Title: Understanding the Salt Lake City Utah Mortgage Security Agreement: Types and Key Aspects Introduction: The Salt Lake City Utah Mortgage Security Agreement plays a pivotal role in real estate transactions by providing security to lenders or financial institutions when financing a property purchase. This detailed description will explore the concept of the Salt Lake City Utah Mortgage Security Agreement, its importance, and delve into the different types that exist. Types of Salt Lake City Utah Mortgage Security Agreement: 1. First Mortgage: A first mortgage is the most common type of mortgage security agreement seen in Salt Lake City, Utah. In this agreement, the lender holds the primary lien position, which means in case of default, they have the first claim on the property. First mortgages are often sought by buyers looking to purchase a property without previous liens or encumbrances. 2. Second Mortgage: A second mortgage security agreement is a secondary lien against a property. It is used when buyers need additional funds for home improvements, debt consolidation, or other financial purposes. In the event of default, the first mortgage holder is paid first, while the second mortgage holder assumes the risk should there be any remaining balance. 3. Home Equity Line of Credit (HELOT): A HELOT is a particularly flexible mortgage security agreement that allows homeowners to secure funds against the equity they have built up in their properties. It functions similarly to a credit card, where borrowers can withdraw or pay back funds within a certain limit and timeframe. Helots provide homeowners with a revolving line of credit that can be tapped into when needed. Key Aspects of the Salt Lake City Utah Mortgage Security Agreement: 1. Security Collateral: The mortgage security agreement typically uses the property being purchased or refinanced as collateral to secure the loan. This collateral ensures that the lender has a tangible asset to recoup their investment in case of default. 2. Recorded Publicly: A critical aspect of the Salt Lake City Utah Mortgage Security Agreement is the requirement for it to be recorded in the county or city's public records. This recording serves as a public notice to other potential lenders, ensuring they are aware of the existing lien on the property. 3. Repayment Terms: The agreement outlines the terms and conditions of repayment, including interest rates, loan duration, and any associated fees or penalties for late payments or prepayment. 4. Foreclosure Proceedings: In the event of borrower default, the lender has the legal right to initiate foreclosure proceedings, eventually leading to the sale of the property to recoup the outstanding mortgage balance. Such proceedings are subject to Utah state laws and must follow established guidelines. Conclusion: The Salt Lake City Utah Mortgage Security Agreement is a crucial component of property financing. Understanding its various types and key aspects allows potential buyers to make informed decisions and ensures a secure and transparent process for both lenders and borrowers. By grasping the fundamentals of this agreement, individuals can confidently navigate the real estate market in Salt Lake City, Utah.

