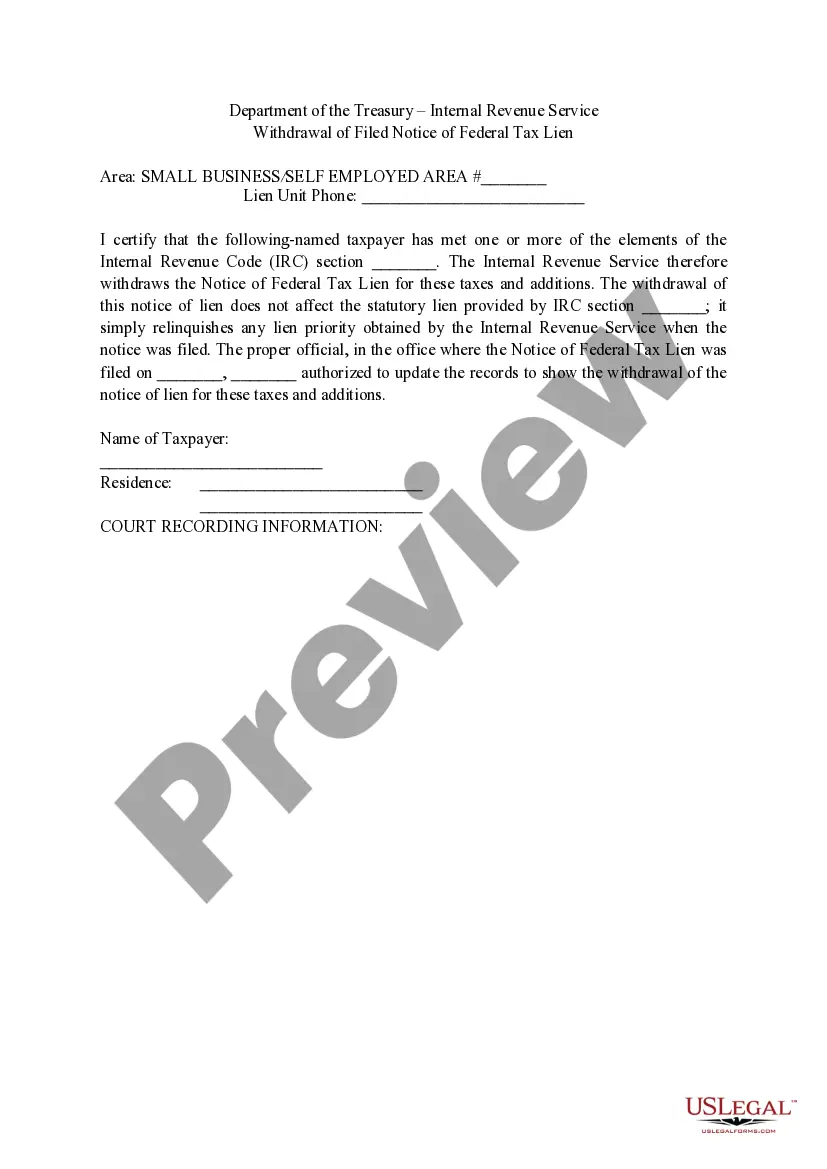

The West Valley City Utah Department of the Treasury- Internal Revenue Service (IRS) offers a process called "Withdrawal of Filed Notice of Federal Tax Lien" to individuals or entities who have satisfied their tax debt obligations. This withdrawal removes the recorded public notice of the tax lien, which can have significant benefits for the taxpayer. When a taxpayer fails to pay their federal tax debts, the IRS may file a Notice of Federal Tax Lien to secure the government's interest in their assets. This lien serves as a legal claim on the taxpayer's property and assets, alerting creditors and potential buyers of the debt owed to the IRS. However, the West Valley City Utah Department of the Treasury- Internal Revenue Service offers eligible taxpayers the opportunity to request a withdrawal of this filed notice under certain circumstances. This withdrawal can be crucial for individuals seeking to improve their credit score, secure loans, or sell their property, as the removal of the lien from the public records can signify a positive change in their tax compliance status. There are different types of West Valley City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien, namely: 1. Withdrawal in full payment: Taxpayers who have successfully paid their outstanding tax debt in full, including interest and penalties, may apply for this type of withdrawal. In this case, the IRS deems the taxpayer's obligation fulfilled, and the notice of federal tax lien can be withdrawn. 2. Withdrawal due to an installment agreement: Taxpayers who have entered into an approved installment agreement with the IRS to pay off their tax debt over time may qualify for this type of withdrawal. Once the installment agreement is deemed compliant, the IRS can withdraw the filed notice of federal tax lien. 3. Withdrawal after the lien release: In situations where the taxpayer has paid their outstanding tax debt, but for some reason, the notice of federal tax lien was not promptly released, they may be eligible for this type of withdrawal. The taxpayer must prove that the lien release was not processed correctly, and upon verification, the IRS can withdraw the filed notice. 4. Withdrawal for other valid reasons: The West Valley City Utah Department of the Treasury- Internal Revenue Service also considers other valid reasons for withdrawing the filed notice of federal tax lien. These can include situations where the lien filing caused significant harm to the taxpayer's ability to earn income or when alternative repayment options were more suitable. To initiate the withdrawal process, eligible taxpayers must submit a formal request to the West Valley City Utah Department of the Treasury- Internal Revenue Service, providing supporting documentation and details about their tax debt resolution. It is recommended to consult a tax professional or visit the official IRS website for specific instructions and forms required for each type of withdrawal.

West Valley City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien Tax Lien

Description

How to fill out West Valley City Utah Department Of The Treasury- Internal Revenue Service Withdrawal Of Filed Notice Of Federal Tax Lien Tax Lien?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the West Valley City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the West Valley City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the West Valley City Utah Department of the Treasury- Internal Revenue Service Withdrawal of Filed Notice of Federal Tax Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!