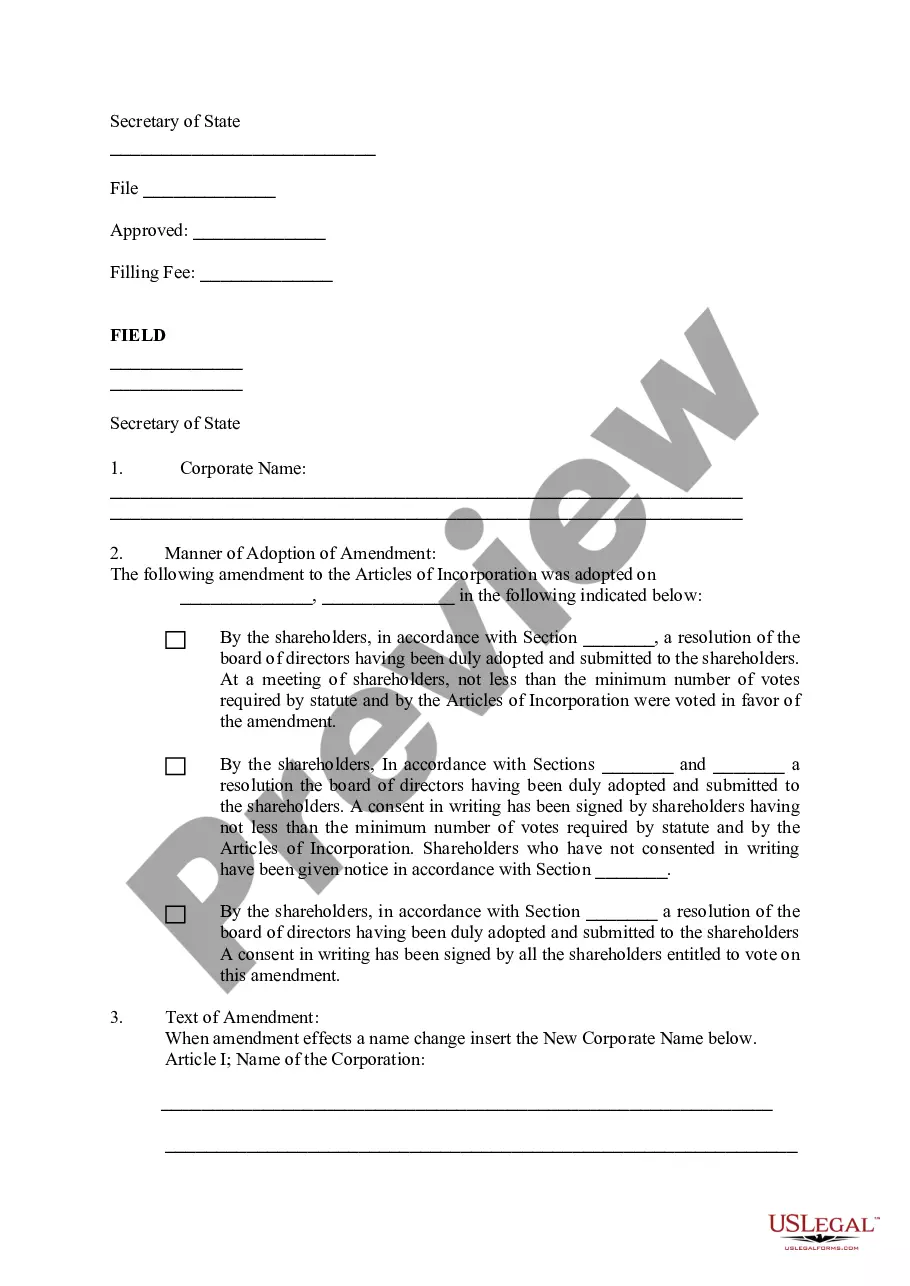

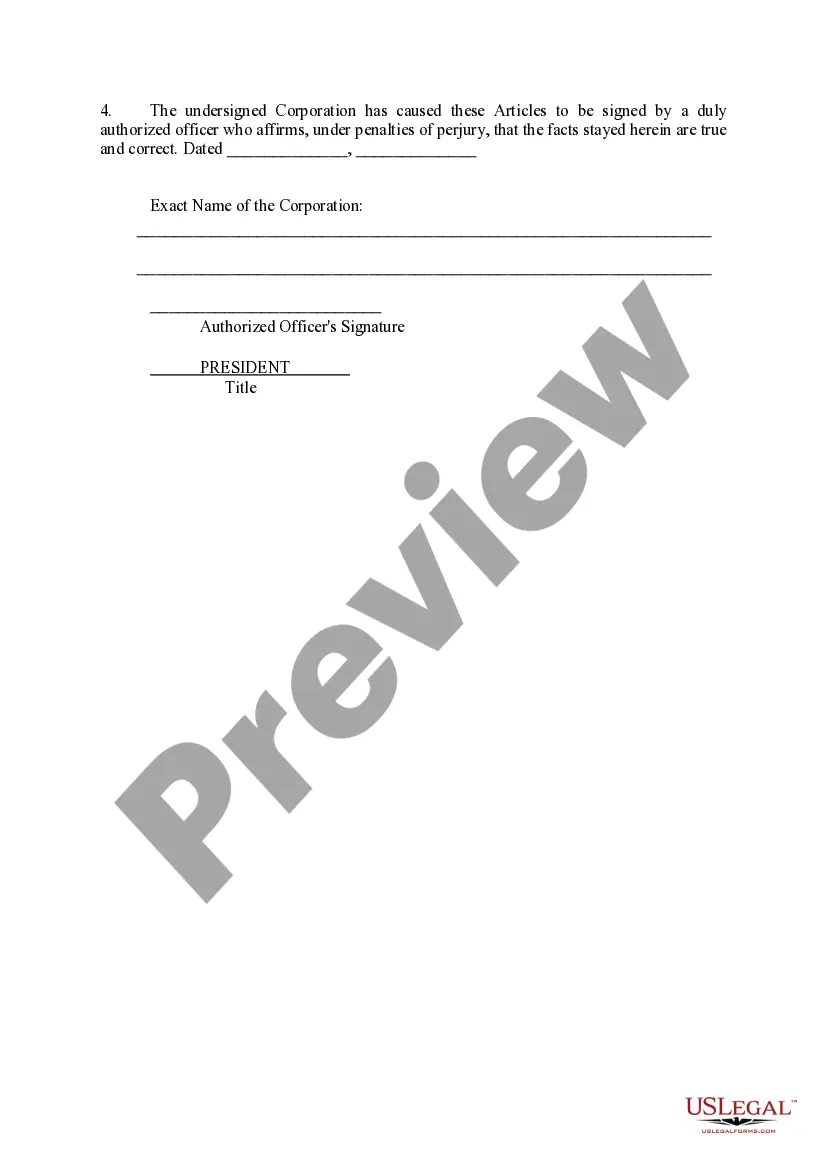

West Jordan Utah Articles of Incorporation: A Comprehensive Guide to Establishing a Business in West Jordan Keywords: West Jordan Utah, Articles of Incorporation, business formation, legal requirements, types of corporations, nonprofit organizations, LLC, for-profit companies. Introduction: The West Jordan Utah Articles of Incorporation is a crucial legal document required for establishing a business in the city of West Jordan. It outlines the fundamental information and guidelines necessary for incorporating a company in compliance with state laws. This article will provide a detailed description of what the West Jordan Utah Articles of Incorporation entail and discuss the various types of incorporation options available. 1. Understanding West Jordan Utah Articles of Incorporation: The Articles of Incorporation serve as the founding document for a business entity and typically include key details about the company, such as its name, purpose, duration, registered office address, names and addresses of incorporates, and authorized shares of stock. 2. Legal Requirements: To successfully file Articles of Incorporation in West Jordan, certain legal requirements must be met. These include selecting a unique business name that adheres to Utah's naming guidelines, identifying the purpose of the company, designating a registered office address, appointing a registered agent, and determining the number and classes of authorized shares. 3. Types of West Jordan Utah Articles of Incorporation: a. LLC (Limited Liability Company): The West Jordan Utah Articles of Incorporation for an LLC provide a flexible and popular option for small businesses. LCS provide limited liability protection while maintaining the simplicity of partnership-style management and taxation. b. For-Profit Corporations: These Articles of Incorporation pertain to businesses organized for profit-making purposes. For-profit corporations offer limited liability protection to shareholders and allow the company to issue stock to raise capital. c. Nonprofit Organizations: Nonprofit corporations, as governed by West