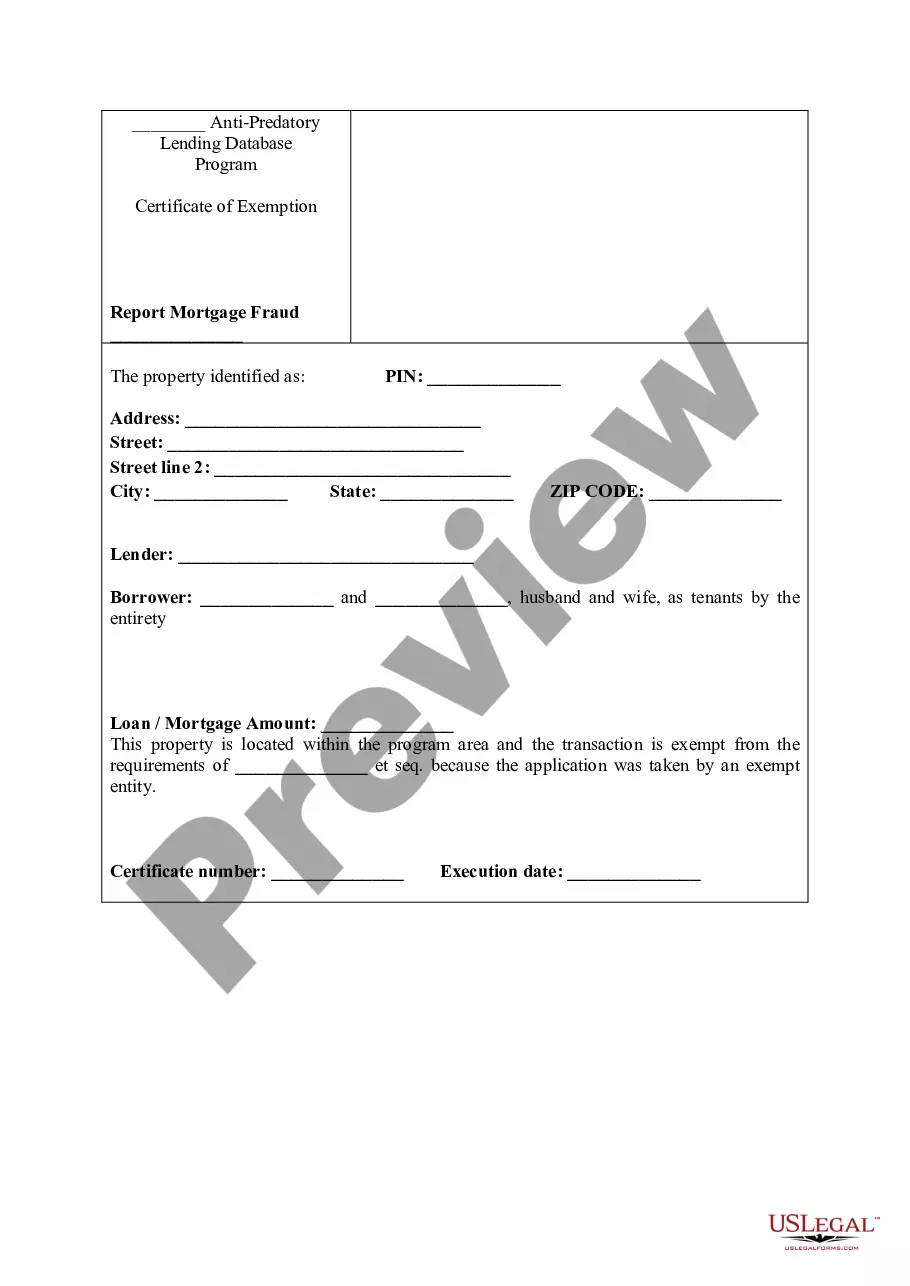

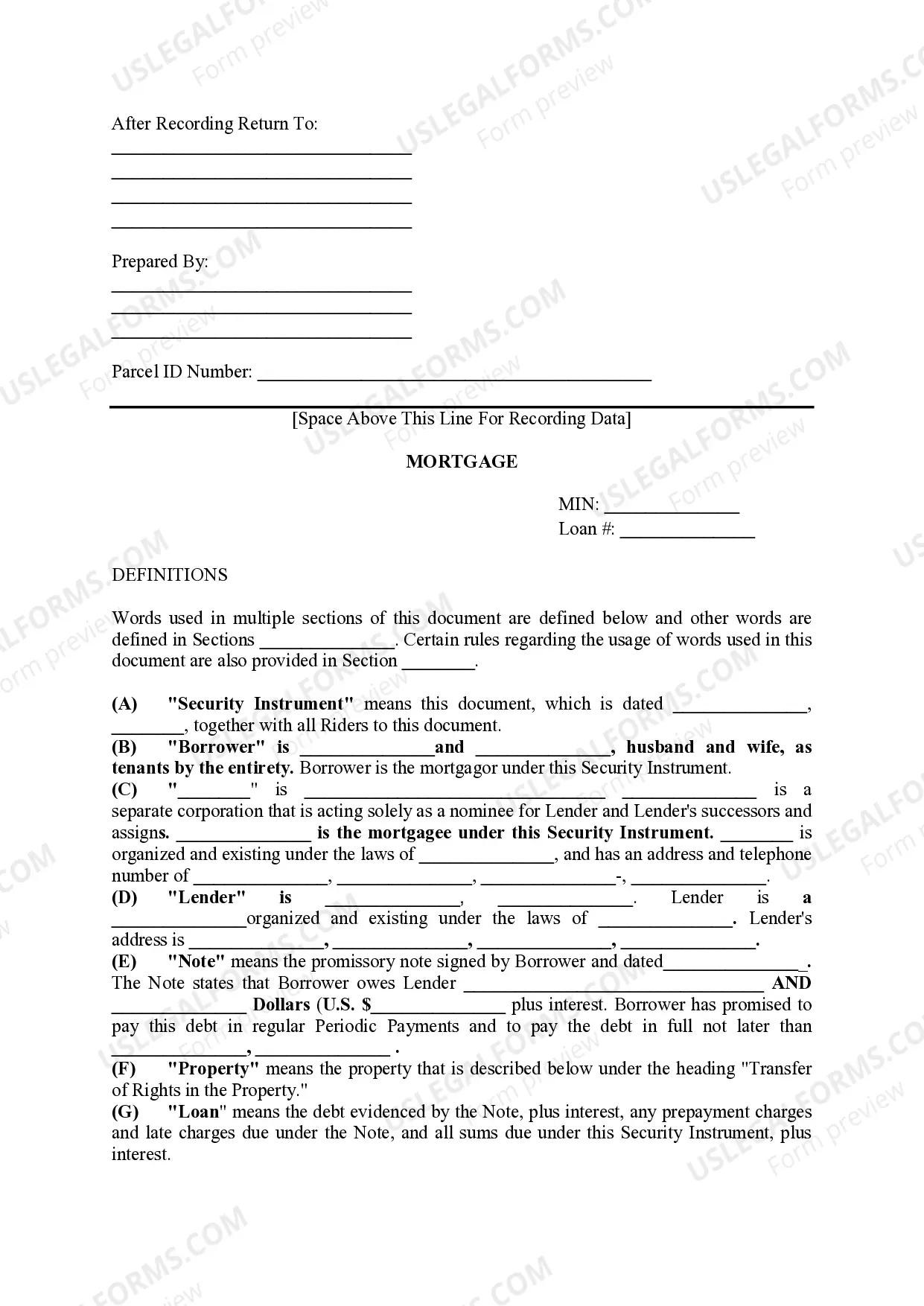

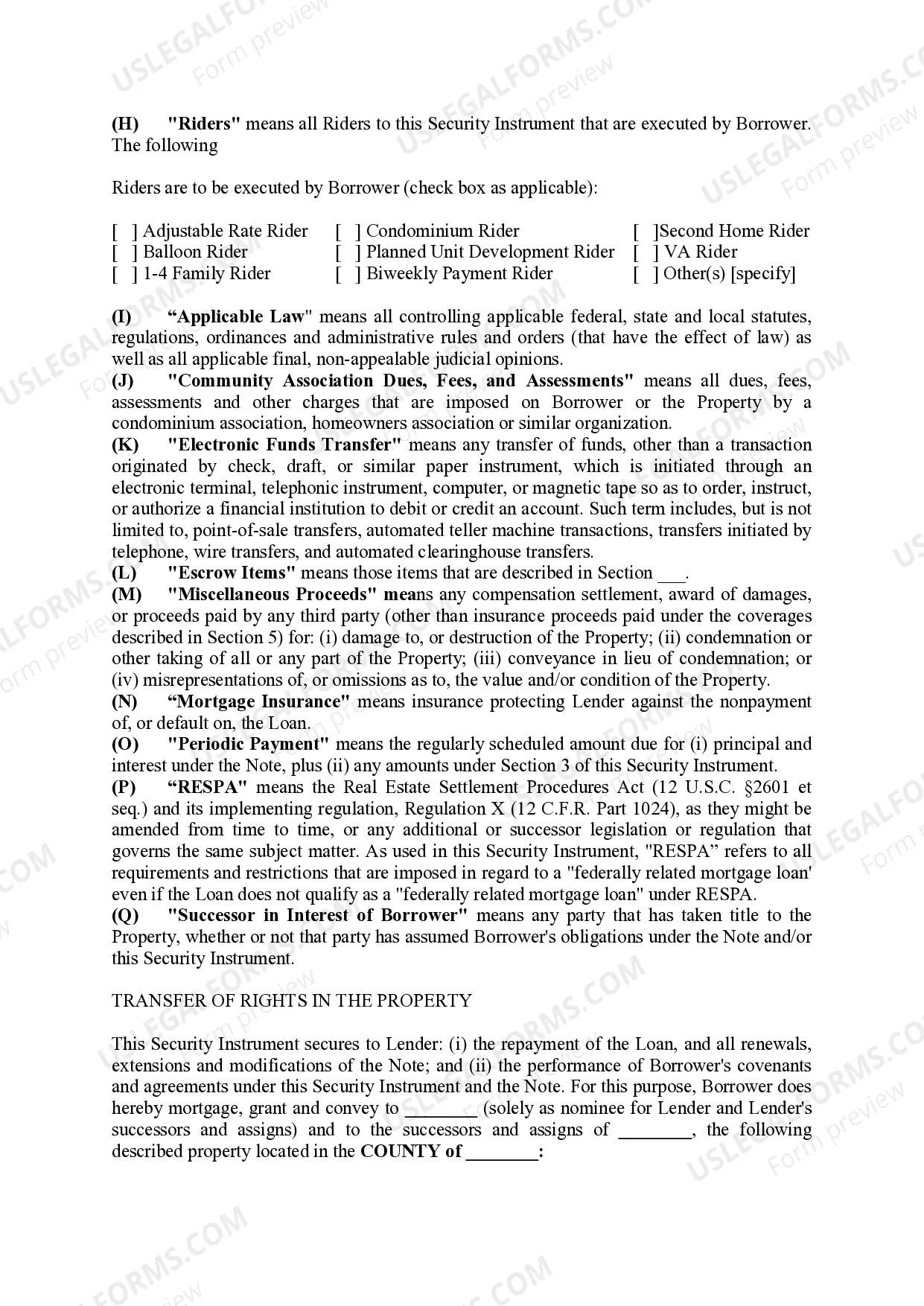

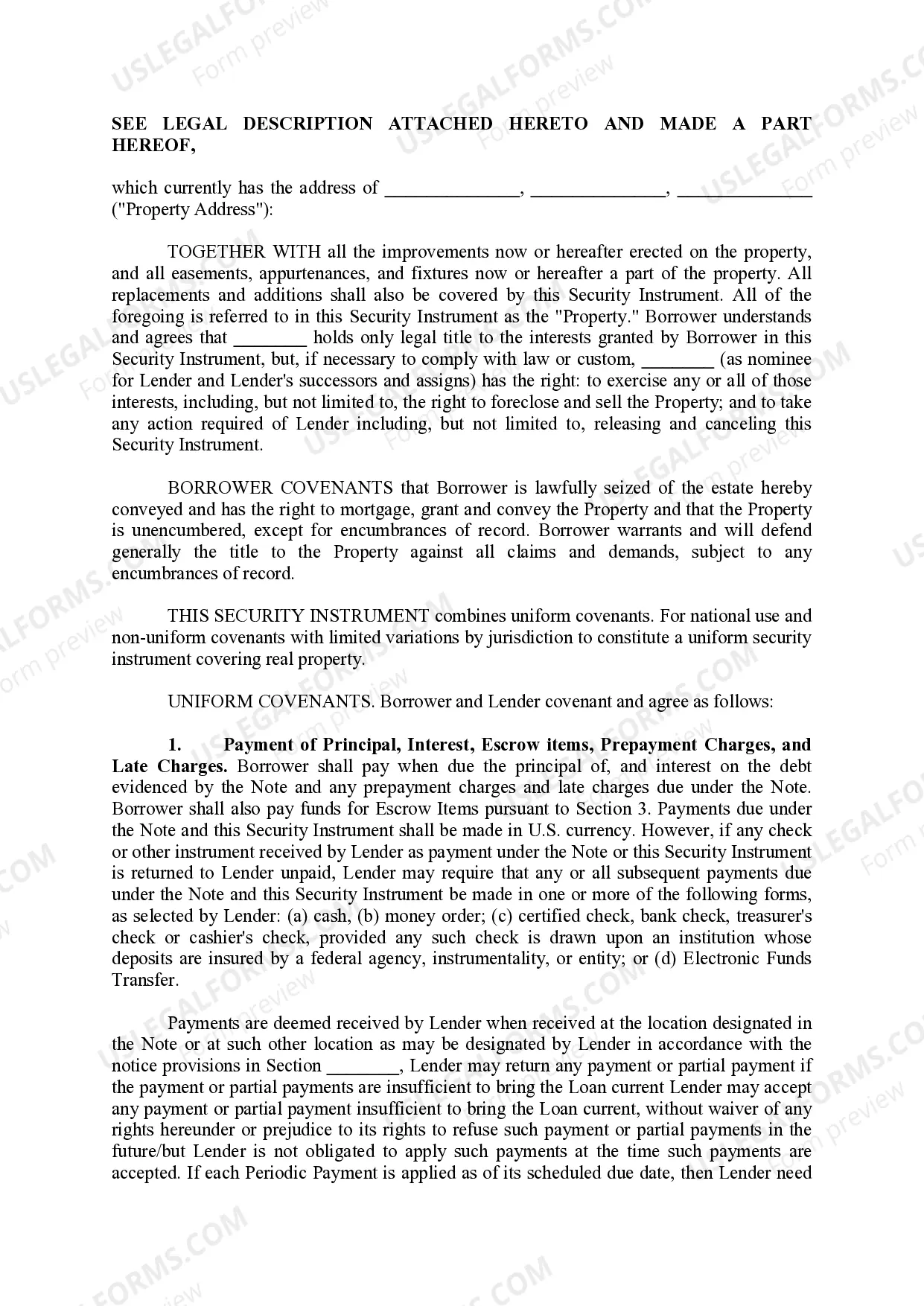

A Provo Utah Mortgage Security Agreement is a legal contract that outlines the terms and conditions of a mortgage loan between a borrower and a lender in Provo, Utah. This agreement serves as a security measure for the lender, ensuring that if the borrower defaults on the loan, the lender has the right to foreclose on the property and recoup their investment. In a Provo Utah Mortgage Security Agreement, the borrower pledges their property as collateral to secure the loan. This collateral can be a residential or commercial property located in Provo, Utah. The agreement specifies the details of the property, including its address, size, and value. The agreement also establishes the terms and conditions of the mortgage loan, including the loan amount, interest rate, repayment schedule, and any specific terms agreed upon by the borrower and lender. These terms determine the duration of the loan and the amount of monthly payments the borrower is obligated