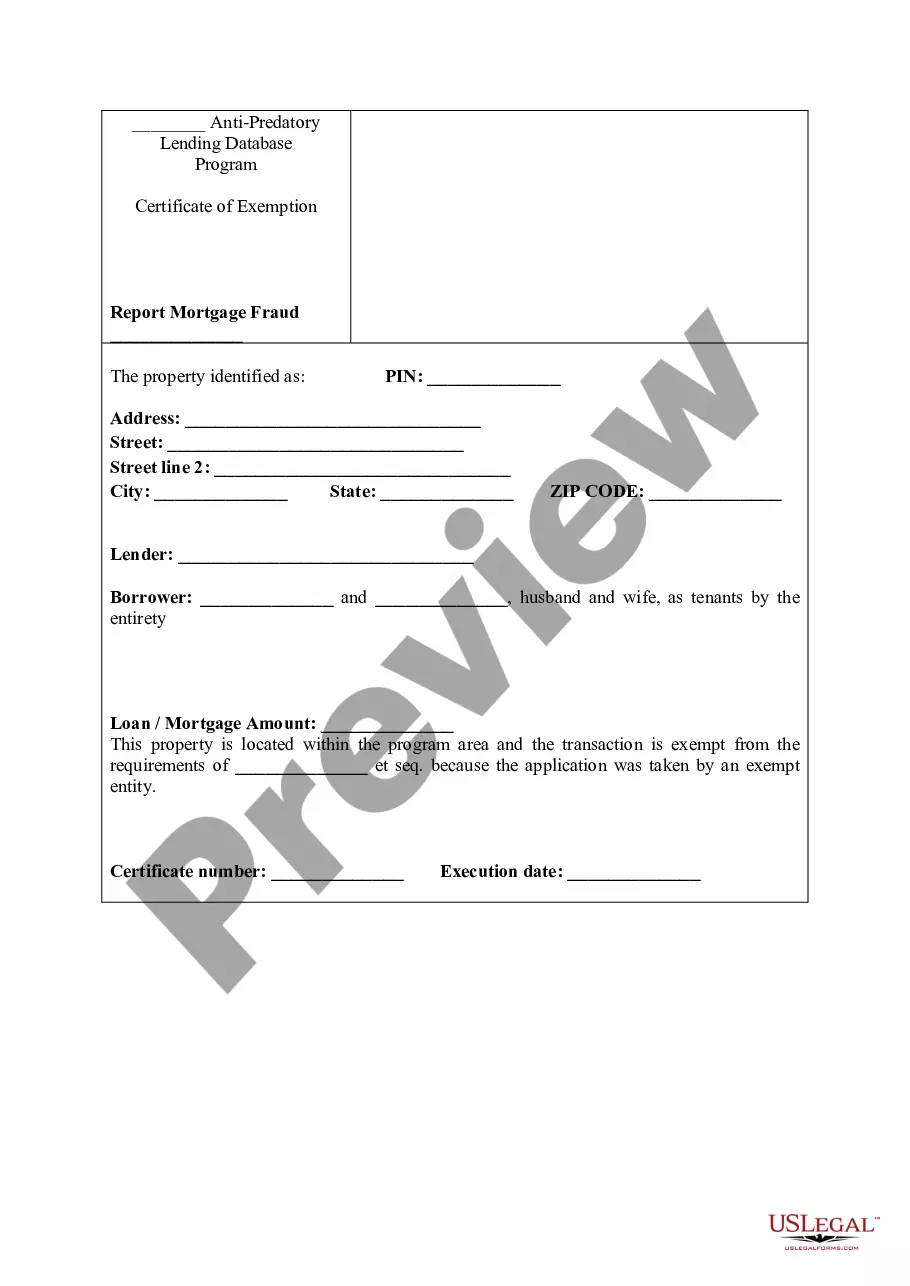

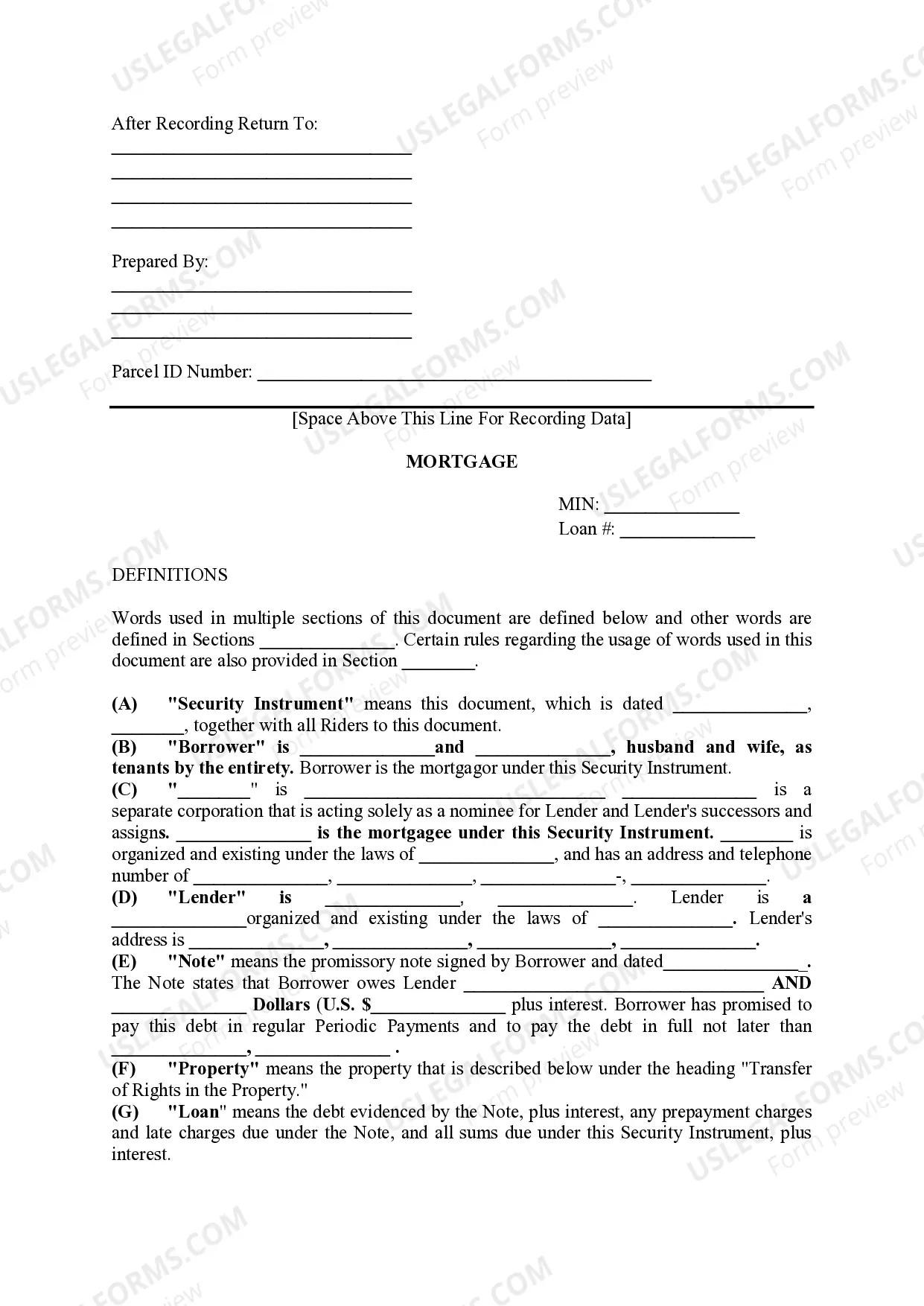

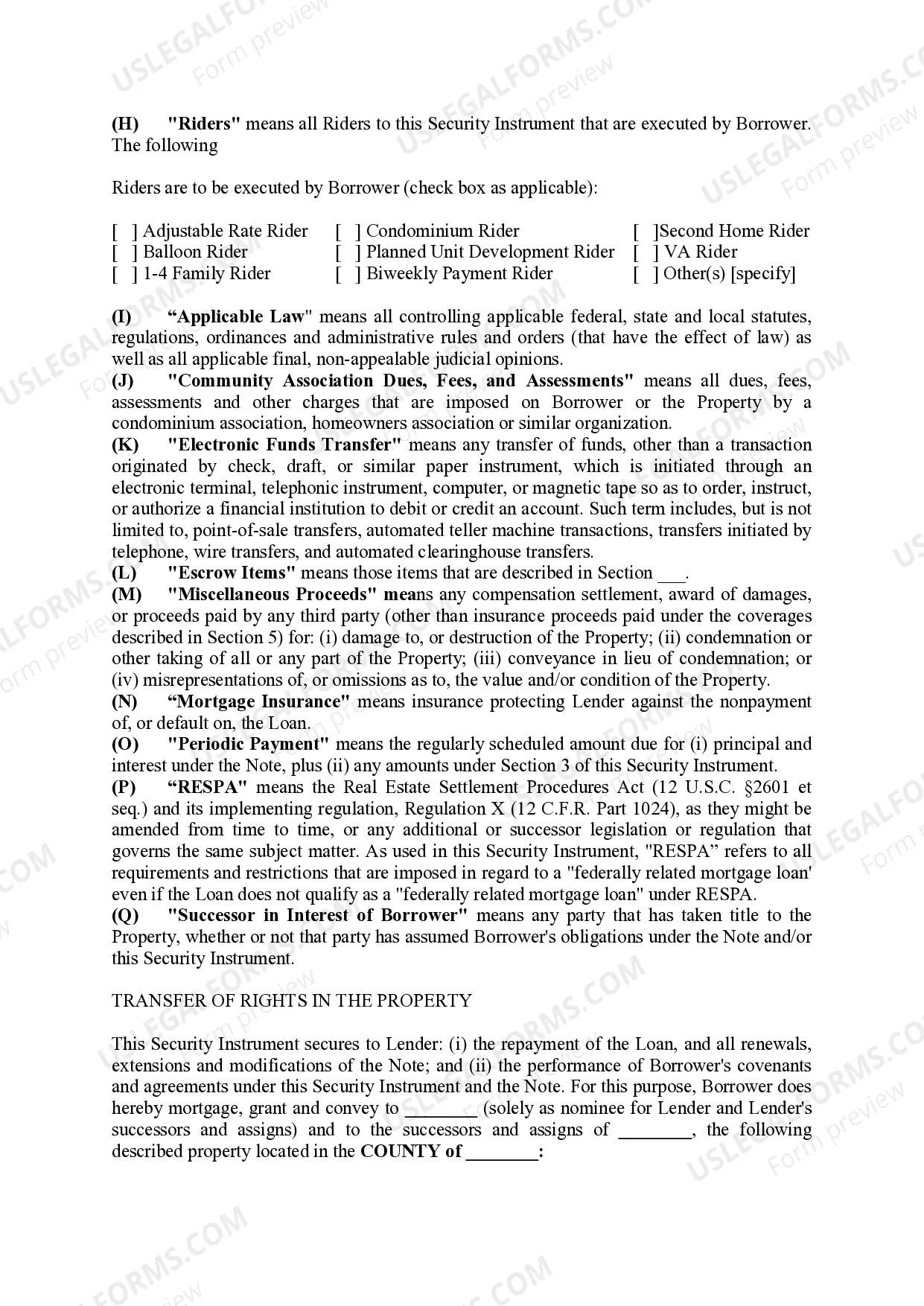

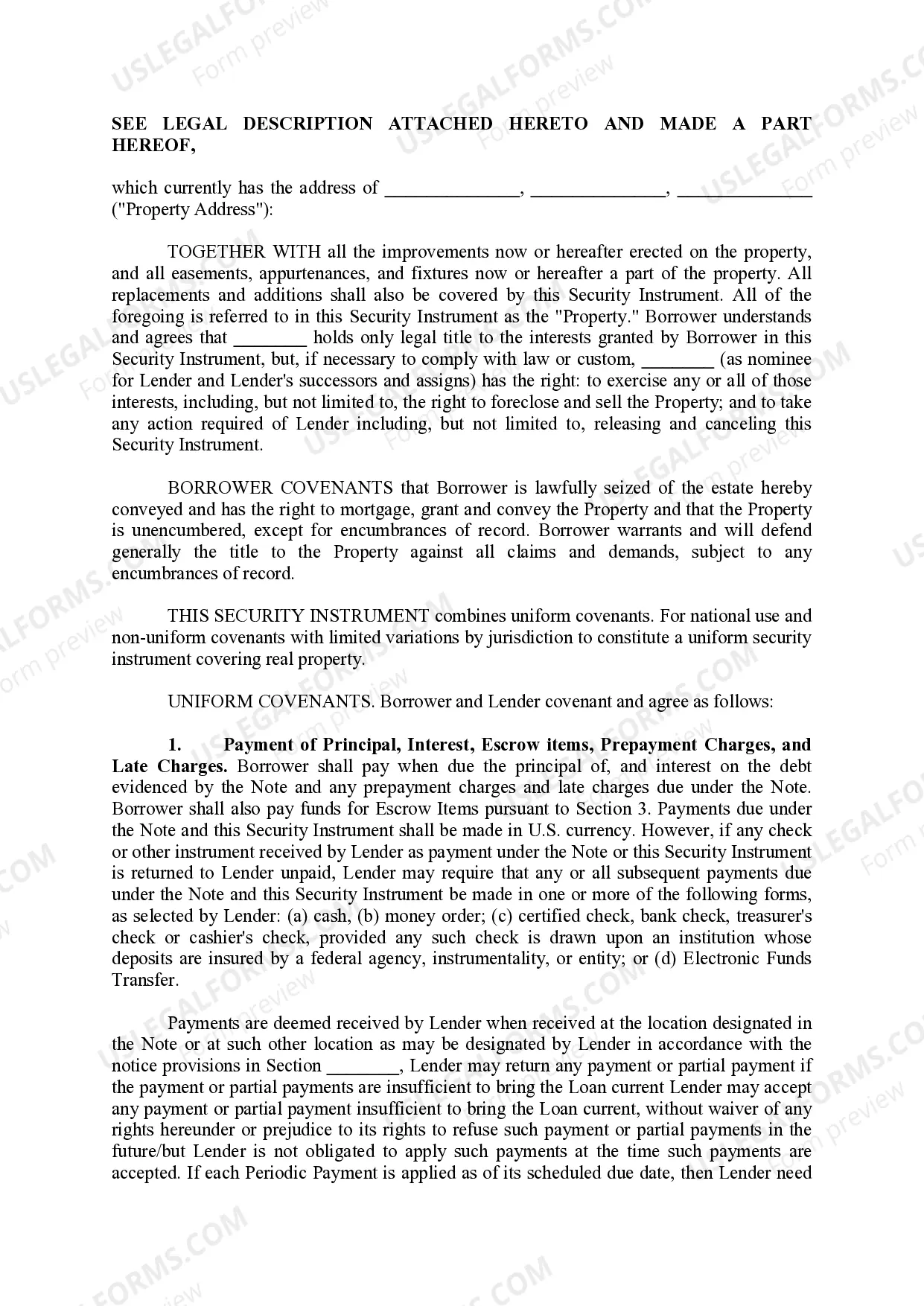

A West Jordan Utah Mortgage Security Agreement, also known as a mortgage, is a legal document that serves as a contract between a borrower and a lender regarding the property being used as collateral for a mortgage loan. This agreement is used to secure the lender's interest in the property and protect their investment. In West Jordan, Utah, there are various types of Mortgage Security Agreements available based on the specific circumstances and needs of the parties involved. Some common types include: 1. Residential Mortgage Security Agreement: This type of agreement is used when an individual is purchasing or refinancing a residential property, such as a house or an apartment. It outlines the terms and conditions of the loan, including repayment schedule, interest rate, and the rights and responsibilities of both the borrower and the lender. 