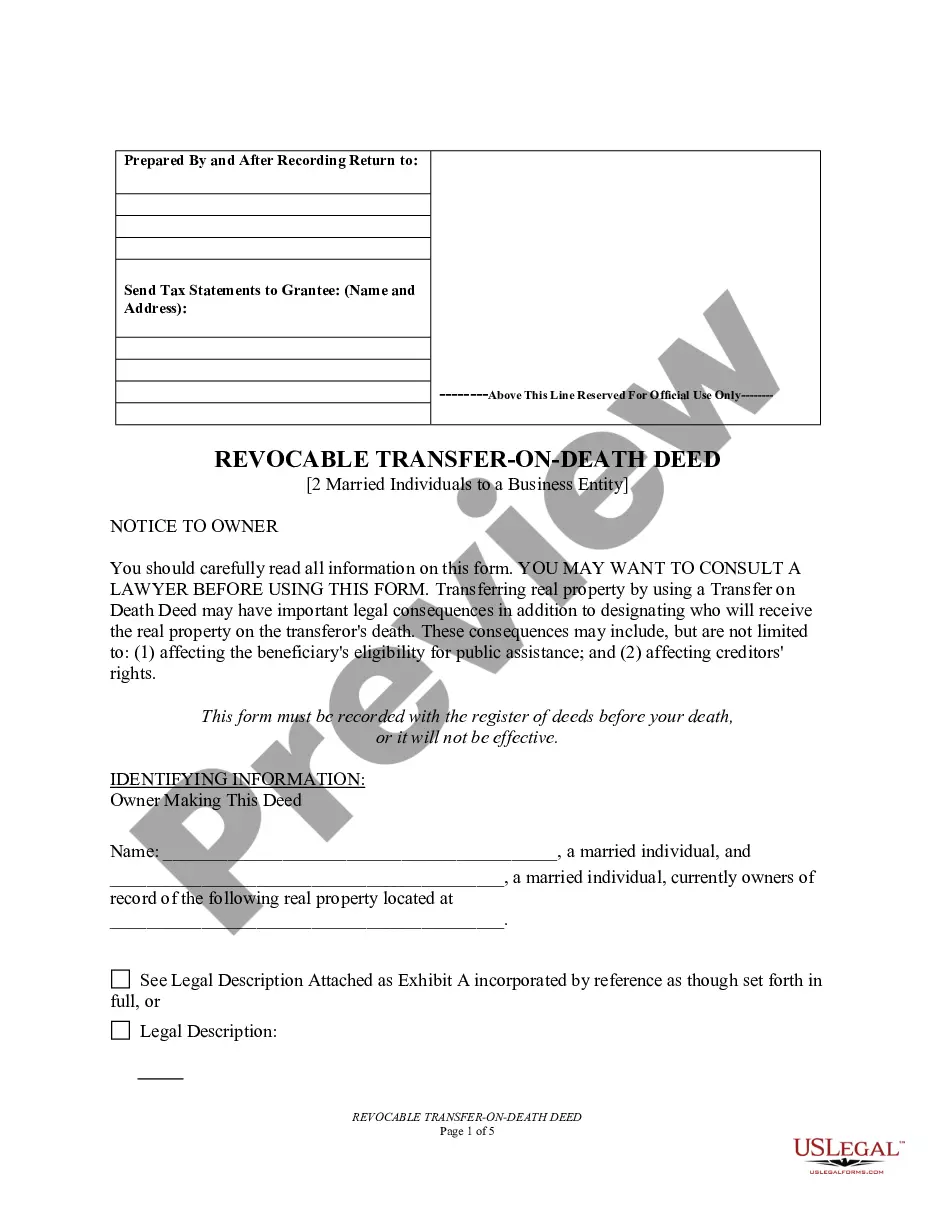

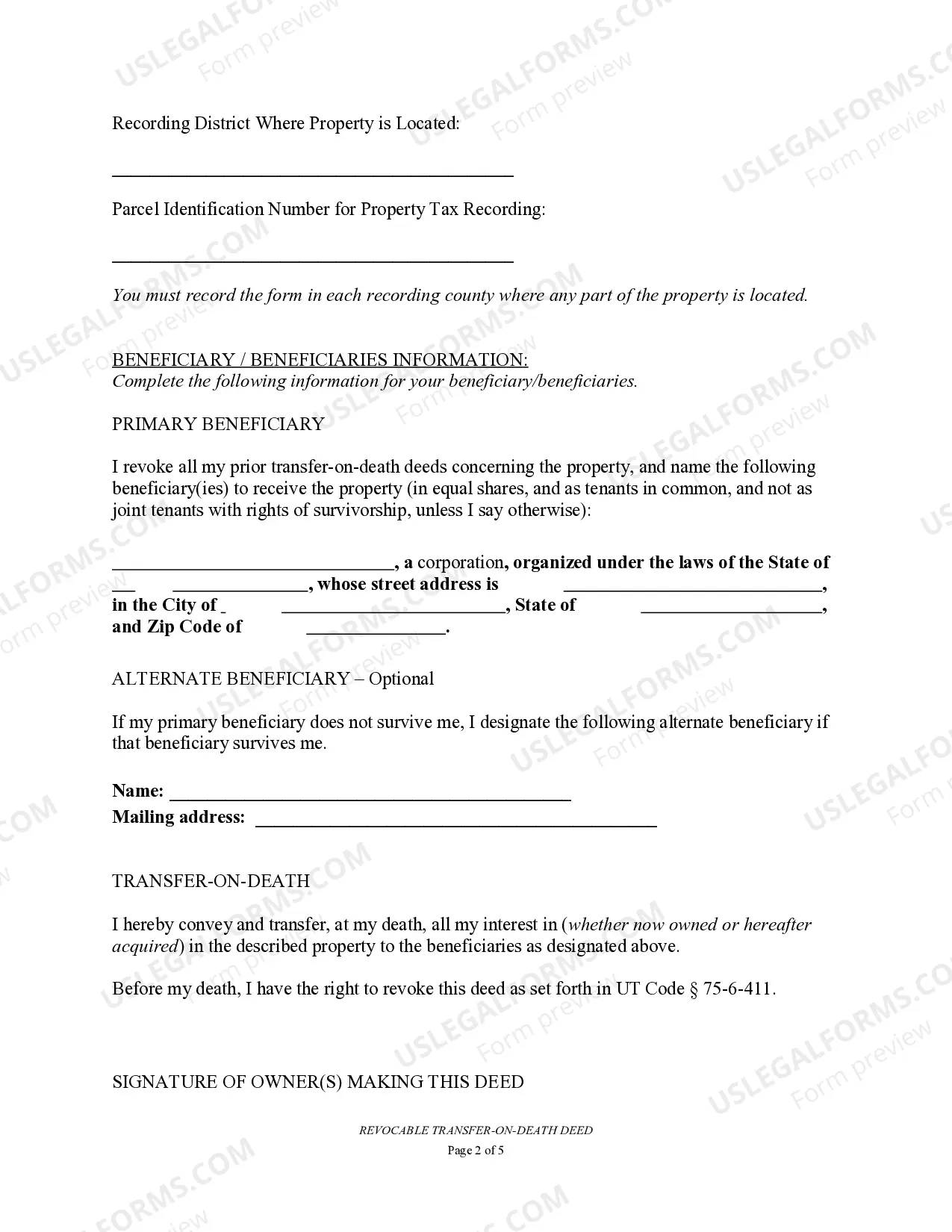

Provo Utah Transfer on Death Deed, also known as TOD — Beneficiary Deed, is a legal instrument that allows married individuals to transfer ownership of their property to a business upon their death. This particular type of deed offers flexibility and control over the distribution of assets, making it a popular option among married business owners in Provo, Utah. The TOD — Beneficiary Deed for Two Married Individuals to a Business is specifically designed for married couples who jointly own property and wish to pass it on to their business as part of their estate planning strategy. By utilizing this deed, the couples can ensure a seamless transfer of their real estate assets upon their death, avoiding the need for probate. There are two main types of Provo Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Business: 1. Joint Tenancy with Rights of Survivorship: In this type of deed, both spouses own the property together and have an equal share. If one spouse passes away, the property automatically transfers to the surviving spouse. However, if both spouses pass away simultaneously, the property will be transferred to the designated business as per the terms stated in the TOD — Beneficiary Deed. 2. Tenancy in Common: With this type of deed, each spouse individually owns a specific share of the property. Upon the death of one spouse, their share will transfer to the surviving spouse if no specific instructions are provided in the TOD — Beneficiary Deed. However, if both spouses pass away simultaneously, the property will be distributed to the designated business according to the terms specified in the deed. It's important for married individuals considering a Provo Utah Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to a Business to consult with a qualified attorney or legal professional specializing in estate planning. They will be able to guide them through the process, ensuring that all legal requirements are met and that their wishes are properly documented and executed.

Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business

Description

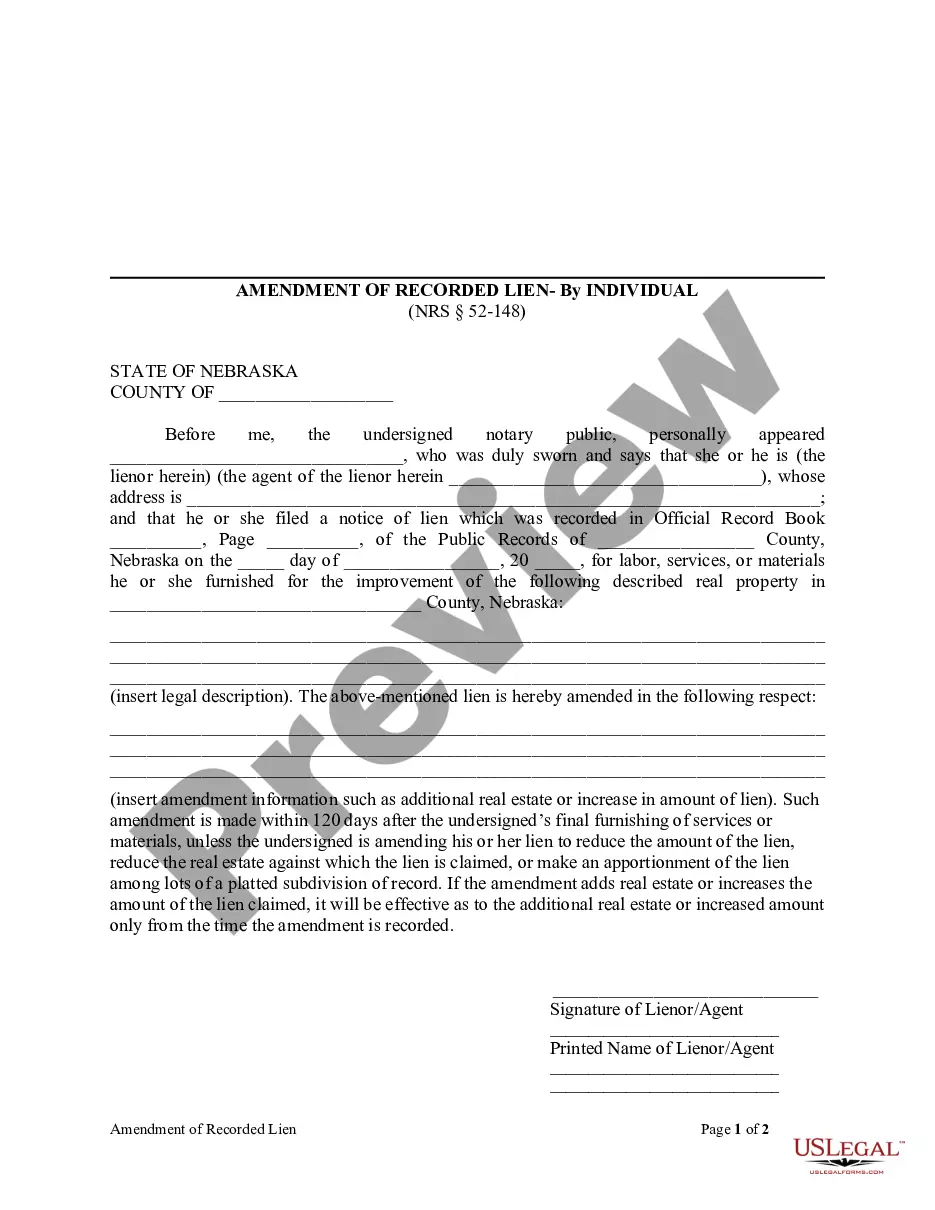

How to fill out Provo Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To A Business?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone without any law background to create such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive library with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you want the Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business quickly using our trusted platform. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps before obtaining the Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business:

- Be sure the form you have chosen is specific to your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a quick outline (if provided) of cases the document can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business as soon as the payment is completed.

You’re good to go! Now you can go on and print out the document or complete it online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

A Provo Utah Transfer on Death Deed or TOD can help bypass probate, but it does not exempt your beneficiaries from potential capital gains taxes. When the property is sold, the beneficiaries may still face tax implications based on the property's appreciated value. It’s advisable to consult a tax professional or estate planner to understand how this deed affects your specific tax situation.

While a Provo Utah Transfer on Death Deed or TOD offers several advantages, it also has limitations. For instance, a TOD does not offer any tax benefits that may be available through other estate planning methods. Moreover, if your real estate situation changes or if you have significant debts, a TOD may not be the most beneficial route for transferring your assets.

