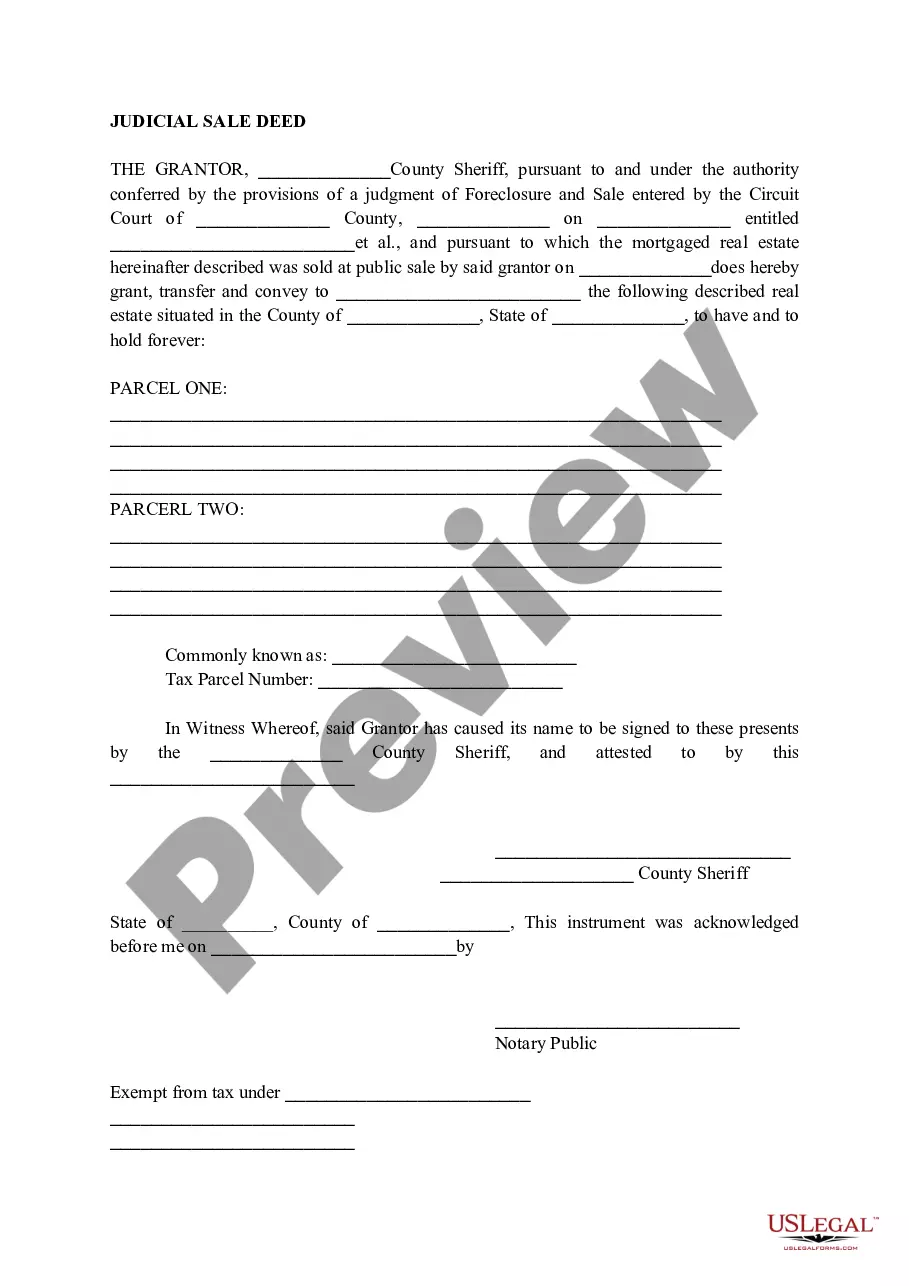

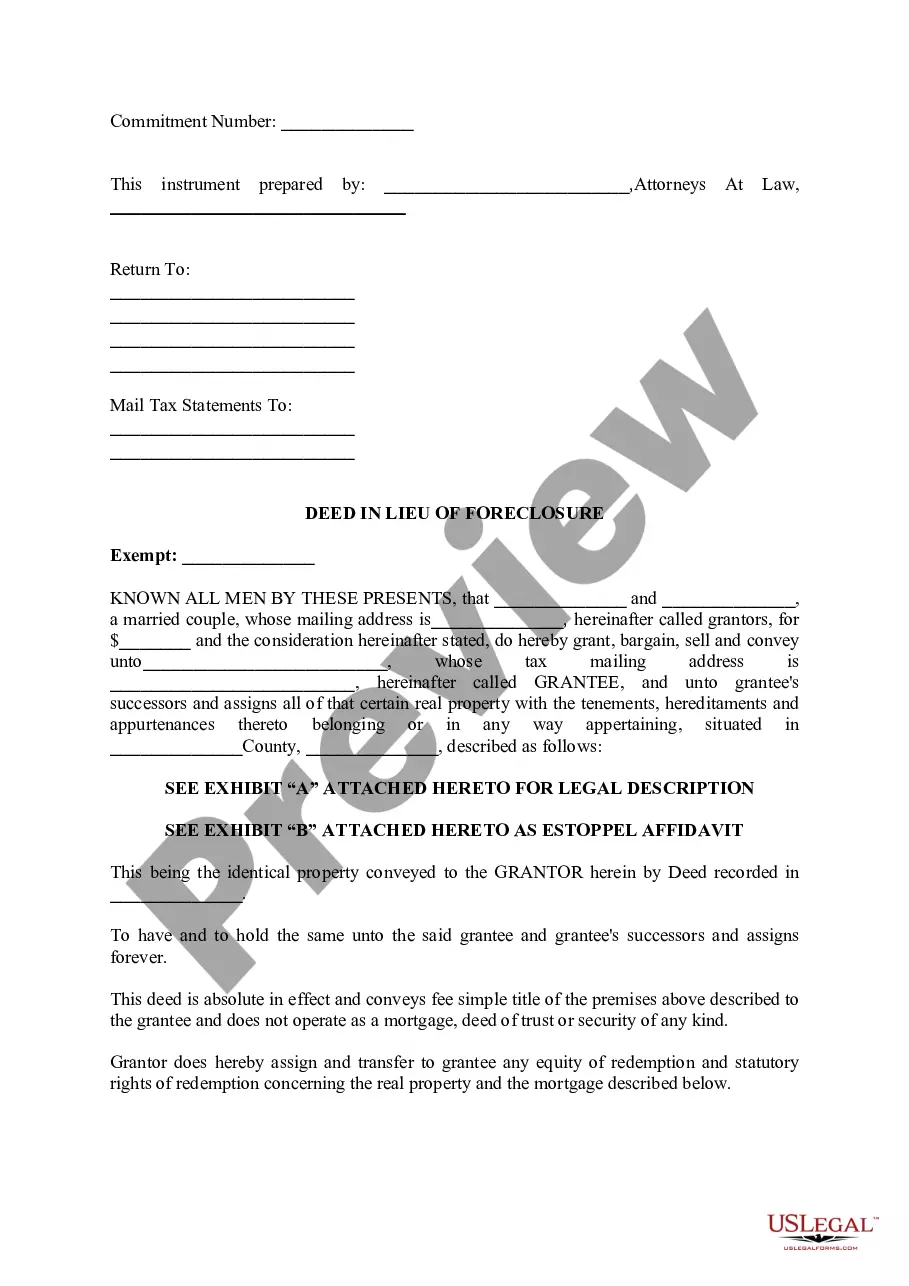

Provo Utah Judicial Sale Deed

Description

How to fill out Utah Judicial Sale Deed?

Utilize the US Legal Forms and gain instant access to any form you desire.

