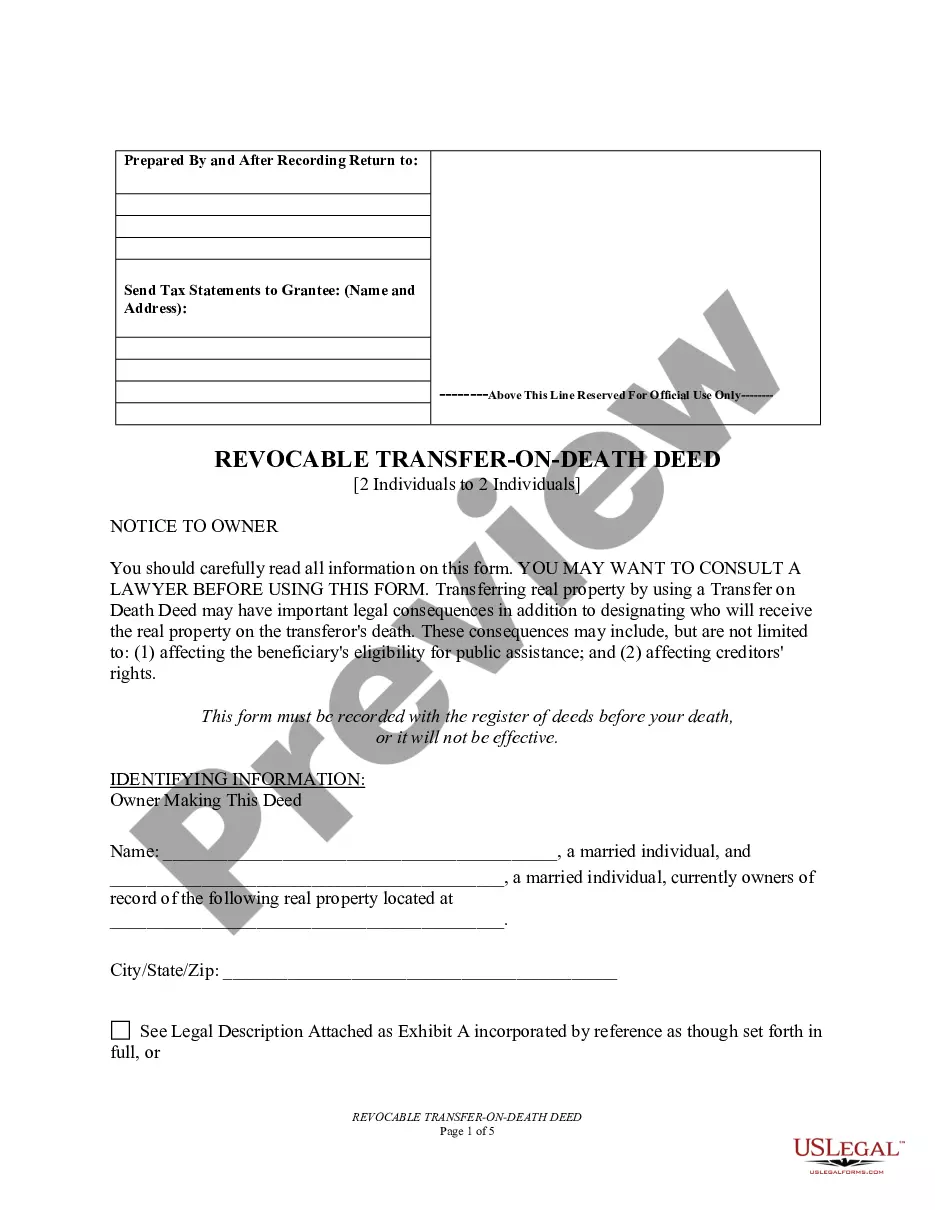

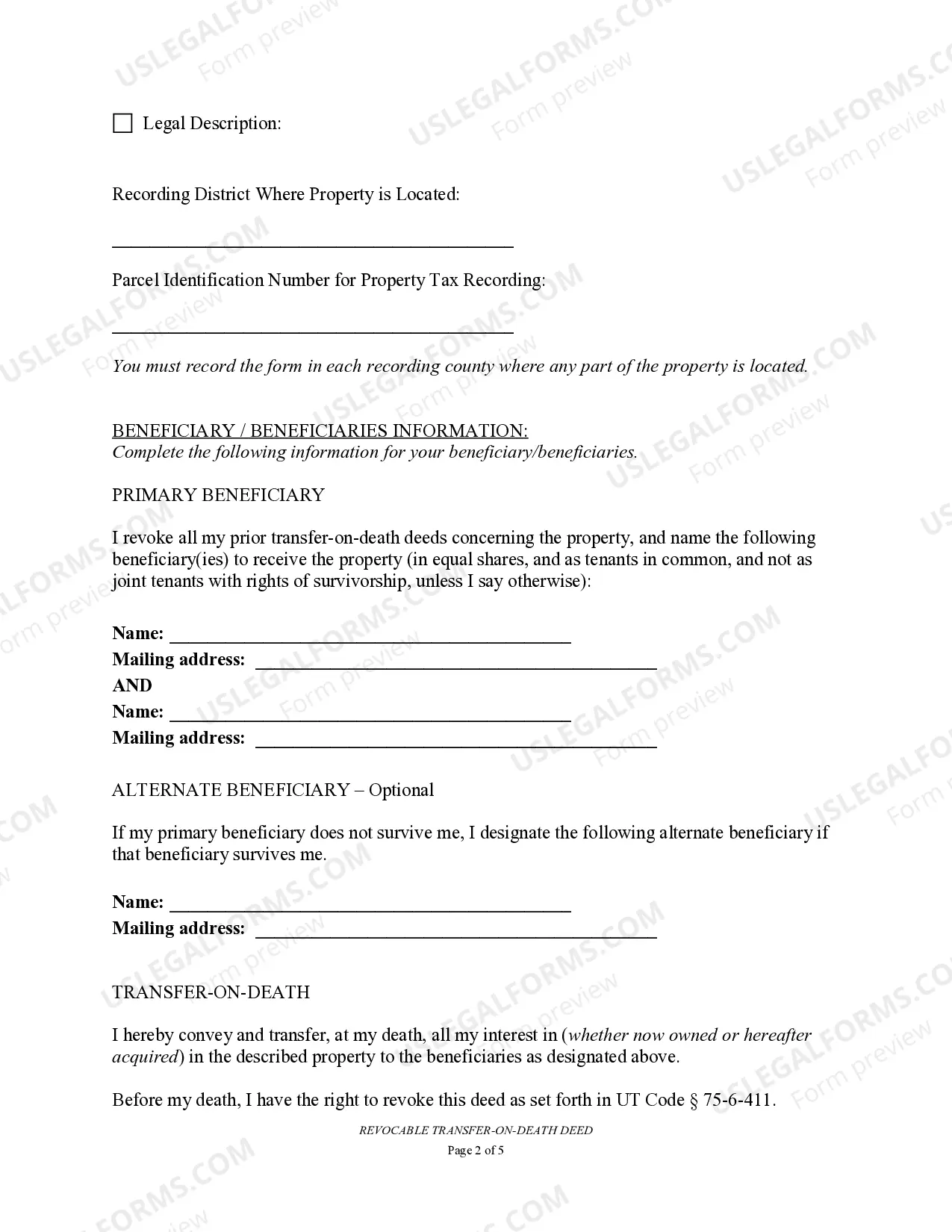

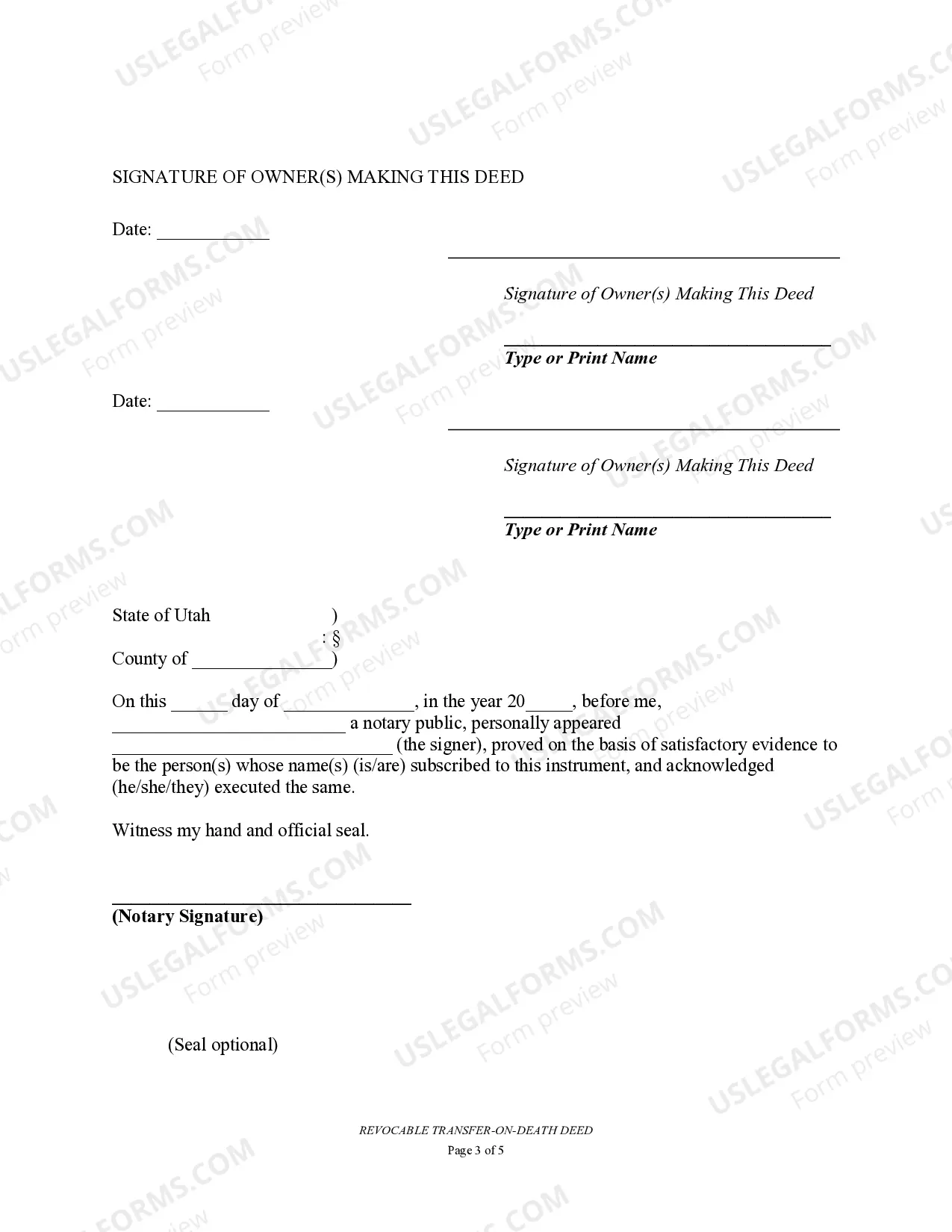

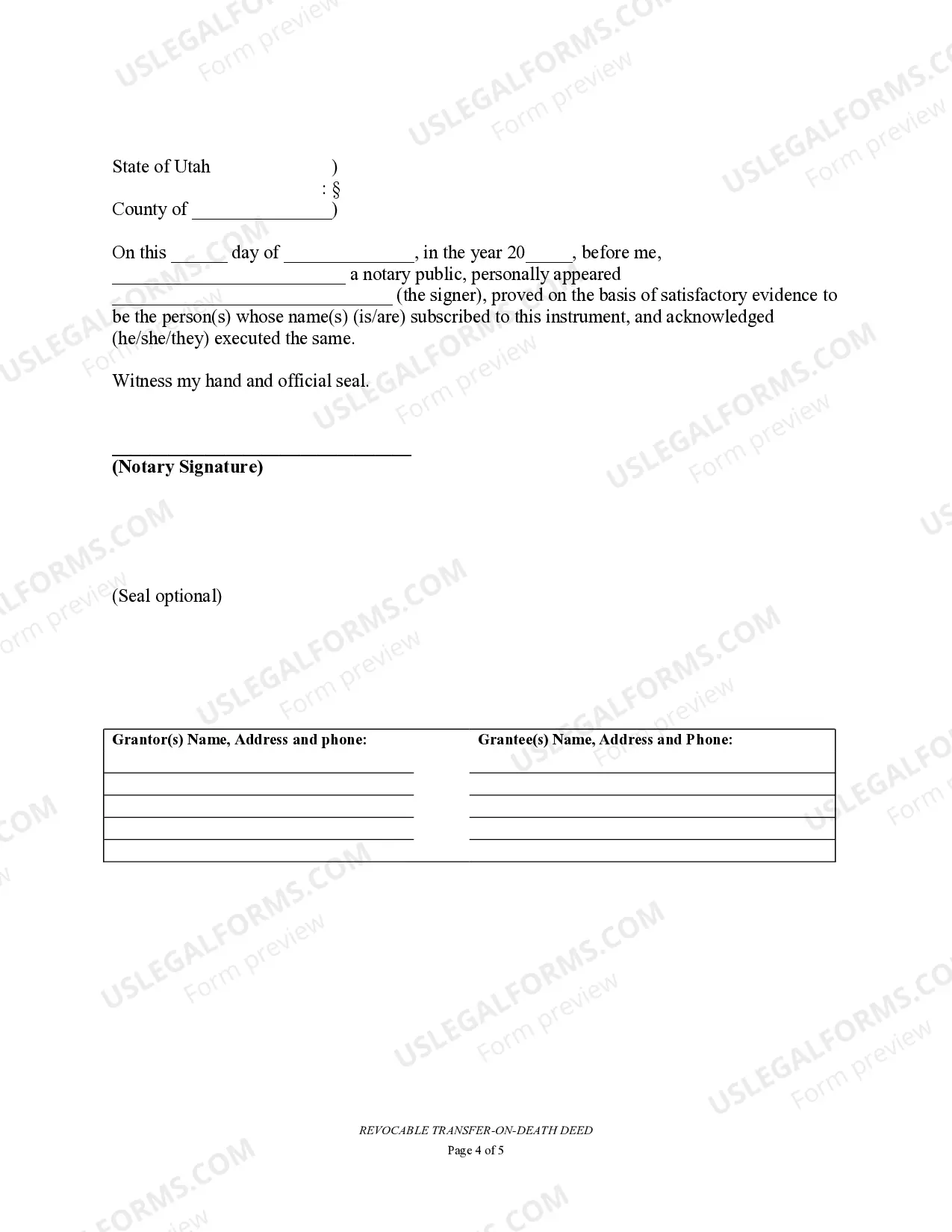

Salt Lake Utah Transfer on Death Deed (TOD) or Beneficiary Deed for Two Married Individuals to Two Individuals is a legal document that allows married couples in Salt Lake City, Utah, to transfer their real estate property to specified individuals upon their deaths. This type of deed ensures a seamless transfer of ownership without the need for probate or a will. The TOD or Beneficiary Deed is designed to provide flexibility and control over the distribution of property after the death of both spouses. By using this document, couples can name two individuals as beneficiaries who will inherit the property jointly. The two individuals can be children, grandchildren, siblings, or any trusted individuals the couple wishes to designate. There are two main types of Salt Lake Utah