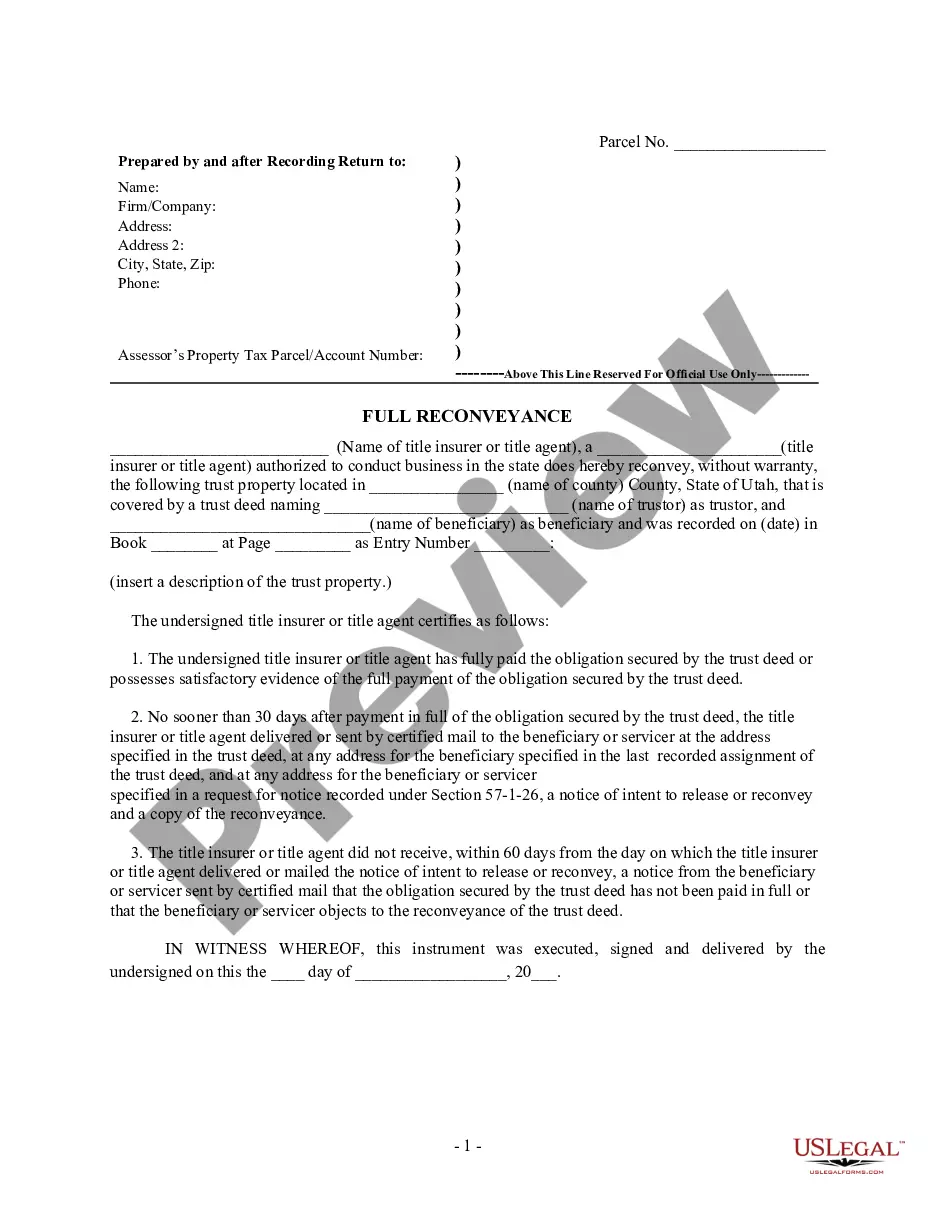

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Utah by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

A Salt Lake City Utah Deed of Re conveyance by Corporate Trustee is a legal document that signifies the transfer of property ownership from a trust or (borrower) to the beneficiary (lender) once a mortgage or deed of trust is fully repaid. This document acts as evidence, guaranteeing that the trust or has fulfilled their payment obligations, and the lender has released their claim on the property. Keywords: Salt Lake City, Utah, deed of reconveyance, corporate trustee, property ownership, mortgage, deed of trust, trust or, beneficiary, repayment. There are a few different types of Salt Lake City Utah Deed of Re conveyance by Corporate Trustee that may be encountered depending on the specific circumstances: 1. Standard Deed of Re conveyance: This is the most common type, occurring when a borrower has successfully repaid their mortgage or fulfilled the terms of their deed of trust. The corporate trustee, representing the lender, prepares and issues the deed of reconveyance to officially release any claims on the property. 2. Deed of Re conveyance with Conditions: In certain cases, additional conditions or stipulations may be included in the deed of reconveyance. For example, if the borrower has partially paid off the mortgage, a conditional release may be granted, enabling them to obtain a partial reconveyance of the property. 3. Deed of Re conveyance Due to Loan Assumption: In instances where the original borrower transfers their property to a new buyer who assumes the existing mortgage or deed of trust, a deed of reconveyance by corporate trustee is issued to acknowledge this change in ownership and responsibility. 4. Trustee-to-Trustee Deed of Re conveyance: When a corporate trustee is replaced by a new corporate trustee, a trustee-to-trustee deed of reconveyance is utilized to transfer trust or's property rights to the new trustee. This document ensures a smooth transition of the borrower's mortgage or deed of trust obligations. 5. Deed of Re conveyance after Foreclosure: In the unfortunate event of foreclosure, where the borrower has defaulted on their mortgage payments, a deed of reconveyance is prepared by the corporate trustee following the successful sale of the property at auction. This document serves as proof that the lender has released any remaining claims on the property. These various types of Salt Lake City Utah Deed of Re conveyance by Corporate Trustee cater to different scenarios in property ownership and are essential for ensuring