Our efficient platform with a vast array of documents streamlines the process of locating and obtaining nearly any document sample you may require.

You can download, complete, and endorse the Provo Utah Judicial Sale Deed within minutes rather than spending hours on the internet searching for a suitable template.

Leveraging our library enhances the security of your document submissions.

If you don’t have an account yet, follow the steps outlined below.

Locate the form you need. Verify that it is the document you were searching for: review its title and description, and take advantage of the Preview feature if it is accessible. If not, utilize the Search bar to find the required one.

- Our knowledgeable legal experts routinely evaluate all documents to ensure that the forms are applicable to a specific area and comply with current laws and regulations.

- How can you acquire the Provo Utah Judicial Sale Deed.

- If you already possess a subscription, simply Log In to your account.

- The Download option will be available for all samples you view.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

Yes, it is possible for someone to place a lien on your house without your immediate knowledge. This may happen if a creditor files a lien for unpaid debts such as loans or taxes. Understanding how these liens can affect your property is essential, particularly concerning issues like a Provo Utah Judicial Sale Deed. To stay informed, utilize resources from uslegalforms that help you manage your property’s legal matters effectively.

To perform a title search in Utah, you'll need to start by visiting the county clerk's office where the property is located. You can request public records by accessing online databases or visiting in person to uncover information about ownership, liens, or encumbrances. Conducting a thorough title search is crucial, especially when considering a Provo Utah Judicial Sale Deed. For assistance in your title search, our uslegalforms platform can be a valuable resource.

Yes, Utah has a redemption period that allows property owners to reclaim their property after a tax sale. Typically, this period lasts for four years in Utah, starting from the date the tax lien is sold. This means that homeowners can regain ownership by paying their outstanding tax debts, making the Provo Utah Judicial Sale Deed an important document in this process. To navigate these situations, uslegalforms offers helpful guides.

In Utah, a lien typically lasts for a period of five years from the date it is recorded. However, if the creditor takes action to renew the lien, it may remain in effect for an additional five years. Understanding the duration of a lien is important, especially when dealing with a Provo Utah Judicial Sale Deed, as this can impact property ownership. If you have questions about liens, our platform at uslegalforms can provide important resources.

Property taxes typically do not come out of your mortgage directly. However, many lenders collect property taxes as part of the monthly mortgage payment and hold that amount in escrow until due. It's important to clarify this with your lender, especially when considering the implications of a Provo Utah Judicial Sale Deed.

In Utah, property taxes can remain unpaid for up to five years before the state places the property up for tax sale. During this time, the property owner may feel pressure to settle tax debts to avoid losing their home. Staying informed about tax timelines is important, especially if you explore options like a Provo Utah Judicial Sale Deed.

In Utah, obtaining a tax deed does not automatically eliminate existing mortgages on the property. The original mortgage may remain in effect, and the lender can still pursue collection. Thus, if you acquire a property through a Provo Utah Judicial Sale Deed, you should understand any underlying mortgage obligations that may come with it.

To check for a lien on a property in Utah, you can visit the local county recorder's office or access online resources provided by the state. These resources often include property records that list liens. Additionally, consulting a real estate attorney can further clarify any liens associated with the property. Understanding the status of liens is crucial when considering a Provo Utah Judicial Sale Deed.

In Utah, a tax sale does not automatically wipe out an existing mortgage. If a property is sold through a Provo Utah Judicial Sale Deed, the mortgage lender may still hold a claim on the property, which can lead to complications for the buyer. It’s advisable to conduct thorough research on the property's financial liabilities and consult with legal experts. UsLegalForms can assist you in understanding the mortgage implications when dealing with tax sales.

To obtain a copy of your deed in Utah, visit your local county recorder's office or check if they offer online services. Providing details such as your property's address will help retrieve the correct Provo Utah Judicial Sale Deed efficiently. If you encounter difficulties or prefer convenience, UsLegalForms can offer personalized solutions to obtain your deed.