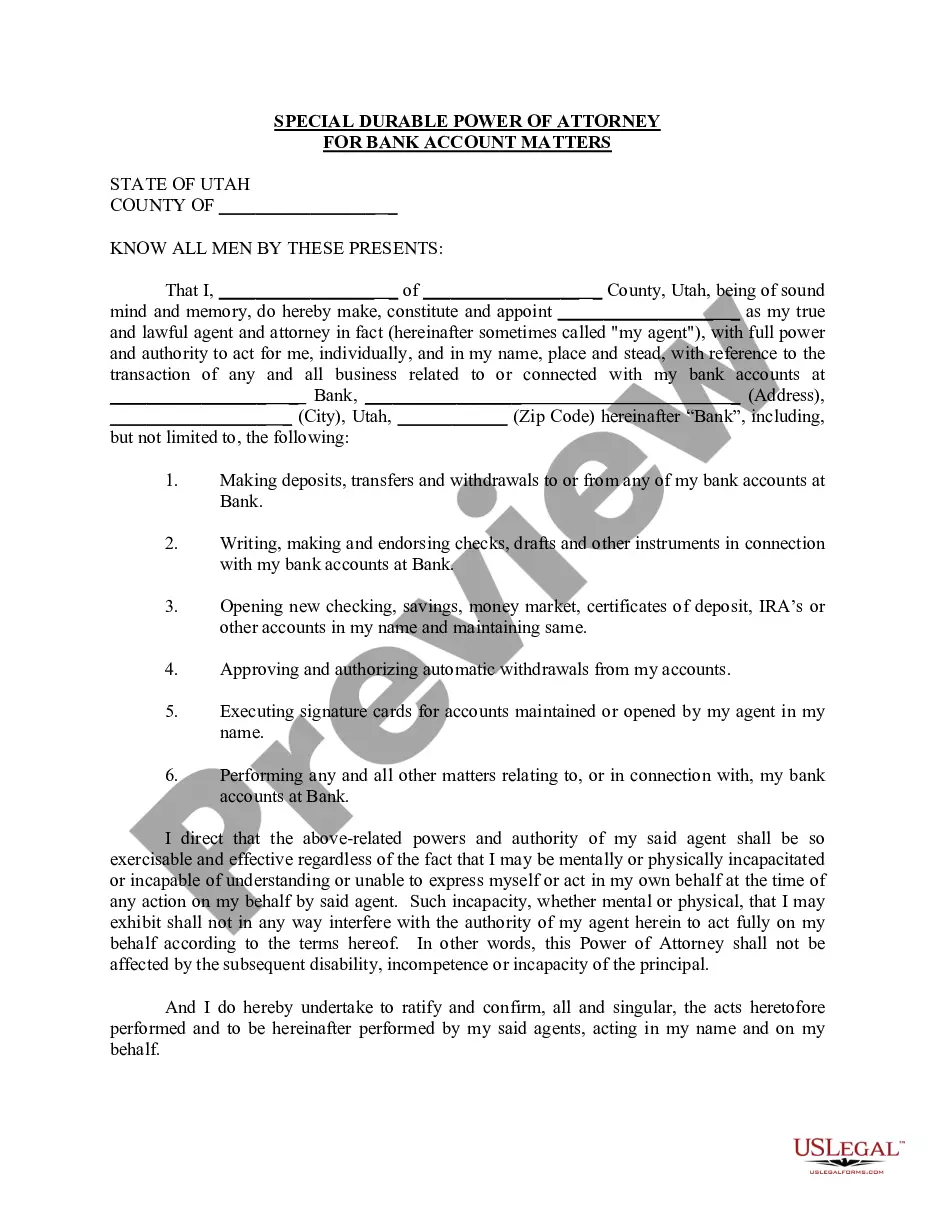

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

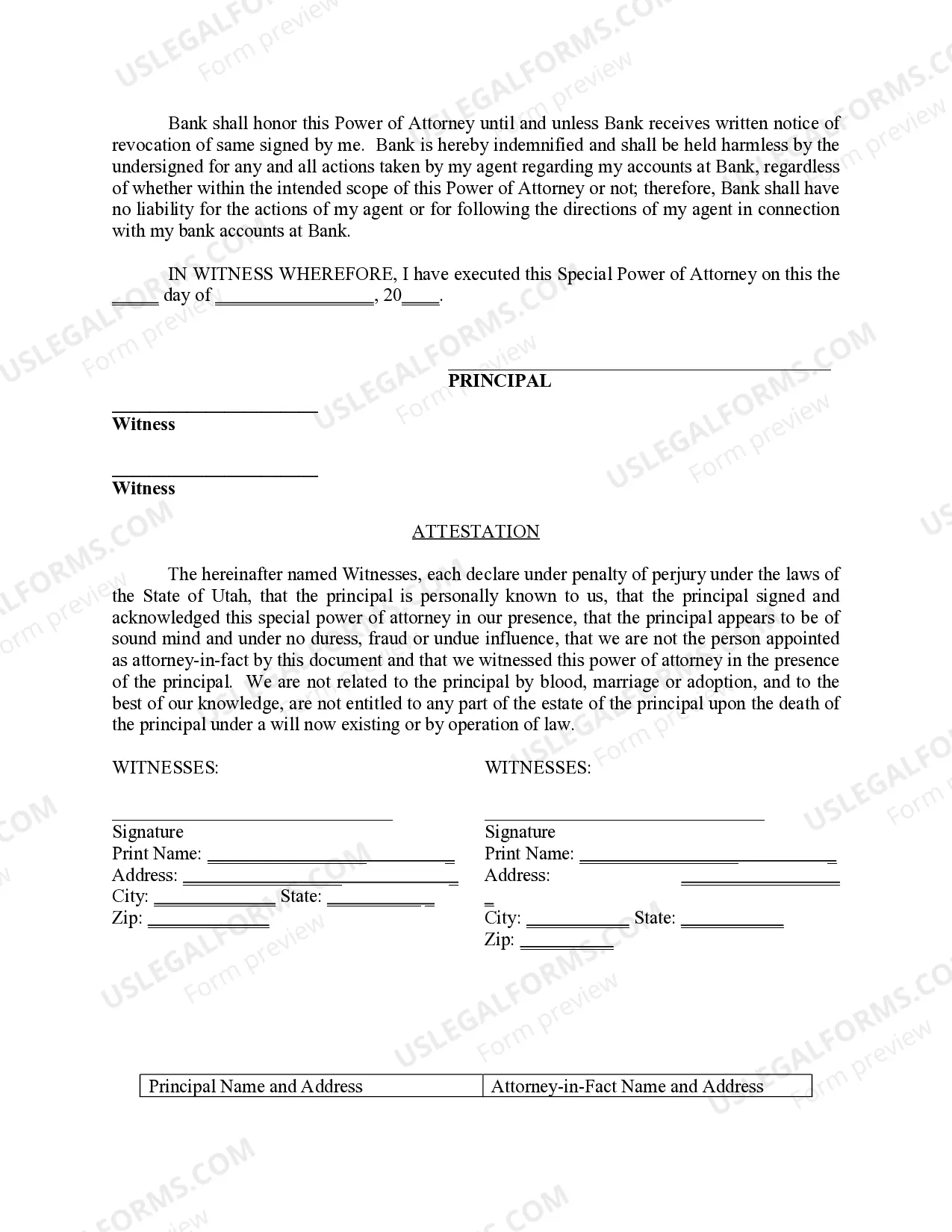

In Salt Lake City, Utah, a Special Durable Power of Attorney for Bank Account Matters is a legal document granting an individual the authority to act on behalf of someone else in specific banking matters. This type of power of attorney is designed to be long-lasting, continuing in effect even if the person granting it becomes incapacitated or mentally incompetent. The Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters is commonly used to appoint a trusted family member or close friend as an agent or attorney-in-fact to handle financial affairs related to the principal's bank accounts. This allows the appointed agent to perform a wide range of tasks, such as depositing or withdrawing funds, managing investments, paying bills, transferring funds between accounts, and handling other banking transactions. There are different types of Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters, including the following: 1. Limited Scope Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific powers and limits them to only those mentioned in the document. It is suitable for situations where the principal wants to grant authority for specific banking matters, but not all-encompassing control. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited scope power of attorney, a general power of attorney grants the agent broader authority to handle all aspects of the principal's bank accounts. This type of power of attorney is suitable for individuals who want their agent to have comprehensive control over their financial matters. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only upon the occurrence of a specific event, such as the principal's incapacitation or mental incompetence. This type of power of attorney ensures that the agent's authority is activated only when needed and provides an extra layer of protection. It is important to consult with an attorney experienced in estate planning and power of attorney matters to ensure that the Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters accurately reflects the principal's intentions and complies with state laws. This legal document offers peace of mind by enabling a trusted individual to manage crucial banking affairs on behalf