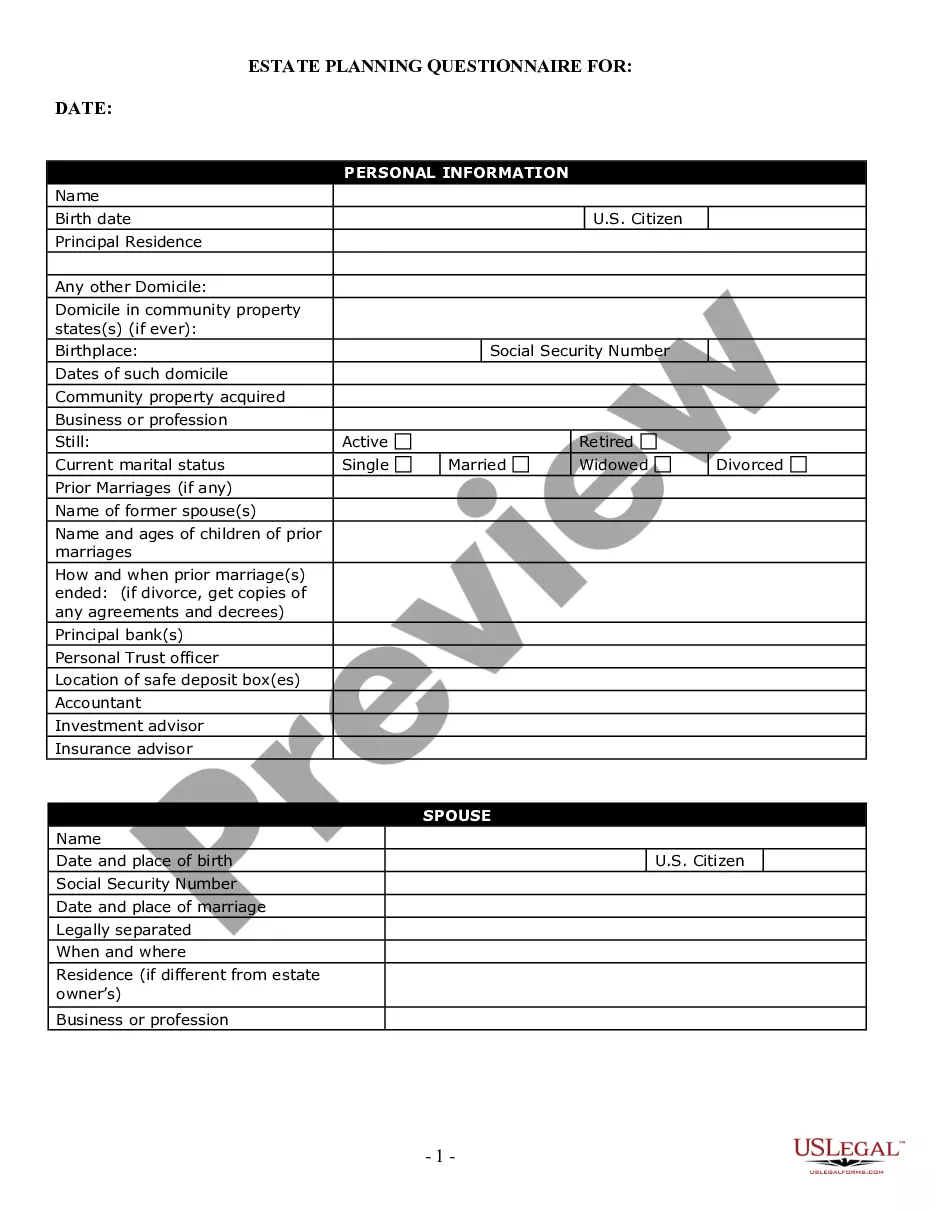

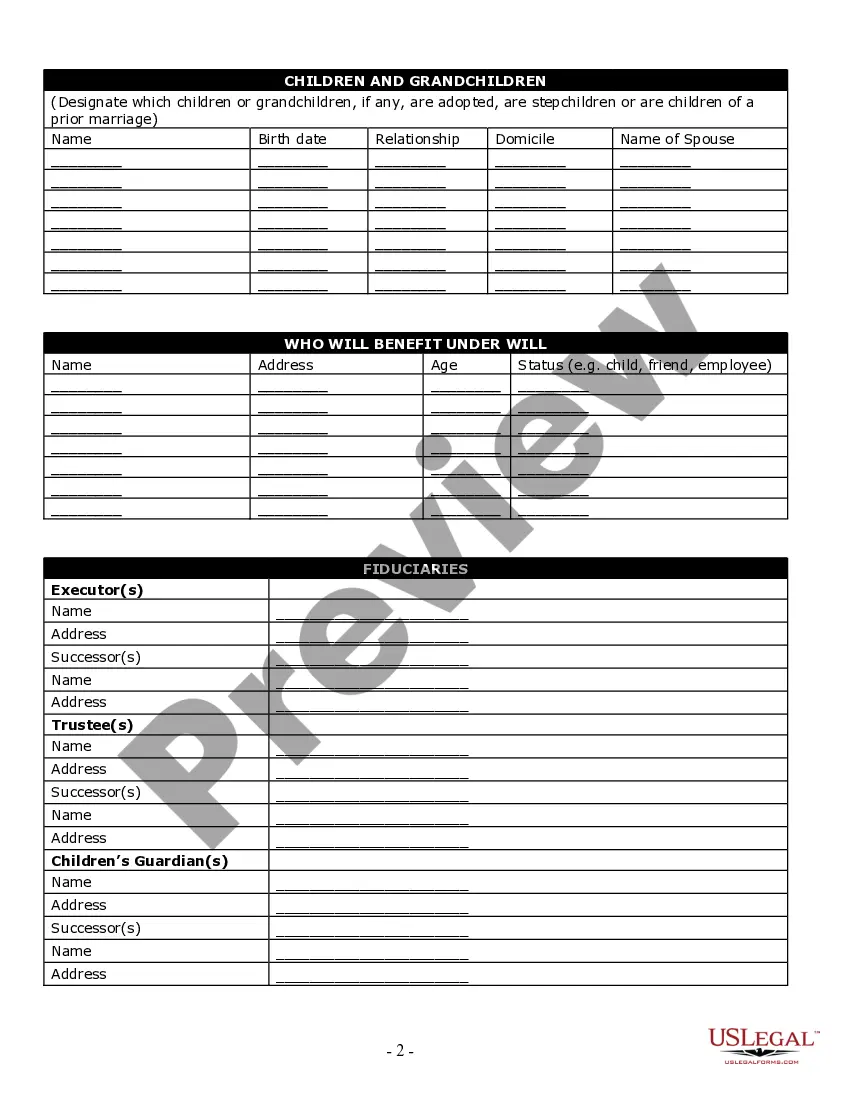

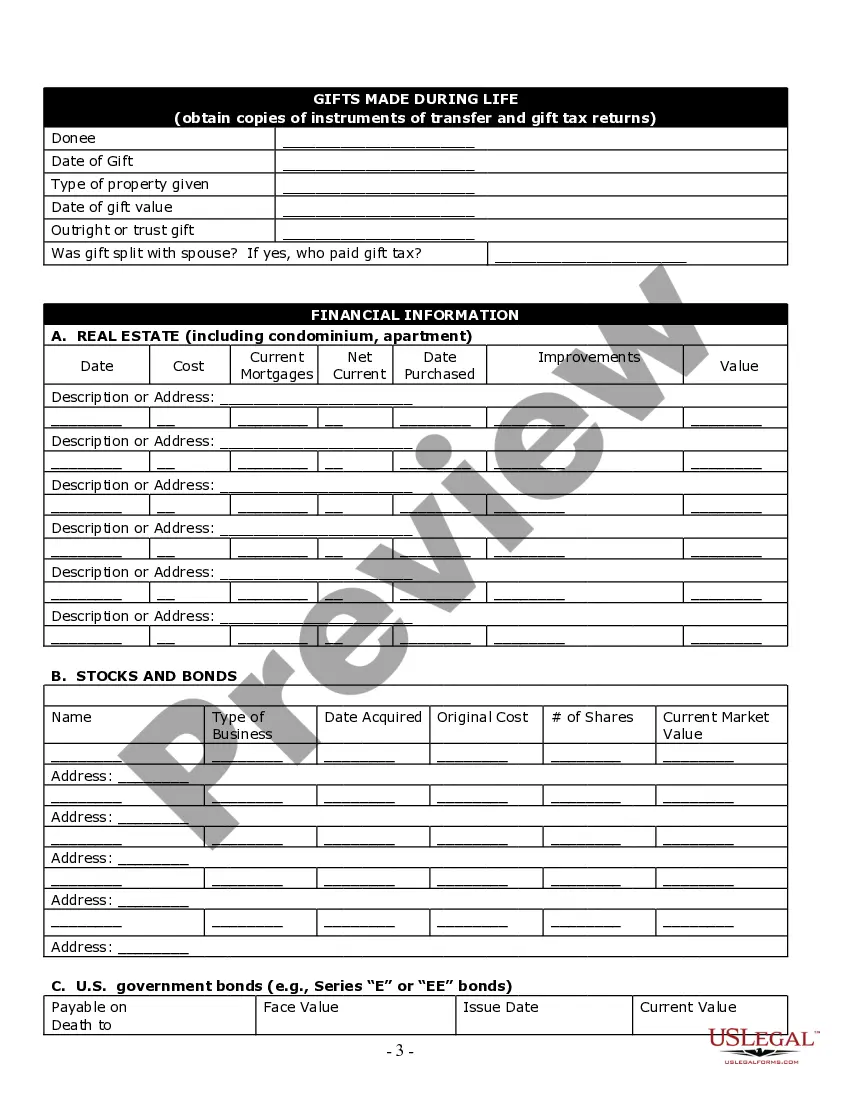

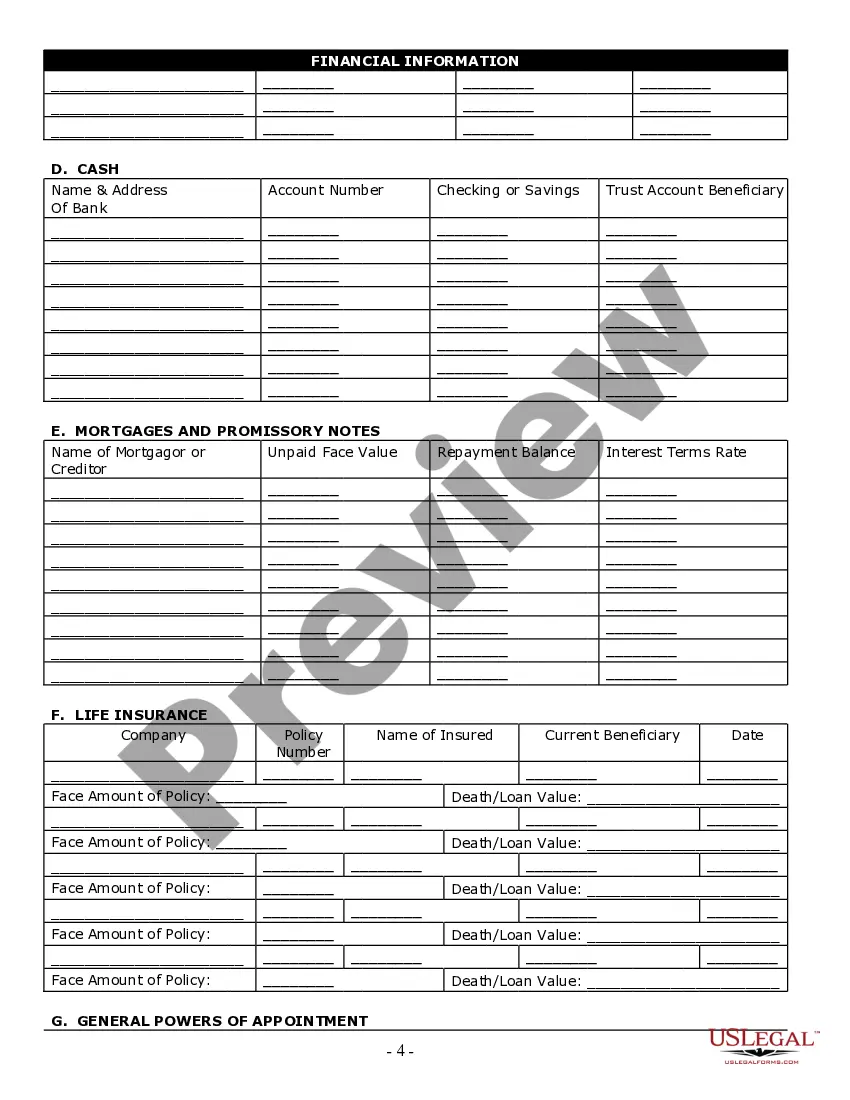

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

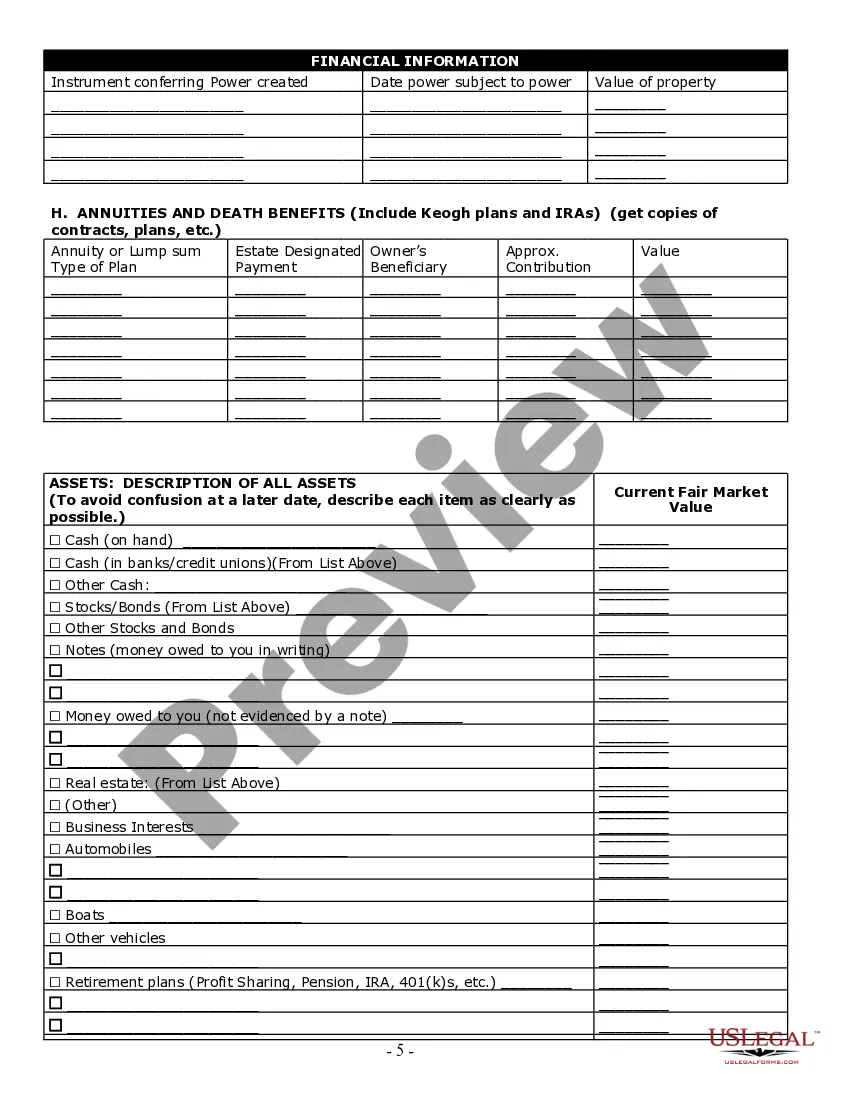

