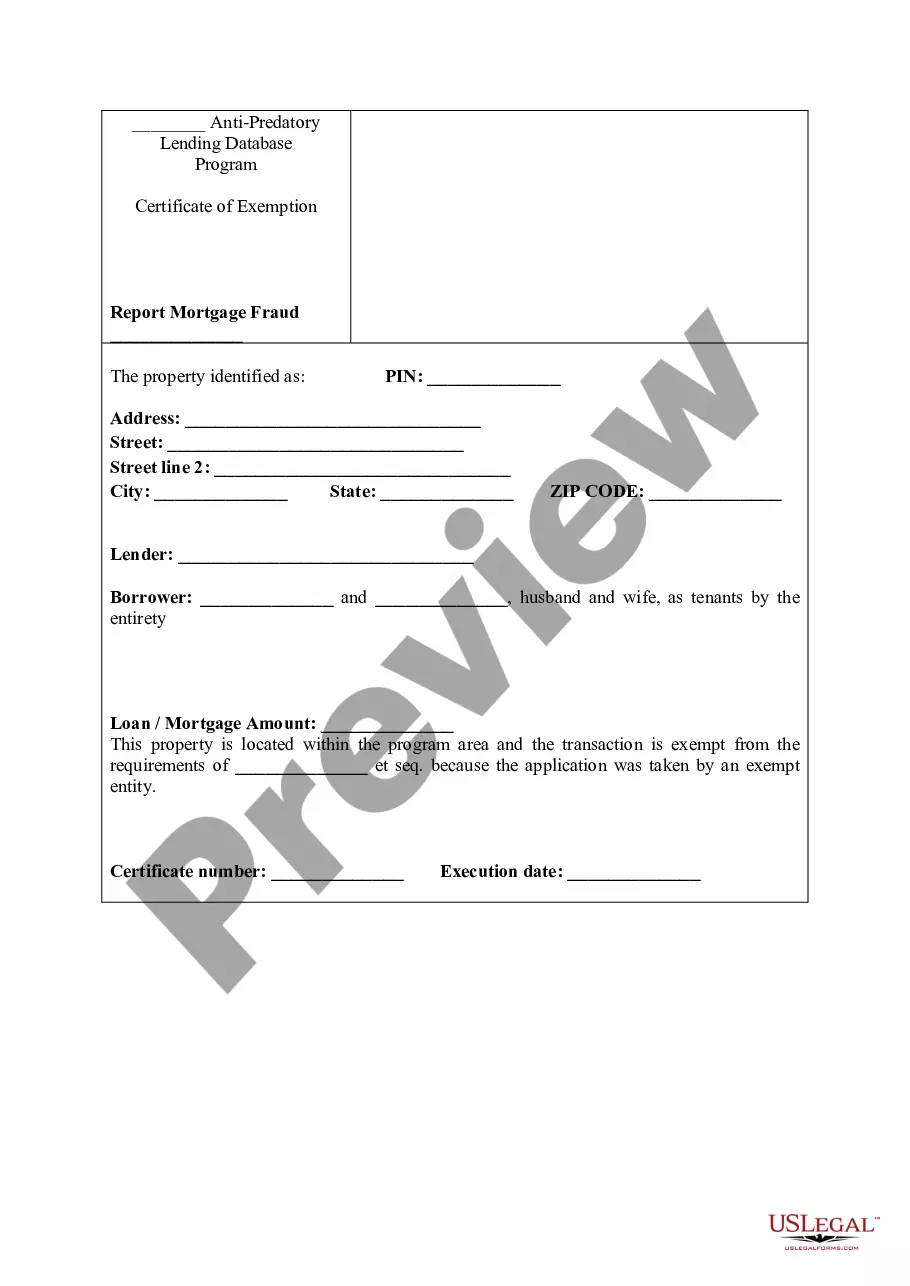

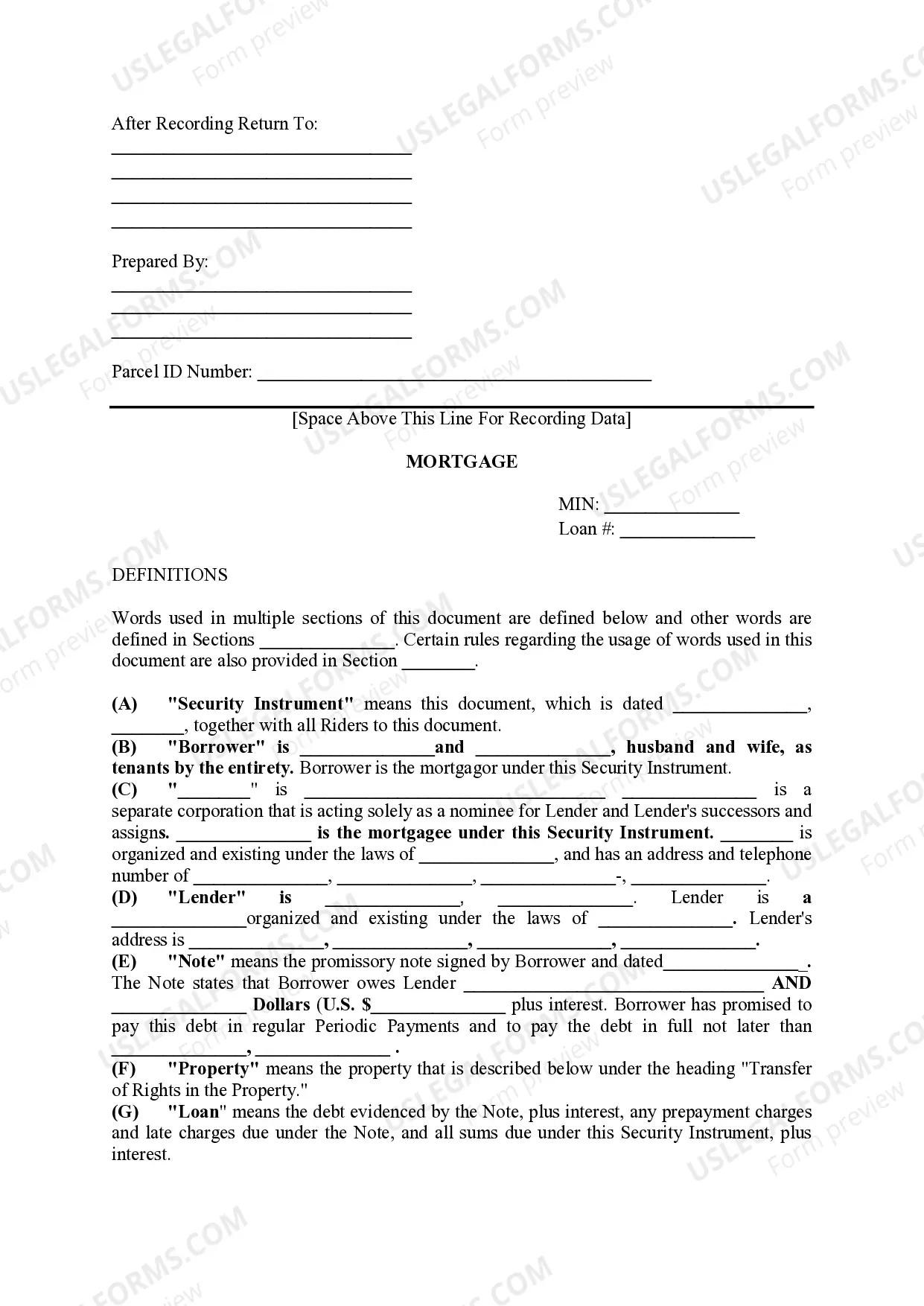

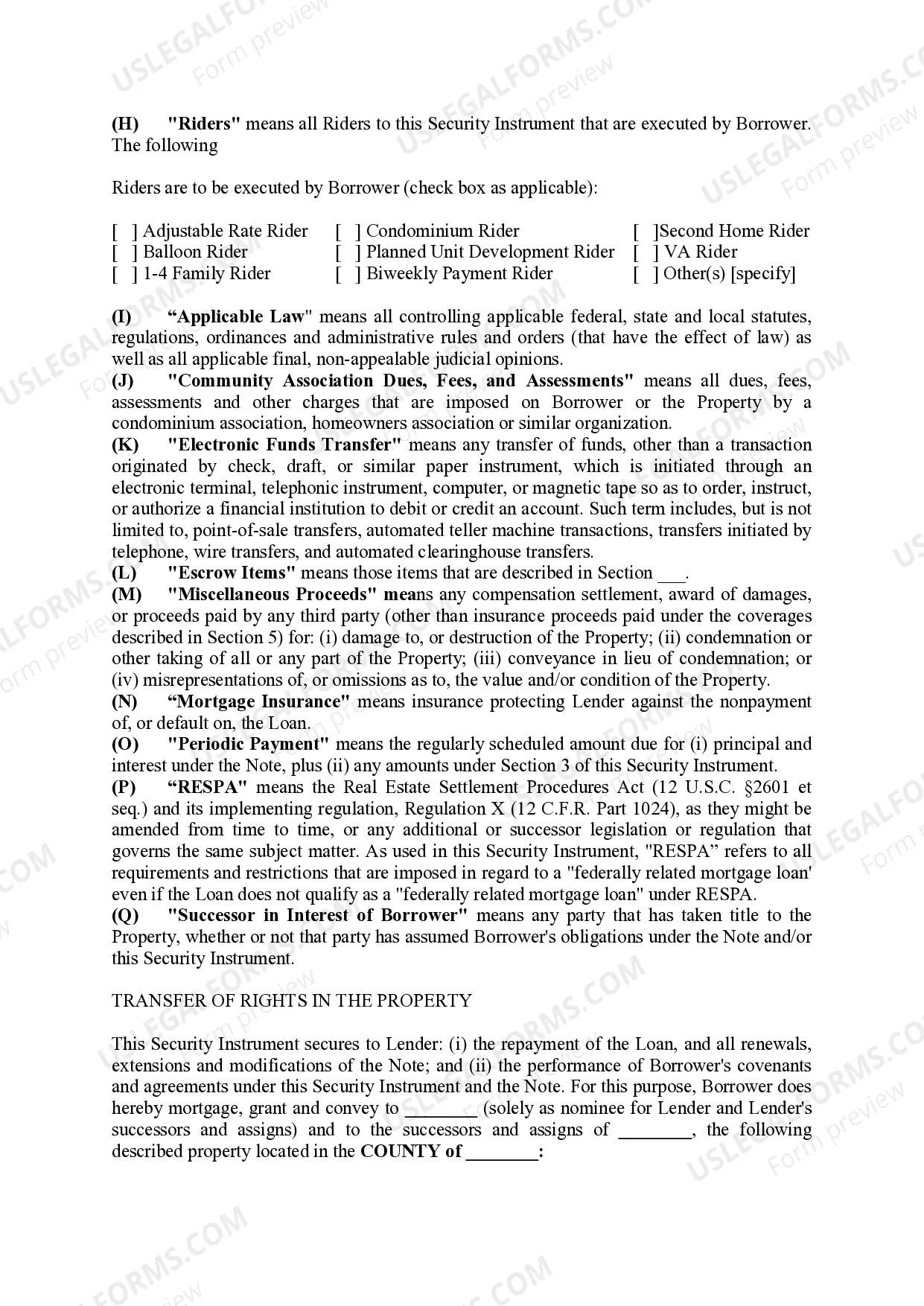

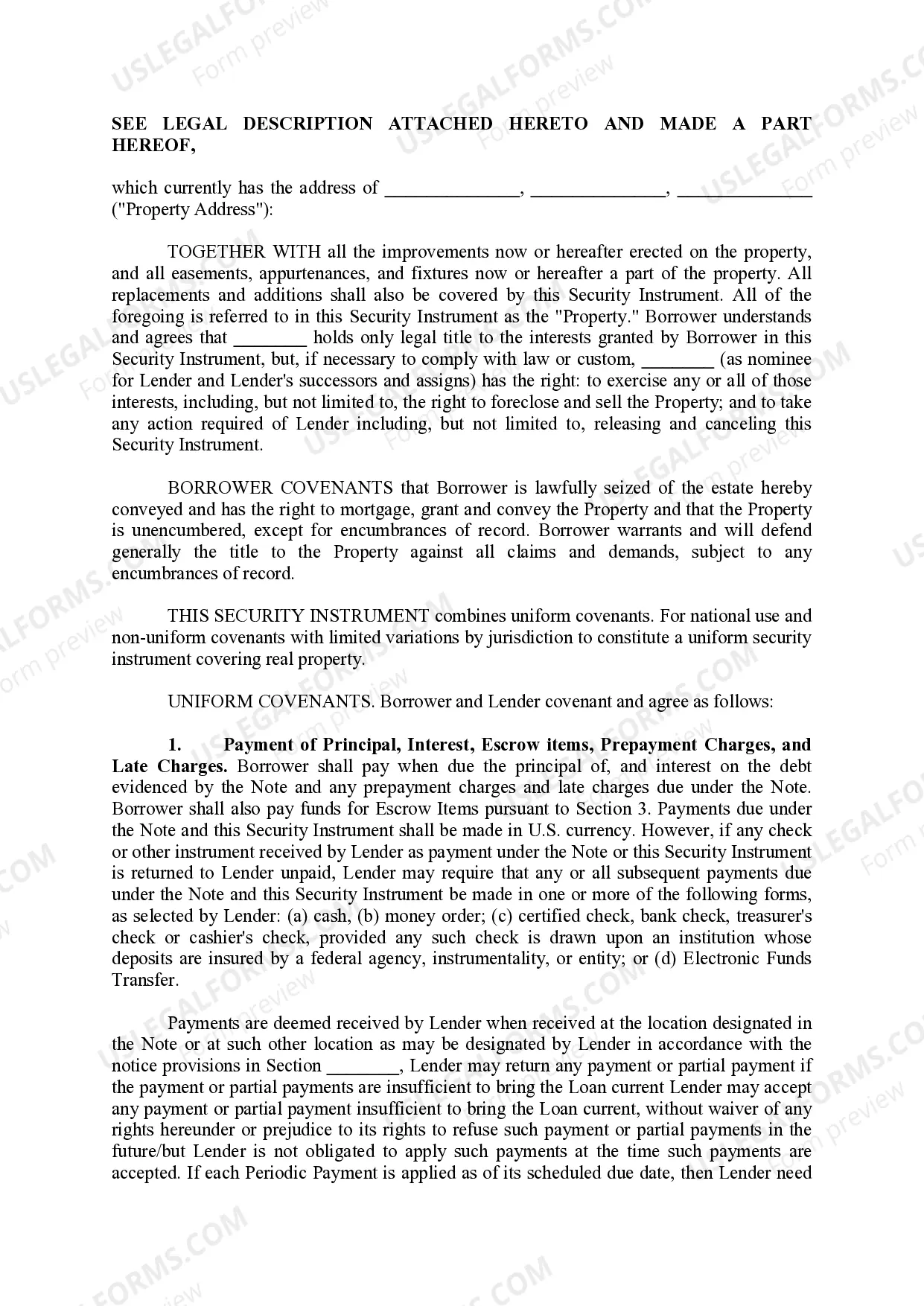

A Salt Lake Utah Mortgage Security Agreement is a legal document that serves as collateral for a loan taken out by a borrower to purchase a property in Salt Lake City, Utah. It is a form of protection for the lender in case the borrower defaults on the loan payments. This agreement outlines the terms and conditions of the mortgage, including the loan amount, interest rate, repayment schedule, and any penalties for defaulting on the loan. It also specifies the rights and responsibilities of both the borrower and the lender. There are several types of Salt Lake Utah Mortgage Security Agreements that individuals and businesses can choose from, depending on their specific needs and circumstances: 1. Conventional Mortgage: This is