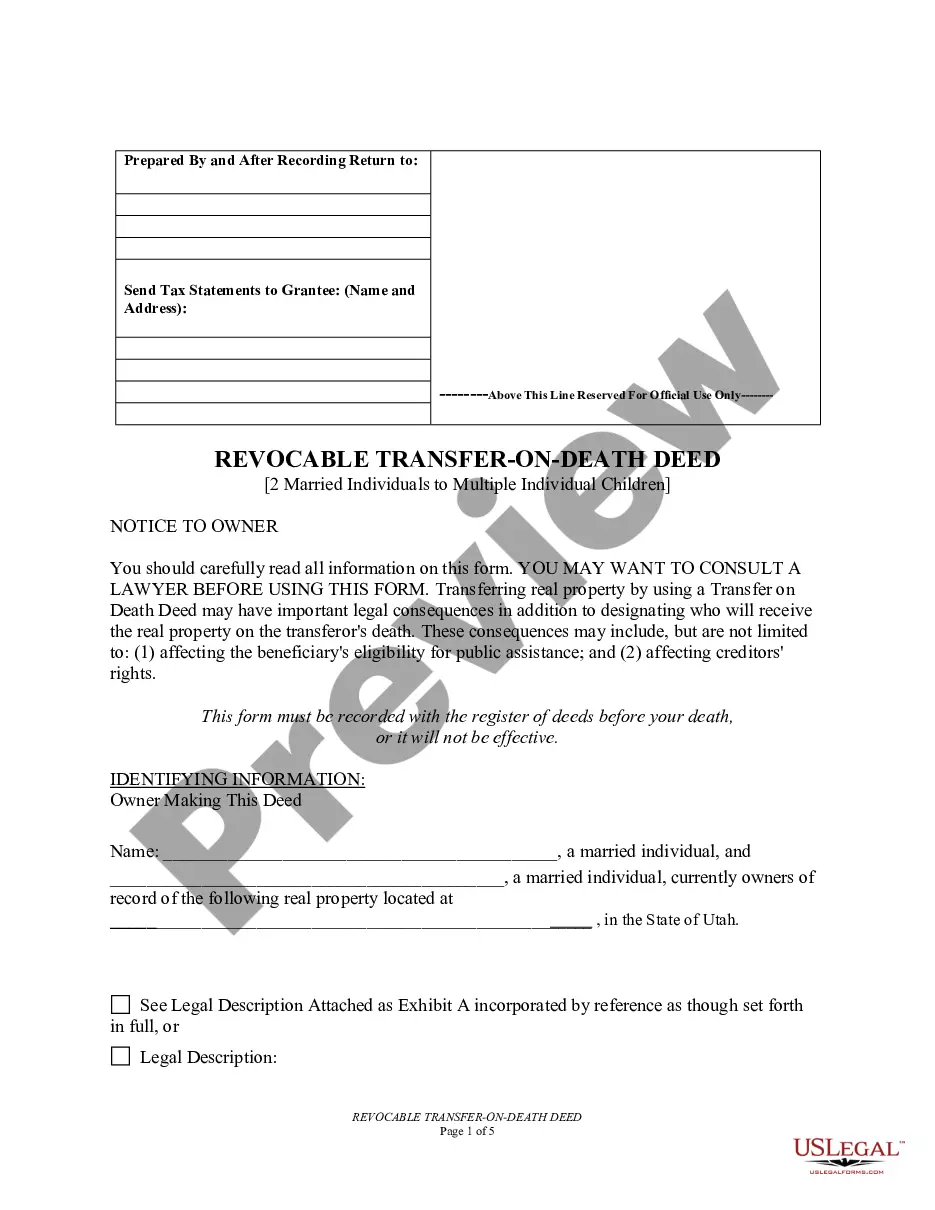

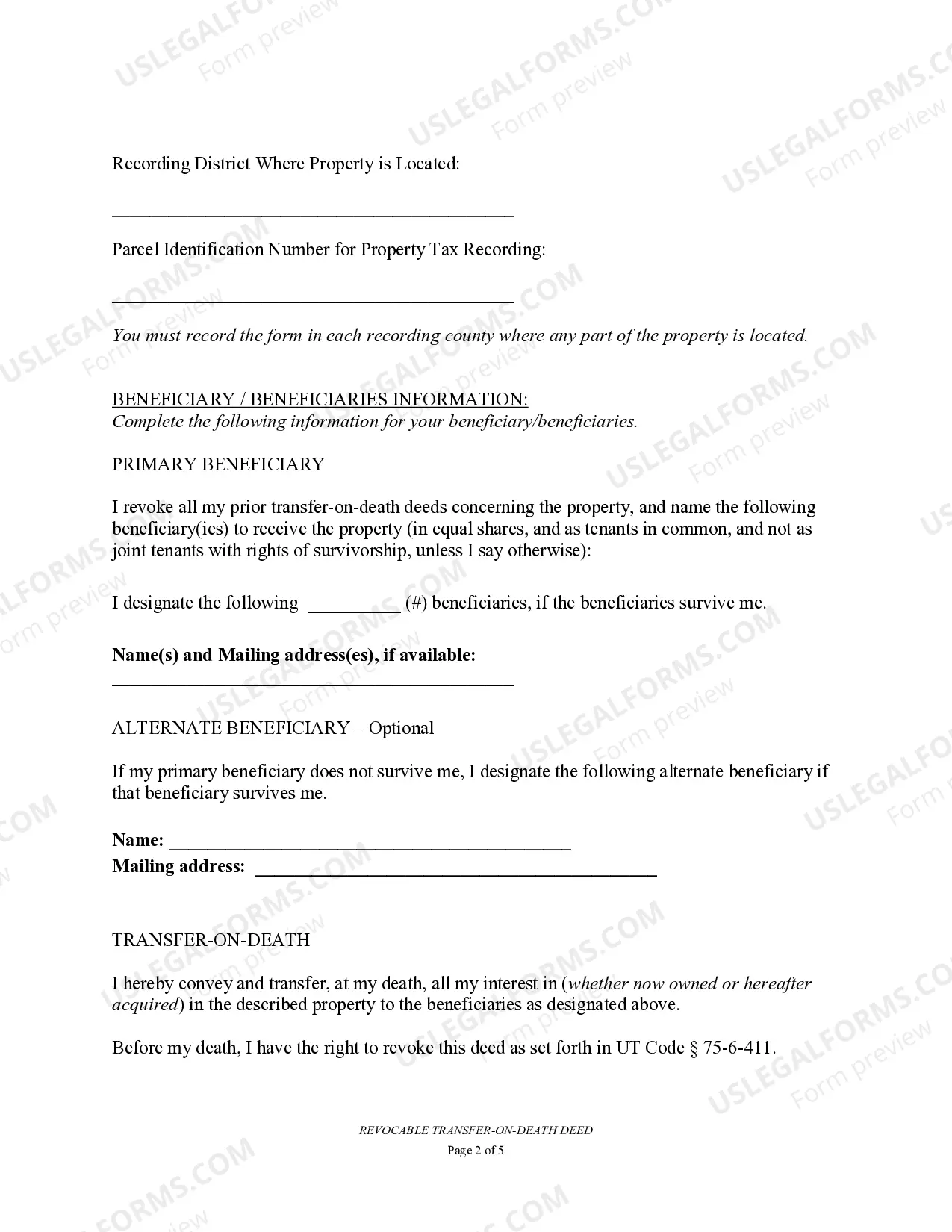

The West Jordan Utah Transfer on Death Deed or TOD — Beneficiary Deed is an estate planning tool that allows married individuals to transfer their real estate property to multiple individuals upon their death. This legally binding deed ensures a smooth and efficient transfer of property without the need for probate. The TOD — Beneficiary Deed for Two Married Individuals to Multiple Individuals is especially useful when two spouses want to leave their property to more than one beneficiary. This type of deed provides flexibility by allowing the married couple to name multiple individuals as beneficiaries. This ensures that their property is distributed according to their wishes, avoiding potential conflicts and uncertainties. There are different types of West Jordan Utah Transfer on Death Deed or TOD — Beneficiary Deeds that cater to specific scenarios and preferences: 1. Joint Tenancy with Rights of Survivorship: This type of deed is commonly used by married couples who want their property to automatically transfer to the surviving spouse upon their death. It ensures that the surviving spouse retains full ownership rights and control over the property. 2. Tenancy in Common: This type of deed allows married couples to designate specific individuals as beneficiaries, who will inherit their respective shares of the property upon their death. Each person named as a beneficiary will hold an undivided interest in the property. 3. Community Property with Rights of Survivorship: This type of deed is specifically designed for married couples in community property states. It ensures that the property automatically transfers to the surviving spouse as their separate property upon the death of one spouse. 