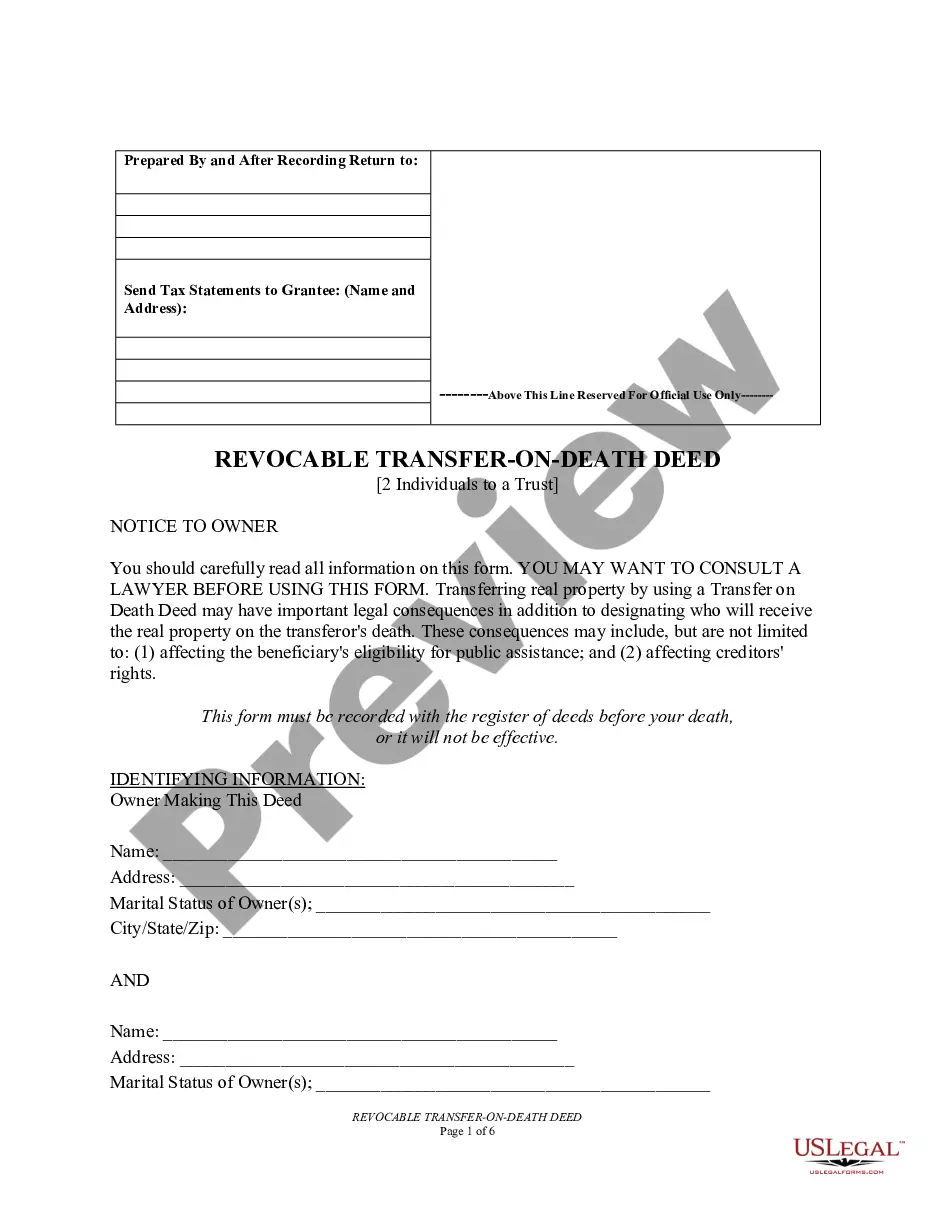

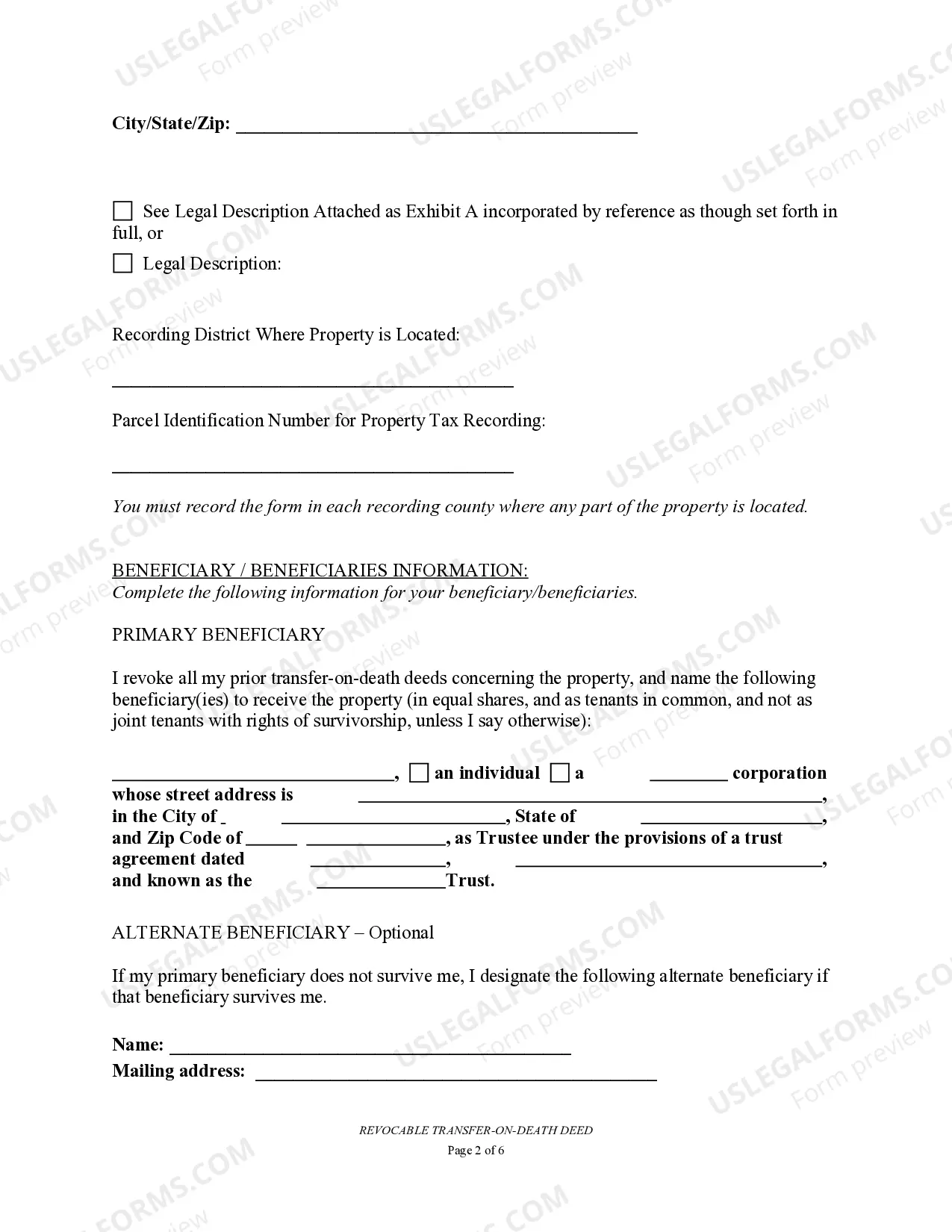

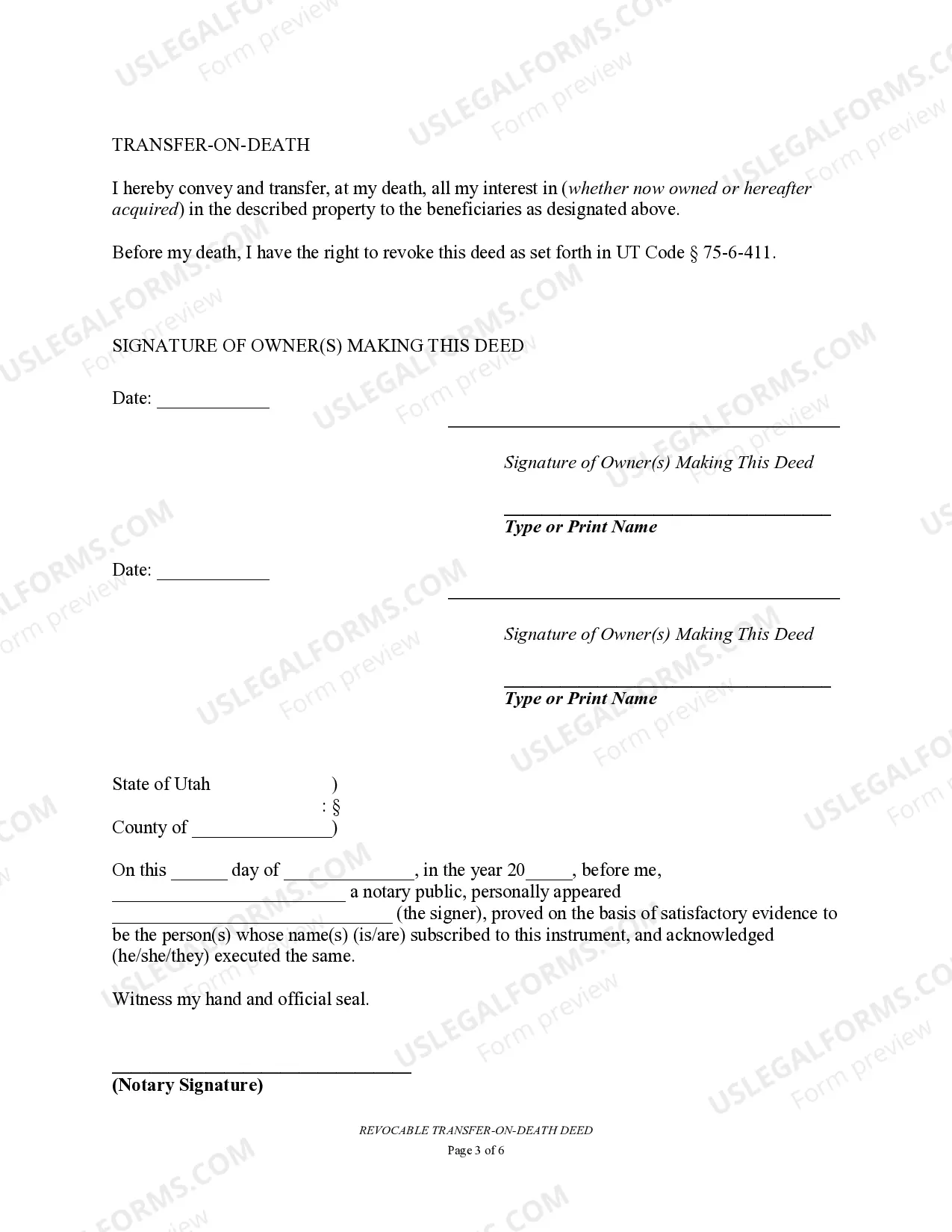

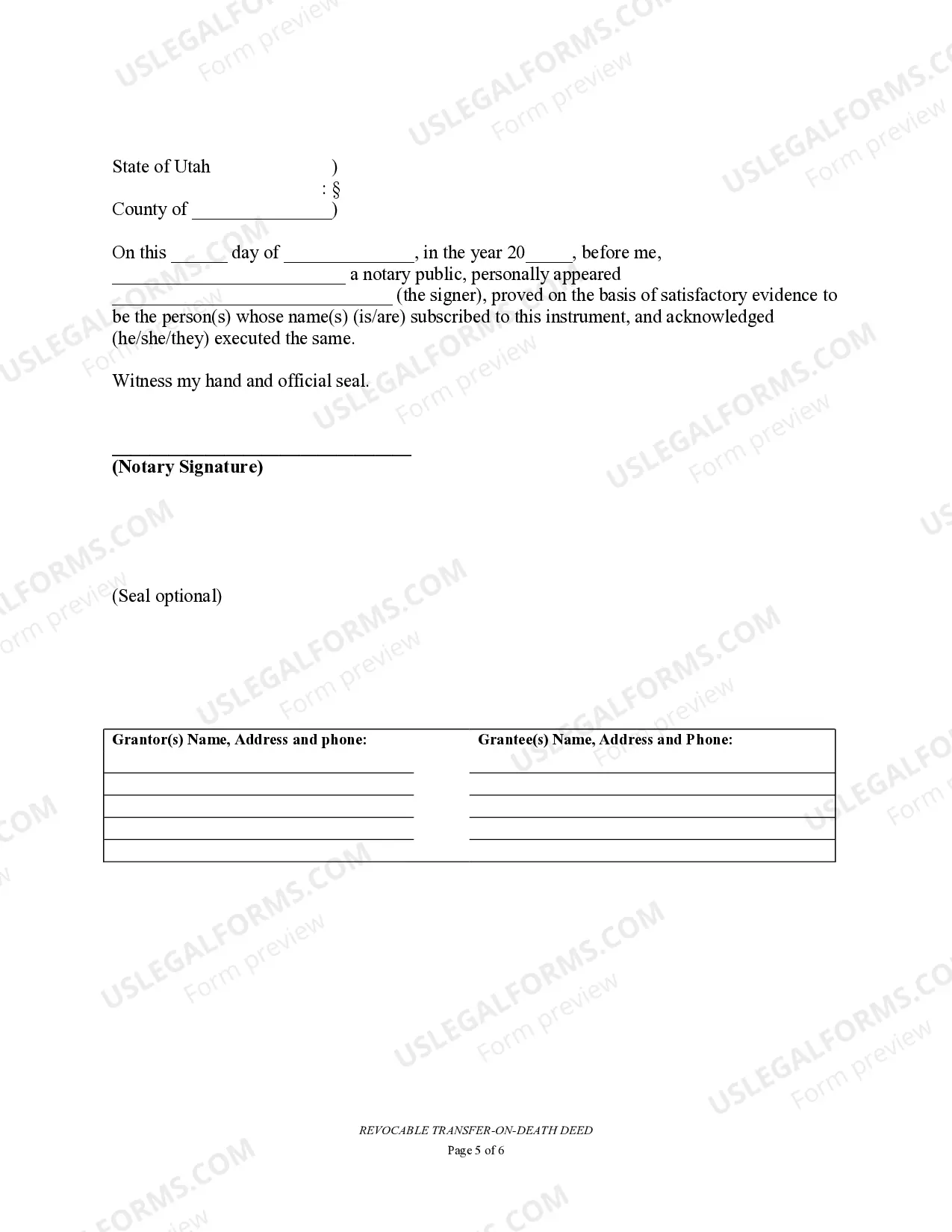

A Transfer on Death Deed, also known as a TOD Beneficiary Deed, is a legal document used in West Valley City, Utah, to transfer property ownership upon the death of the current owner directly to the named beneficiary or beneficiaries without the need for probate. This type of deed is primarily used to simplify the transfer of real estate assets and avoid the complexities and delays of the probate process. A Transfer on Death Deed can be particularly beneficial for two individuals who want to ensure a seamless transfer of their property to a trust upon their passing. By naming a trust as the beneficiary, the property can be managed and distributed according to the individuals' wishes, providing potential tax benefits