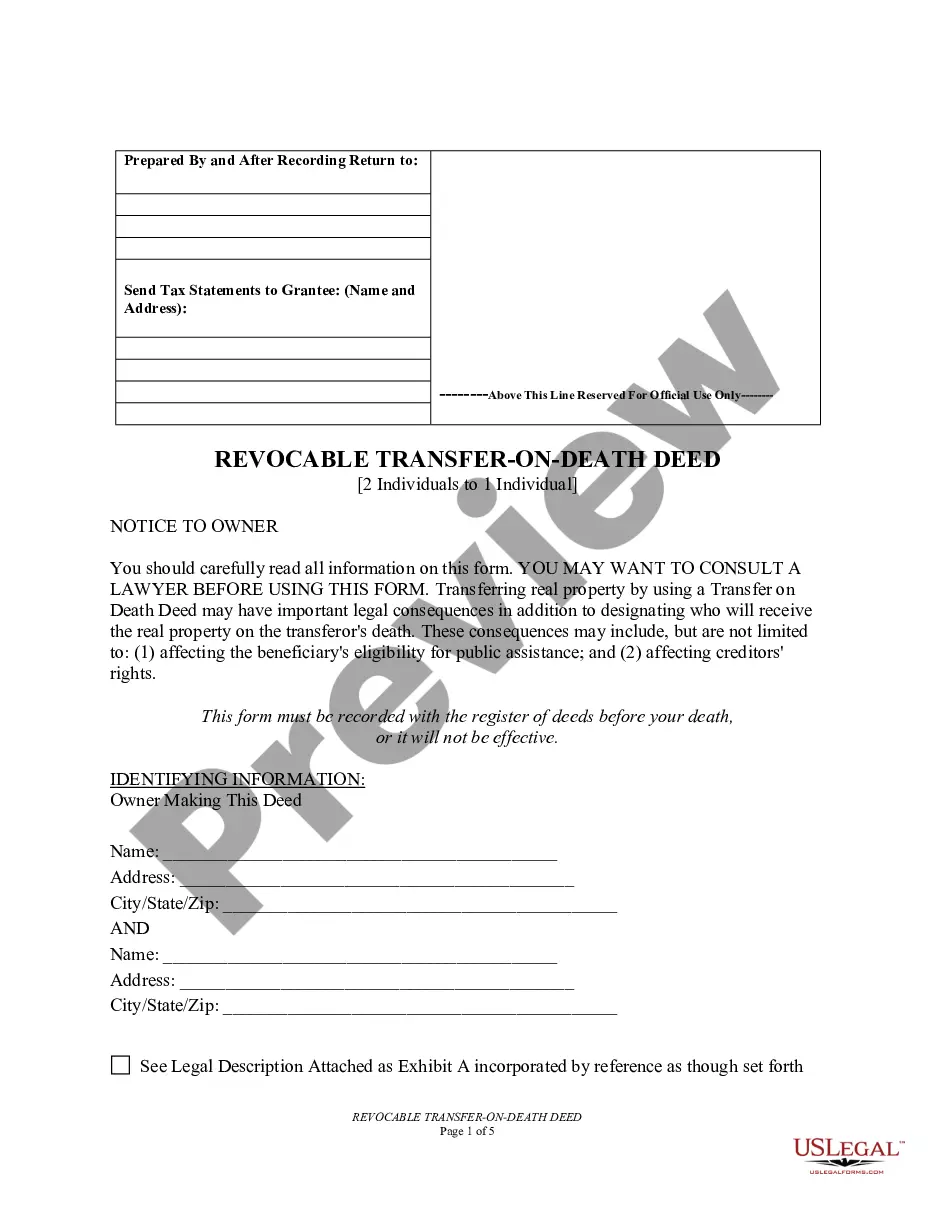

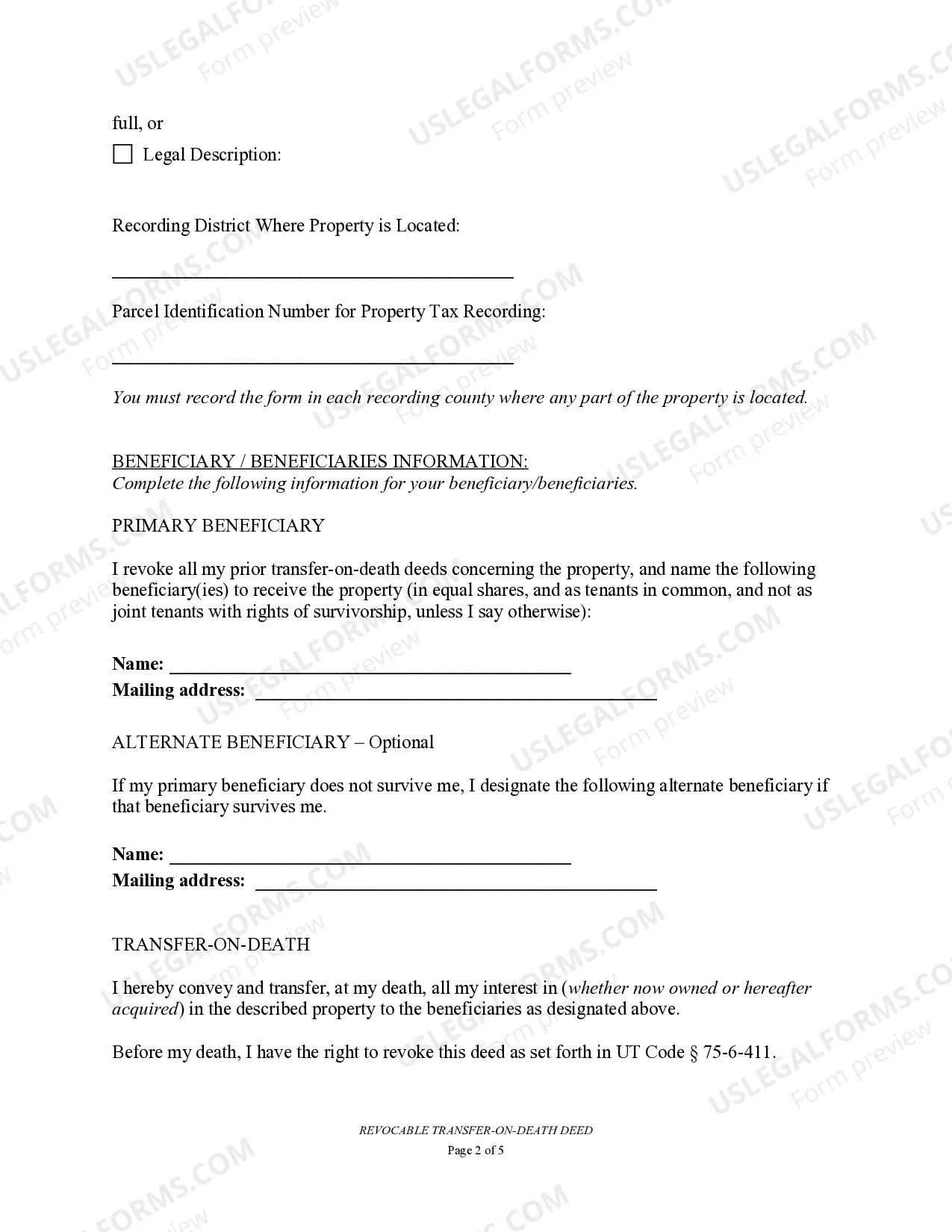

The West Valley City Utah Transfer on Death Deed, also known as a TOD — Beneficiary Deed for Two Individuals to One Individual, is a legal document that allows the transfer of real estate upon the death of the current owners, directly to a named beneficiary. The TOD — Beneficiary Deed is commonly used in West Valley City, Utah, to efficiently transfer property without the need for probate. This type of deed is particularly beneficial for individuals who wish to designate a specific person as the sole beneficiary of their property when they pass away. By using a TOD — Beneficiary Deed for Two Individuals to One Individual, the property can be easily transferred without the complexities typically associated with probate court proceedings. There are various types of West Valley City Utah Transfer on Death Deeds or TOD — Beneficiary Deeds for Two Individuals to One Individual, each designed to cater to different circumstances. These include: 1. Joint Tenancy with Right of Survivorship: This type of transfer on death deed allows two individuals to jointly own a property, with the right of survivorship. When one owner passes away, their share of the property automatically transfers to the surviving owner. 2. Tenancy in Common: Under this arrangement, two individuals can own the property with distinct ownership percentages. In the event of death, the deceased owner's share will be transferred to the named beneficiary, as specified in the deed. 3. Life Estate Deed: This type of deed grants one individual (the life tenant) the right to use and enjoy the property during their lifetime. Upon the life tenant's death, the property automatically passes to the designated beneficiary. 4. Community Property with Right of Survivorship: This type of deed is typically used by married couples and allows for the seamless transfer of property upon the death of one spouse to the surviving spouse. Utilizing any of these West Valley City Utah Transfer on Death Deeds or TOD — Beneficiary Deeds for Two Individuals to One Individual can help individuals streamline their estate planning process, avoiding the need for probate, and ensuring a smooth transfer of property to their desired beneficiaries. It is advisable to consult with an experienced attorney or legal professional when considering this type of property transfer.

West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to One Individual

Description

How to fill out West Valley City Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To One Individual?

If you are looking for a relevant form, it’s difficult to find a more convenient platform than the US Legal Forms website – one of the most considerable online libraries. With this library, you can get thousands of templates for business and individual purposes by categories and regions, or keywords. Using our advanced search function, getting the latest West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to One Individual is as elementary as 1-2-3. Furthermore, the relevance of each document is confirmed by a team of skilled lawyers that regularly review the templates on our website and update them in accordance with the most recent state and county laws.

If you already know about our platform and have an account, all you should do to receive the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to One Individual is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you want. Read its explanation and make use of the Preview feature (if available) to see its content. If it doesn’t meet your needs, use the Search option at the top of the screen to discover the needed document.

- Affirm your selection. Choose the Buy now button. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the received West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to One Individual.

Each form you add to your user profile does not have an expiration date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to get an additional duplicate for editing or printing, feel free to come back and save it once again at any time.

Take advantage of the US Legal Forms extensive collection to gain access to the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to One Individual you were looking for and thousands of other professional and state-specific samples in one place!