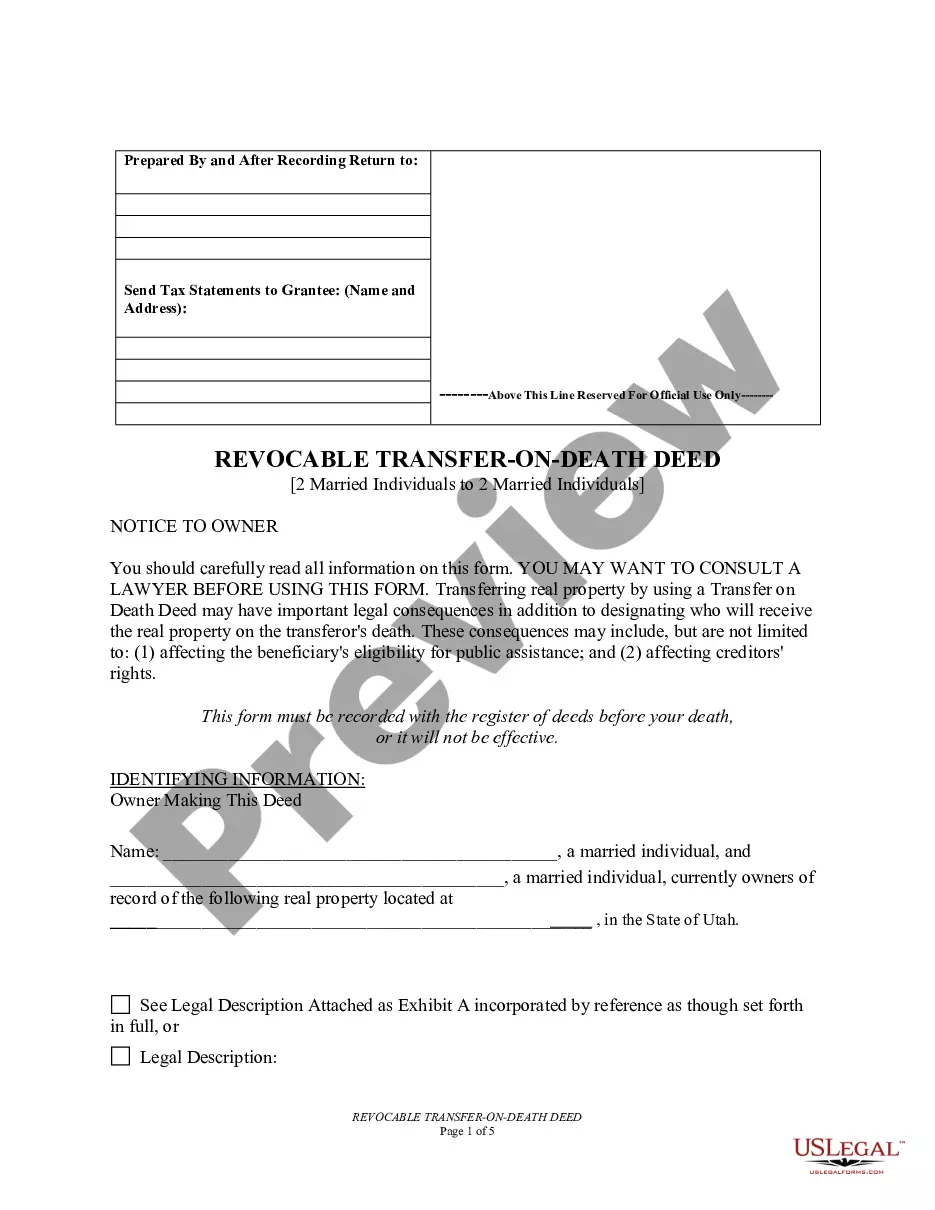

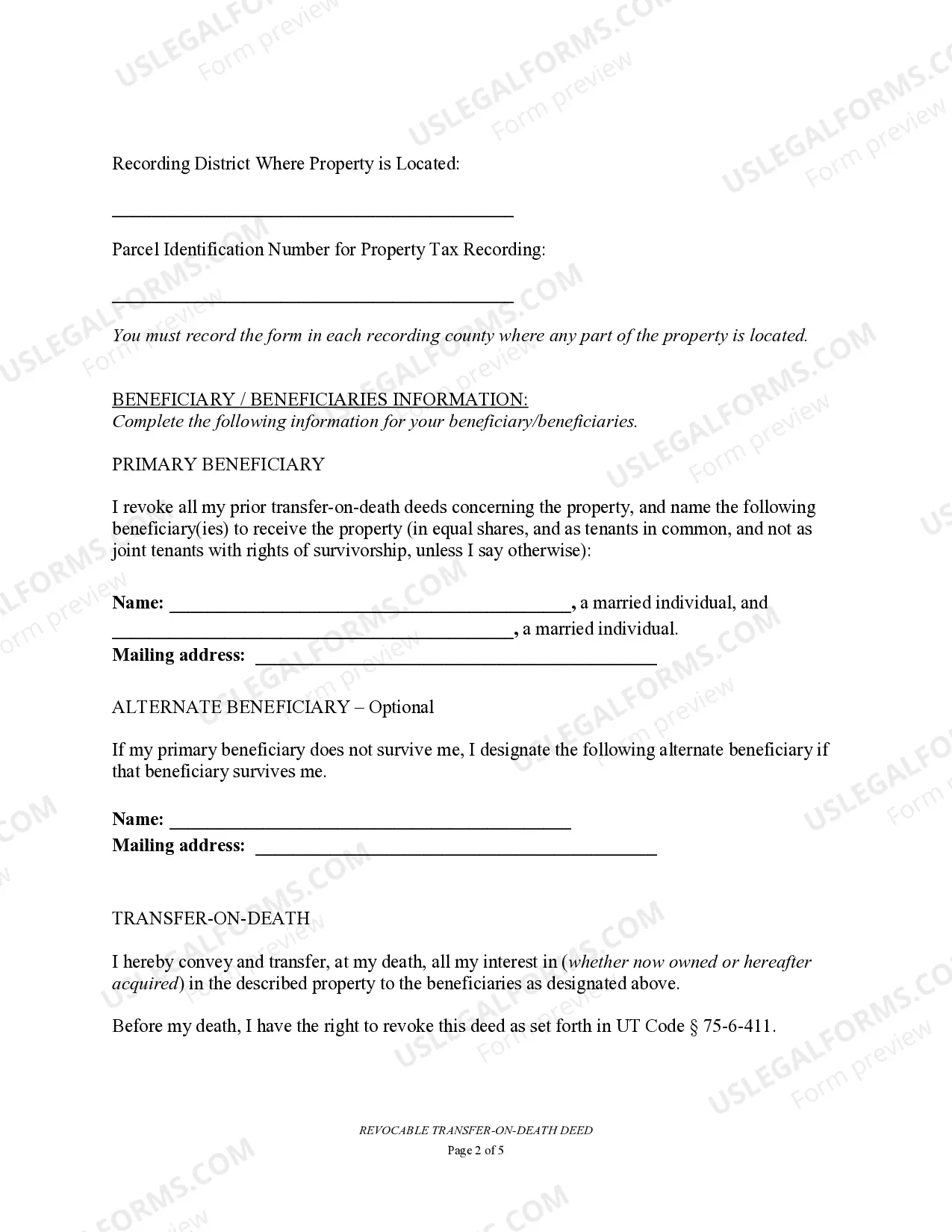

A West Jordan Utah Transfer on Death Deed, also known as a TOD Beneficiary Deed, is a legal document that allows married individuals in West Jordan, Utah, to transfer their property to married beneficiaries upon their death. This type of deed is commonly used to avoid probate and ensure a smooth transfer of property ownership. There are various types of Transfer on Death Deeds or TOD-Beneficiary Deed options available specifically for two married individuals who wish to transfer their assets to two married beneficiaries. These options include: 1. Joint Tenancy with Rights of Survivorship: This type of TOD deed allows two married individuals to hold equal ownership of their property. In the event of one spouse's death, the ownership transfers entirely to the surviving spouse. 2. Tenancy by the Entirety: This TOD deed option is exclusively for married couples and provides a form of joint ownership. It offers additional protection against creditors and ensures that if one spouse passes away, their interest automatically transfers to the surviving spouse. 