Jordan Utah Articles of Incorporation, are established solely for charitable, educational, religious, or scientific purposes. These organizations enjoy tax-exempt status while serving the betterment of society as a whole. Conclusion: Establishing a business in West Jordan, Utah requires the completion of the West Jordan Utah Articles of Incorporation. This essential legal document outlines the necessary information and guidelines for incorporating a company within the city's boundaries. Whether opting for an LLC, for-profit corporation, or nonprofit organization, understanding the significance of the Articles of Incorporation and meeting the legal requirements is vital for successfully establishing and operating a business entity in West Jordan, Utah.

West Jordan Utah Articles of Incorporation

Description

How to fill out West Jordan Utah Articles Of Incorporation?

Make use of the US Legal Forms and get instant access to any form sample you want. Our helpful platform with thousands of document templates allows you to find and get virtually any document sample you require. You can export, complete, and sign the West Jordan Utah Articles of Incorporation in a couple of minutes instead of surfing the Net for several hours searching for the right template.

Using our collection is a superb way to improve the safety of your record submissions. Our professional attorneys on a regular basis review all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you get the West Jordan Utah Articles of Incorporation? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Open the page with the form you require. Ensure that it is the form you were hoping to find: verify its headline and description, and use the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the file. Pick the format to get the West Jordan Utah Articles of Incorporation and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable form libraries on the internet. We are always ready to assist you in virtually any legal process, even if it is just downloading the West Jordan Utah Articles of Incorporation.

Feel free to benefit from our platform and make your document experience as convenient as possible!