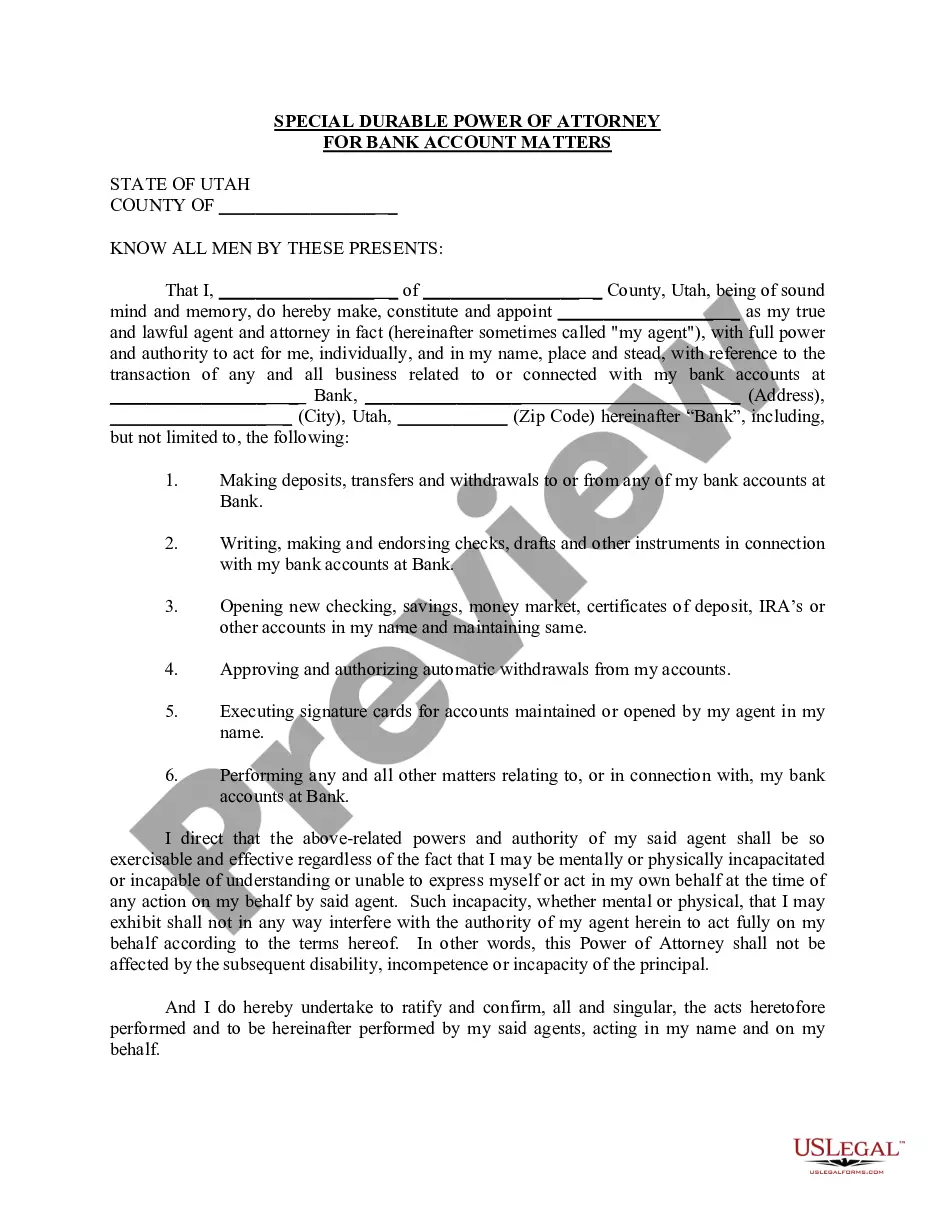

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

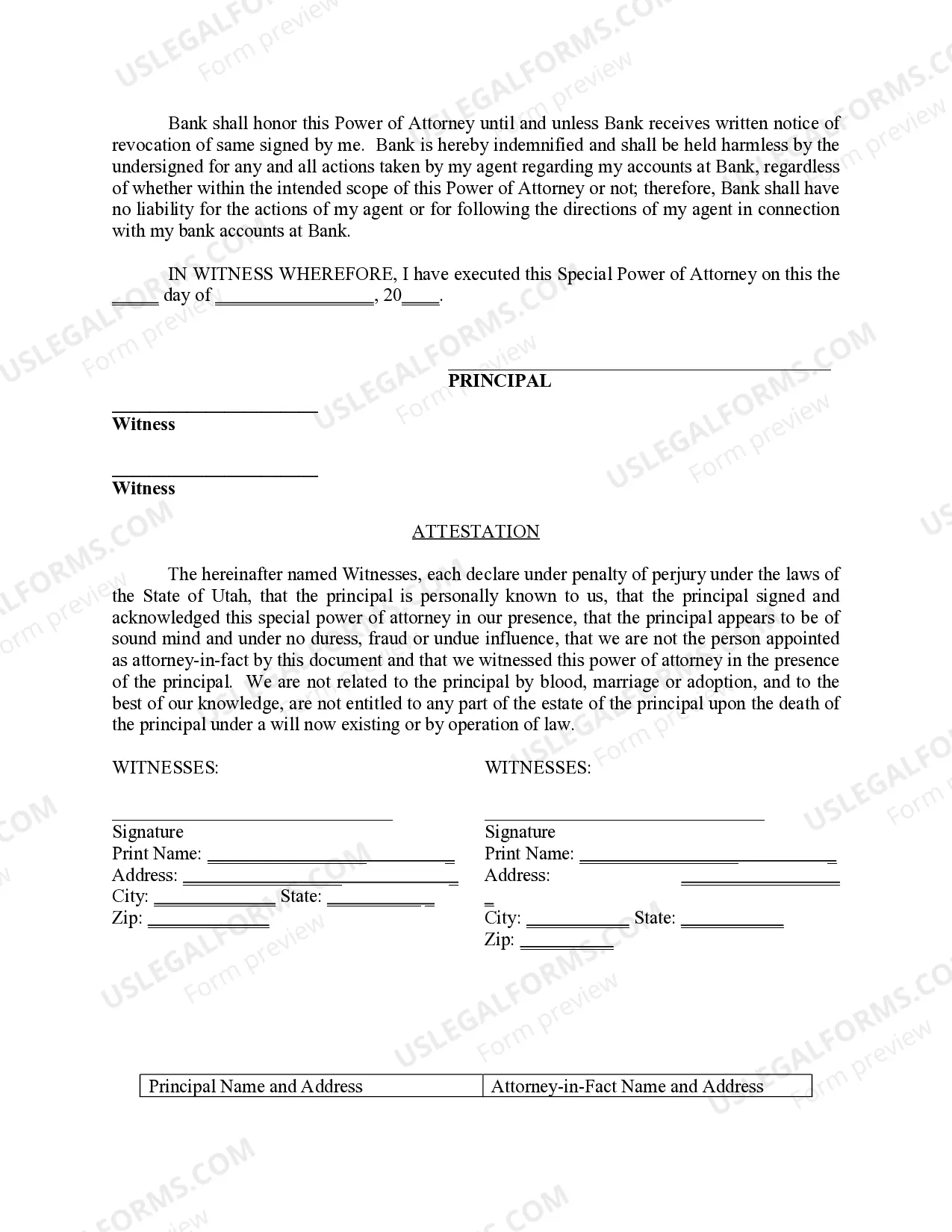

The Salt Lake City Utah Special Durable Power of Attorney for Bank Account Matters is a legal document granting specific authority to an individual, known as the agent or attorney-in-fact, to handle and make decisions regarding a person's bank accounts. This power of attorney is especially designed to be durable, meaning it remains effective even if the principal becomes incapacitated or mentally incompetent. In Salt Lake City, Utah, there are different types of Special Durable Power of Attorney for Bank Account Matters available, depending on the specific needs and circumstances of the principal. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This form grants the agent limited authority to handle specific banking transactions on behalf of the principal. It may include tasks such as depositing or withdrawing funds, paying bills, or managing investments. The agent's powers are strictly limited to the tasks outlined in the document. 2. General Special Durable Power of Attorney for Bank Account Matters: Unlike the limited version, this type of power of attorney provides the agent with broader authority to manage almost all aspects of the principal's bank accounts. It allows the agent to perform all activities related to banking matters, including opening or closing accounts, applying for loans, managing investments, and more. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific triggering event occurs, typically the incapacity of the principal. It grants the agent authority over the principal's bank accounts, ensuring their uninterrupted management in case of incapacity. In all types of Salt Lake City Utah Special Durable Power of Attorney for Bank Account Matters, it is essential to include specific clauses that outline the agent's duties, limitations, and responsibilities. The document must comply with Utah state laws, which regulate the requirements and validity of powers of attorney. When creating a Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with a qualified attorney familiar with Utah's laws to ensure that the document accurately reflects one's intentions and meets all legal requirements. Additionally, the principal should carefully select a trustworthy and reliable