to make. In addition to the general agreement, there are different types of Provo Utah Mortgage Security Agreements that borrowers and lenders can choose from, depending on their specific needs and circumstances. Some common types include: 1. Residential Mortgage Security Agreement: This type of agreement is used when the borrower is obtaining a mortgage loan to purchase or refinance a residential property, such as a house or condominium, in Provo, Utah. 2. Commercial Mortgage Security Agreement: This agreement is designed for borrowers seeking a mortgage loan to finance a commercial property, such as an office building, retail space, or industrial property in Provo, Utah. 3. Construction Mortgage Security Agreement: This type of agreement is used when the borrower intends to use the mortgage loan to finance the construction or renovation of a property located in Provo, Utah. It typically includes additional provisions related to the construction process and disbursement of funds. 4. Second Mortgage Security Agreement: In some cases, borrowers may need to take out a second mortgage on their property in Provo, Utah. This can be done through a second mortgage security agreement, which outlines how the second mortgage will be treated in relation to any existing mortgages. 5. Adjustable-Rate Mortgage (ARM) Security Agreement: This agreement is specifically for borrowers who opt for an adjustable-rate mortgage loan in Provo, Utah. It details the terms and conditions of the ARM, including the initial interest rate, adjustment periods, and annual percentage rate (APR). It is important for both borrowers and lenders to fully understand the terms and conditions outlined in a Provo Utah Mortgage Security Agreement. Seeking legal advice or consulting with a professional in the field is always recommended ensuring compliance with local regulations and to protect the interests of all parties involved.

Provo Utah Mortgage Security Agreement

Description

How to fill out Provo Utah Mortgage Security Agreement?

If you are searching for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can get a huge number of form samples for organization and personal purposes by categories and states, or keywords. Using our advanced search feature, finding the most recent Provo Utah Mortgage Security Agreement is as elementary as 1-2-3. Additionally, the relevance of every file is verified by a team of expert attorneys that regularly check the templates on our website and revise them according to the newest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Provo Utah Mortgage Security Agreement is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you want. Check its explanation and use the Preview option to explore its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the proper record.

- Confirm your choice. Click the Buy now button. After that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Provo Utah Mortgage Security Agreement.

Every form you save in your account does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to get an extra duplicate for modifying or creating a hard copy, you may return and save it once more at any time.

Take advantage of the US Legal Forms professional library to get access to the Provo Utah Mortgage Security Agreement you were seeking and a huge number of other professional and state-specific templates on a single platform!