Title: Understanding West Jordan Utah Deceased Joint Tenancy: A Comprehensive Overview Introduction: West Jordan, Utah, is a city where families often opt for joint tenancy ownership in real estate properties. Joint tenancy with right of survivorship is a common arrangement that allows multiple individuals to co-own a property. However, upon the demise of one of the joint tenants, the property undergoes a transition known as West Jordan Utah Deceased Joint Tenancy. In this article, we will delve into the details of this topic, exploring its intricacies and various types that exist. 1. West Jordan Utah Deceased Joint Tenancy Defined: West Jordan Utah Deceased Joint Tenancy refers to the legal process that occurs when one of the joint tenants of a property based in West Jordan, Utah, passes away. It involves the redistribution of the deceased's share of ownership to the surviving joint tenants. 2. Types of West Jordan Utah Deceased Joint Tenancy: a) Traditional Joint Tenancy: In this type, joint tenants acquire equal shares of the property, and upon the death of one tenant, their share automatically passes to the surviving joint tenants as per the 'right of survivorship' principle. b) Joint Tenancy with Modern Estate Planning Tools: This variation allows joint tenants to include provisions and conditions for the transfer of ownership upon death. This may involve the use of wills, trusts, or other estate planning tools, ensuring a smooth and customized transition of the deceased's share. c) Tenancy in Common Conversion: While not specifically a West Jordan Utah Deceased Joint Tenancy type, there are cases where joint tenancy is converted into tenancy in common to manage inheritance issues. This allows for more flexibility in dividing the property among heirs. 3. Legal Considerations for West Jordan Utah Deceased Joint Tenancy: a) Probate Proceedings: Depending on the value of the deceased joint tenant's share, the property may need to go through probate court procedures, ensuring a legal transfer of ownership. b) Documentation Requirements: To effectuate West Jordan Utah Deceased Joint Tenancy, necessary documentation such as death certificates, affidavits of survivorship, and property deeds must be filed with the appropriate county and state authorities. c) Tax Implications: Understanding and accounting for any tax consequences arising from a deceased joint tenant's transfer of ownership is vital. Seeking professional advice is recommended to ensure compliance with state and federal tax regulations. 4. Benefits of West Jordan Utah Deceased Joint Tenancy: a) Avoidance of Probate: Deceased joint tenancy allows the property to pass directly to the surviving joint tenants without the need for probate proceedings, saving time, cost, and maintaining privacy. b) Simplicity and Continuity: With West Jordan Utah Deceased Joint Tenancy, the ownership transition occurs smoothly and immediately, as stipulated in the joint tenancy agreement, providing ease of management and stability. c) Asset Protection and Estate Planning: This arrangement ensures that the property is protected from creditors, as it cannot be included in the deceased joint tenant's estate, and allows for effective estate planning by avoiding potential inheritance disputes. Conclusion: West Jordan Utah Deceased Joint Tenancy represents an important aspect of property ownership within the region. By comprehending its intricacies and the available types, individuals can safeguard their assets and ensure the smooth transition of ownership upon a joint tenant's demise. Engaging legal professionals who specialize in real estate and estate planning can further help in navigating the complexities and maximizing the benefits of this arrangement.

