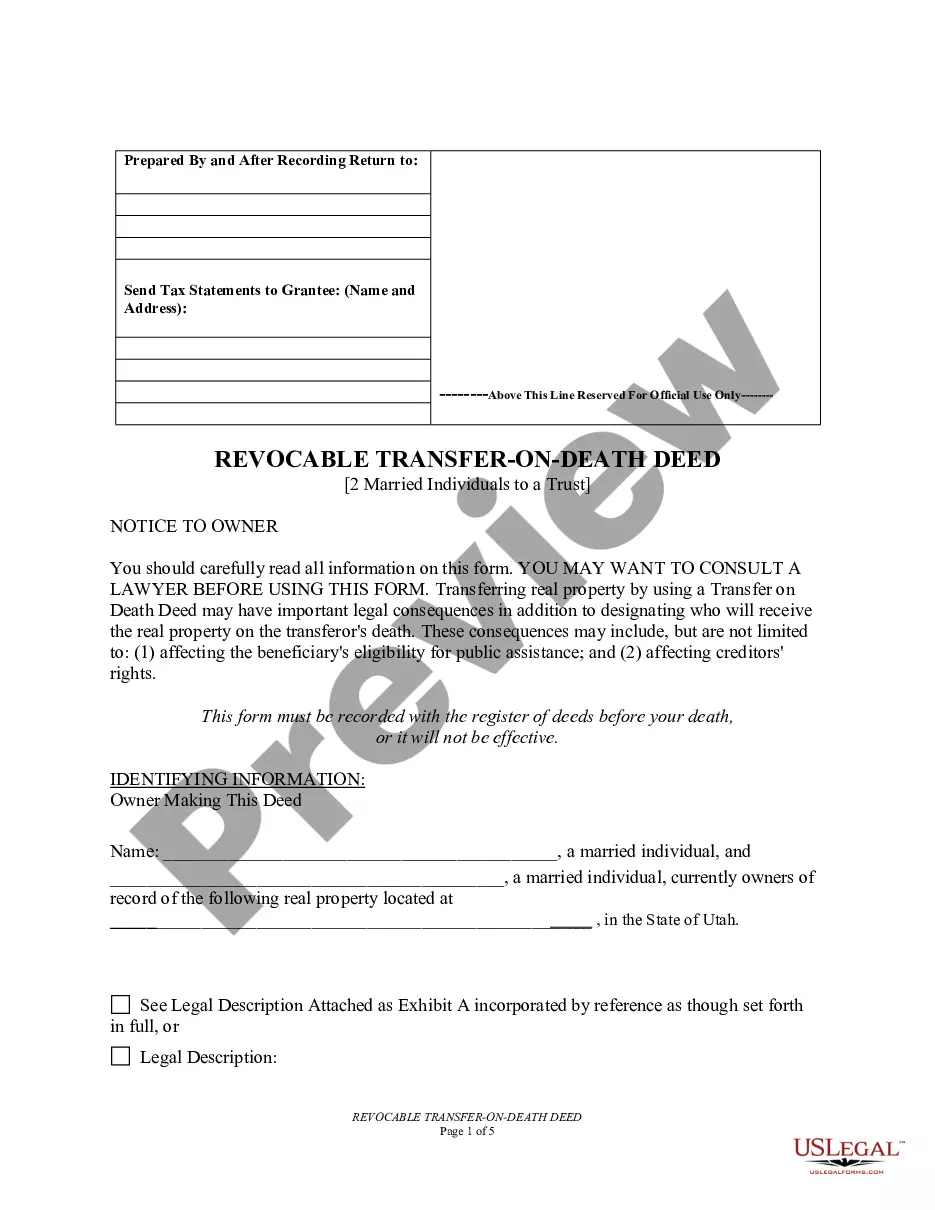

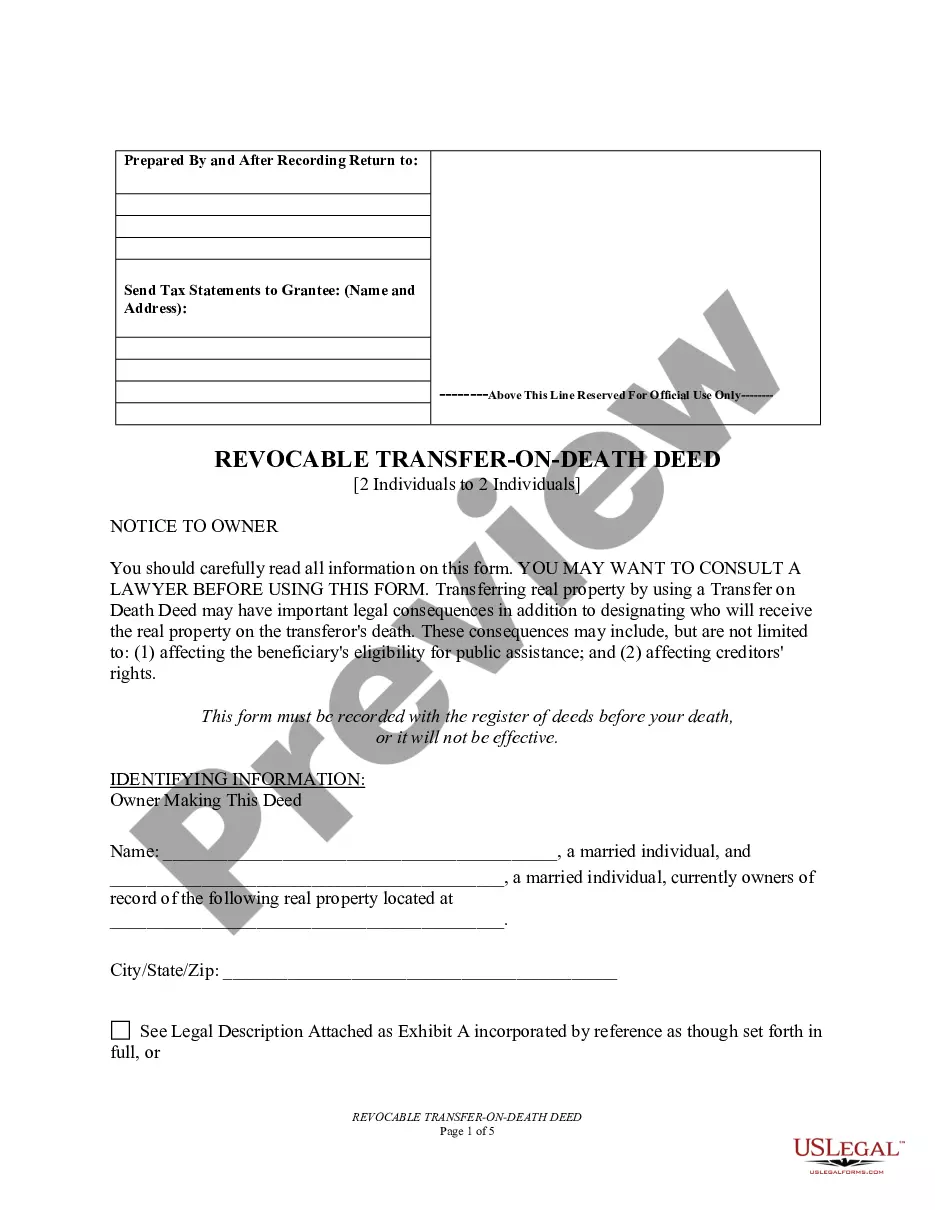

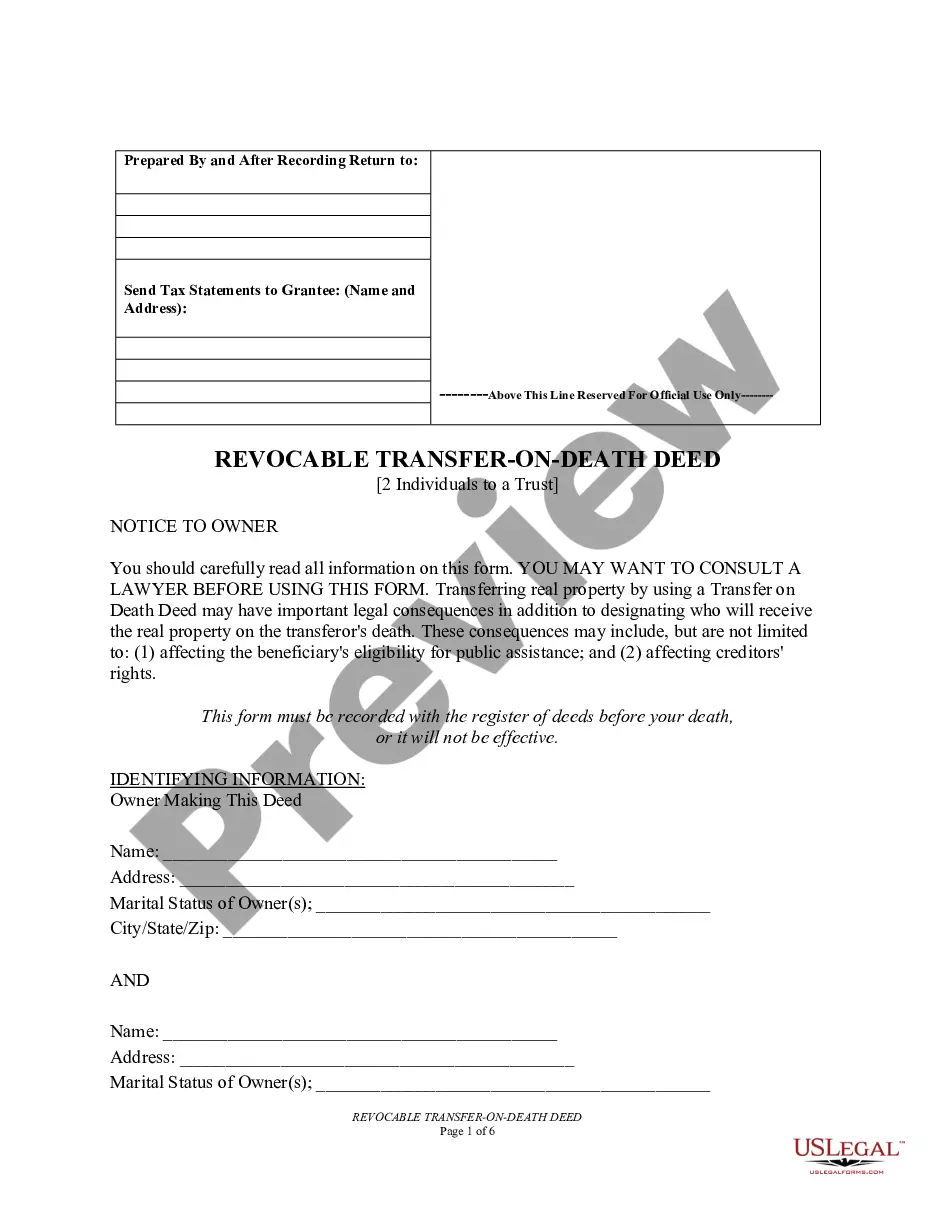

The West Valley City Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Trust is a legal instrument that allows married couples to transfer their real property to a trust upon their death without the need for probate. This type of deed ensures a smooth and efficient transfer of property ownership while maximizing tax benefits and minimizing costs for the beneficiaries. There are two main variations of the West Valley City Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Trust, which are commonly used by married couples: 1. Joint Tenancy with Right of Survivorship (TWOS) — This type of deed allows the property to be held jointly by both spouses with the right of survivorship. In the event of the death of one spouse, the property automatically passes to the surviving spouse