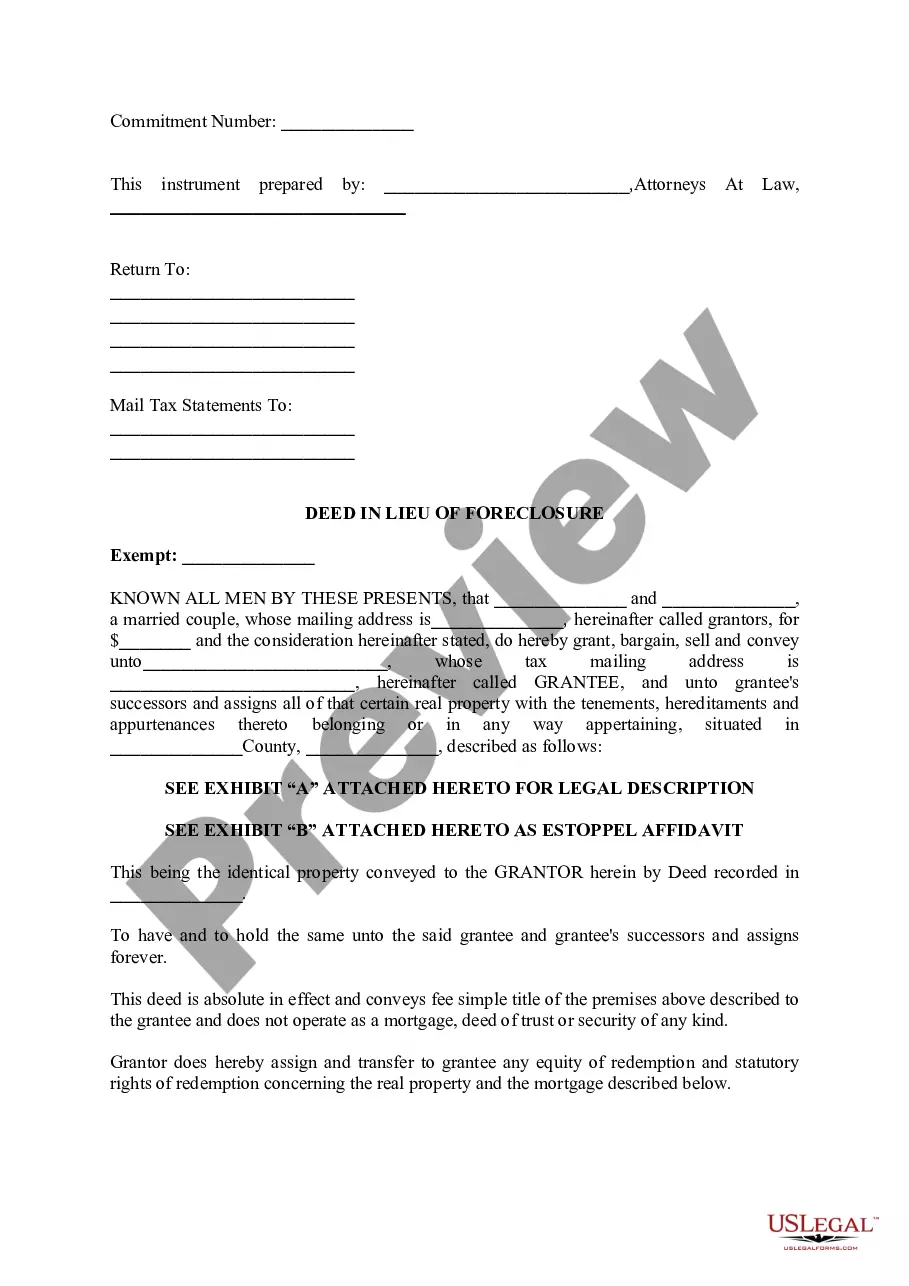

Salt Lake Utah Deed in Lieu of Foreclosure

Description

How to fill out Utah Deed In Lieu Of Foreclosure?

Regardless of social or professional standing, completing legal paperwork is an unfortunate requirement in today’s workplace.

Frequently, it’s nearly impossible for someone without a legal background to create such documents from the ground up, primarily due to the complex terminology and legal nuances they entail.

This is where US Legal Forms proves useful.

Ensure the template you selected is appropriate for your area since laws from one state or county may not apply to another.

Check the form and read a brief description (if available) regarding the scenarios for which the document is applicable.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their efficiency with our DIY forms.

- Whether you need the Salt Lake Utah Deed in Lieu of Foreclosure or any other document valid in your region, US Legal Forms puts everything within reach.

- Here’s how to quickly obtain the Salt Lake Utah Deed in Lieu of Foreclosure using our reliable service.

- If you are already a subscriber, you can simply Log In to download the required form.

- However, if you are a newcomer to our library, please follow these steps before downloading the Salt Lake Utah Deed in Lieu of Foreclosure.

