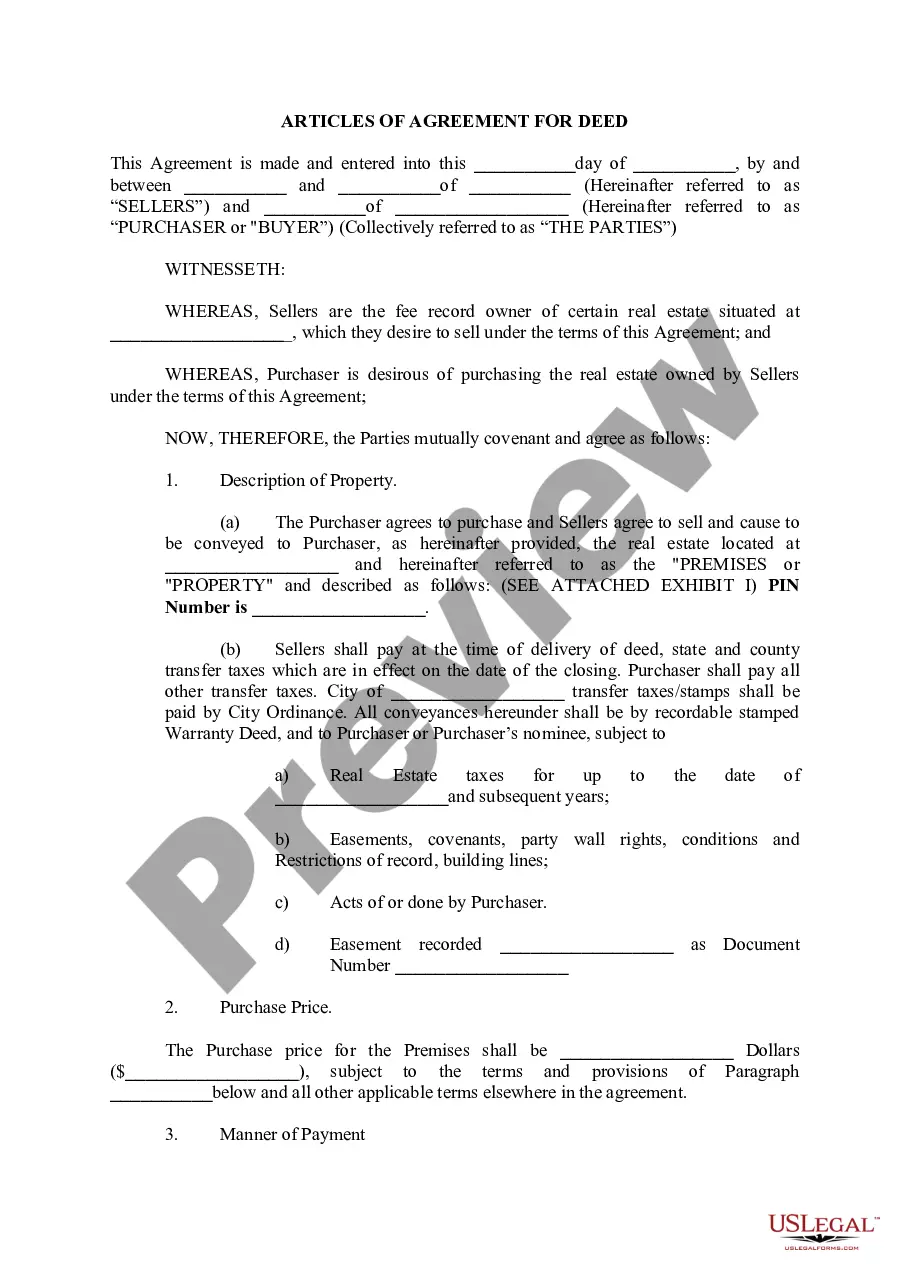

The West Jordan Utah Articles of Agreement for Deed is a legally binding contract that establishes the terms and conditions for the transfer of ownership of a property from the seller to the buyer. This type of agreement is commonly used in real estate transactions, particularly when the buyer may not have immediate access to traditional financing options or when the seller is willing to finance the purchase. The main purpose of the West Jordan Utah Articles of Agreement for Deed is to outline the agreed-upon terms of the sale, including the purchase price, payment schedule, interest rate (if applicable), and any additional provisions or conditions negotiated between the parties involved. This agreement serves as evidence of the buyer's promise to pay the amount due over a specified period of time, while giving the seller the right to retain legal title to the property until the full payment has been made. It is important to note that while the buyer may possess the property and have rights akin to ownership during the repayment period, the legal title remains with the seller until the final payment is made. Once the full payment is successfully completed, the seller transfers legal ownership of the property to the buyer through a deed, typically a Warranty Deed or a Quitclaim Deed, depending on the specific agreement reached. Different types of West Jordan Utah Articles of Agreement for Deed may vary in their terms and conditions. For instance, some agreements may include provisions for the payment of property taxes and insurance by the buyer, while others may require the seller to maintain these responsibilities until the final payment. Moreover, agreements can differ in terms of interest rates, repayment periods, down payment amounts, and any penalties for missed payments. In summary, the West Jordan Utah Articles of Agreement for Deed is a contractual agreement that enables a property sale to take place with the buyer making installment payments directly to the seller. This helps facilitate transactions when traditional financing is not readily available or when the seller is open to providing financing options. Buyers and sellers should carefully review and negotiate the terms within the agreement to ensure a mutually beneficial and legally sound arrangement.

