The West Jordan Utah Department of the Treasury- Internal Revenue Service (IRS) is responsible for handling the withdrawal of filed Notice of Federal Tax Liens. A Notice of Federal Tax Lien is a document filed by the IRS to inform creditors and the public that a taxpayer owes unpaid federal taxes. The withdrawal process allows a taxpayer to remove the lien from public records, which may have a negative impact on their creditworthiness and financial standing. In West Jordan, Utah, the Department of the Treasury- Internal Revenue Service offers various types of withdrawal of filed Notice of Federal Tax Lien services. Some different types of withdrawals include: 1. Direct Debit Installment Agreement (DDA) Withdrawal: Taxpayers who are able to set up a direct debit installment agreement with the IRS may qualify for a withdrawal. This option allows taxpayers to make regular automatic payments towards their tax debt and demonstrates their commitment to resolve the unpaid taxes. 2. Full Payment Withdrawal: If a taxpayer has paid their outstanding tax debt in full, they can request a withdrawal. The IRS reviews the payment and, if verified, removes the lien from public records. 3. Installment Agreement Withdrawal: Taxpayers who have entered into an installment agreement with the IRS and meet certain criteria may be eligible for a withdrawal. This withdrawal removes the lien from public records once the taxpayer has made a certain number of consecutive payments and meets other conditions. 4. Offer in Compromise Withdrawal: In some cases, the IRS may accept an Offer in Compromise (OIC) from a taxpayer, which allows them to settle their tax debt for less than they owe. If the OIC is accepted and the taxpayer meets all the terms, a withdrawal of the filed Notice of Federal Tax Lien may be considered. 5. Certificate of Discharge: A Certificate of Discharge removes a federal tax lien from specific property, allowing the taxpayer to sell or refinance the property without the lien affecting the transaction. This type of withdrawal is typically granted when the IRS determines that it is in the best interest of all parties involved. It is essential for taxpayers in West Jordan, Utah, who wish to pursue a withdrawal of filed Notice of Federal Tax Lien to consult with a qualified tax professional or contact the local Department of the Treasury- Internal Revenue Service for guidance and assistance tailored to their specific situation. The withdrawal process can be complex, and it is crucial to ensure compliance with all requirements and deadlines set by the IRS.