3. Community Property with Right of Survivorship: In states that recognize community property laws, such as Utah, this TOD deed allows two married individuals to hold property as community property. In the event of one spouse's death, their share automatically transfers to the surviving spouse, bypassing probate. 4. Tenancy in Common: Unlike the previous options, this TOD deed allows married individuals to hold unequal ownership interests in the property. In the event of one spouse's death, their interest does not automatically transfer to the surviving spouse but is instead distributed according to their estate plan or state's laws of intestate succession. It's crucial for married individuals in West Jordan, Utah, to understand the various options available to them when considering a Transfer on Death Deed or TOD-Beneficiary Deed. Seeking legal advice from a qualified attorney can help ensure the correct type of deed is chosen based on individual circumstances and goals. Additionally, consulting with a real estate professional familiar with local laws and regulations can provide further guidance during the transfer process.

West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries

Description

How to fill out Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To Two Married Beneficiaries?

If you’ve previously utilized our service, Log In to your account and store the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries on your device by clicking the Download button. Ensure your subscription remains active. If not, extend it as per your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to each document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

- Ensure you’ve found the correct document. Examine the description and utilize the Preview option, if available, to verify it satisfies your requirements. If it does not align with your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card details or the PayPal option to finalize the transaction.

- Receive your West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries. Select the file format for your document and save it to your device.

- Finish your sample. Print it out or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

The main difference between a TOD and a beneficiary deed lies in their technical definitions and uses. While both achieve the same goal of transferring property upon death, a TOD deed typically creates an immediate legal interest while the owner is alive. In contrast, a beneficiary deed may not create such interests until the owner's death. Understanding these nuances is essential, and resources from uslegalforms can clarify these differences for your specific needs.