West Jordan Utah Articles of Agreement for Deed

Description

How to fill out West Jordan Utah Articles Of Agreement For Deed?

If you are looking for a valid form template, it’s difficult to choose a better platform than the US Legal Forms site – probably the most considerable online libraries. With this library, you can find thousands of document samples for organization and personal purposes by categories and regions, or keywords. With our high-quality search function, finding the most up-to-date West Jordan Utah Articles of Agreement for Deed is as elementary as 1-2-3. Additionally, the relevance of every record is verified by a team of expert lawyers that on a regular basis review the templates on our website and update them according to the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to get the West Jordan Utah Articles of Agreement for Deed is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the sample you want. Check its explanation and use the Preview function (if available) to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the needed file.

- Confirm your decision. Select the Buy now option. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Pick the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the obtained West Jordan Utah Articles of Agreement for Deed.

Each and every template you add to your account has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to have an extra duplicate for modifying or printing, you may come back and save it once more at any time.

Take advantage of the US Legal Forms professional library to get access to the West Jordan Utah Articles of Agreement for Deed you were looking for and thousands of other professional and state-specific samples in one place!

Form popularity

FAQ

A contract for deed can be a beneficial option for buyers who want to avoid traditional mortgages. However, it's essential to weigh the pros and cons, such as potential high interest rates and loss of property rights in case of default. In West Jordan, Utah, the Articles of Agreement for Deed provide a clear framework to assess whether this financing option aligns with your goals.

One disadvantage of a contract for deed is that the seller retains the legal title to the property until the buyer pays off the balance. This means that if buyers miss payments, they could lose their investment without recourse. Additionally, in West Jordan, Utah, it's critical to carefully review the Articles of Agreement for Deed to ensure you understand your rights and obligations.

An agreement for deed in Florida functions similarly to a contract for deed, where the seller retains the title until the buyer fulfills their payment obligations. This type of agreement serves as a financing method for buyers who may not qualify for traditional loans. While this information is specific to Florida, residents in West Jordan, Utah should consult local laws and the Articles of Agreement for Deed for relevant details.

When buying a house, the contract is often prepared by a real estate agent or an attorney, depending on the circumstances. It's important to have a detailed agreement that protects your interests as a buyer. Using resources like US Legal Forms can assist you in obtaining the necessary materials for the West Jordan Utah Articles of Agreement for Deed.

To transfer property in Utah, you typically need to prepare a deed that legally signifies the transfer. This document must be recorded with the county recorder’s office to ensure public notice. If you're looking to do this in West Jordan, using the West Jordan Utah Articles of Agreement for Deed can facilitate a smoother transaction.

Real estate contracts can be created by various parties, including real estate agents, attorneys, and homeowners. They often rely on templates or specialized legal documents to ensure they meet local regulations. If you are in West Jordan, Utah, using US Legal Forms can provide you with the necessary resources to draft a solid agreement that aligns with the West Jordan Utah Articles of Agreement for Deed.

A contract for deed between family members is an agreement where one family member agrees to buy property from another, usually with flexible payment terms. This arrangement allows for greater convenience and can be a way to keep the property within the family. In West Jordan, Utah, this agreement can be structured using the West Jordan Utah Articles of Agreement for Deed to ensure clarity and legal protection.

In West Jordan, Utah, anyone can technically write up a contract for deed, but it's advisable to have a professional handle it. Real estate agents, attorneys, or specialized platforms like US Legal Forms can provide guidance to ensure compliance with local laws. Utilizing such resources will help you create a legally binding document that protects both parties' interests.

Writing a land agreement involves specifying key details like the parties involved, property description, and terms of the agreement. Ensure you include payment terms, any contingencies, and responsibilities of both parties. Additionally, it's essential to address dispute resolution and governing laws applicable in West Jordan, Utah. US Legal Forms provides templates that assist in drafting an effective land agreement.

The articles of agreement for a warranty deed outline the seller's promise to transfer ownership of the property and ensure clear title. This document includes detailed conditions and obligations related to the property. In West Jordan, Utah, these articles confirm that the buyer will receive a warranty deed once payments are complete. Using a reliable legal platform like US Legal Forms can simplify finding the appropriate documents.

Interesting Questions

More info

Find Schools To help residents of Utah navigate their legal options for repayment of mortgages, the State Bar of Utah has created the Guide to Securitization to help residents know their property rights and understand their due diligence obligations prior to purchasing a secured mortgage. See our Securitization page for more information. Utah's State Bar website highlights the following helpful resources: The Uniform Commercial Code. The Uniform Credit Code The Utah Land Title Act or the Land Title Disclosure Act The Housing Code Divorce Court Ordinances, Court Rules, and Rules of Procedure State Bar of Utah's Guide to Securitization Bills and Regulations Homeowners' Association Agreements Criminal Law State Bar Of Utah's Guide for Securitization Borrower Rights Home Finance Education Legal Topics The State Bar of Utah also offers a free legal video that highlights current issues, and provides tips, tools, and strategies on a variety of topics.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.