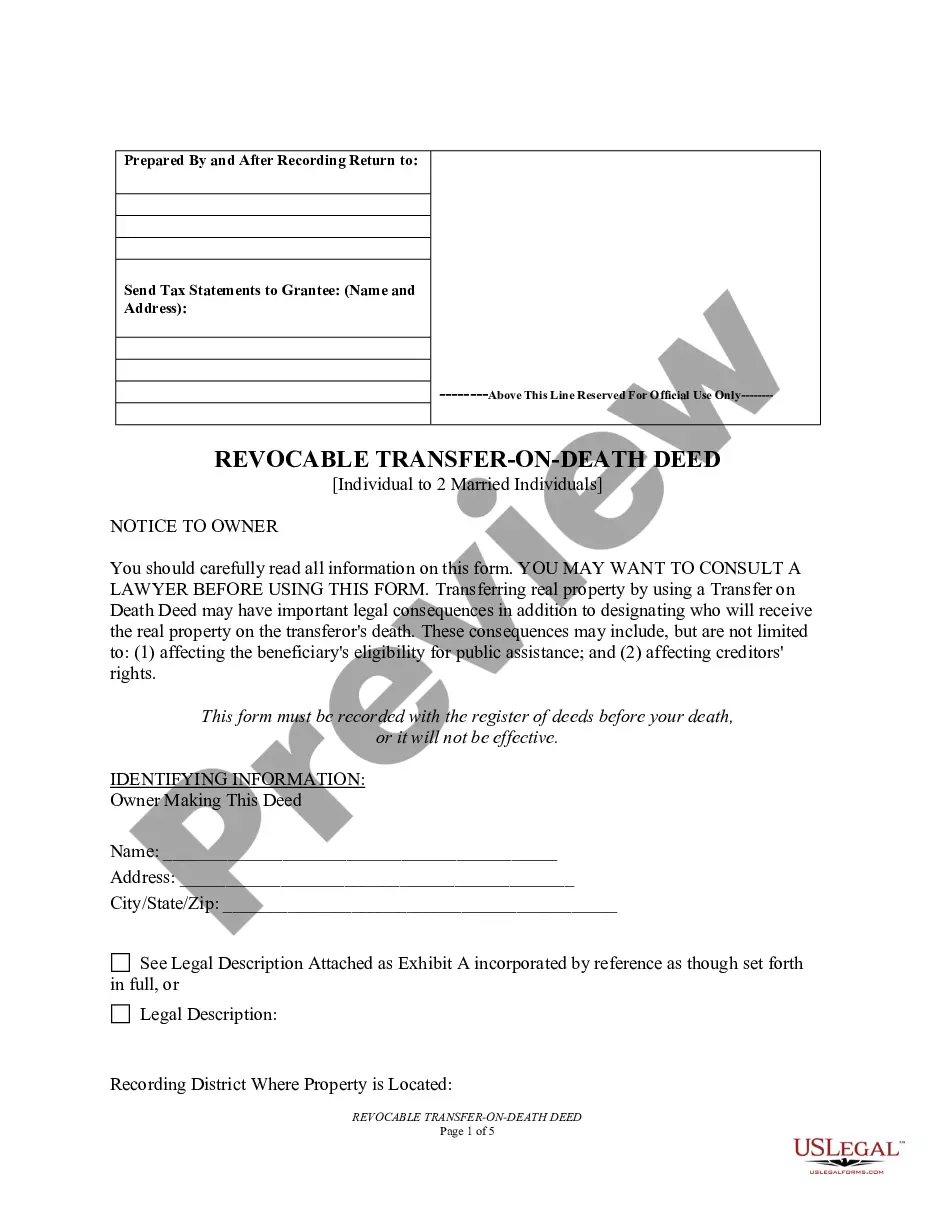

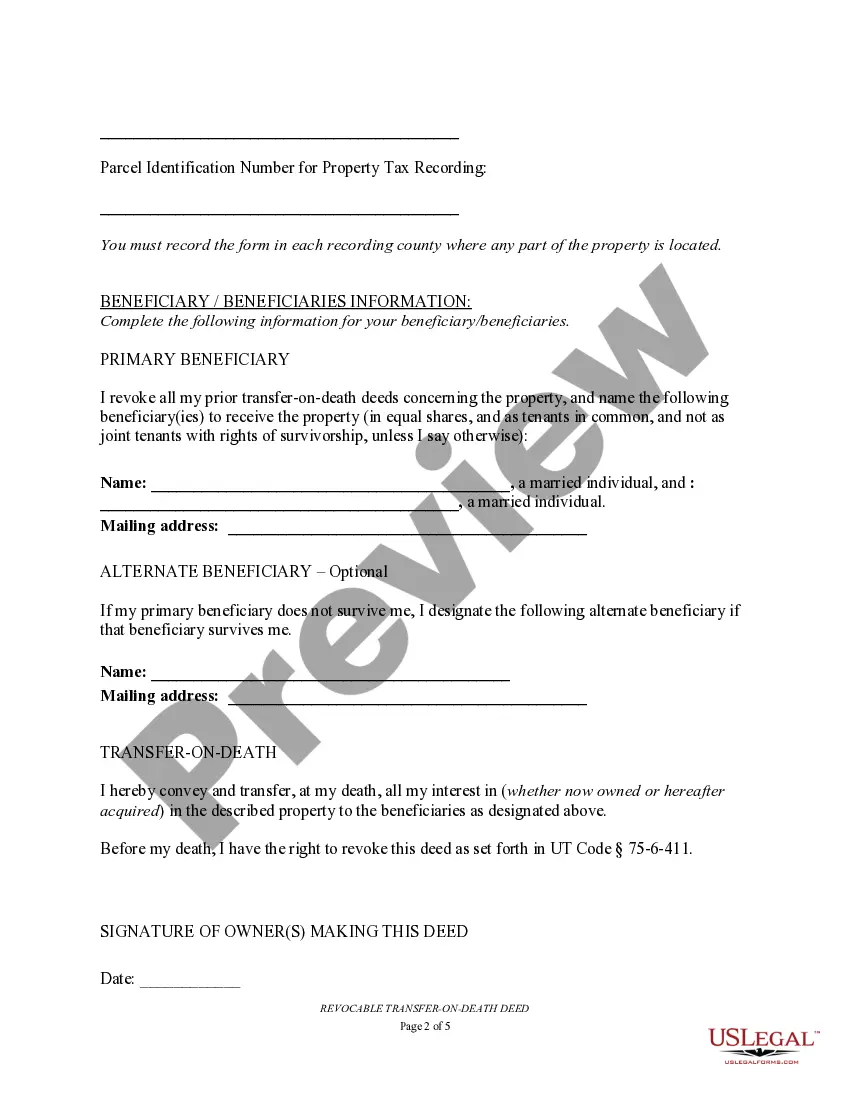

Salt Lake Utah Transfer on Death Deed (TOD) or Beneficiary Deed for Individual to Married Beneficiaries allows individuals in Salt Lake, Utah, to designate married beneficiaries who will receive their property upon their death. This legal document is a useful tool for estate planning and helps facilitate the transfer of real estate without the need for probate. There are two main types of Salt Lake Utah Transfer on Death Deeds or Beneficiary Deeds for Individual to Married Beneficiaries: 1. Revocable Transfer on Death Deed: This type of deed enables the property owner to maintain complete control over their property during their lifetime. They have the flexibility to amend or revoke the deed at any time. Upon the owner's death, the property passes directly to the named married beneficiaries without the need for probate. 2. Irrevocable Transfer on Death Deed: Unlike the revocable option, this type of deed cannot be changed or revoked once executed. The property owner relinquishes all control over the property and cannot sell or mortgage it without the consent of the named married beneficiaries. This type of deed is often used when the owner wants to ensure that the property goes directly to the beneficiaries without any potential interference or disputes. By using a Salt Lake Utah Transfer on Death Deed or Beneficiary Deed for Individual to Married Beneficiaries, the property owner can have peace of mind knowing that their property will transfer smoothly to their chosen beneficiaries without the costly and time-consuming probate process. This method also helps the beneficiaries avoid any potential inheritance conflicts. To execute a Salt Lake Utah Transfer on Death Deed or Beneficiary Deed for Individual to Married Beneficiaries, it is essential to consult with an experienced estate planning attorney who can guide the property owner through the legal process and ensure that the deed meets all the necessary requirements under Utah law. In conclusion, the Salt Lake Utah Transfer on Death Deed or Beneficiary Deed for Individual to Married Beneficiaries provides a convenient and efficient way for property owners to transfer their real estate to their married beneficiaries without probate. Whether choosing the revocable or irrevocable option, this legal tool helps simplify estate planning and ensure a smooth transfer of property.

Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries

Description

How to fill out Salt Lake Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Married Beneficiaries?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries is proper for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

How can I obtain a copy of my deed? You can request a copy from our office in person or by mail. Copies are $1.00 per page. If mailing your request, please enclose the appropriate fee for the copy and a self-addressed stamped envelope.

