Salt Lake City Utah Deed in Lieu of Foreclosure is a legal process in which a homeowner transfers ownership of their property to the lender in order to avoid foreclosure. This can be an alternative solution for homeowners who are struggling to make their mortgage payments and are unable to sell their property for an amount that covers the outstanding debt. In a Salt Lake City Utah Deed in Lieu of Foreclosure, the homeowner voluntarily surrenders the property to the lender, and in return, the lender agrees to release them from their mortgage obligation. This can be a mutually beneficial arrangement as it allows the homeowner to avoid the negative consequences of foreclosure on their credit report and also saves the lender time and money associated with the foreclosure process. There are two main types of Salt Lake City Utah Deed in Lieu of Foreclosure: 1. Traditional Deed in Lieu of Foreclosure: This is the standard process where the lender accepts the property title in exchange for releasing the homeowner from their mortgage debt. The homeowner must meet certain eligibility criteria set by the lender, such as demonstrating financial hardship and making a good faith effort to sell the property at fair market value. 2. Cash for Keys: This is a variation of the traditional Deed in Lieu of Foreclosure where the lender provides the homeowner with a monetary incentive to voluntarily vacate the property. In addition to transferring the property title, the lender offers a cash amount to help the homeowner with relocation expenses or to incentivize their cooperation. Both types of Deed in Lieu of Foreclosure allow homeowners to avoid the lengthy and costly foreclosure process while providing a way for lenders to recover some of their investment. It is important for homeowners to consult with a qualified attorney or real estate professional to understand the potential consequences and benefits of pursuing a Deed in Lieu of Foreclosure in Salt Lake City, Utah.

Salt Lake City Utah Deed in Lieu of Foreclosure

Category:

State:

Utah

City:

Salt Lake City

Control #:

UT-LR058T

Format:

Word;