of the principal when they are unable to do so themselves.In Salt Lake City, Utah, a Special Durable Power of Attorney for Bank Account Matters is a legal document granting an individual the authority to act on behalf of someone else in specific banking matters. This type of power of attorney is designed to be long-lasting, continuing in effect even if the person granting it becomes incapacitated or mentally incompetent. The Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters is commonly used to appoint a trusted family member or close friend as an agent or attorney-in-fact to handle financial affairs related to the principal's bank accounts. This allows the appointed agent to perform a wide range of tasks, such as depositing or withdrawing funds, managing investments, paying bills, transferring funds between accounts, and handling other banking transactions. There are different types of Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters, including the following: 1. Limited Scope Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific powers and limits them to only those mentioned in the document. It is suitable for situations where the principal wants to grant authority for specific banking matters, but not all-encompassing control. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited scope power of attorney, a general power of attorney grants the agent broader authority to handle all aspects of the principal's bank accounts. This type of power of attorney is suitable for individuals who want their agent to have comprehensive control over their financial matters. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only upon the occurrence of a specific event, such as the principal's incapacitation or mental incompetence. This type of power of attorney ensures that the agent's authority is activated only when needed and provides an extra layer of protection. It is important to consult with an attorney experienced in estate planning and power of attorney matters to ensure that the Salt Lake Utah Special Durable Power of Attorney for Bank Account Matters accurately reflects the principal's intentions and complies with state laws. This legal document offers peace of mind by enabling a trusted individual to manage crucial banking affairs on behalf of the principal when they are unable to do so themselves.