Application for Utah Title ? Form TC-656, Application for Utah Title must be completed by the new vehicle owners. This may be completed at the DMV at the time of transfer. Safety and/or Emissions Inspection Certificates ? If you plan on registering the vehicle, a safety and/or emissions inspection may be required.

A Utah quitclaim deed form (sometimes called a quick claim deed or quitclaim deed) allows the current owner (grantor) to transfer property to a new owner (grantee) without making any guarantees about whether the grantor has clear title to the property.

Utah now allows you to leave real estate with transfer-on-death deeds, also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death. You can revoke the deed or sell the property at any time; the beneficiary you name on the deed has no rights until your death.

Living trusts In Utah, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Utah now allows you to leave real estate with transfer-on-death deeds, also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death. You can revoke the deed or sell the property at any time; the beneficiary you name on the deed has no rights until your death.

Probate is not required. The TOD deed has no effect until you die. You can revoke it at any time. You are also free to transfer the property to someone else during your lifetime....Title 75 Chapter 6 Part 4 Section 416. IndexUtah CodePart 4Uniform Real Property Transfer on Death Act3 more rows

One year limitation on sale. One of the big limitations of a Transfer on Death Deed is that the property generally may not be sold for one year following the death of the original owner. With a trust, the trustee can sell the property immediately after death without probate.

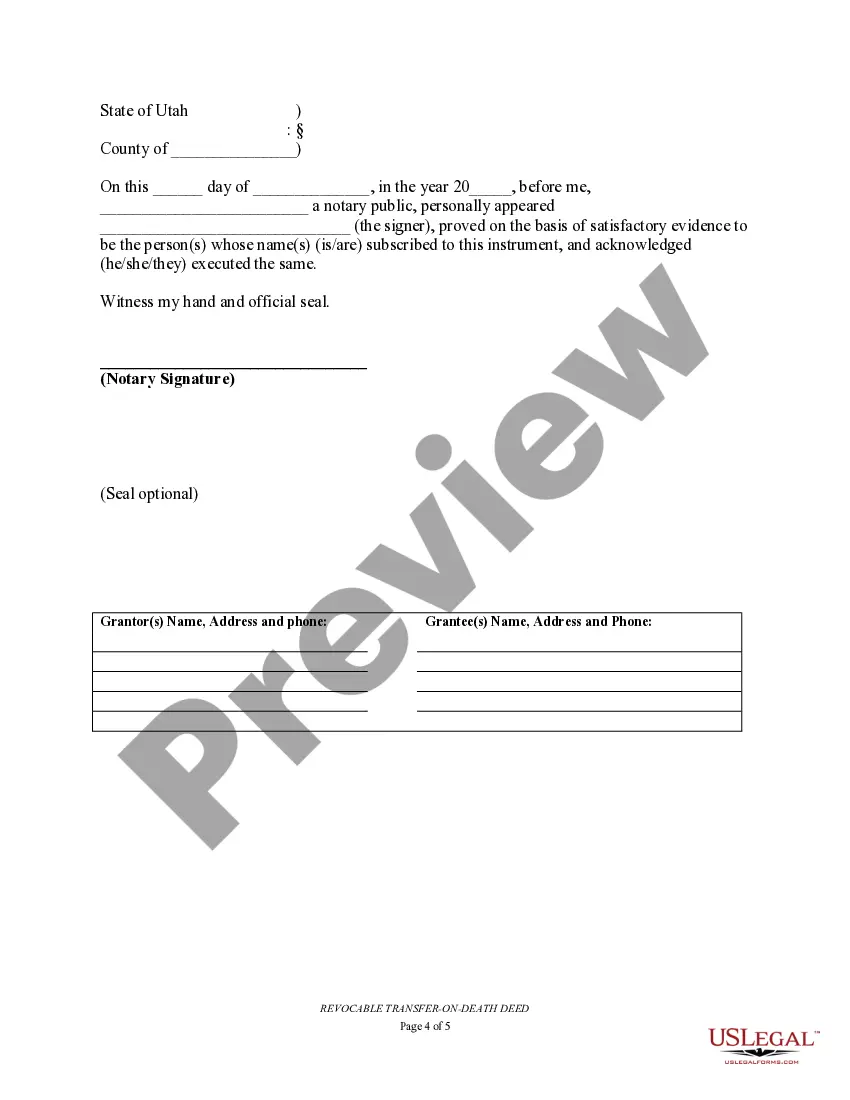

Utah Code § 57-1-12.5. Utah Quit Claim Deed Form ? Provides no warranty of title....Transferring Utah real estate involves four general steps: Locate the Prior Deed to the Property.Create the New Deed.Sign and Notarize the New Deed.File the Deed with the County.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.