One potential drawback of a Provo Utah Transfer on Death Deed or TOD is that it may not provide comprehensive asset protection. Unlike trusts, TOD deeds do not shield your assets from creditors or taxes. It is wise to consider these factors before deciding on a TOD as part of your estate plan, especially when planning for your business.

Using a Provo Utah Transfer on Death Deed or TOD can be a wise choice for many couples. It simplifies the process of transferring property, ensuring that your designated beneficiary receives the asset directly upon your passing, bypassing probate. However, it's essential to weigh your unique circumstances and goals when considering if this option is right for you.

Choosing between a Provo Utah Transfer on Death Deed or TOD and a trust often hinges on your specific situation. A TOD offers simplicity and avoids probate, while a trust provides greater flexibility and control over asset distribution. We recommend consulting with a professional to evaluate what aligns best with your estate planning goals as two married individuals.

When comparing a Provo Utah Transfer on Death Deed or TOD to a life estate deed, the best choice depends on your circumstances. A TOD allows you to retain full control of your property during your lifetime, while a life estate deed can complicate your ability to make future decisions. Consider speaking with a legal expert to determine which option best meets your needs as married individuals planning for your business.

Choosing between a Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business and traditional beneficiary designations usually depends on personal circumstances. A TOD deed allows for easy transfer of property without probate, while beneficiary designations might apply to accounts or insurance. Both options have their benefits; therefore, it is wise to evaluate your entire estate and consult with a legal professional to determine the most suitable approach.