TOD or Beneficiary Deeds for two married individuals: 1. Joint Tenants with Right of Survivorship (TWOS): This type of TOD or Beneficiary Deed grants the designated beneficiaries equal ownership rights. In the event of the death of one spouse, the surviving spouse automatically becomes the sole owner. When both spouses pass away, the named beneficiaries inherit the property jointly. 2. Tenants in Common: With this option, two individuals are still named as beneficiaries, but they hold separate and distinct ownership interests. Each beneficiary's share in the property can be equal or set differently according to the couples' wishes. When one spouse dies, their share passes directly to their named beneficiary. If both spouses pass away, the beneficiaries own the property as tenants in common and can sell or transfer their individual shares independently. The Salt Lake Utah TOD or Beneficiary Deed for Two Married Individuals to Two Individuals is a powerful estate planning tool that can simplify the transfer process, avoid probate costs and delays, and ensure that couples' real estate assets are distributed according to their wishes. It is important to consult with an attorney specializing in estate planning to draft and execute this deed correctly, considering state-specific laws and regulations.

Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals

Description

How to fill out Salt Lake Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To Two Individuals?

If you are searching for a relevant form template, it’s impossible to choose a better place than the US Legal Forms site – one of the most comprehensive online libraries. Here you can find a large number of templates for organization and individual purposes by types and regions, or keywords. With our high-quality search option, discovering the latest Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals is as easy as 1-2-3. Moreover, the relevance of each and every file is verified by a group of expert attorneys that on a regular basis review the templates on our website and update them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you require. Read its information and use the Preview function (if available) to check its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the proper document.

- Confirm your decision. Choose the Buy now option. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the obtained Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals.

Every template you add to your profile does not have an expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to have an additional duplicate for enhancing or printing, you can return and export it once again at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals you were seeking and a large number of other professional and state-specific templates on a single website!