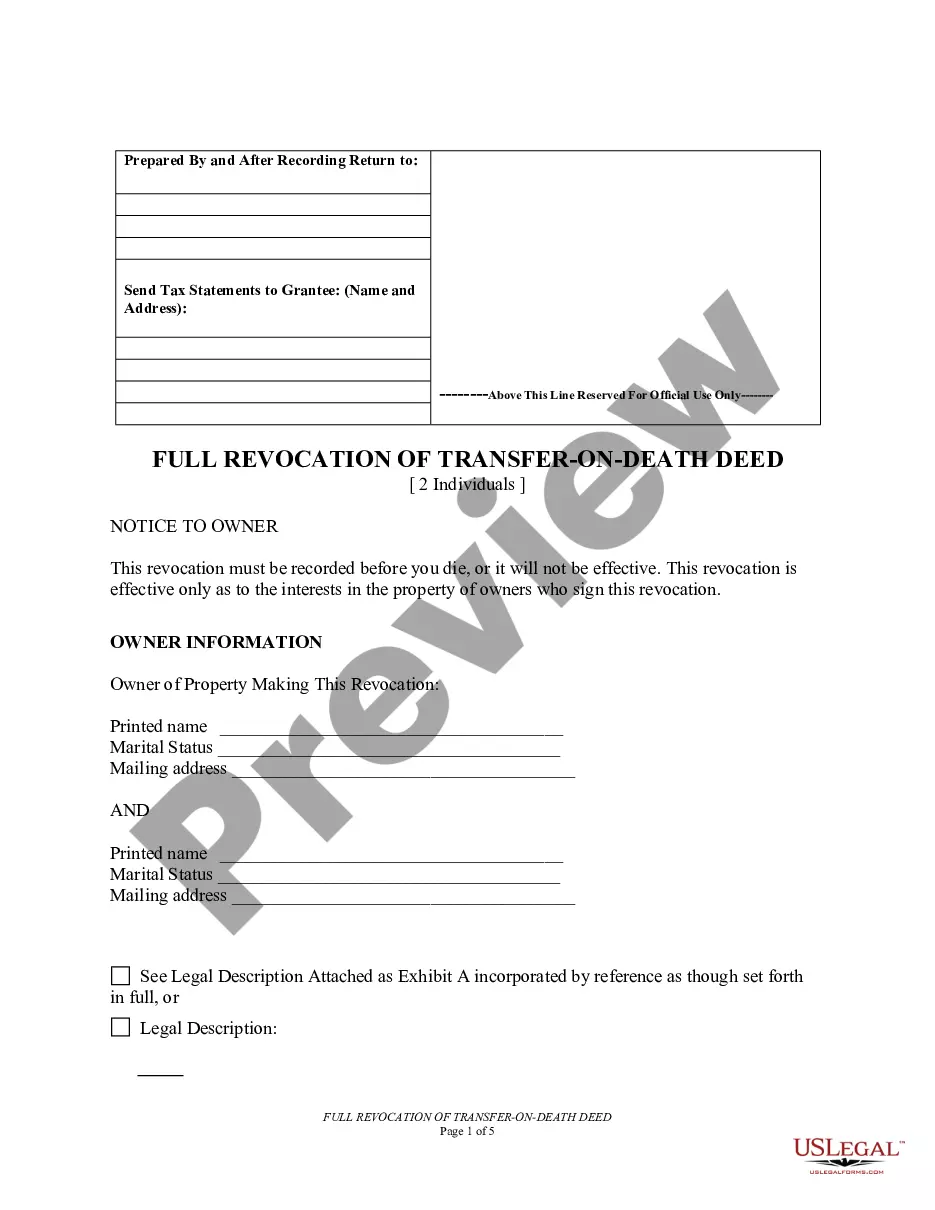

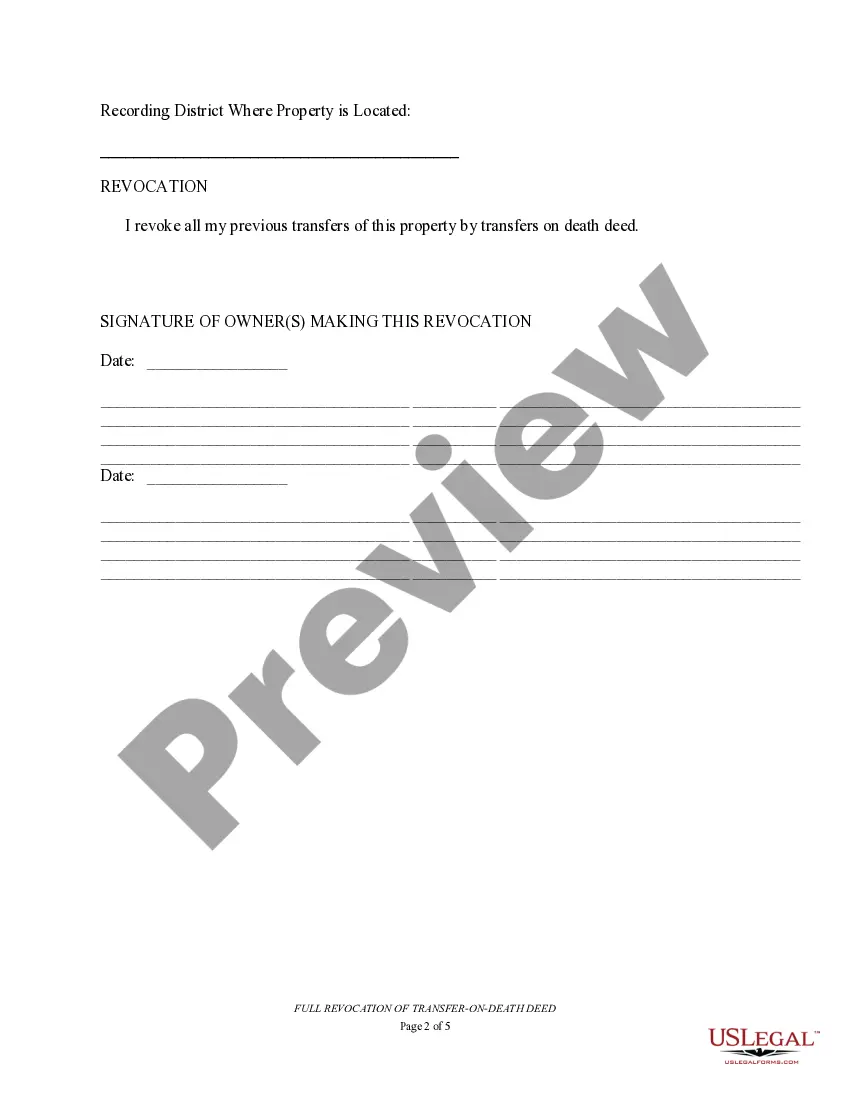

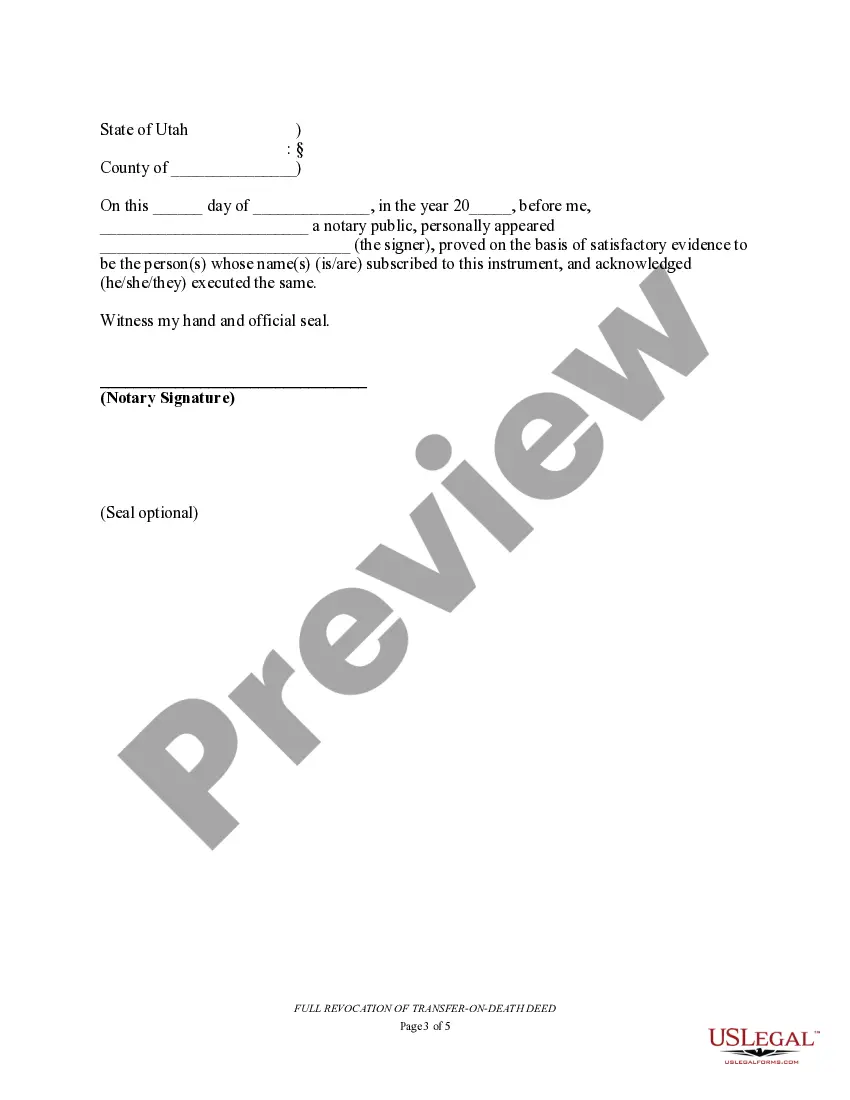

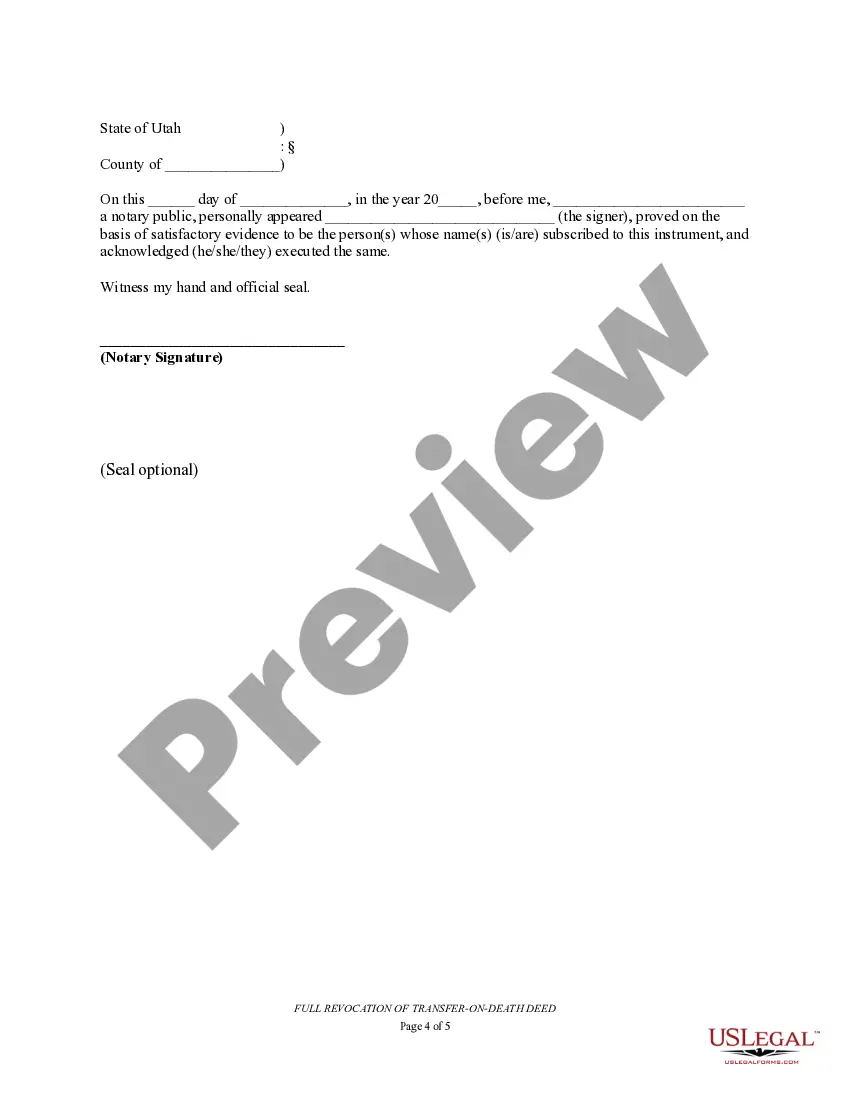

A Salt Lake City Utah Revocation of Transfer on Death Deed — Beneficiary Deed for TwGrantersrs is a legal document that allows two individuals to revoke a transfer on death deed and make changes to the beneficiary designation in regard to their real property in Salt Lake City, Utah. This particular deed ensures that the transfer of ownership upon the granters' death will be directed to the intended beneficiaries. One type of Salt Lake City Utah Revocation of Transfer on Death Deed — Beneficiary Deed for TwGrantersrs is the Joint Tenancy with Rights of Survivorship. This type of deed is commonly used by spouses or partners who wish to ensure that the surviving granter automatically inherits the property upon the other granter's death. Another type is the Tenants in Common. This allows each granter to have an undivided interest in the property, and upon their death, their share will pass to the designated beneficiary. This type of deed is often chosen when the granters have different preferences for the ultimate distribution of their interests. It is crucial to understand the process and implications of creating a Salt Lake City Utah Revocation of Transfer on Death Deed — Beneficiary Deed for TwGrantersrs. In order to initiate the revocation, the granters must complete a legal document stating their intention to revoke the previous transfer on death deed. This document should include their full names, the legal description of the property, and the specific beneficiary changes they wish to make. The revocation must be signed by both granters in front of a notary public and subsequently recorded with the Salt Lake County Recorder's Office. The recorded revocation will invalidate the previous transfer on death deed and ensure that any changes made in the new beneficiary designation will take effect upon the granters' deaths. By utilizing a Salt Lake City Utah Revocation of Transfer on Death Deed — Beneficiary Deed for TwGrantersrs, individuals gain control over the distribution of their real property, allowing them to leave a legacy for their chosen beneficiaries. It is advisable to consult with a qualified attorney to ensure that the deed adheres to all legal requirements and effectively reflects the granters' wishes.

Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors

Description

How to fill out Salt Lake City Utah Revocation Of Transfer On Death Deed - Beneficiary Deed For Two Grantors?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous platform with a plethora of document templates simplifies the search for and acquisition of nearly any sample document you desire.

You can export, complete, and validate the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors in a few minutes instead of spending hours browsing the web for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submission.

If you have not yet created an account, follow the instructions below.

Make sure it is the specific form you need: review its title and details, and consider using the Preview feature if available. Otherwise, employ the Search field to locate the necessary one.

- Our skilled legal experts consistently examine all documents to ensure that the templates are applicable to a given state and adhere to current laws and regulations.

- How can you acquire the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors.

- If you possess an account, simply Log In.

- The Download option will appear for all the files you access.

- Moreover, you can locate all your previously saved documents in the My documents section.

Form popularity

FAQ

Revoking a transfer on death deed in Texas requires the grantor to create and record a new instrument that indicates the revocation. This document should be filed in the appropriate county office where the original deed was recorded. It is crucial to communicate this change to any involved beneficiaries to maintain transparency. For further assistance regarding the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, consider utilizing the resources available at USLegalForms.

Texas does recognize transfer on death deeds, but they are subject to specific rules. These deeds must be properly executed, and the conveyance only takes effect upon the grantor's death. However, complications can arise if there are changes to beneficiaries or if debts exist against the estate. It is essential to familiarize yourself with the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors to ensure your interests are protected.

Transfer on death (TOD) deeds can have several drawbacks. They may create complications if the grantor changes their mind about beneficiaries without formally revoking the deed, leading to potential conflict. Moreover, properties transferred via TOD may still be subject to estate taxes, which can surprise beneficiaries. Understanding the implications of the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors can help you better navigate these challenges.

To revoke a transfer on death deed in Illinois, the grantor must execute a new deed explicitly stating the revocation. This new deed should be recorded in the same office where the original deed was filed. It is also wise to notify the beneficiaries of this change to avoid confusion. For detailed steps concerning the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, you might want to explore resources from USLegalForms.

In Texas, the use of transfer on death deeds can complicate estate planning. Problems arise when property owners are unaware of the implications these deeds can have on their tax situation and their ability to change their mind about beneficiaries. Additionally, Texas may not honor these deeds under all circumstances, leading to potential disputes among heirs. If you need clarity on the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, consider consulting a professional for guidance.

To transfer property in Utah, you must prepare a deed, such as a warranty deed or quitclaim deed, and file it with the county recorder's office. Ensure you provide accurate details regarding the property and the parties involved. If you have set up a transfer on death deed, the process may differ slightly since the transfer occurs after death. For your questions about the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, uslegalforms can provide the necessary forms and guidance.

In Utah, the survivorship law allows co-owners of property to automatically inherit the other owner's share upon their death. This law is often utilized in joint tenancy situations, which can simplify property transfer and avoid probate. It's essential to understand the implications of this arrangement on estate planning. For more assistance on navigating the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, uslegalforms offers helpful resources.

To transfer title after death in Utah, you typically need to present an original death certificate and the relevant property documents to the county recorder's office. If a transfer on death deed is in place, the process simplifies, as the property transfers directly to named beneficiaries. Always review local regulations to ensure compliance with state laws. For guidance on the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, uslegalforms can provide valuable assistance.

Utah does allow a transfer on death deed, and it has specific rules governing its creation and use. This deed enables you to designate beneficiaries to inherit your property immediately after your death. Ensuring compliance with these rules is crucial to avoid issues later. When you need to manage the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, look into the resources available on uslegalforms.

Yes, you can establish a transfer on death deed in Utah. This legal tool allows you to transfer property directly to your beneficiaries without going through probate. It’s important to ensure that the deed is properly executed and recorded to avoid any complications. For assistance with the Salt Lake City Utah Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors, consider using the uslegalforms platform.