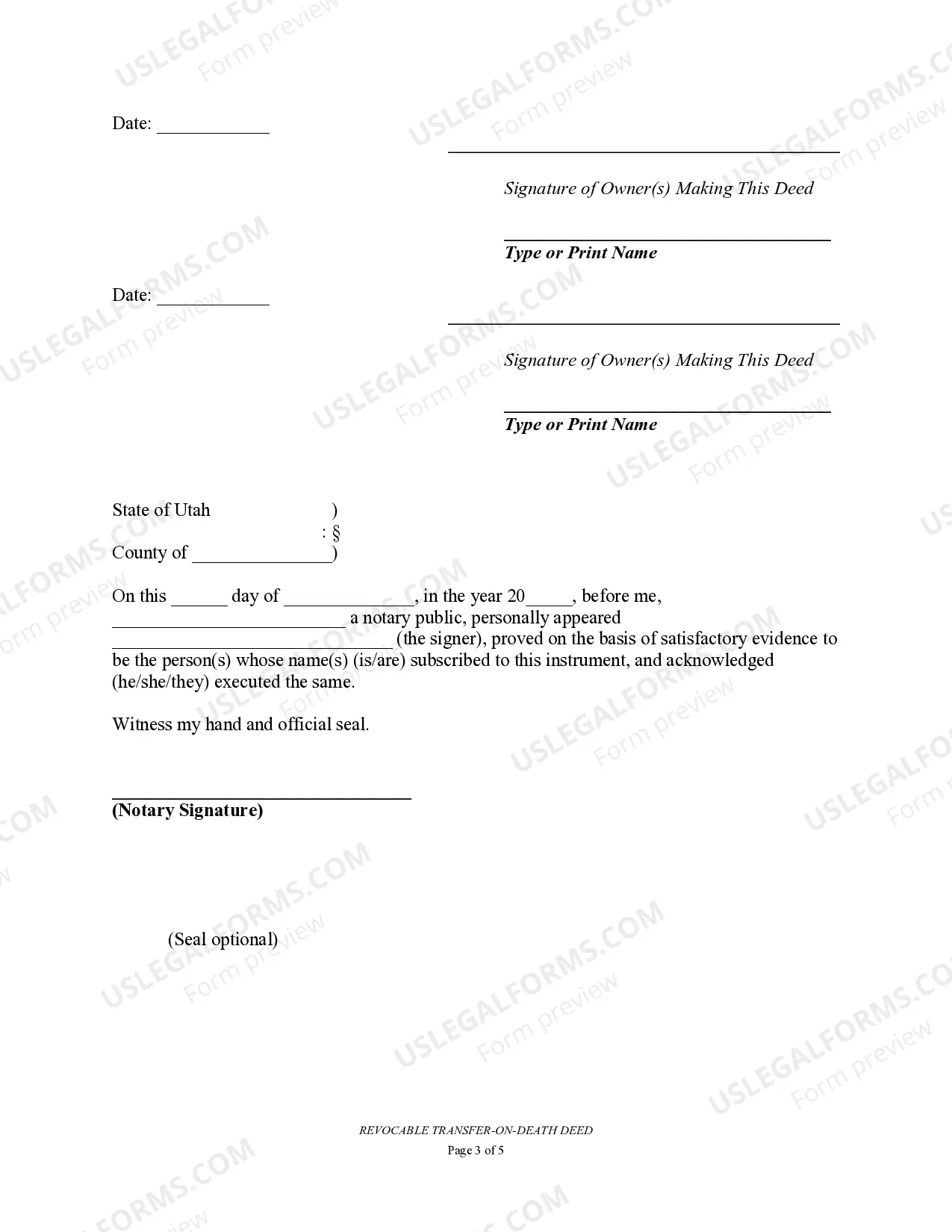

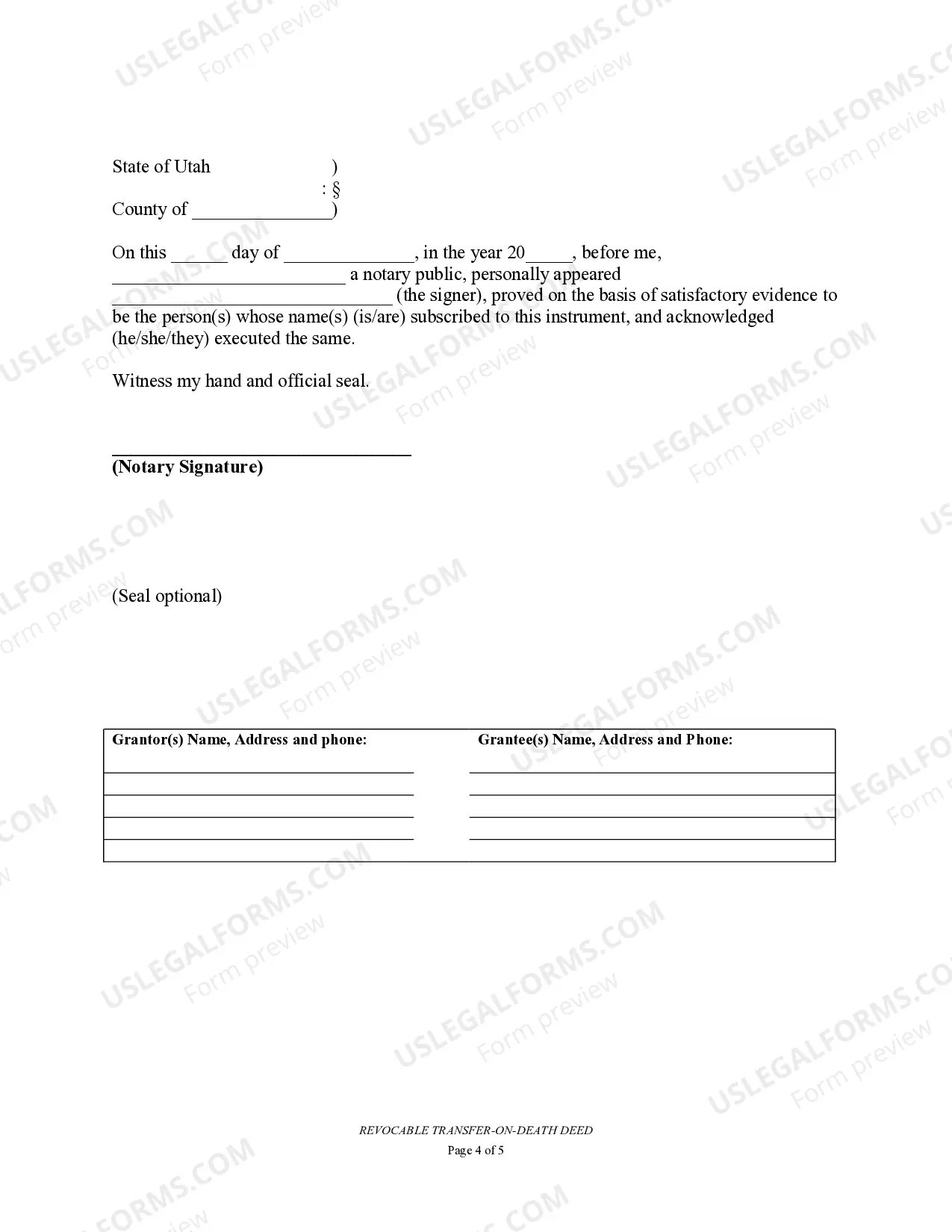

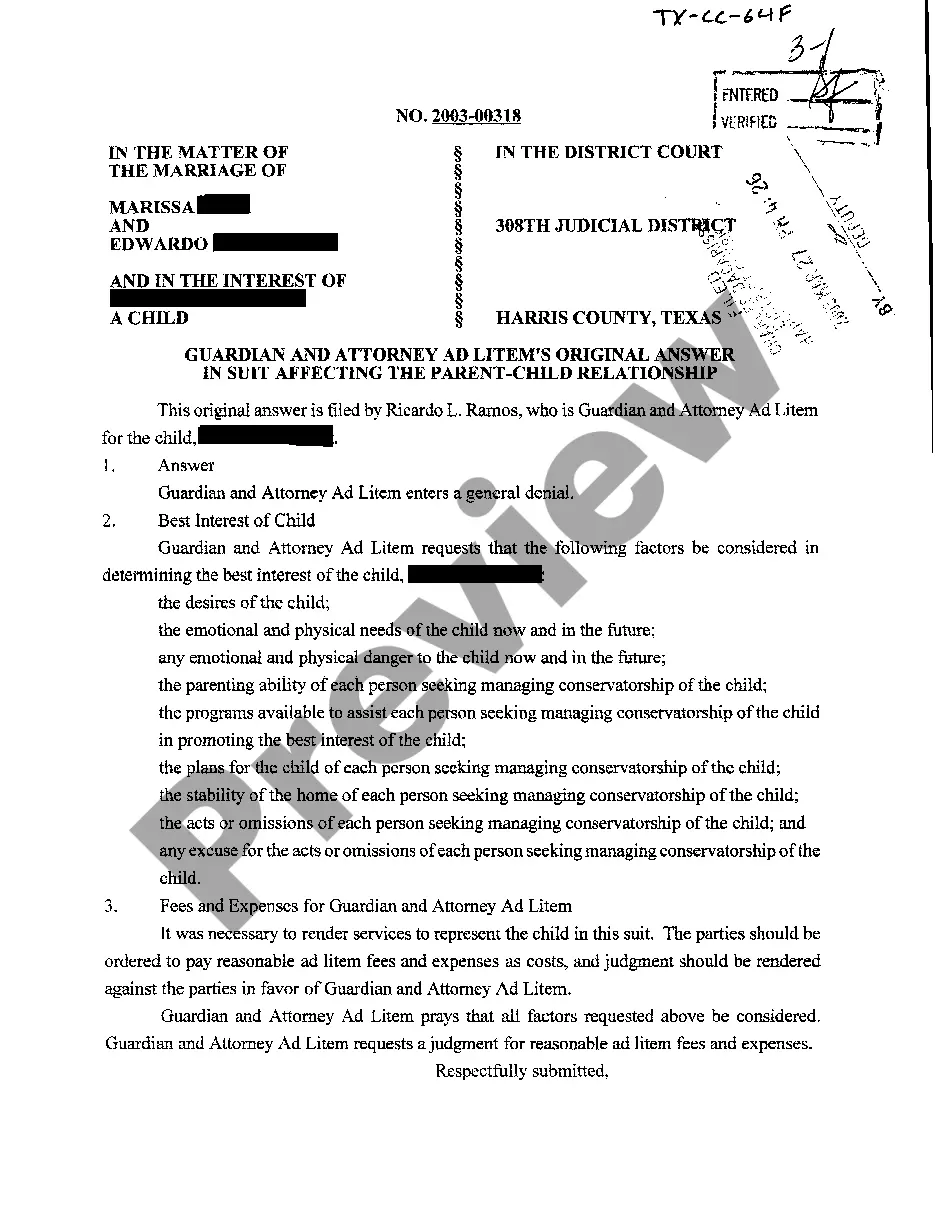

To transfer titles after death in Utah, you can utilize the Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business, if one was filed. If not, the estate may need to go through probate to validate the will or determine heirs. Gather the required documents, such as the death certificate and any relevant property deeds. Consulting a knowledgeable legal source, like USLegalForms, can streamline this process efficiently.

Yes, Utah does allow the creation of a Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business. This legal document enables property owners to designate beneficiaries to inherit the property directly upon their death. It simplifies the inheritance process by avoiding probate, provided the deed meets all state requirements. This option is gaining popularity among property owners in Utah for its efficiency.

While many individuals can complete a Provo Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business without an attorney, legal advice can be beneficial. An attorney can ensure that all paperwork is filled out correctly and legally sound, reducing the risk of future disputes. They can also advise on potential tax implications and other legal considerations. Ultimately, it is a personal choice but might be wise in complex situations.