2. Commercial Mortgage Security Agreement: When a borrower intends to purchase or refinance a commercial property, such as an office building, retail space, or warehouse, a commercial mortgage security agreement is used. This agreement includes details on the loan amount, interest rate, repayment terms, and any additional conditions specific to commercial properties. 3. Construction Mortgage Security Agreement: This agreement is relevant when a borrower is financing the construction of a property in West Jordan, Utah. It covers the financing of both the land and the construction, and outlines the disbursement of funds in stages as the construction progresses. 4. Second Mortgage Security Agreement: In situations where a borrower already has an existing mortgage on a property and wishes to borrow additional funds against the same property, a second mortgage security agreement is utilized. This document secures the lender's interest in the property, following the first mortgage, and outlines the terms and conditions of the additional loan. In conclusion, a West Jordan Utah Mortgage Security Agreement is a crucial legal document that sets out the terms of a mortgage loan and secures the lender's interest in the property. Different types of mortgage security agreements cater to the specific needs of borrowers for residential, commercial, construction, and second mortgage purposes. It is important for borrowers and lenders to carefully review and understand this agreement to ensure a smooth and secure mortgage transaction.

West Jordan Utah Mortgage Security Agreement

Description

How to fill out West Jordan Utah Mortgage Security Agreement?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no law education to create this sort of paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you want the West Jordan Utah Mortgage Security Agreement or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the West Jordan Utah Mortgage Security Agreement quickly using our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, in case you are a novice to our platform, ensure that you follow these steps prior to downloading the West Jordan Utah Mortgage Security Agreement:

- Be sure the template you have chosen is good for your area considering that the regulations of one state or area do not work for another state or area.

- Review the form and read a brief outline (if available) of scenarios the document can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account login information or create one from scratch.

- Select the payment gateway and proceed to download the West Jordan Utah Mortgage Security Agreement as soon as the payment is done.

You’re good to go! Now you can proceed to print the form or complete it online. Should you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.