4. Life Estate: This type of deed grants one spouse a life estate in the property, allowing them to live in and use the property during their lifetime. Upon the death of the life estate holder, the property passes to the named beneficiaries. By utilizing the West Jordan Utah Transfer on Death Deed or TOD — Beneficiary Deeds, married individuals can efficiently transfer their property to multiple individuals, ensuring their wishes are fulfilled. It is recommended to consult with an experienced estate planning attorney to determine the most suitable type of deed based on individual circumstances and goals.

West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals

Description

How to fill out West Jordan Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To Multiple Individuals?

Make use of the US Legal Forms and get immediate access to any form you need. Our useful website with a huge number of documents allows you to find and get virtually any document sample you require. It is possible to download, complete, and sign the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals in just a few minutes instead of browsing the web for hours trying to find a proper template.

Utilizing our library is a great way to improve the safety of your document submissions. Our professional legal professionals regularly check all the records to ensure that the forms are relevant for a particular state and compliant with new acts and regulations.

How do you get the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Open the page with the template you need. Make certain that it is the form you were seeking: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the file. Pick the format to obtain the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable document libraries on the internet. We are always ready to assist you in any legal case, even if it is just downloading the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!

Form popularity

FAQ

Yes, Utah allows the use of transfer on death deeds, such as the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals. This option provides a straightforward method of passing real estate directly to beneficiaries without the complexities of probate. Using this tool can simplify inheritance and provide peace of mind.