and protection for the beneficiaries. There are two main types of Transfer on Death Deeds or TOD Beneficiary Deeds for two individuals to a trust in West Valley City, Utah: 1. Joint Tenancy with Right of Survivorship: This type of deed allows for two individuals to own property jointly and equally, with the right of survivorship. In the event of one individual's death, the surviving individual becomes the sole owner of the property. By designating the trust as the primary beneficiary, the property will transfer directly to the trust upon the death of both individuals, thus ensuring a smooth transition of ownership. 2. Tenancy in Common: With a Tenancy in Common deed, two individuals can own property together, but they can have unequal ownership shares. In this case, each individual can designate their respective shares of the property to the trust as beneficiaries. Upon the death of one or both individuals, the assigned shares will transfer directly to the trust, in accordance with their specified distribution instructions. Utilizing a Transfer on Death Deed or TOD Beneficiary Deed for two individuals to a trust in West Valley City, Utah, can provide peace of mind by securing the transfer of real estate property to a trust seamlessly. This legal instrument can streamline the estate planning process, facilitate the efficient transfer of assets, and potentially minimize any associated taxes or probate costs.

West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust

Description

How to fill out West Valley City Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To A Trust?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law background to draft such papers from scratch, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you need the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust in minutes employing our trusted service. If you are already an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our library, make sure to follow these steps before downloading the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust:

- Ensure the template you have chosen is suitable for your area since the regulations of one state or county do not work for another state or county.

- Review the document and go through a brief description (if available) of cases the document can be used for.

- If the form you chosen doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the West Valley City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust once the payment is completed.

You’re good to go! Now you can proceed to print out the document or complete it online. In case you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.