without the need for probate. Upon the death of both spouses, the property is then transferred to the designated trust as outlined in the deed. 2. Tenancy by the Entirety — This form of ownership is only available to married couples and provides joint ownership with the right of survivorship. Similar to TWOS, the property automatically passes to the surviving spouse upon the death of one spouse. Upon the death of both spouses, the property is transferred to the trust designated in the deed. Utilizing the West Valley City Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Trust offers significant advantages. Firstly, it avoids the need for probate, a costly and time-consuming legal process that is typically required for transferring property ownership upon death. Secondly, it allows for tax benefits, as the property's value is not included in the deceased individual's estate for tax purposes. This can result in substantial savings for the beneficiaries. To execute such a deed, individuals must comply with the legal requirements outlined in the West Valley City Utah statutes. These include completing the necessary forms, signing the deed before a notary public, and recording the deed with the appropriate county recorder's office. It is crucial to ensure accuracy and compliance with all legal requirements to avoid any potential issues with the transfer of property. In conclusion, the West Valley City Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Trust is a valuable tool for married couples seeking a seamless and efficient transfer of property to a trust upon their death. By utilizing the appropriate deed variation and complying with legal requirements, couples can ensure the smooth transition of their assets while maximizing tax benefits and minimizing costs for their beneficiaries.

