The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

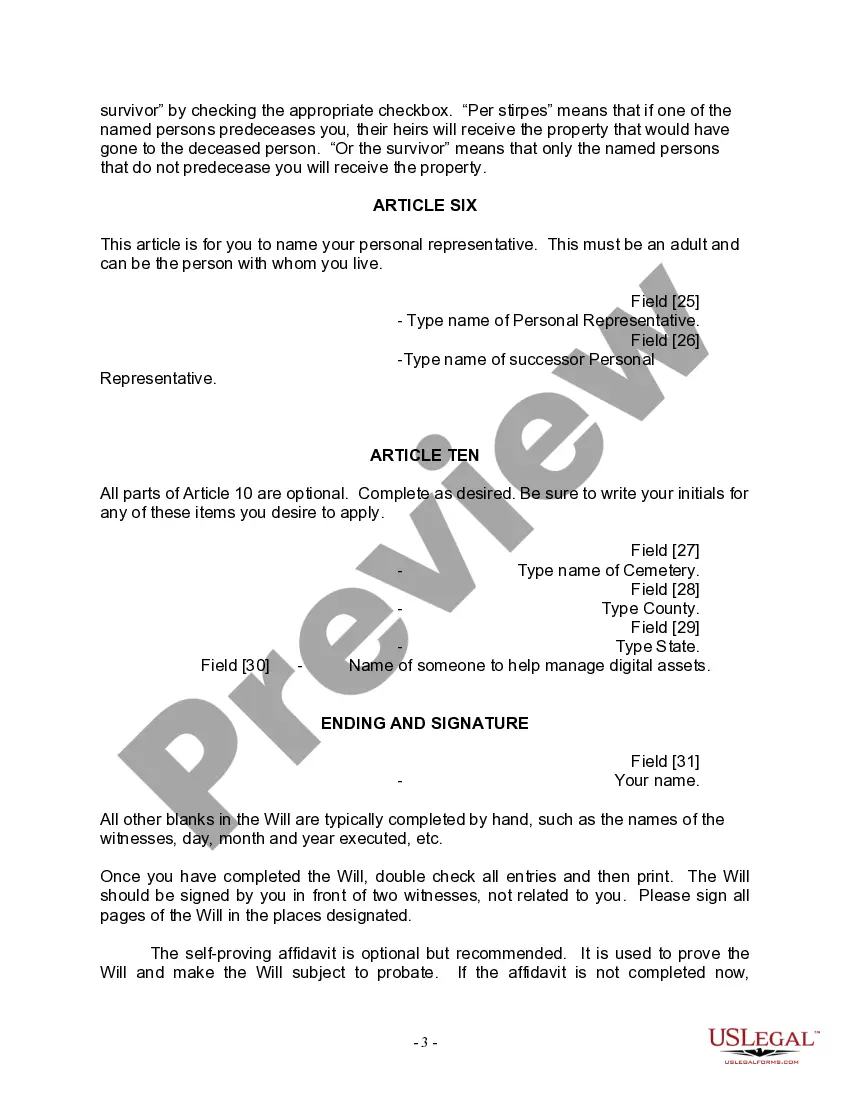

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

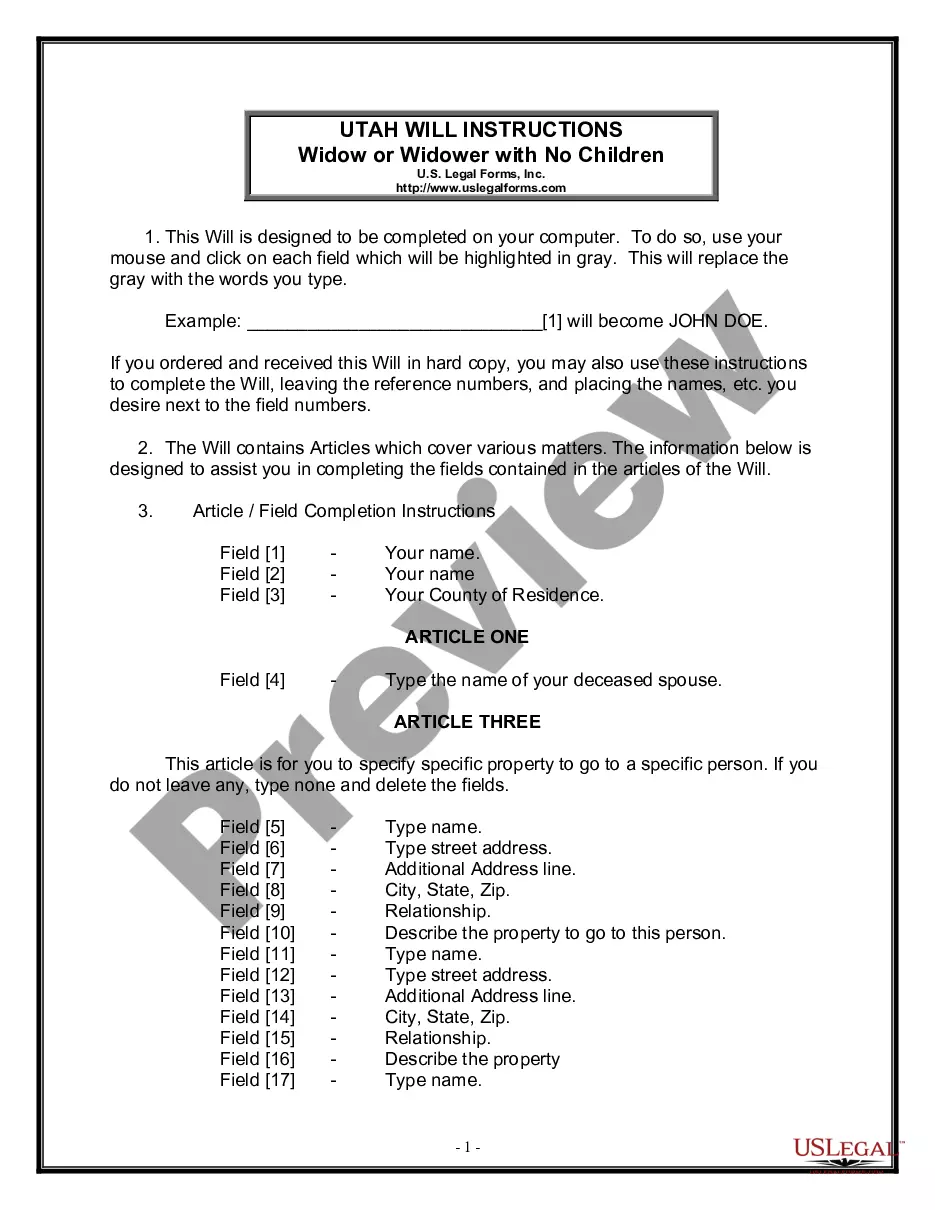

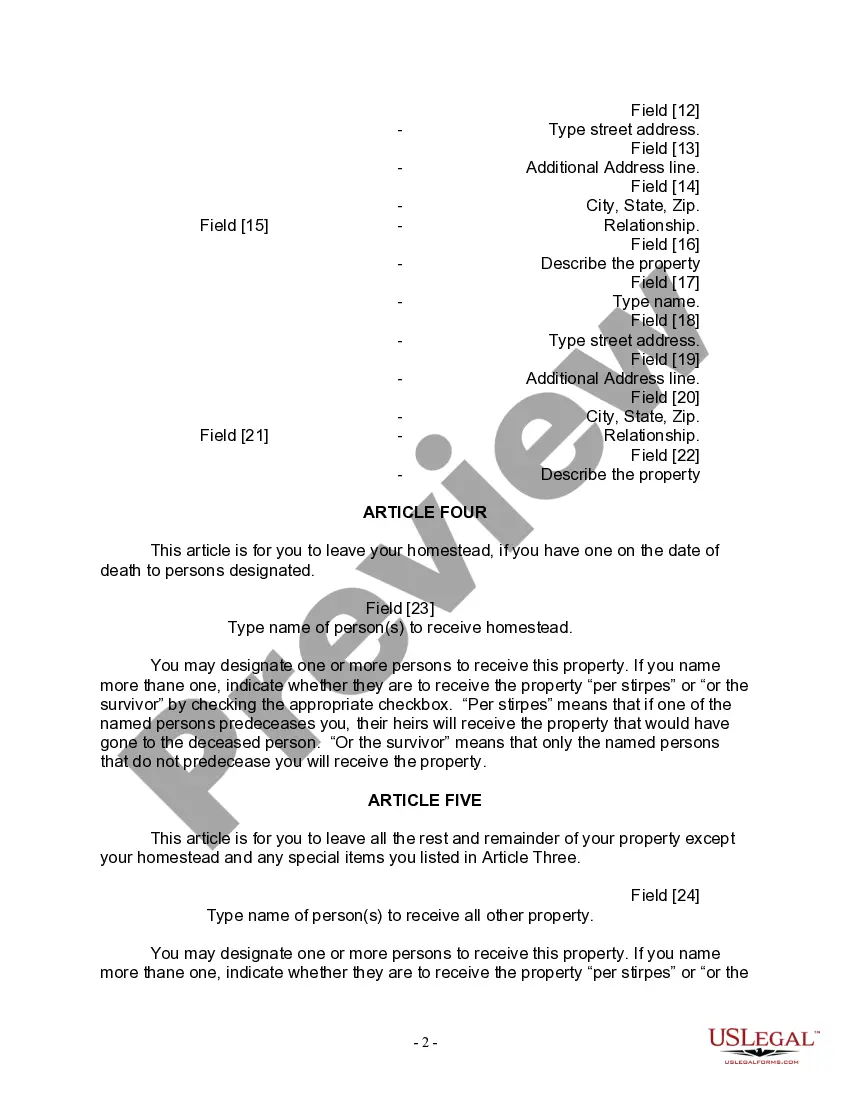

Description: The West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to outline their final wishes and distribute their assets upon their death. This comprehensive form covers all the essential components of a last will, empowering individuals to have control over how their estate will be managed and distributed after their passing. This specific West Jordan Utah legal last will form for a widow or widower with no children is designed to cater to the unique circumstances of individuals who find themselves in this situation. It acknowledges that without children, the distribution of assets may require different considerations and provisions compared to those with offspring. With this form, widows or widowers can provide clear instructions on how their assets should be divided among beneficiaries such as family members, friends, charitable organizations, or other loved ones. Some of the essential elements that may be included in the West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children are: 1. Personal Information: This section captures the vital information of the individual, including their full name, residence, date of birth, and any other relevant identification details. 2. Appointment of Executor: Granting the role of executor is a crucial decision for any individual creating a last will. This section allows the widow or widower to name a trusted person who will oversee the distribution of assets according to the instructions provided in the will. 3. Asset Distribution: This part of the form allows individuals to outline how they want their assets to be distributed after their death. It may include specific bequests to family members or friends, instructions for charitable donations, or any other desired allocations. 4. Debts and Taxes: The form typically requires individuals to address any outstanding debts or taxes and provide instructions on how these should be settled from their estate. 