Provo Utah Assignment of Rents is a legal document that transfers the right to collect income generated from a property to a creditor. When individuals or businesses obtain a loan or mortgage to purchase or refinance a property in Provo, Utah, the lender often requires an Assignment of Rents as additional security. Keywords: Provo Utah, Assignment of Rents, legal document, transfer, collect income, property, creditor, loan, mortgage, purchase, refinance, lender, security. There are different types of Provo Utah Assignment of Rents, depending on the specific purpose and circumstances. Let's explore some of these variations: 1. Absolute Assignment of Rents: This refers to the complete transfer of rent collection rights to the creditor. In this case, the lender gains full control and ownership of the rental income generated by the property. The borrower will have no authority or access to the rent proceeds until the loan or mortgage is fully paid off. 2. Conditional Assignment of Rents: This type of Assignment of Rents is contingent upon certain conditions, typically related to the borrower defaulting on loan repayments. If the borrower fails to meet the loan obligations, the lender can step in and exercise their right to collect the rental income as a form of repayment. 3. Partial Assignment of Rents: With this type of Assignment of Rents, only a portion of the rental income is transferred to the lender. It could be a fixed amount or a percentage determined through mutual agreement. This arrangement may allow the borrower to retain some control over the property's cash flow while satisfying the lender's security requirements. 4. Temporary Assignment of Rents: In certain situations, creditors may request a temporary Assignment of Rents. This arrangement allows the lender to collect the rental income for a limited duration, intending to recoup any outstanding payments or address specific financial concerns. Once the agreed-upon period elapses, the assignment is terminated, and the rights revert to the borrower. 5. Non-Disturbance Agreement and Assignment of Rents: This type of assignment benefits tenants by ensuring the continuity of their rights even if the borrower defaults on loan repayments. It is a legally binding agreement between the lender and the tenant, stating that the lender will not disturb or interfere with the tenant's lease agreement and rights, including the right to collect rent. In Provo, Utah, Assignment of Rents serves as an additional layer of security for lenders, mitigating their risks by providing a direct claim to rental income. It is essential for borrowers to fully understand the terms and conditions outlined in the Assignment of Rents agreement before entering into any loan or mortgage arrangement.

Provo Utah Assignment of Rents

State:

Utah

City:

Provo

Control #:

UT-LR047T

Format:

Word;