Rich Text

Instant download

Description

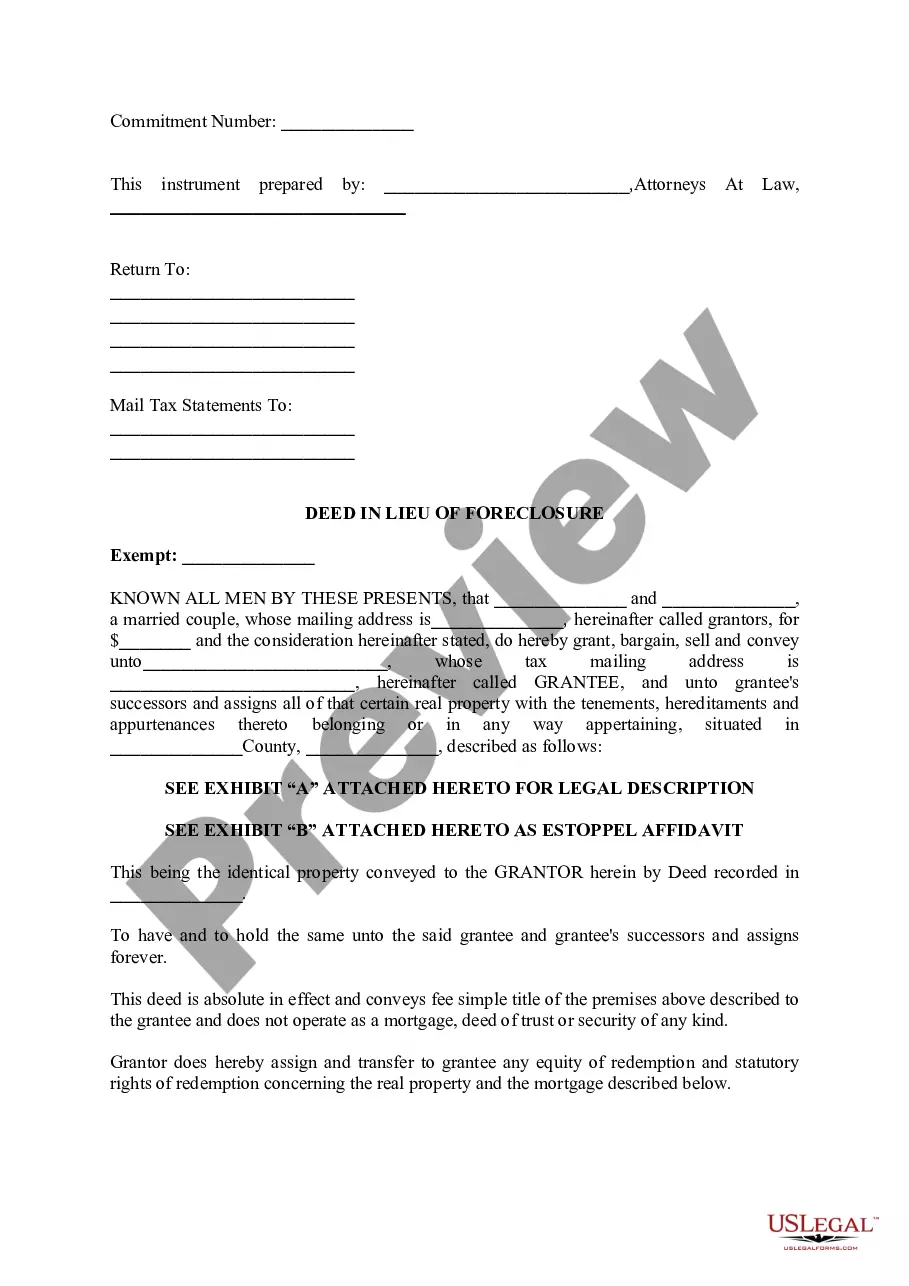

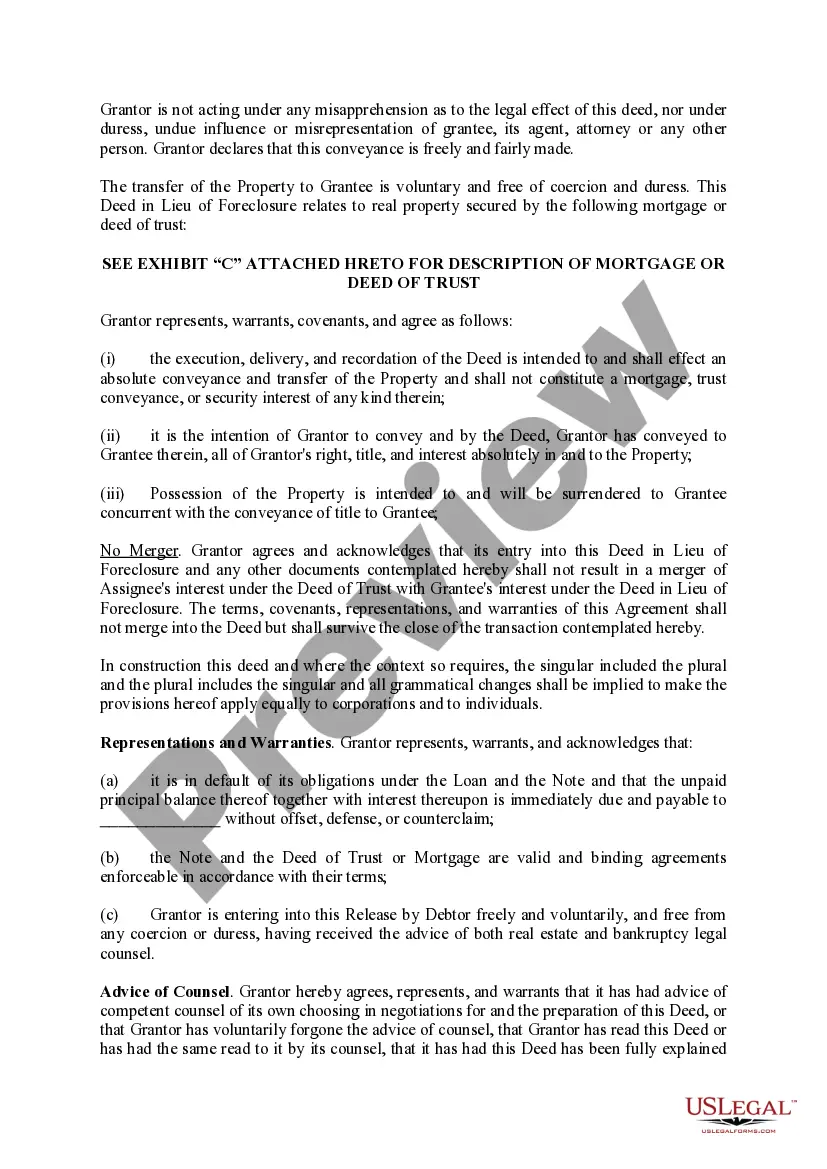

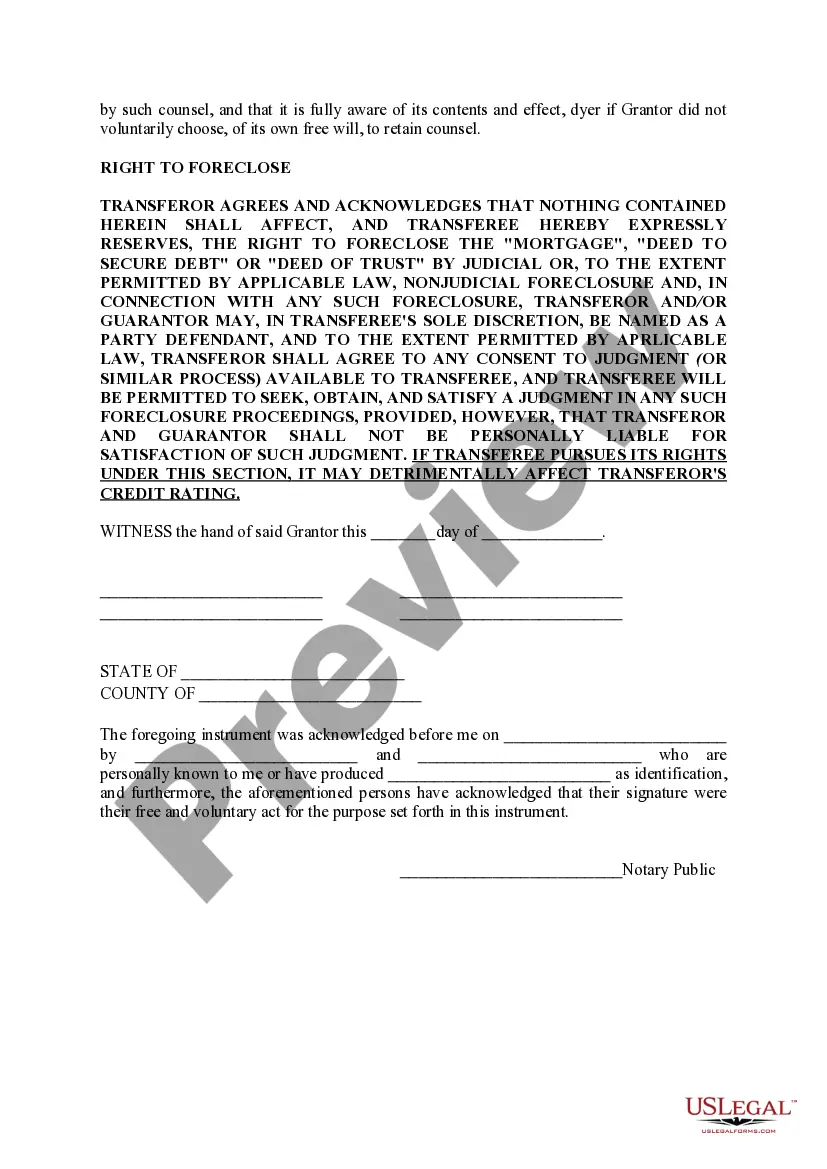

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Salt Lake City Utah Deed in Lieu of Foreclosure is a legal process in which a homeowner transfers ownership of their property to the lender in order to avoid foreclosure. This can be an alternative solution for homeowners who are struggling to make their mortgage payments and are unable to sell their property for an amount that covers the outstanding debt. In a Salt Lake City Utah Deed in Lieu of Foreclosure, the homeowner voluntarily surrenders the property to the lender, and in return, the lender agrees to release them from their mortgage obligation. This can be a mutually beneficial arrangement as it allows the homeowner to avoid the negative consequences of foreclosure on their credit report and also saves the lender time and money associated with the foreclosure process. There are two main types of Salt Lake City Utah Deed in Lieu of Foreclosure: 1. Traditional Deed in Lieu of Foreclosure: This is the standard process where the lender accepts the property title in exchange for releasing the homeowner from their mortgage debt. The homeowner must meet certain eligibility criteria set by the lender, such as demonstrating financial hardship and making a good faith effort to sell the property at fair market value. 2. Cash for Keys: This is a variation of the traditional Deed in Lieu of Foreclosure where the lender provides the homeowner with a monetary incentive to voluntarily vacate the property. In addition to transferring the property title, the lender offers a cash amount to help the homeowner with relocation expenses or to incentivize their cooperation. Both types of Deed in Lieu of Foreclosure allow homeowners to avoid the lengthy and costly foreclosure process while providing a way for lenders to recover some of their investment. It is important for homeowners to consult with a qualified attorney or real estate professional to understand the potential consequences and benefits of pursuing a Deed in Lieu of Foreclosure in Salt Lake City, Utah.

Free preview

How to fill out Salt Lake City Utah Deed In Lieu Of Foreclosure?

If you’ve already utilized our service before, log in to your account and save the Salt Lake City Utah Deed in Lieu of Foreclosure on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Salt Lake City Utah Deed in Lieu of Foreclosure. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!