West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust

Description

How to fill out Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To A Trust?

If you are looking for a pertinent form, it’s exceptionally challenging to find a more suitable location than the US Legal Forms website – arguably the most comprehensive collections online.

With this library, you can acquire a vast number of form templates for business and personal use by categories and states, or keywords.

With our superior search capability, locating the latest West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the file type and download it to your device.

- Additionally, the relevance of each document is confirmed by a group of qualified lawyers who regularly review the templates on our platform and revise them according to the latest state and county laws.

- If you are already familiar with our system and have an active account, all you need to do to obtain the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have located the form you desire. Review its details and use the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the suitable document.

- Validate your selection. Hit the Buy now button. After that, select your preferred subscription plan and provide information to register for an account.

Form popularity

FAQ

The West Valley City Utah Transfer on Death Deed or TOD can indeed override a trust under certain circumstances. When you have assets assigned to a TOD, those assets usually go directly to the named beneficiary, regardless of your trust's directives. Keeping your estate planning documents in sync is critical to avoid conflicts. Consider using platforms like uslegalforms to ensure your documents reflect your desires accurately.

Yes, a beneficiary designation, such as the West Valley City Utah Transfer on Death Deed or TOD, can supersede terms outlined in a trust. If you name someone as a beneficiary, that designation typically controls how your asset is distributed upon your passing. This highlights the importance of keeping all legal documents current and aligned with your intentions. Engaging with professionals can aid in navigating these complexities effectively.

In many cases, the West Valley City Utah Transfer on Death Deed or TOD will override a trust after your death. If the TOD designates a beneficiary directly, that designation typically takes precedence over your trust provisions regarding that asset. This means that your chosen beneficiary will receive the asset directly, bypassing the trust. To ensure your wishes are fulfilled, it's advisable to consult with a legal professional knowledgeable in estate planning.

A validly executed beneficiary deed, such as the West Valley City Utah Transfer on Death Deed or TOD, can override a trust under specific circumstances. For instance, if you have designated a beneficiary on a TOD and also included similar assets in your trust, the TOD may take precedence. It's crucial to review your estate planning documents regularly to ensure they reflect your current intentions. Understanding how these instruments interact can save you issues later.

One disadvantage of the West Valley City Utah Transfer on Death Deed or TOD is that it may not account for all legal considerations of your estate. If you have significant debts or complexities in your estate, the TOD may create issues during probate or affect your trust. Furthermore, if you change your mind about the beneficiaries, you must update the TOD accordingly. Thus, careful planning and consideration are essential.

While it is not legally required to hire a lawyer for a West Valley City Utah Transfer on Death Deed, working with a legal expert can provide valuable guidance. A lawyer can help ensure that the deed meets all legal standards and aligns with your specific intentions, especially for two married individuals creating a trust. Engaging professionals can also minimize potential disputes among beneficiaries in the future. If you have specific questions, uslegalforms offers resources that can assist you through the process.

One notable disadvantage of the West Valley City Utah Transfer on Death Deed is that it does not provide asset protection while you are alive. Additionally, if the beneficiaries are not prepared or able to manage the property, complications can arise, especially if there are multiple beneficiaries. It is also crucial to remember that with a TOD deed, you retain full control of the property until death, which might not align with everyone's estate planning goals. This reality underscores the importance of careful planning for two married individuals contemplating a trust.

The West Valley City Utah Transfer on Death Deed, or TOD, allows property owners to transfer their real estate to beneficiaries upon their passing without going through probate. In contrast, a beneficiary deed serves a similar purpose but may have different legal implications depending on state laws. Often, a TOD offers greater flexibility for the property owner to modify or revoke the deed during their lifetime. Therefore, understanding these distinctions is key for two married individuals considering a trust.

While a transfer on death deed offers many benefits, there are some potential disadvantages to consider. For example, it may not protect your property from creditors after your death. Additionally, changes in state laws could affect the deed's effectiveness. It is wise to evaluate these factors carefully, especially for two married individuals planning to set up a trust in West Valley City, Utah.

Writing a beneficiary deed involves several key steps. First, identify the property and clearly state your intentions to transfer it upon your passing. It's crucial to follow the correct legal format and include both married individuals' names if applicable. If you need assistance, platforms like uslegalforms can provide you with resources and templates to help simplify the process.