Rich Text

Instant download

Description

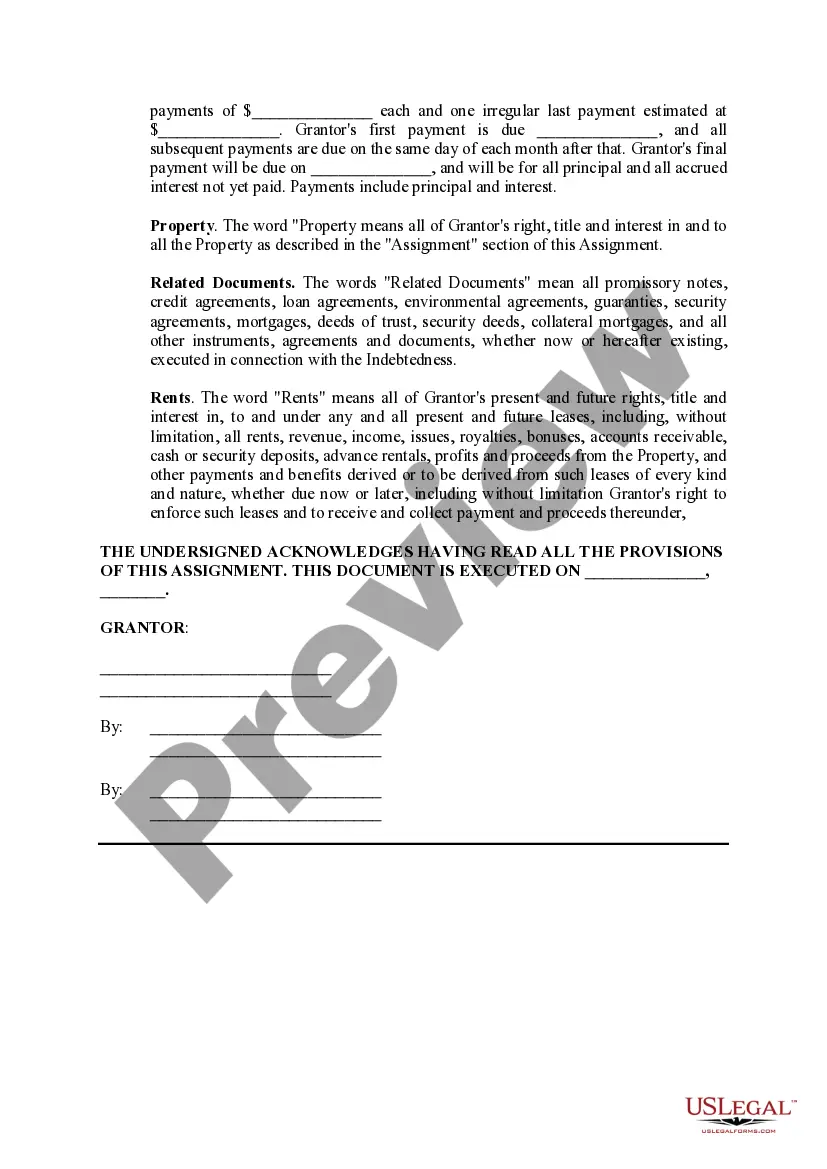

Assignment consists of a transfer of property or some right or interest in property from one person to another. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the interest or thing assigned.

Provo Utah Assignment of Rents is a legal document that transfers the right to collect income generated from a property to a creditor. When individuals or businesses obtain a loan or mortgage to purchase or refinance a property in Provo, Utah, the lender often requires an Assignment of Rents as additional security. Keywords: Provo Utah, Assignment of Rents, legal document, transfer, collect income, property, creditor, loan, mortgage, purchase, refinance, lender, security. There are different types of Provo Utah Assignment of Rents, depending on the specific purpose and circumstances. Let's explore some of these variations: 1. Absolute Assignment of Rents: This refers to the complete transfer of rent collection rights to the creditor. In this case, the lender gains full control and ownership of the rental income generated by the property. The borrower will have no authority or access to the rent proceeds until the loan or mortgage is fully paid off. 2. Conditional Assignment of Rents: This type of Assignment of Rents is contingent upon certain conditions, typically related to the borrower defaulting on loan repayments. If the borrower fails to meet the loan obligations, the lender can step in and exercise their right to collect the rental income as a form of repayment. 3. Partial Assignment of Rents: With this type of Assignment of Rents, only a portion of the rental income is transferred to the lender. It could be a fixed amount or a percentage determined through mutual agreement. This arrangement may allow the borrower to retain some control over the property's cash flow while satisfying the lender's security requirements. 4. Temporary Assignment of Rents: In certain situations, creditors may request a temporary Assignment of Rents. This arrangement allows the lender to collect the rental income for a limited duration, intending to recoup any outstanding payments or address specific financial concerns. Once the agreed-upon period elapses, the assignment is terminated, and the rights revert to the borrower. 5. Non-Disturbance Agreement and Assignment of Rents: This type of assignment benefits tenants by ensuring the continuity of their rights even if the borrower defaults on loan repayments. It is a legally binding agreement between the lender and the tenant, stating that the lender will not disturb or interfere with the tenant's lease agreement and rights, including the right to collect rent. In Provo, Utah, Assignment of Rents serves as an additional layer of security for lenders, mitigating their risks by providing a direct claim to rental income. It is essential for borrowers to fully understand the terms and conditions outlined in the Assignment of Rents agreement before entering into any loan or mortgage arrangement.