5. Residual Estate: In case there are any leftover assets after all specific provisions and bequests have been made, this section allows the individual to specify how these remaining assets should be distributed. 6. Testamentary Trust: If the individual wishes to establish a trust to manage their assets after their death, this section provides the opportunity to designate a trustee and outline the terms and conditions of the trust. Different West Jordan Utah Legal Last Will Forms for a Widow or Widower with no Children may exist depending on specific variations and preferences of individuals. Some variations may include the inclusion of additional provisions such as funeral arrangements, guardianship provisions for pets, or conditional bequests based on certain events. It is essential to consult with a qualified attorney familiar with Utah state laws to ensure the completed form meets all legal requirements and properly interprets the intentions of the individual. These legal professionals can help tailor the West Jordan Utah Legal Last Will Form to individual circumstances and draft provisions that accurately reflect the wishes and desires of the widow or widower.Description: The West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to outline their final wishes and distribute their assets upon their death. This comprehensive form covers all the essential components of a last will, empowering individuals to have control over how their estate will be managed and distributed after their passing. This specific West Jordan Utah legal last will form for a widow or widower with no children is designed to cater to the unique circumstances of individuals who find themselves in this situation. It acknowledges that without children, the distribution of assets may require different considerations and provisions compared to those with offspring. With this form, widows or widowers can provide clear instructions on how their assets should be divided among beneficiaries such as family members, friends, charitable organizations, or other loved ones. Some of the essential elements that may be included in the West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children are: 1. Personal Information: This section captures the vital information of the individual, including their full name, residence, date of birth, and any other relevant identification details. 