One major disadvantage of a transfer on death deed is the possible ambiguity it creates among family members regarding ownership. If not clearly defined, beneficiaries may dispute their rights, leading to conflict. Utilizing services like uslegalforms can help clarify these issues and ensure your wishes are carried out.

A transfer on death deed can be a good idea for many, providing ease of transfer and avoiding probate, as shown in the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals. However, individual circumstances vary, and it is important to assess your personal situation and consult estate planning professionals when making this decision.

A transfer on death deed does not inherently avoid capital gains tax on appreciated assets. When beneficiaries inherit property, the basis may be stepped up, which can potentially minimize capital gains taxes in the future. Understanding how this impacts your estate can be clarified through resources like uslegalforms.

Some disadvantages of a transfer on death deed include the lack of protection from creditors and the potential for conflicts among multiple beneficiaries. Additionally, if any beneficiary predeceases you, their share may have to go through probate unless otherwise specified. It's important to weigh these concerns with advisers like uslegalforms for thorough planning.

Yes, accounts structured as TOD typically avoid probate, similar to the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals. By designating a beneficiary, you streamline the transfer process, allowing heirs to receive assets directly upon your death, thus saving time and reducing complexity.

In Indiana, the requirements for a transfer on death deed include proper documentation and recording akin to the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals. The deed must be signed, witnessed, and submitted to the county recorder. This ensures your intentions for property transfer are legally enforceable.

