A transfer on death (TOD) or beneficiary deed is a legal document that allows individuals to transfer their West Jordan, Utah property to a trust upon their death. This can be a beneficial estate planning tool for married individuals looking to ensure their assets are properly managed and distributed according to their wishes. The West Jordan Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Trust is a specific type of TOD deed that applies to married couples who jointly own property and wish to transfer it to a trust. By implementing this deed, the property ownership will automatically transfer to the named trust beneficiaries upon the death of both spouses, avoiding the need for probate. There are different variations of TOD or beneficiary deeds available in West Jordan, Utah, depending on specific circumstances and preferences: 1. West Jordan Utah Transfer on Death Deed or TOD for Two Married Individuals to a Trust with Equal Ownership: This deed option applies when both spouses have equal ownership rights over the property. It ensures that the property passes to the trust beneficiaries upon the death of both spouses. 2. West Jordan Utah Transfer on Death Deed or TOD for Two Married Individuals to a Trust with Unequal Ownership: In cases where one spouse holds a larger share of the property ownership, this deed allows for the transfer of their respective shares to the trust beneficiaries upon the death of both spouses. 3. West Jordan Utah Transfer on Death Deed or TOD for Two Married Individuals to Separate Trusts: If spouses wish to have separate trusts for their respective shares of the property, this deed variant allows for the transfer of each spouse's interest to their individual trusts upon their joint demise. It is essential to consult with a qualified attorney specializing in estate planning and real estate law in West Jordan, Utah to determine the most suitable type of TOD or beneficiary deed for specific circumstances. Properly executing and recording any transfer on death deed will help ensure a smooth transition of property ownership while fulfilling the wishes and objectives outlined in an individual's estate plan.

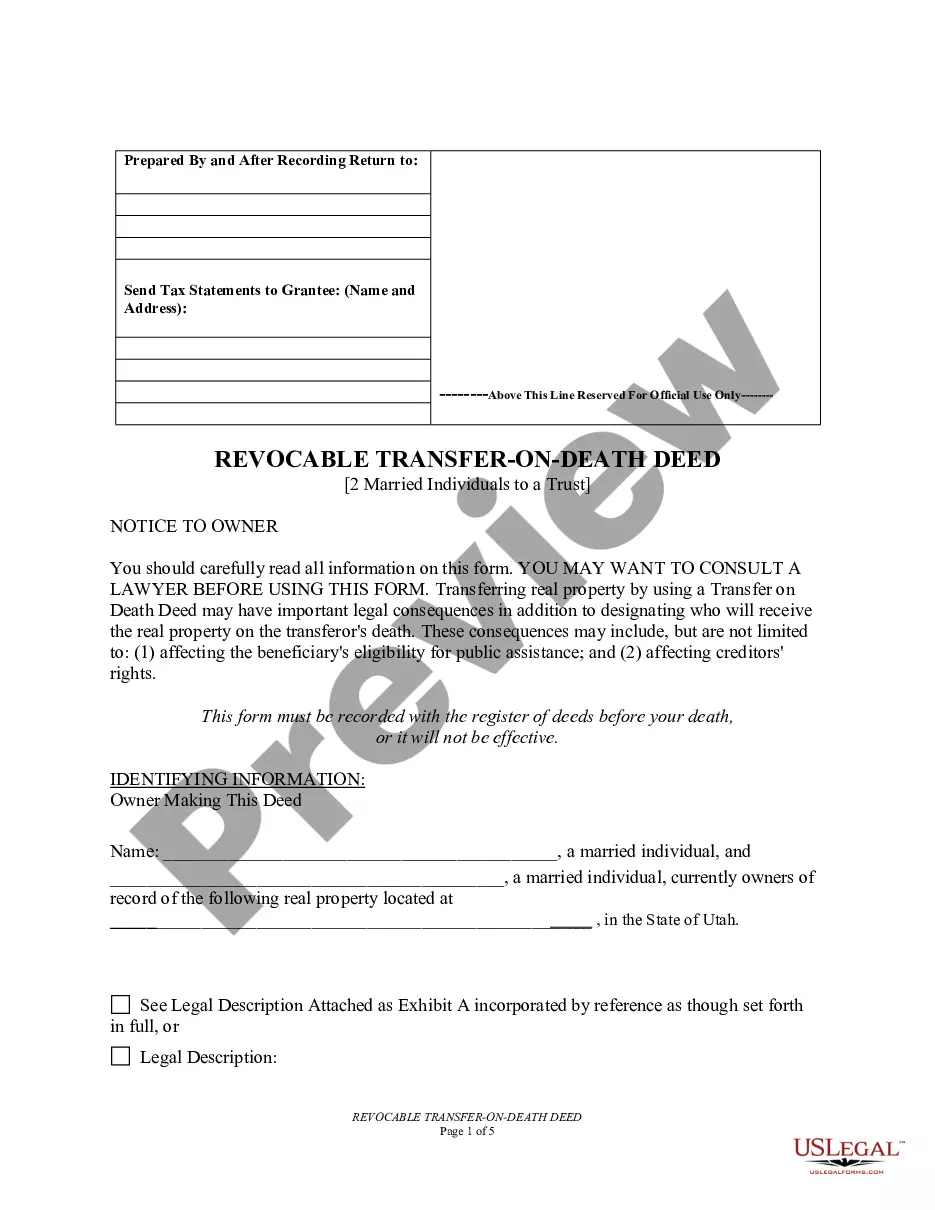

West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust

Description

How to fill out West Jordan Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To A Trust?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no law education to draft this sort of papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust in minutes using our reliable service. In case you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are new to our library, make sure to follow these steps before obtaining the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust:

- Ensure the template you have chosen is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the form and read a short description (if provided) of cases the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start again and search for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment method and proceed to download the West Jordan Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust once the payment is through.

You’re good to go! Now you can proceed to print the form or fill it out online. If you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.