2. Appointment of Executor: Granting the role of executor is a crucial decision for any individual creating a last will. This section allows the widow or widower to name a trusted person who will oversee the distribution of assets according to the instructions provided in the will. 3. Asset Distribution: This part of the form allows individuals to outline how they want their assets to be distributed after their death. It may include specific bequests to family members or friends, instructions for charitable donations, or any other desired allocations. 4. Debts and Taxes: The form typically requires individuals to address any outstanding debts or taxes and provide instructions on how these should be settled from their estate. 5. Residual Estate: In case there are any leftover assets after all specific provisions and bequests have been made, this section allows the individual to specify how these remaining assets should be distributed. 6. Testamentary Trust: If the individual wishes to establish a trust to manage their assets after their death, this section provides the opportunity to designate a trustee and outline the terms and conditions of the trust. Different West Jordan Utah Legal Last Will Forms for a Widow or Widower with no Children may exist depending on specific variations and preferences of individuals. Some variations may include the inclusion of additional provisions such as funeral arrangements, guardianship provisions for pets, or conditional bequests based on certain events. It is essential to consult with a qualified attorney familiar with Utah state laws to ensure the completed form meets all legal requirements and properly interprets the intentions of the individual. These legal professionals can help tailor the West Jordan Utah Legal Last Will Form to individual circumstances and draft provisions that accurately reflect the wishes and desires of the widow or widower.