the most common type of mortgage security agreement and is typically offered by banks and lending institutions. It requires a down payment and follows specific guidelines set by Fannie Mae or Freddie Mac. 2. FHA Mortgage: The Federal Housing Administration (FHA) offers this type of mortgage, which is insured by the government. It is a popular choice for first-time homebuyers or individuals with lower credit scores, as it allows for lower down payments and has less stringent qualification requirements. 3. VA Mortgage: This type of mortgage is available to eligible veterans, active-duty service members, and surviving spouses. It is guaranteed by the U.S. Department of Veterans Affairs (VA) and offers favorable terms, such as now down payment and competitive interest rates. 4. USDA Mortgage: The U.S. Department of Agriculture (USDA) provides this type of mortgage for individuals buying homes in eligible rural areas. It offers 100% financing and low-interest rates to promote homeownership and development in rural communities. 5. Jumbo Mortgage: This is a type of mortgage agreement that exceeds the loan limits set by Fannie Mae and Freddie Mac for conventional loans. It is commonly sought by borrowers purchasing high-value properties in Salt Lake City, Utah. In conclusion, a Salt Lake Utah Mortgage Security Agreement is a vital legal document that outlines the terms and conditions of a loan used to purchase a property in Salt Lake City. Different types of agreements, such as conventional, FHA, VA, USDA, and jumbo mortgages, cater to various borrower needs and circumstances.

Salt Lake Utah Mortgage Security Agreement

Description

How to fill out Salt Lake Utah Mortgage Security Agreement?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal background to create this sort of paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Salt Lake Utah Mortgage Security Agreement or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Salt Lake Utah Mortgage Security Agreement in minutes using our trustworthy service. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps before obtaining the Salt Lake Utah Mortgage Security Agreement:

- Be sure the template you have found is suitable for your area since the rules of one state or county do not work for another state or county.

- Review the form and go through a brief description (if available) of scenarios the paper can be used for.

- In case the form you picked doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Salt Lake Utah Mortgage Security Agreement once the payment is through.

You’re all set! Now you can go ahead and print the form or fill it out online. If you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.