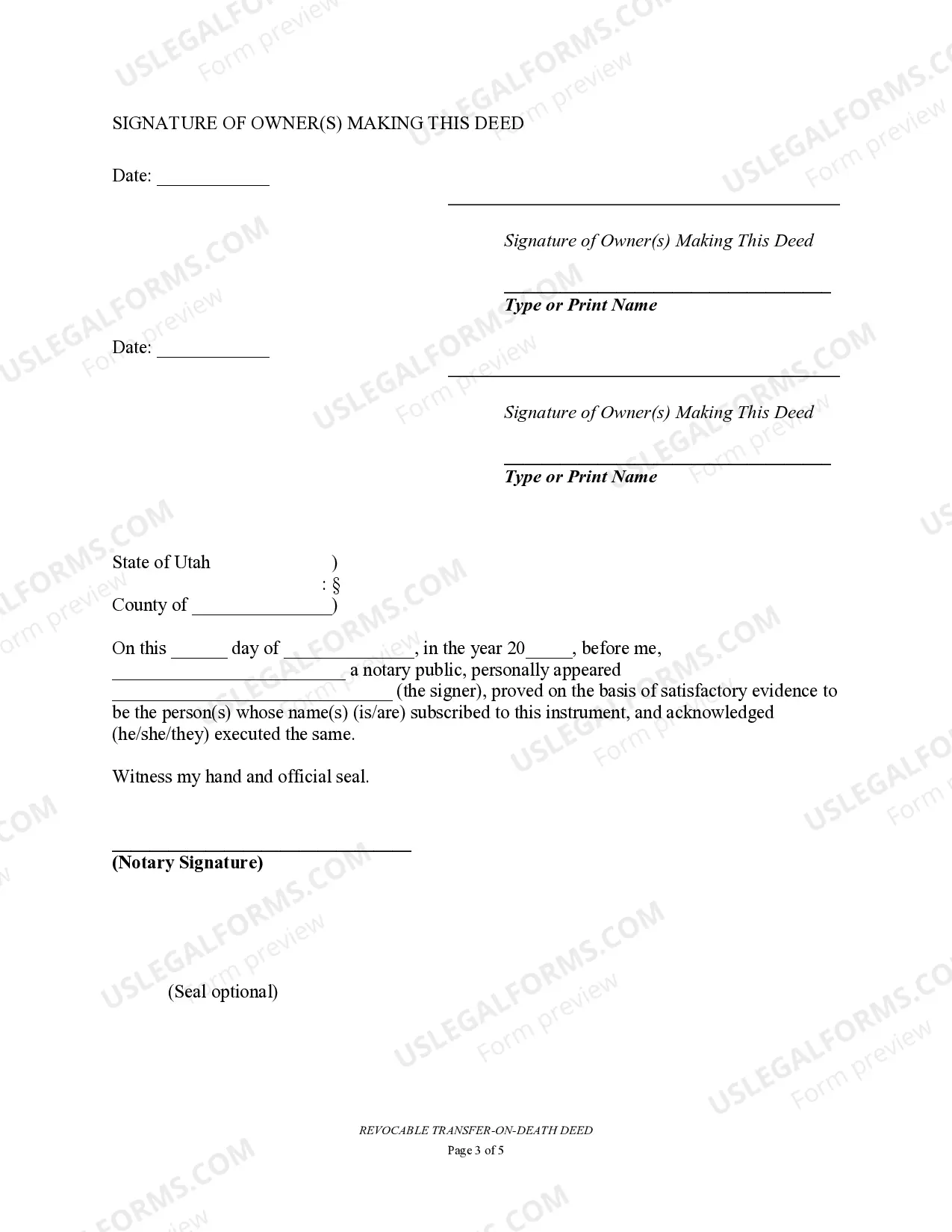

Writing a beneficiary deed involves a few key steps. First, include a clear description of the property and identify both the current owners and beneficiaries. It’s essential to follow the specific legal requirements in West Jordan, Utah, ensuring that the document is properly executed and notarized. For those seeking assistance, uslegalforms offers templates and guidance to help you draft an effective beneficiary deed.

A Transfer on Death (TOD) deed and a beneficiary deed serve similar purposes but are not identical. Both allow for the transfer of real estate upon the owner's death, bypassing probate. However, the specific terminology can vary by state, and it’s essential to understand how each is defined in West Jordan, Utah. Utilizing a platform like uslegalforms can clarify these distinctions and guide you through the appropriate process.