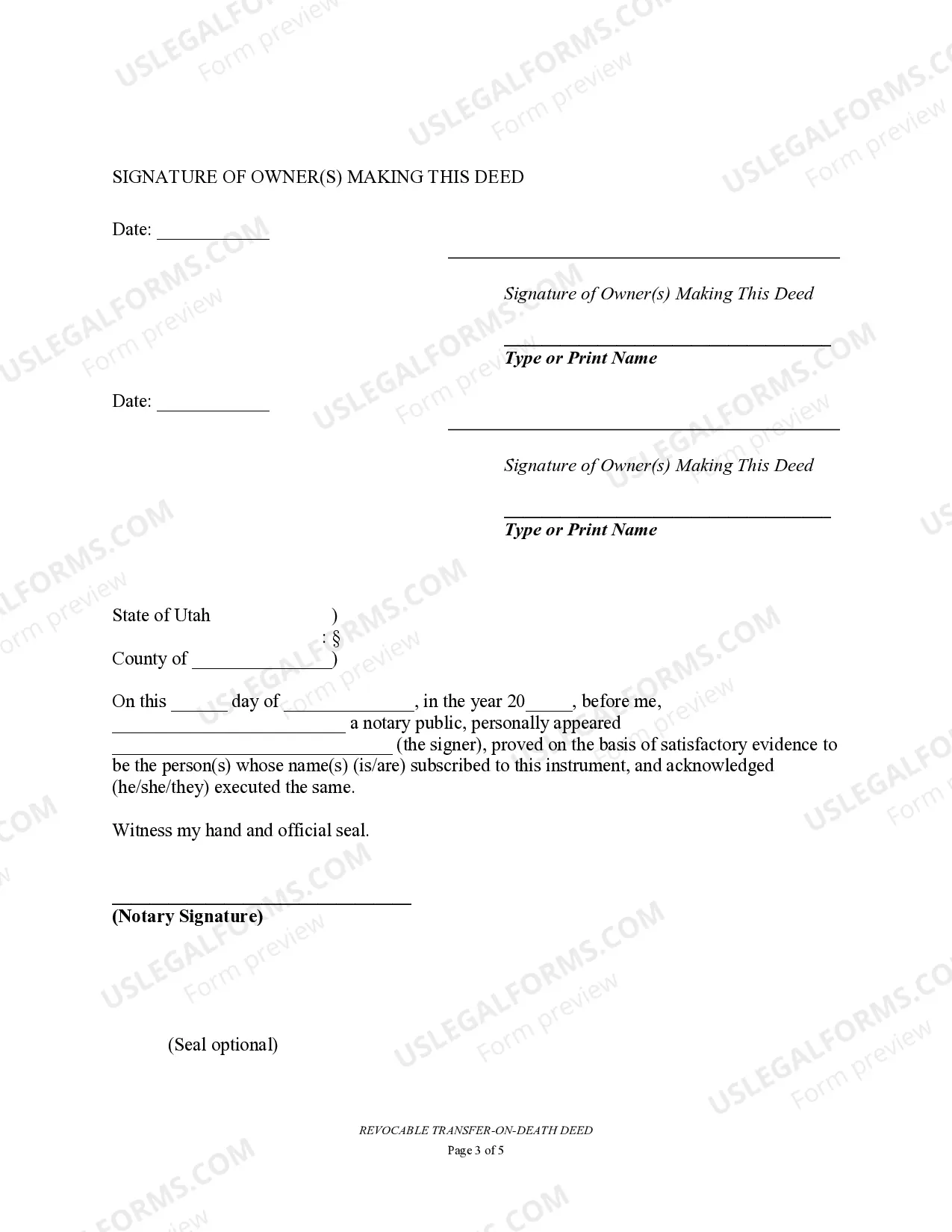

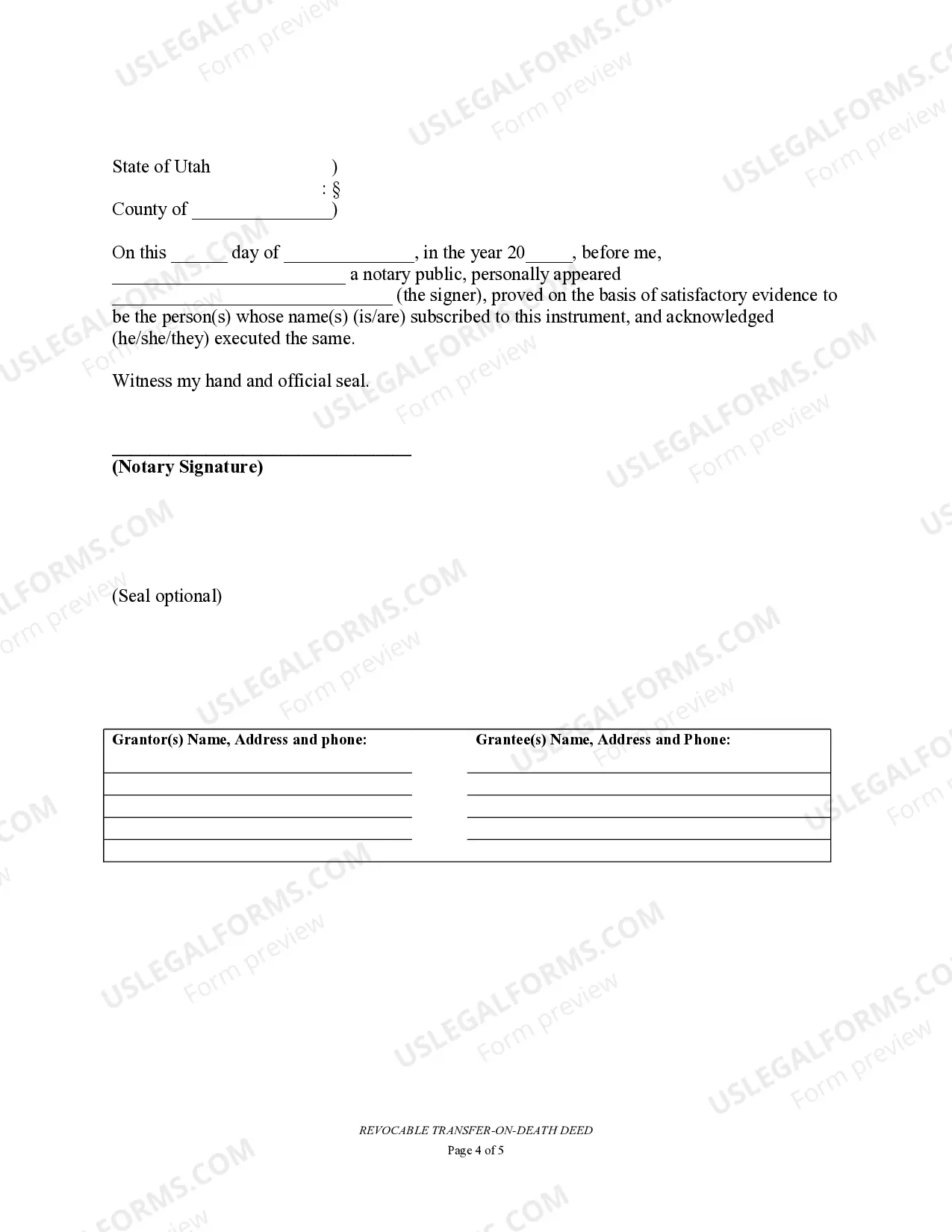

While you can complete a West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals without an attorney, consulting one can help ensure proper execution. An attorney can assist in clarifying legal language and confirming that the deed complies with state laws. This support can help prevent future disputes or issues.

The disadvantages of a transfer on death deed include potential conflicts among beneficiaries, particularly if the terms are unclear. Furthermore, this deed doesn't protect against estate claims or provide tax benefits like some other estate planning tools. It is vital to consider all aspects and consult resources like uslegalforms for guidance.

While the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Multiple Individuals offers many benefits, it has some drawbacks. For instance, if the beneficiary does not survive you, or if you do not update the deed, your property may not transfer as intended. Additionally, creditors may still claim against your assets after your death.