clarity, legitimacy, and transferring legal obligations between trust or and beneficiary.A Salt Lake City Utah Deed of Re conveyance by Corporate Trustee is a legal document that signifies the transfer of property ownership from a trust or (borrower) to the beneficiary (lender) once a mortgage or deed of trust is fully repaid. This document acts as evidence, guaranteeing that the trust or has fulfilled their payment obligations, and the lender has released their claim on the property. Keywords: Salt Lake City, Utah, deed of reconveyance, corporate trustee, property ownership, mortgage, deed of trust, trust or, beneficiary, repayment. There are a few different types of Salt Lake City Utah Deed of Re conveyance by Corporate Trustee that may be encountered depending on the specific circumstances: 1. Standard Deed of Re conveyance: This is the most common type, occurring when a borrower has successfully repaid their mortgage or fulfilled the terms of their deed of trust. The corporate trustee, representing the lender, prepares and issues the deed of reconveyance to officially release any claims on the property. 2. Deed of Re conveyance with Conditions: In certain cases, additional conditions or stipulations may be included in the deed of reconveyance. For example, if the borrower has partially paid off the mortgage, a conditional release may be granted, enabling them to obtain a partial reconveyance of the property. 3. Deed of Re conveyance Due to Loan Assumption: In instances where the original borrower transfers their property to a new buyer who assumes the existing mortgage or deed of trust, a deed of reconveyance by corporate trustee is issued to acknowledge this change in ownership and responsibility. 4. Trustee-to-Trustee Deed of Re conveyance: When a corporate trustee is replaced by a new corporate trustee, a trustee-to-trustee deed of reconveyance is utilized to transfer trust or's property rights to the new trustee. This document ensures a smooth transition of the borrower's mortgage or deed of trust obligations. 5. Deed of Re conveyance after Foreclosure: In the unfortunate event of foreclosure, where the borrower has defaulted on their mortgage payments, a deed of reconveyance is prepared by the corporate trustee following the successful sale of the property at auction. This document serves as proof that the lender has released any remaining claims on the property. These various types of Salt Lake City Utah Deed of Re conveyance by Corporate Trustee cater to different scenarios in property ownership and are essential for ensuring clarity, legitimacy, and transferring legal obligations between trust or and beneficiary.