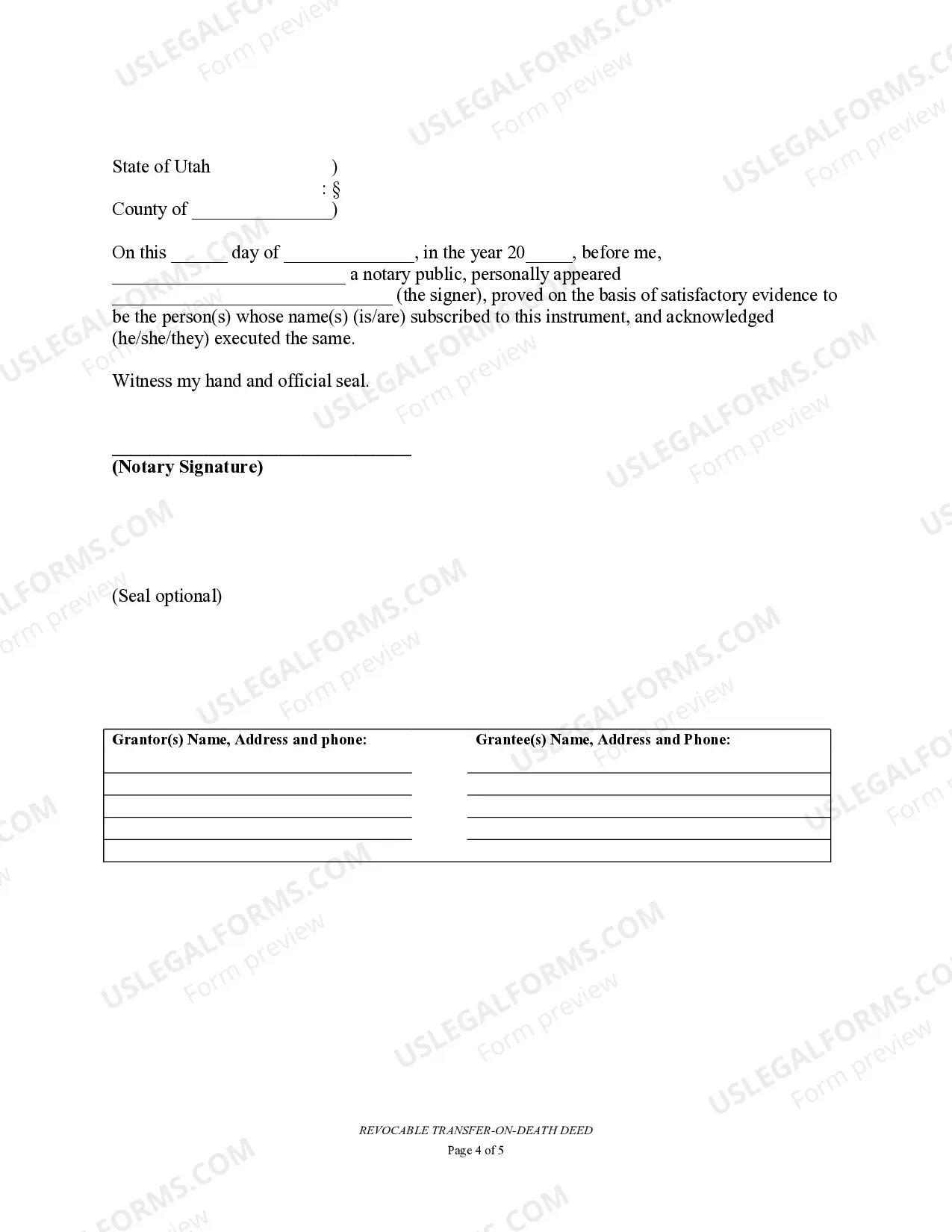

To transfer a property using a West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries, you must complete the deed form correctly. Ensure that both beneficiaries' names are included clearly in the deed. Once completed, you need to sign the document in front of a notary and record it with the county recorder. This process helps ensure a smooth transfer after the original owner's passing.

Yes, a Transfer on Death Deed - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries effectively avoids probate in West Jordan, Utah. This deed allows property to transfer directly to the named beneficiaries upon the owner’s death without the lengthy probate process. However, ensure that the deed is completed correctly to guarantee these benefits. Using platforms like uslegalforms can provide resources and guidance to create your TOD deed accurately.

Using a Transfer on Death Deed comes with certain drawbacks that you should be aware of. For one, it does not allow for conditions or restrictions on how beneficiaries may use the property. Additionally, changes in circumstances, such as a divorce or the death of a beneficiary, can complicate matters. It’s wise to carefully plan and possibly consult with professionals to navigate these challenges.

While a Transfer on Death Deed or TOD - Beneficiary Deed can simplify the transfer process, it does have disadvantages. For instance, it may not provide protection from creditors, and some beneficiaries may face tax implications. Additionally, if not properly executed, this deed could lead to disputes among beneficiaries. Consider discussing any concerns with a legal expert to ensure you make the best choice.

A Transfer on Death Deed or TOD - Beneficiary Deed can be a wise choice for many couples in West Jordan, Utah. This option allows you to transfer property to your beneficiaries without going through probate. It keeps your estate plan straightforward and can provide peace of mind. Evaluate your unique situation and consider consulting with a professional.

In Utah, you can transfer the title after death by using a West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries. This deed automatically transfers ownership to the designated beneficiaries upon the owner’s death without going through probate. It's vital to ensure all legal requirements are met for a smooth transfer process. USLegalForms offers templates and resources to facilitate this transition, making it easier for you and your beneficiaries.

To create a West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Married Beneficiaries, you must complete a specific form and ensure it is properly signed and notarized. The deed must be filed with the county recorder’s office where the property is located. It is essential to follow Utah state laws to make the deed valid. Utilizing services from USLegalForms can guide you through the necessary steps and provide official documentation.