West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien

Description

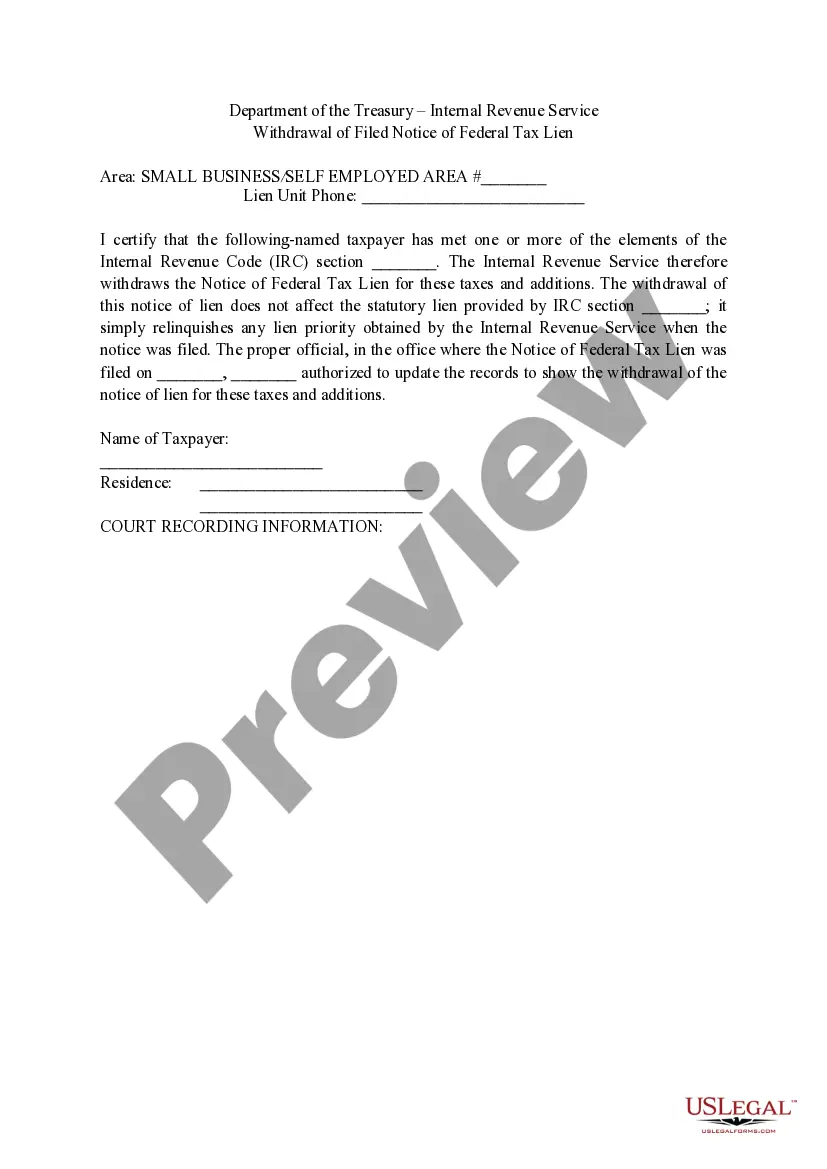

How to fill out West Jordan Utah Department Of The Treasury- Internal Revenue Service Withdrawal Of Filed Notice Of Federal Tax Lien Tax Lien?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

If a lien is withdrawn, it signifies that the creditor has retracted their claim against your property. This action can occur for various reasons, such as a mistake in filing or an agreement with the debtor. Understanding the implications of a lien withdrawal from the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien is vital for maintaining your property rights and ensuring your financial transactions proceed without issues.

A lien withdrawal indicates that the creditor has decided to remove the lien without requiring full payment of the debt. This often occurs when the lien was filed in error or if negotiations have taken place. On the other hand, a lien release from the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien happens when the debt has been fully satisfied, and the lien is formally removed.

When a lien is released, it indicates that the creditor has relinquished their claim against your property. This process typically involves the filing of a release document with the West Jordan Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien. It is important for property owners to understand that a release does not erase the original debt but allows them to regain full control of their asset.

To get the IRS to release a lien, you must address your tax debt, either by paying the full amount owed or entering into an installment agreement. After fulfilling your obligations, you can request a release of the lien directly from the IRS. This process can be simplified through services like uslegalforms, which guide you through the necessary steps to effectively manage the West Jordan Utah Department of the Treasury - Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien.

Receiving a certificate of release of federal tax lien indicates you have rectified your tax debts, and the IRS acknowledges this resolution. It serves as formal recognition that you have met all conditions concerning your tax obligations. Therefore, this document is crucial for those looking to improve their credit standing or sell their property in West Jordan Utah, as it signals to potential buyers that all tax-related matters are settled.

The release of a certificate of lien removes the legal claim the IRS had against your property due to outstanding taxes. When the IRS files this release, it marks the end of the lien and eases concerns regarding your property’s marketability. This action can significantly benefit those in West Jordan Utah who are striving for financial recovery, as it frees them from restrictive obligations.

With a tax lien certificate, you can prove that your liability for the debt has been addressed. This certificate plays a vital role in clearing obstacles when seeking loans or refinancing property. Moreover, you can provide this documentation to creditors to demonstrate that you have resolved your tax issues. If you're in West Jordan and dealing with the IRS, managing your tax lien certificate can facilitate smoother financial transactions.

A certificate of release of federal tax lien is a document issued by the IRS, signifying that your tax lien has been removed. This release indicates that you have satisfied your tax obligations. Essentially, it helps clear your credit report and improves your financial standing. If you're navigating the West Jordan Utah Department of the Treasury - Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien, understanding this certificate is crucial.

A lien withdrawal is a process where an already filed federal tax lien is formally removed by the IRS. This occurs typically because you have settled your tax debt or worked out an agreement with the IRS to resolve the issue. Residents of West Jordan, Utah, can benefit from a lien withdrawal as it restores your financial freedom and opens up new opportunities.

A notice of federal tax lien indicates that the IRS has filed a claim against your property due to unpaid taxes. This public notice serves as a legal warning to creditors that the government has interest in your assets until the debt is resolved. For individuals in West Jordan, Utah, understanding this notice can be the first step toward resolving tax issues.