West Jordan Utah Deceased Joint Tenancy

Description

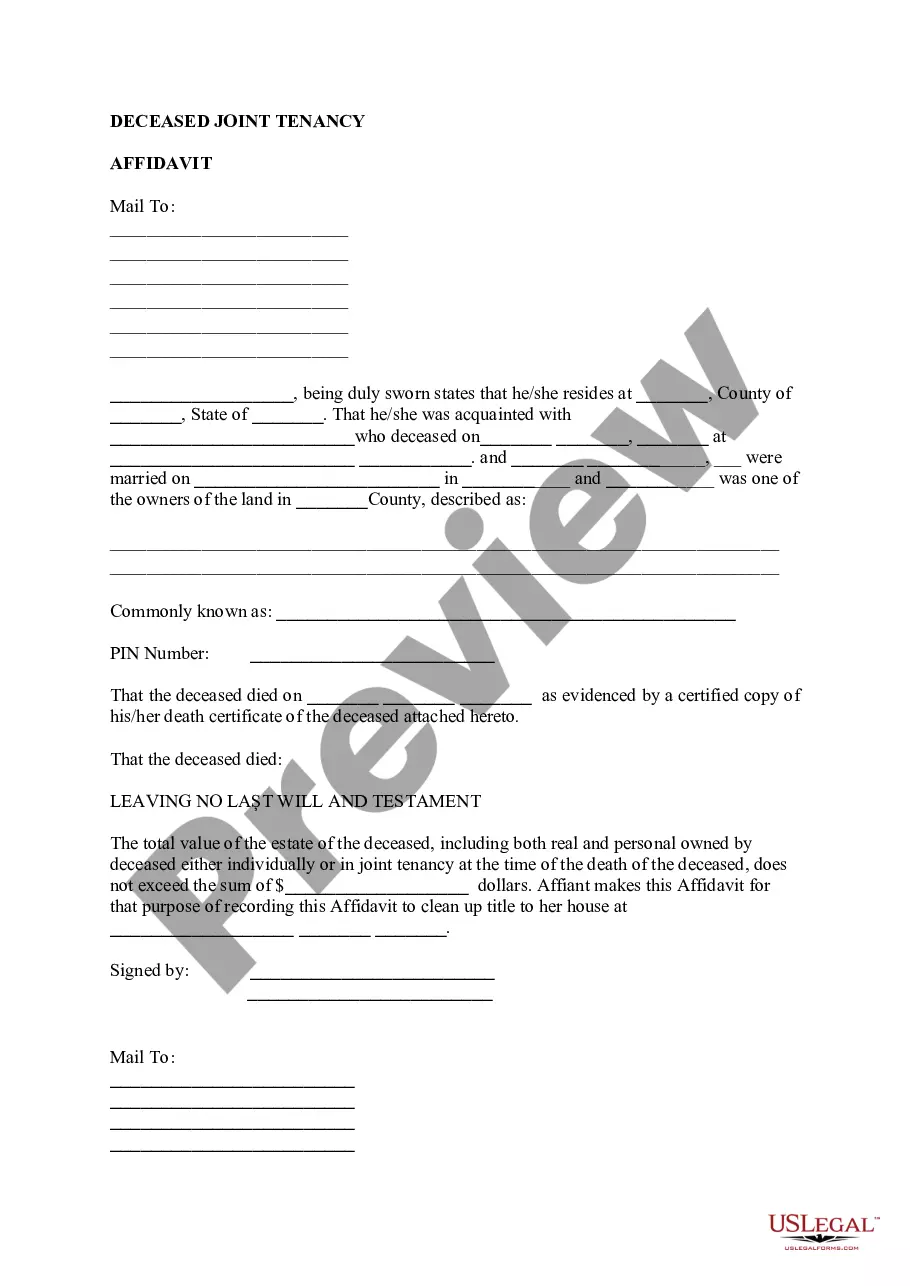

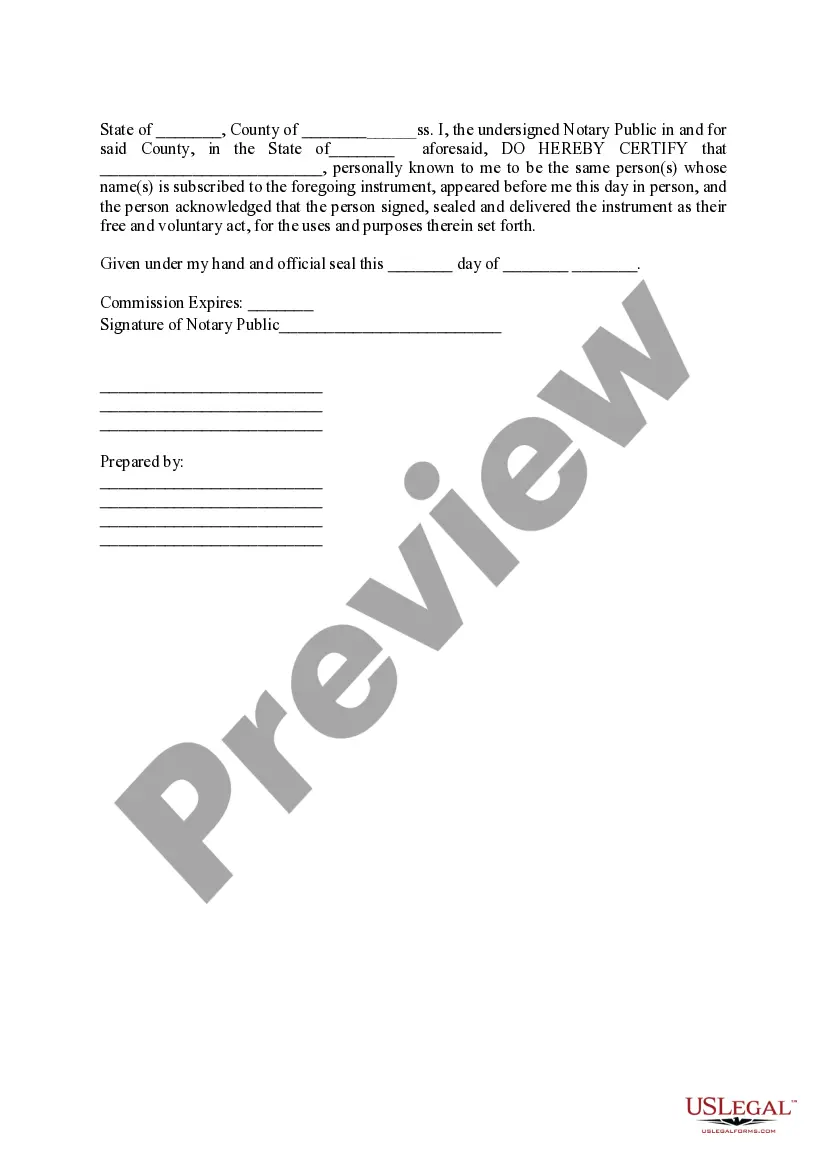

How to fill out West Jordan Utah Deceased Joint Tenancy?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any legal education to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the West Jordan Utah Deceased Joint Tenancy or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the West Jordan Utah Deceased Joint Tenancy in minutes using our trusted service. If you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the West Jordan Utah Deceased Joint Tenancy:

- Ensure the template you have chosen is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a brief outline (if provided) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the West Jordan Utah Deceased Joint Tenancy as soon as the payment is done.

You’re good to go! Now you can proceed to print the document or fill it out online. In case you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.