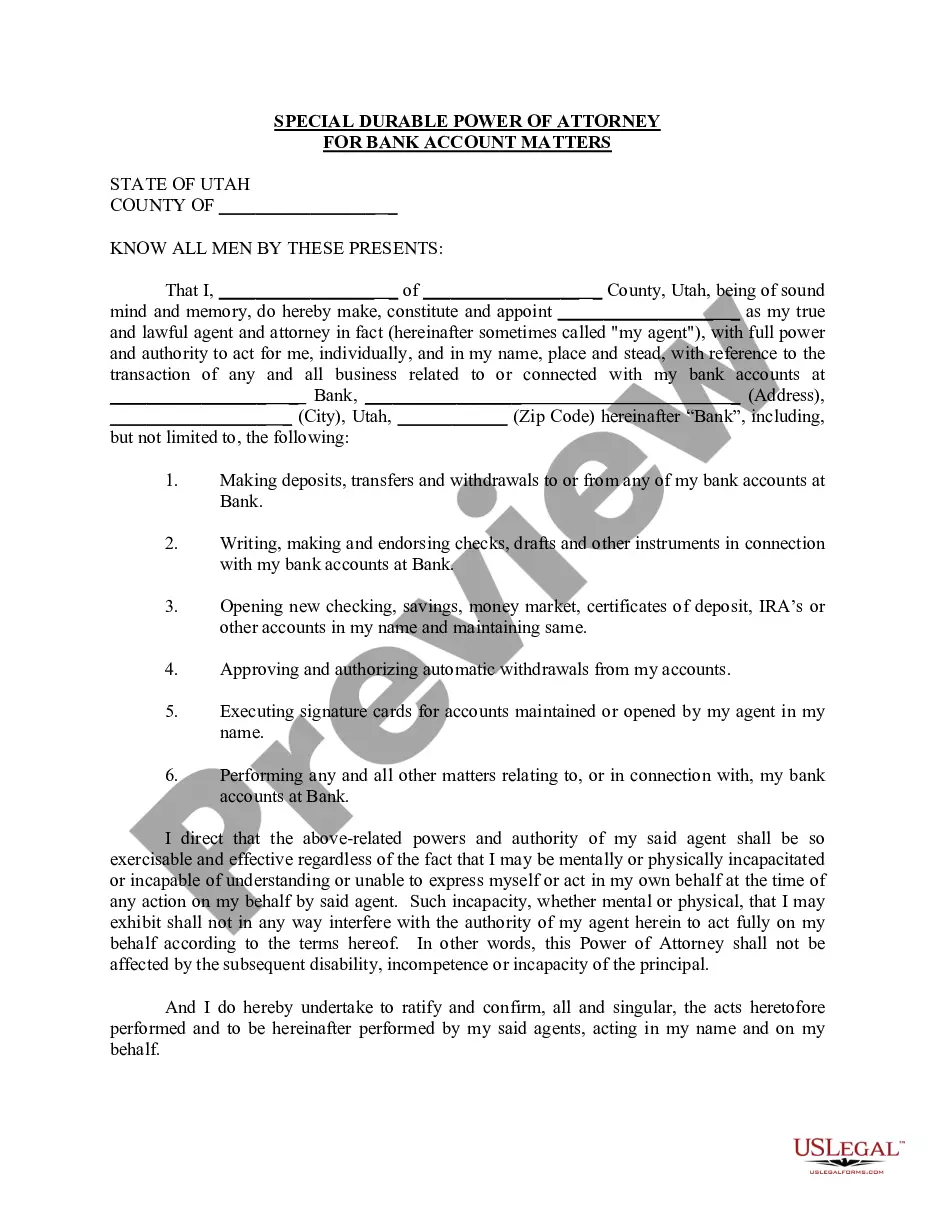

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

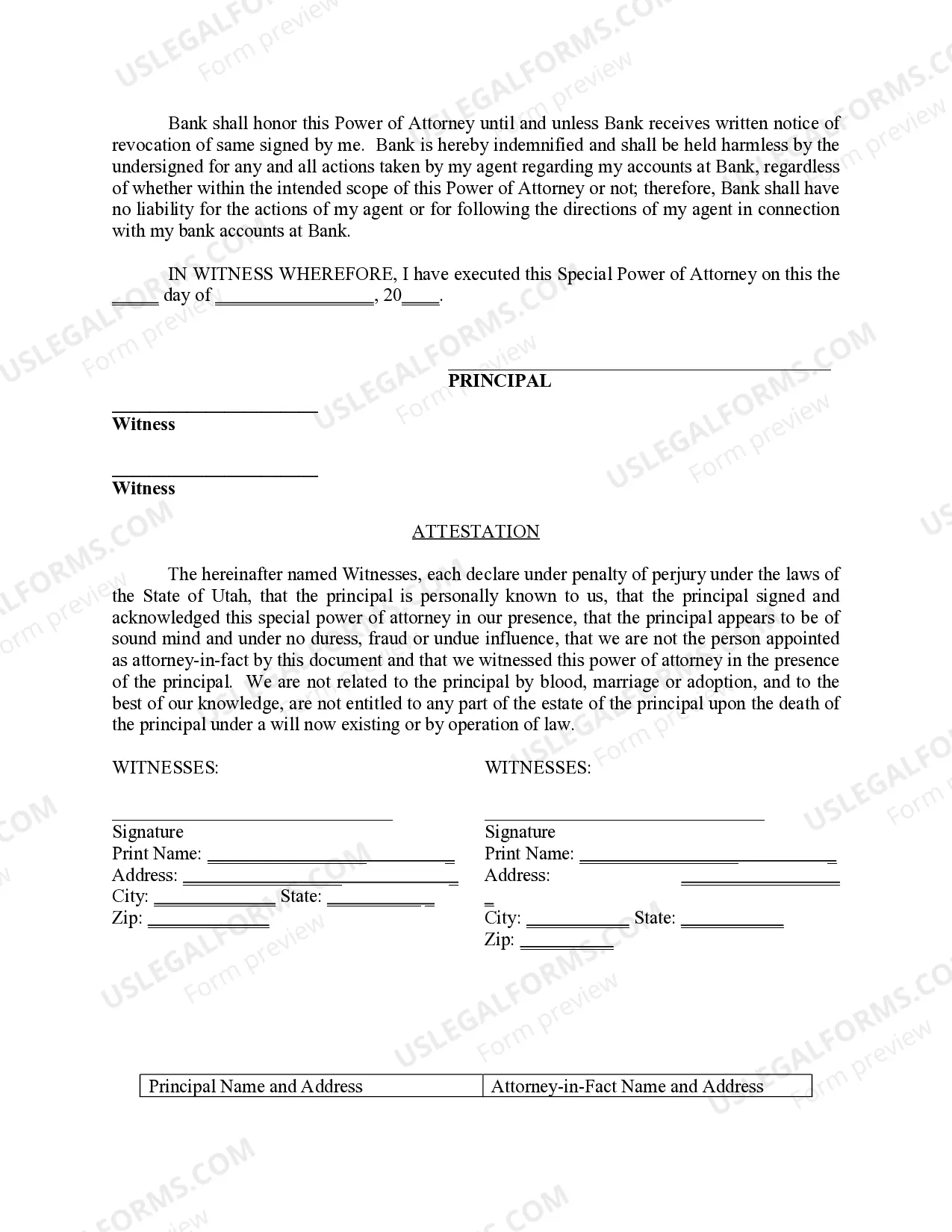

Provo Utah Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual, known as the agent, the authority to manage bank account affairs on behalf of the principal. This type of power of attorney is specifically designed to handle financial matters relating to bank accounts in the Provo Utah area. The Provo Utah Special Durable Power of Attorney for Bank Account Matters ensures that the agent has the legal capacity to make decisions, perform transactions, and access important banking information, with the principal's explicit consent. It is important to note that this power of attorney remains effective even if the principal becomes incapacitated or unable to manage their bank account affairs due to physical or mental reasons. There are several variations or types of Provo Utah Special Durable Power of Attorney for Bank Account Matters that can be customized to fit specific circumstances and preferences. Some commonly used variations include: 1. Limited Power of Attorney for Bank Account Matters: This type grants the agent specific powers to perform certain actions or transactions related to bank accounts. The powers given are limited in scope and duration, and they can be explicitly defined in the document. 2. General Power of Attorney for Bank Account Matters: This comprehensive type gives the agent broad authority to manage and control all aspects of the principal's bank accounts. It covers a wide range of financial activities, including making deposits, withdrawals, writing checks, transferring funds, and accessing account statements. 3. Springing Power of Attorney for Bank Account Matters: Unlike other types, this power of attorney becomes effective only when a specific event or condition occurs, usually the incapacity of the principal. It offers protection and peace of mind to the principal, ensuring that their bank accounts are managed appropriately during times of incapacity. 