Form popularity

FAQ

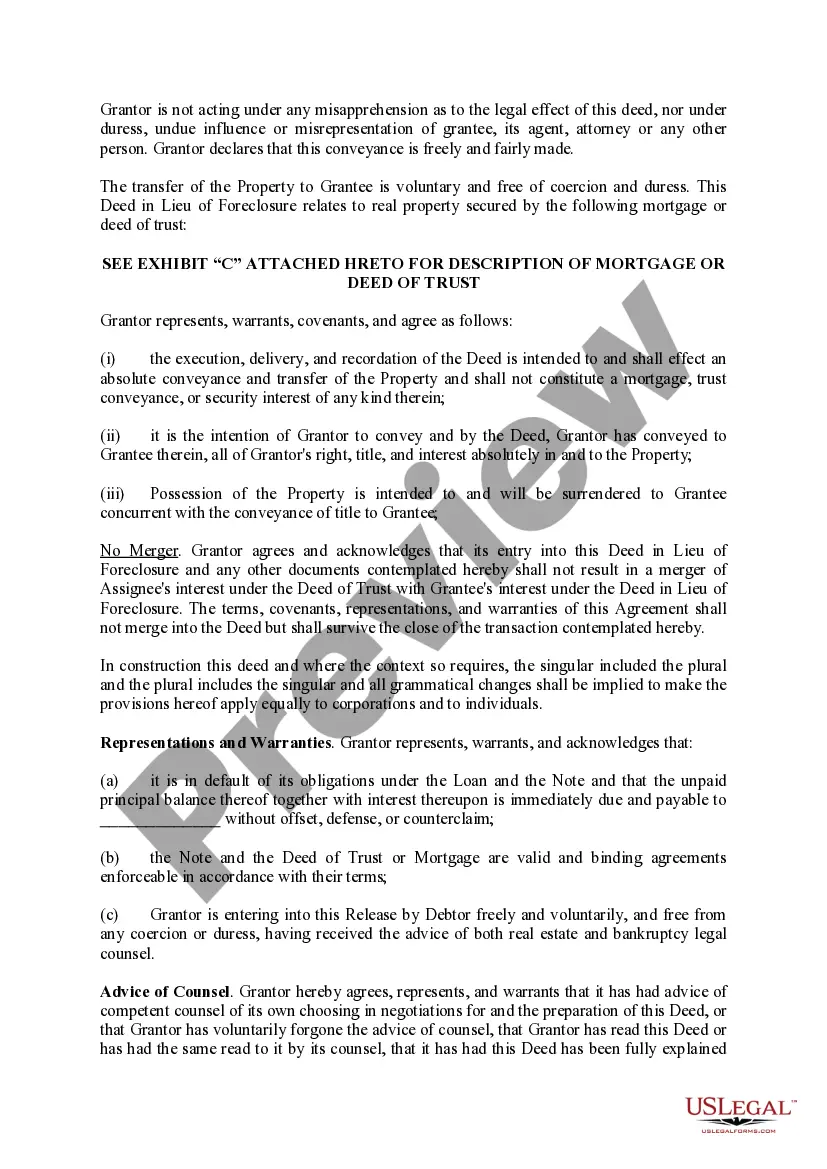

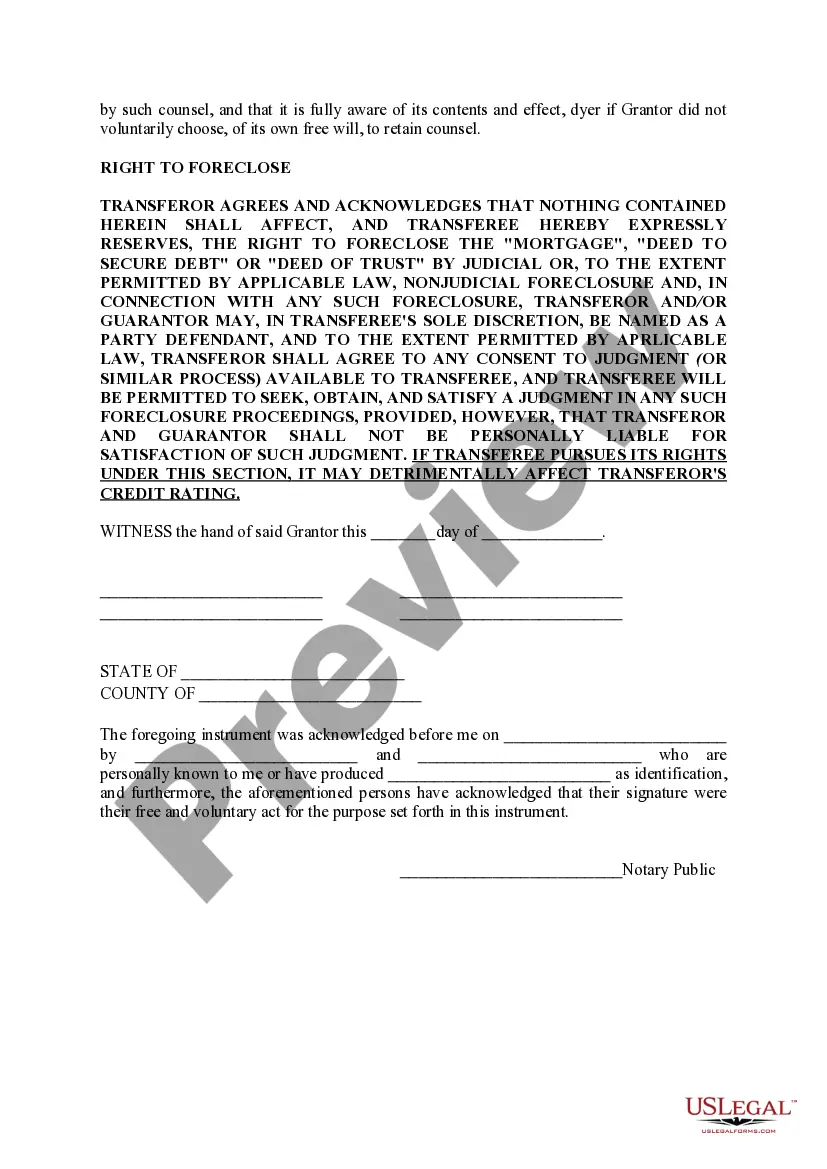

While a Salt Lake Utah Deed in Lieu of Foreclosure can offer a way to avoid foreclosure, it does come with disadvantages. It may affect your credit score negatively, although typically less so than a foreclosure. Additionally, you may still owe taxes on any forgiven debt, and some lenders might require you to prove your financial hardship. Thus, it's vital to fully understand the implications before proceeding.

To process a Salt Lake Utah Deed in Lieu of Foreclosure, start by contacting your lender to discuss your situation. Gather necessary documents, including your mortgage information and any financial records. Next, work with a real estate attorney or use platforms like USLegalForms to ensure all paperwork is correctly completed. Finally, submit the deed to the lender and have it recorded with the county.

Lenders often prefer a Salt Lake Utah Deed in Lieu of Foreclosure because it allows them to recover their losses more quickly and efficiently. This option saves time and resources compared to the lengthy and costly foreclosure process. Additionally, a deed in lieu often leads to less property depreciation, which is beneficial for lenders concerned about maintaining asset value.

Yes, you can buy a house after a Salt Lake Utah Deed in Lieu of Foreclosure, but certain conditions apply. Generally, lenders may require a waiting period of two to four years after such a deed before you're eligible for a new mortgage. During this time, it is advisable to work on rebuilding your credit and demonstrating financial stability.

One disadvantage of a Salt Lake Utah Deed in Lieu of Foreclosure is the potential for tax implications. In some cases, lenders may consider the forgiven amount as income, leading to a tax bill. Additionally, while it typically allows for a quicker exit from a financial hardship, homeowners may still have lingering feelings of loss, making it harder emotionally to move forward.