Free preview

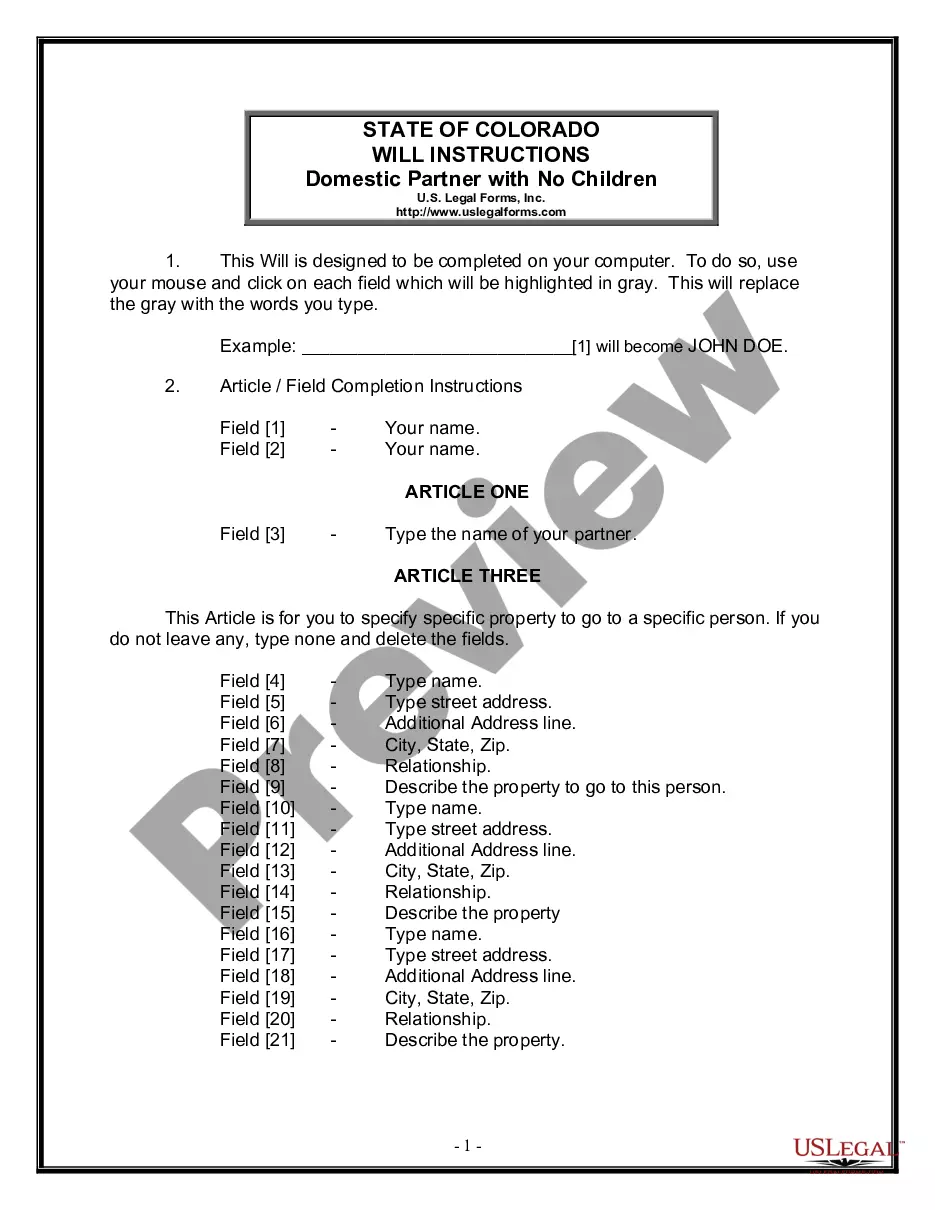

How to fill out Provo Utah Assignment Of Rents?

If you’ve already utilized our service before, log in to your account and download the Provo Utah Assignment of Rents on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Provo Utah Assignment of Rents. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!