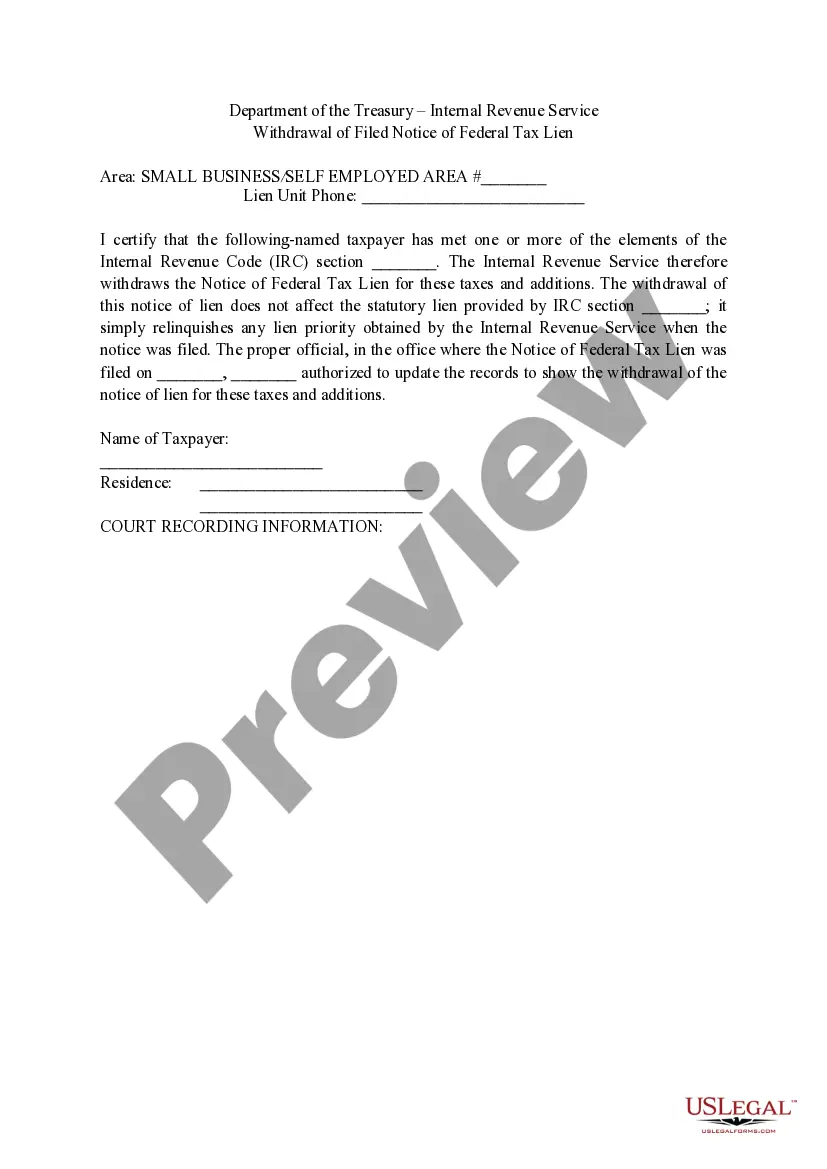

How to fill out Salt Lake City Utah Department Of The Treasury- Internal Revenue Service Withdrawal Of Filed Notice Of Federal Tax Lien Tax Lien?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Salt Lake City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!