The impact of a Salt Lake Utah Deed in Lieu of Foreclosure on your credit can be significant but is often less damaging than foreclosure itself. It may stay on your credit report for up to seven years, affecting your ability to obtain future loans during that time. However, if managed well, individuals can start rebuilding their credit sooner after a deed in lieu than after experiencing a foreclosure.

A Salt Lake Utah Deed in Lieu of Foreclosure can negatively impact your credit score, but it is generally less severe than a full foreclosure. This action may lower your score by 50 to 100 points, depending on your initial credit standing. While this drop can affect your creditworthiness, it often allows for a quicker recovery compared to more drastic actions like foreclosure.

When comparing a foreclosure to a Salt Lake Utah Deed in Lieu of Foreclosure, it's essential to recognize the implications of each option. Typically, a deed in lieu may be seen as the more desirable choice because it resolves the default quickly and can limit further financial liabilities. However, both options have significant negative consequences, including damage to your credit score. Ultimately, choosing between them often depends on your specific financial situation.

A deed in lieu of foreclosure accepted by the lender is a legal document whereby the borrower gives their property back to the lender, allowing them to avoid traditional foreclosure. This agreement typically helps both parties, as it allows the lender to regain control of the property while offering the homeowner an opportunity to lessen their debt burden. Utilizing services like USLegalForms can simplify this process by providing necessary templates and guidance for navigating your Salt Lake Utah Deed in Lieu of Foreclosure.

Several factors can prevent a lender from accepting a Salt Lake Utah Deed in Lieu of Foreclosure. For instance, the existence of subordinate liens or outstanding debts on the property can complicate acceptance, as the lender may want full ownership without additional obligations. Additionally, if the value of the property is significantly lower than the outstanding mortgage, lenders might perceive this as a loss and choose to pursue foreclosure instead.