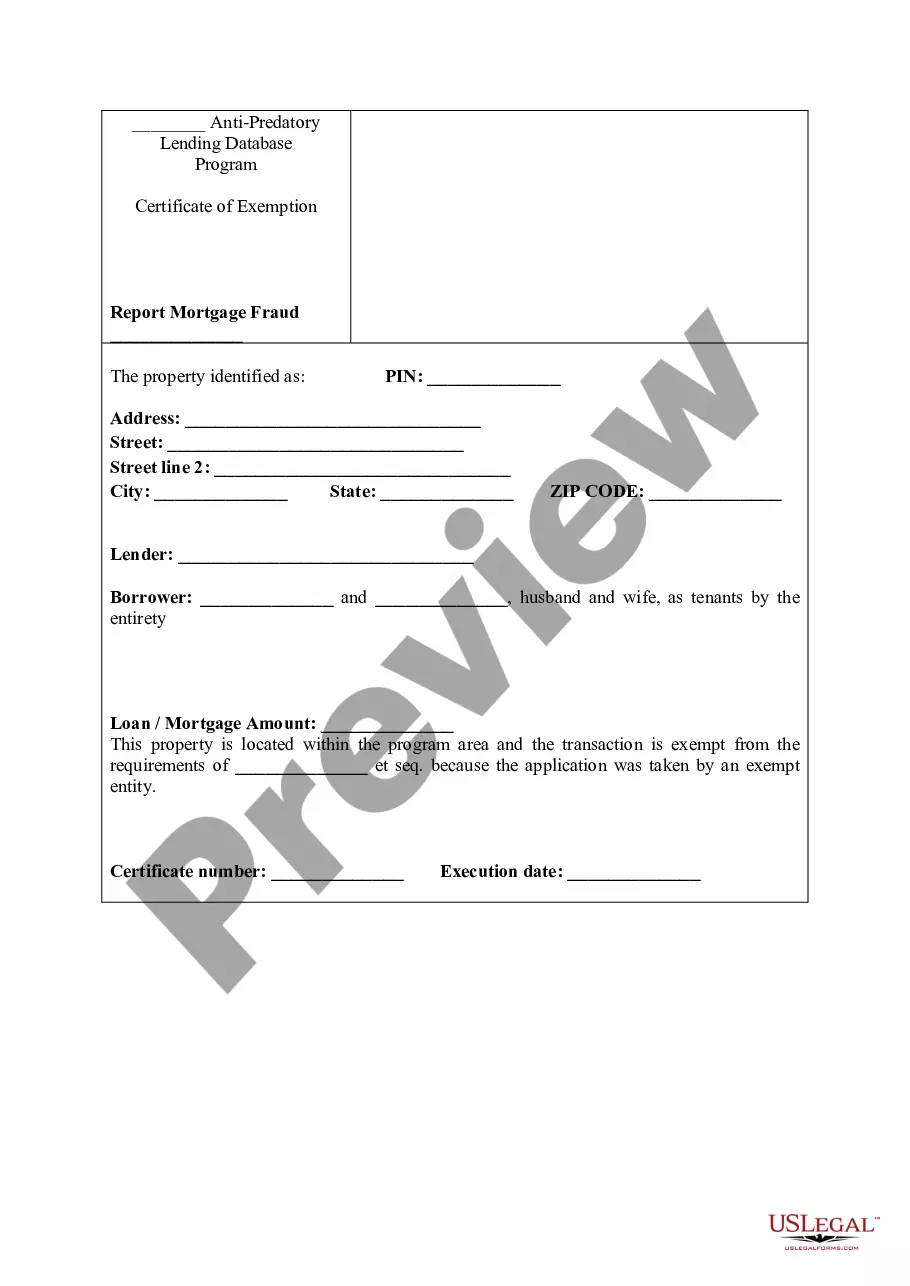

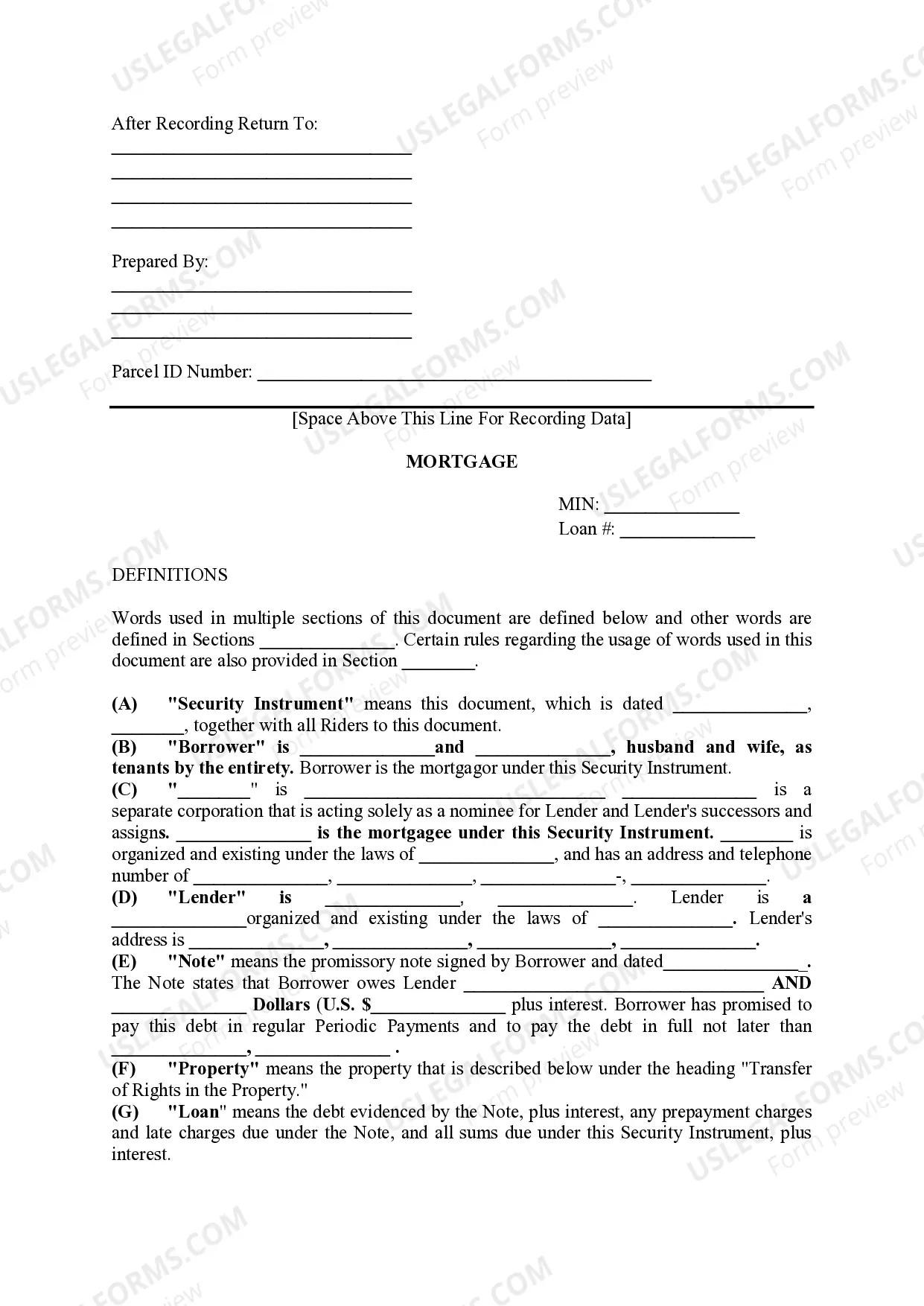

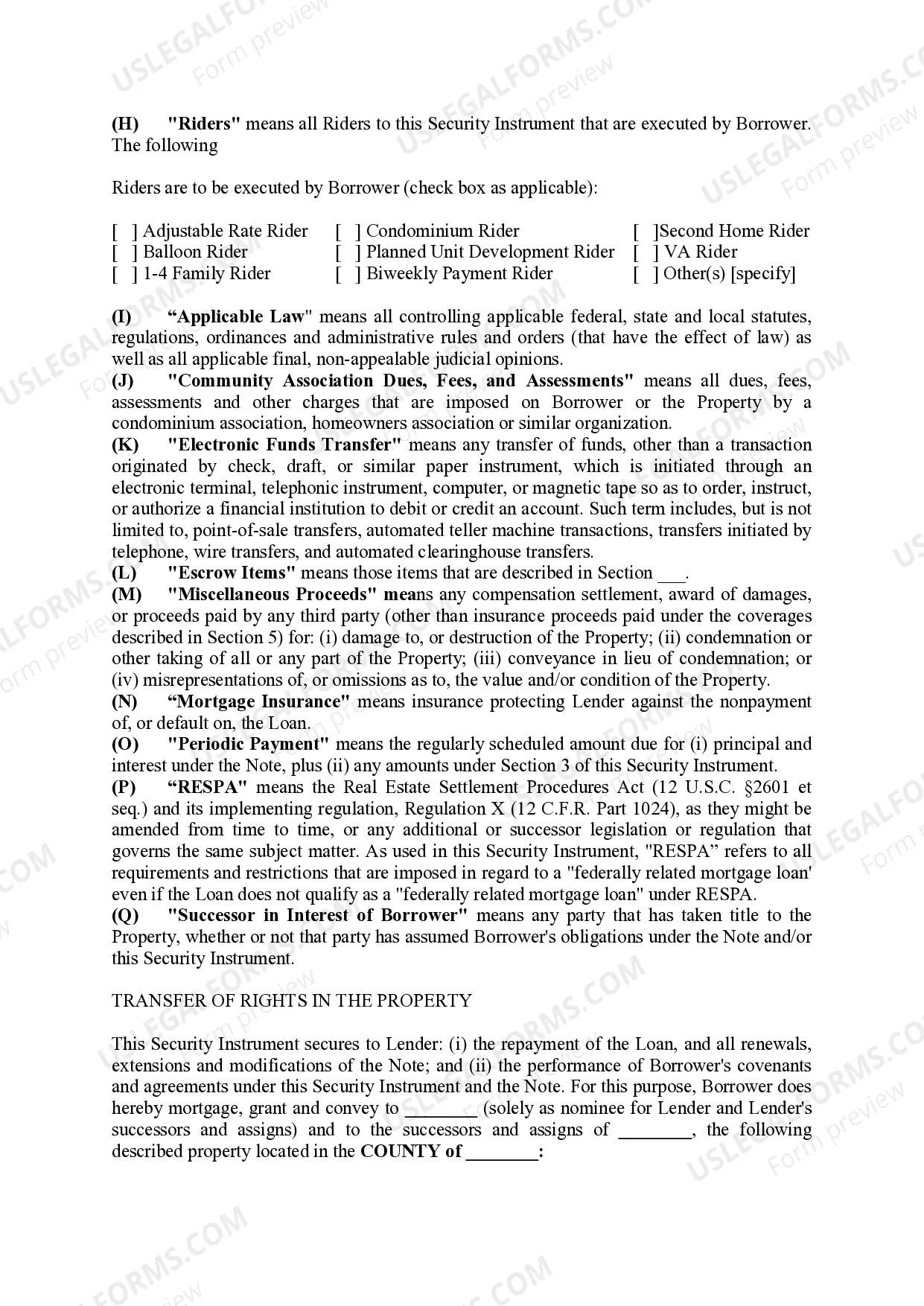

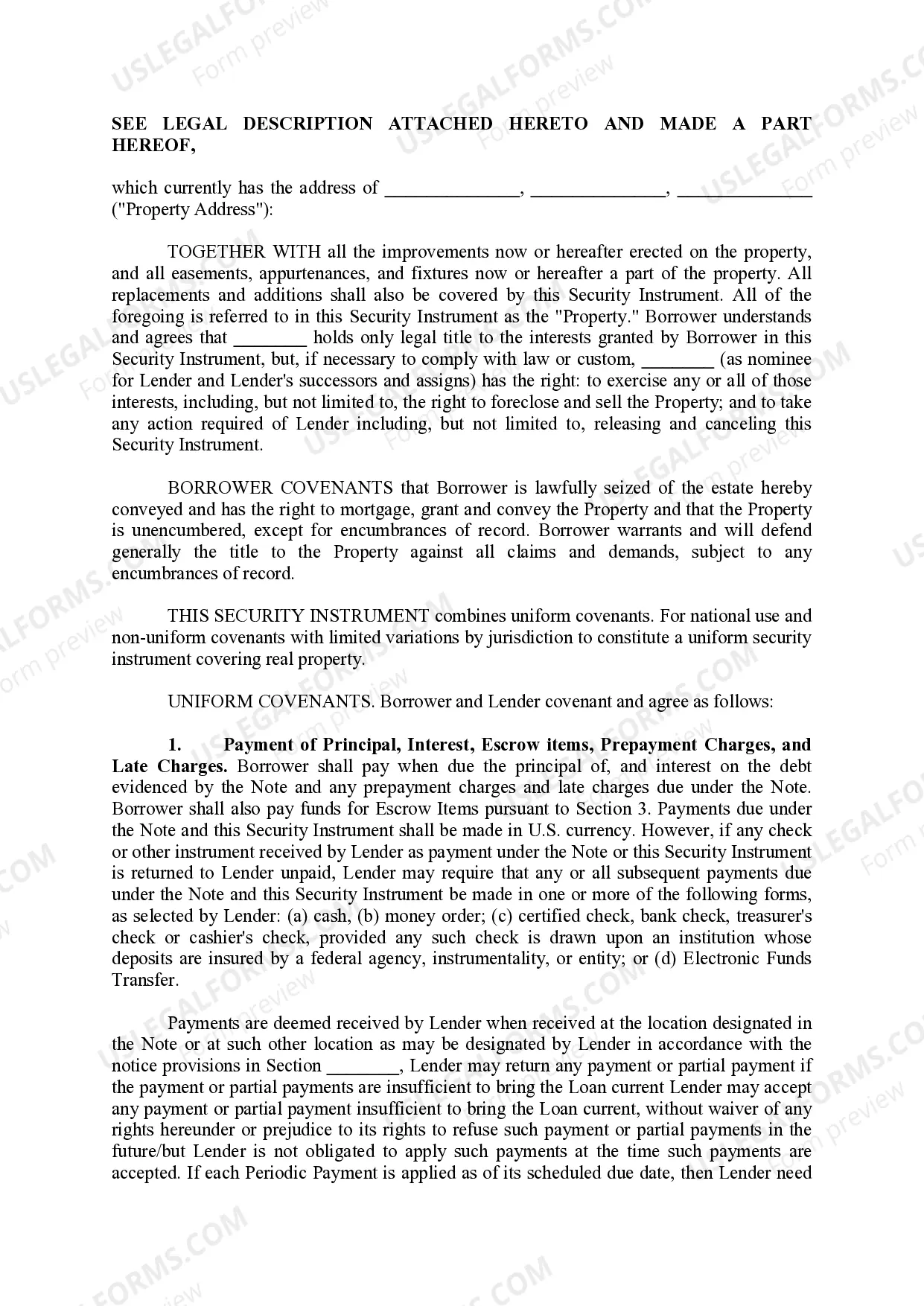

Salt Lake City Utah Mortgage Security Agreement

Description

How to fill out Salt Lake City Utah Mortgage Security Agreement?

Do you need a trustworthy and affordable legal forms supplier to get the Salt Lake City Utah Mortgage Security Agreement? US Legal Forms is your go-to choice.

Whether you need a simple agreement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Salt Lake City Utah Mortgage Security Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Salt Lake City Utah Mortgage Security Agreement in any provided format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online once and for all.