4. Irrevocable Power of Attorney for Bank Account Matters: With this type, the power of attorney cannot be revoked or terminated by the principal once it is established. This is a more rigid arrangement and is typically used when special circumstances warrant the need for a permanent agent. 5. Joint Power of Attorney for Bank Account Matters: This type allows multiple agents to be appointed simultaneously, granting them the authority to act together or separately in managing the principal's bank accounts. This can provide added flexibility and oversight, ensuring checks and balances within the power of attorney arrangement. When considering a Provo Utah Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with a qualified attorney familiar with Utah state laws and regulations, as they can guide you through the process and ensure that all legal requirements are met. This will help protect the principal's interests and ensure that their bank account affairs are handled responsibly and in accordance with their wishes.Provo Utah Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual, known as the agent, the authority to manage bank account affairs on behalf of the principal. This type of power of attorney is specifically designed to handle financial matters relating to bank accounts in the Provo Utah area. The Provo Utah Special Durable Power of Attorney for Bank Account Matters ensures that the agent has the legal capacity to make decisions, perform transactions, and access important banking information, with the principal's explicit consent. It is important to note that this power of attorney remains effective even if the principal becomes incapacitated or unable to manage their bank account affairs due to physical or mental reasons. There are several variations or types of Provo Utah Special Durable Power of Attorney for Bank Account Matters that can be customized to fit specific circumstances and preferences. Some commonly used variations include: 1. Limited Power of Attorney for Bank Account Matters: This type grants the agent specific powers to perform certain actions or transactions related to bank accounts. The powers given are limited in scope and duration, and they can be explicitly defined in the document. 2. General Power of Attorney for Bank Account Matters: This comprehensive type gives the agent broad authority to manage and control all aspects of the principal's bank accounts. It covers a wide range of financial activities, including making deposits, withdrawals, writing checks, transferring funds, and accessing account statements. 3. Springing Power of Attorney for Bank Account Matters: Unlike other types, this power of attorney becomes effective only when a specific event or condition occurs, usually the incapacity of the principal. It offers protection and peace of mind to the principal, ensuring that their bank accounts are managed appropriately during times of incapacity. 4. Irrevocable Power of Attorney for Bank Account Matters: With this type, the power of attorney cannot be revoked or terminated by the principal once it is established. This is a more rigid arrangement and is typically used when special circumstances warrant the need for a permanent agent. 5. Joint Power of Attorney for Bank Account Matters: This type allows multiple agents to be appointed simultaneously, granting them the authority to act together or separately in managing the principal's bank accounts. This can provide added flexibility and oversight, ensuring checks and balances within the power of attorney arrangement. When considering a Provo Utah Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with a qualified attorney familiar with Utah state laws and regulations, as they can guide you through the process and ensure that all legal requirements are met. This will help protect the principal's interests and ensure that their bank account affairs are handled responsibly and in accordance with their wishes.