agent to act in their best interest when managing their bank accounts.The Salt Lake City Utah Special Durable Power of Attorney for Bank Account Matters is a legal document granting specific authority to an individual, known as the agent or attorney-in-fact, to handle and make decisions regarding a person's bank accounts. This power of attorney is especially designed to be durable, meaning it remains effective even if the principal becomes incapacitated or mentally incompetent. In Salt Lake City, Utah, there are different types of Special Durable Power of Attorney for Bank Account Matters available, depending on the specific needs and circumstances of the principal. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This form grants the agent limited authority to handle specific banking transactions on behalf of the principal. It may include tasks such as depositing or withdrawing funds, paying bills, or managing investments. The agent's powers are strictly limited to the tasks outlined in the document. 2. General Special Durable Power of Attorney for Bank Account Matters: Unlike the limited version, this type of power of attorney provides the agent with broader authority to manage almost all aspects of the principal's bank accounts. It allows the agent to perform all activities related to banking matters, including opening or closing accounts, applying for loans, managing investments, and more. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific triggering event occurs, typically the incapacity of the principal. It grants the agent authority over the principal's bank accounts, ensuring their uninterrupted management in case of incapacity. In all types of Salt Lake City Utah Special Durable Power of Attorney for Bank Account Matters, it is essential to include specific clauses that outline the agent's duties, limitations, and responsibilities. The document must comply with Utah state laws, which regulate the requirements and validity of powers of attorney. When creating a Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with a qualified attorney familiar with Utah's laws to ensure that the document accurately reflects one's intentions and meets all legal requirements. Additionally, the principal should carefully select a trustworthy and reliable agent to act in their best interest when managing their bank accounts.