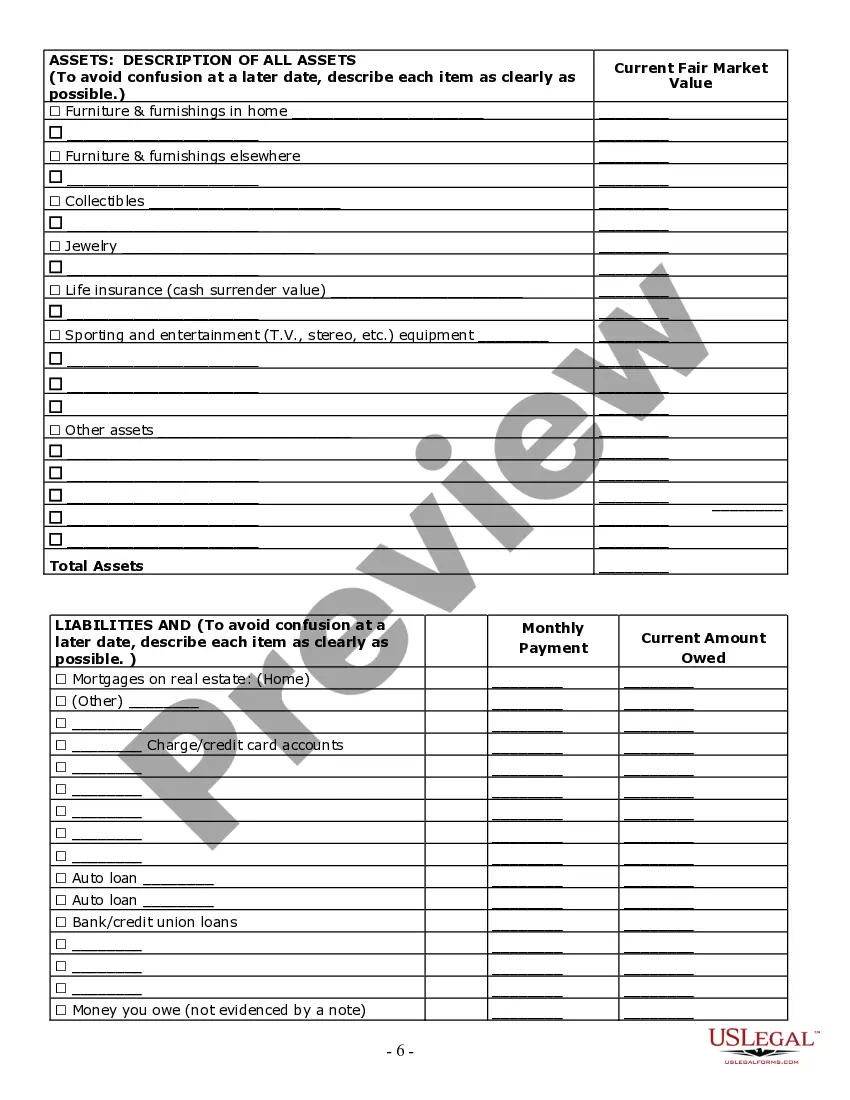

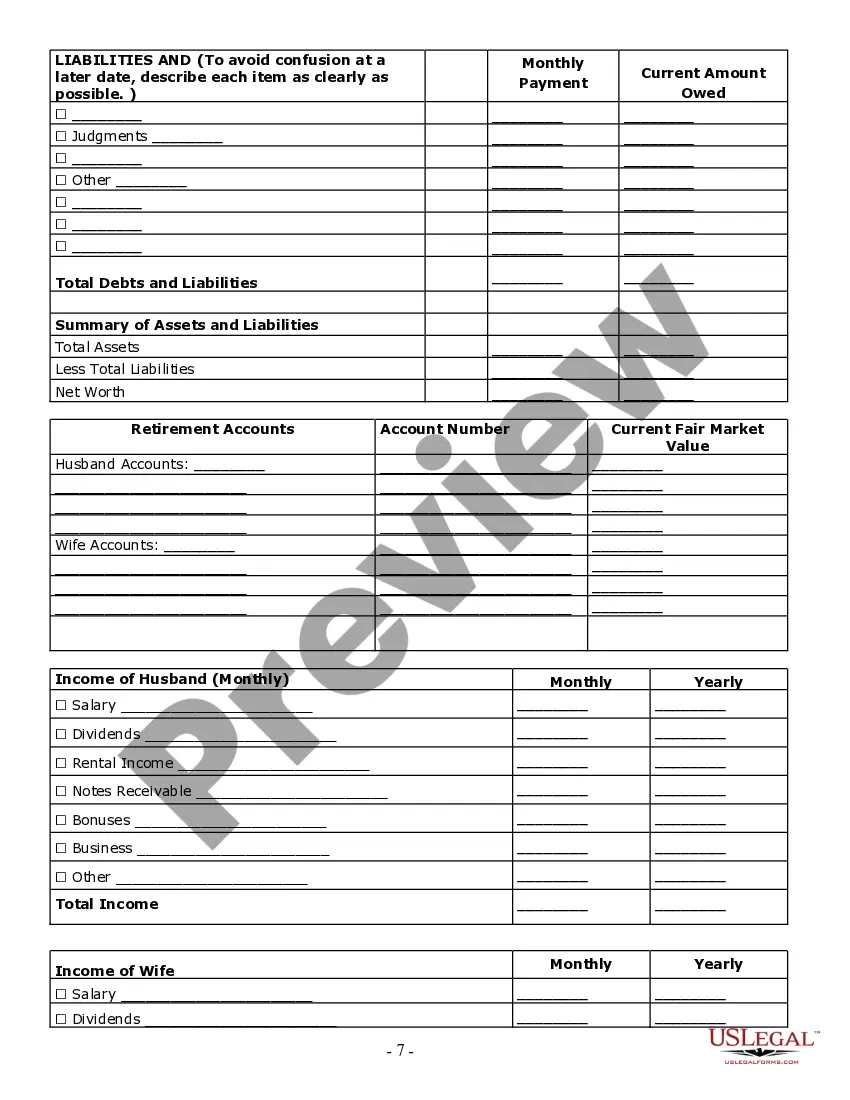

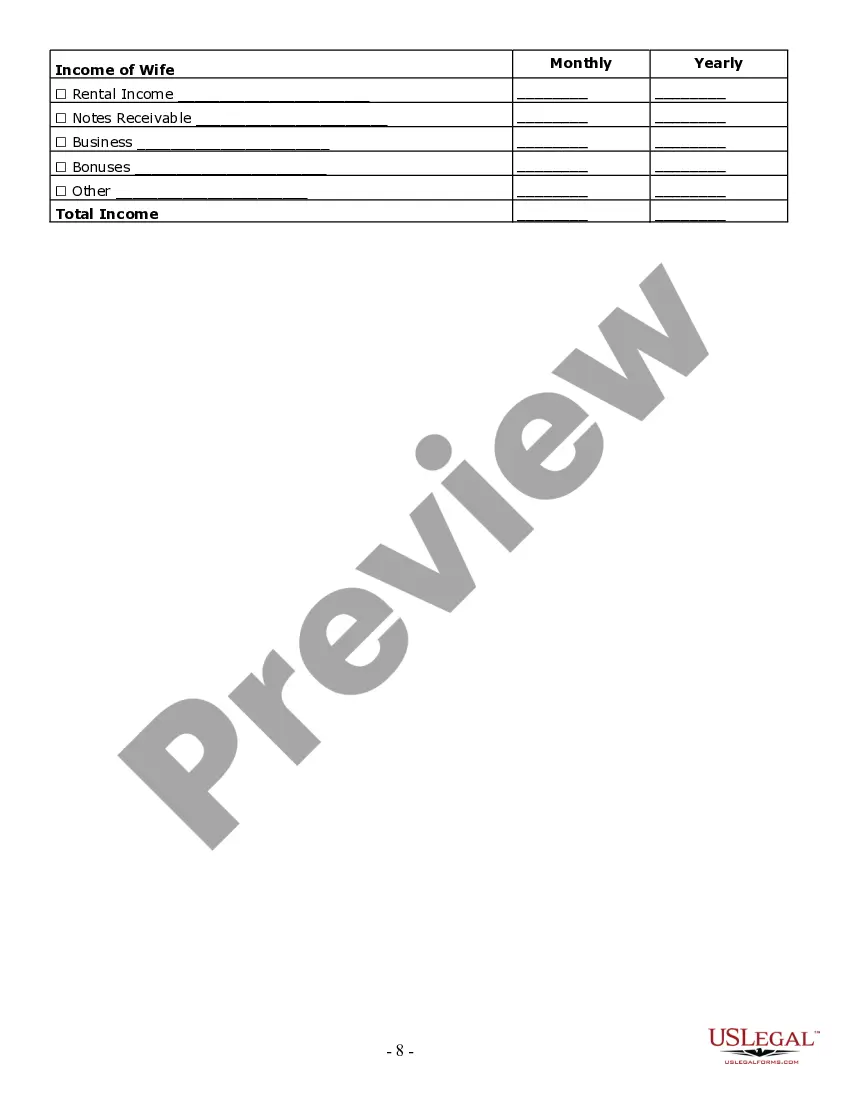

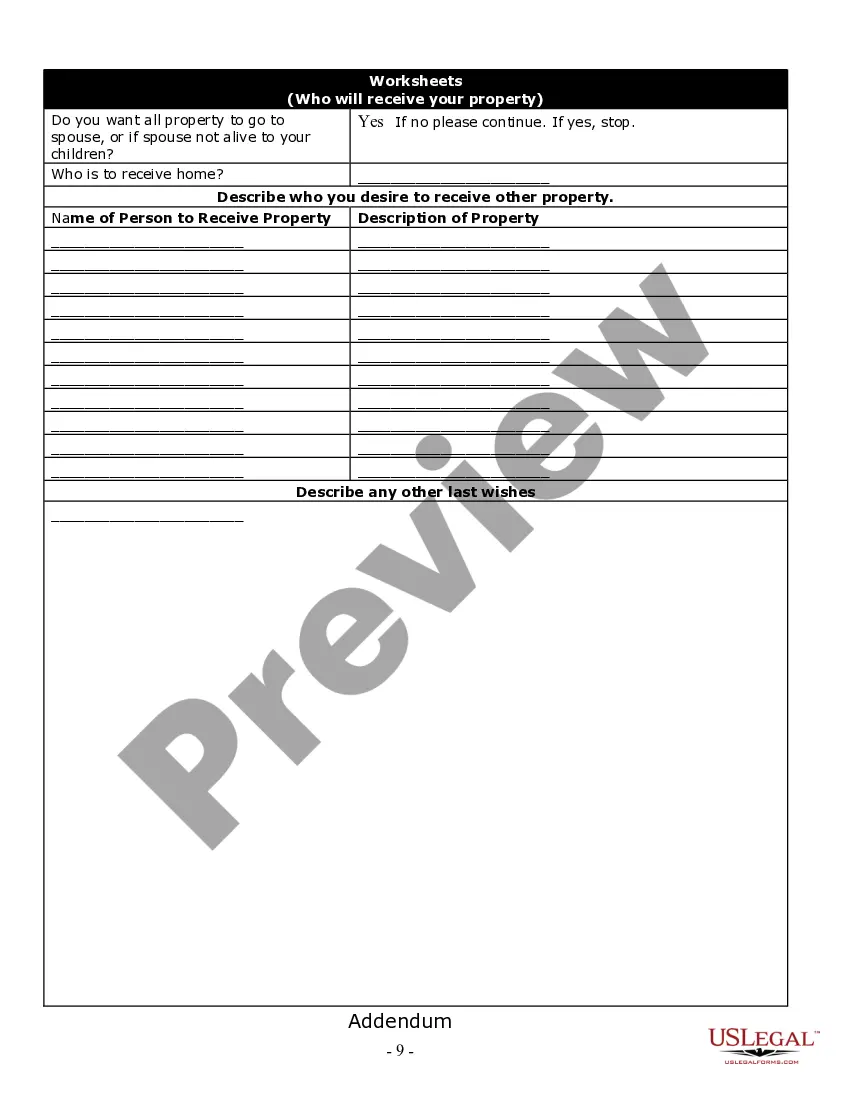

Salt Lake Utah Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in organizing and planning their future financial and legal arrangements. These documents serve as a roadmap for estate planning attorneys and their clients to gather vital information, establish goals, and customize estate plans tailored to the specific needs and wishes of the individual or family. The Salt Lake Utah Estate Planning Questionnaire and Worksheets cover various aspects of estate planning, including: 1. Personal Information: This section captures basic personal details such as full name, contact information, marital status, and number of dependents. 2. Assets and Liabilities: Individuals using these worksheets will provide a detailed overview of their assets, including real estate properties, bank accounts, investments, retirement plans, business interests, and personal belongings. They will also document their liabilities such as mortgages, loans, and debts. 3. Beneficiary Designations: This section addresses the designation of beneficiaries for life insurance policies, retirement accounts, and other assets requiring beneficiary designation. 4. Guardianship Designations: For individuals with minor children, this area allows them to specify their preferred guardians for the care of their children in case of their incapacity or death. 5. Healthcare Directives: This portion focuses on the individual's preferences regarding healthcare decisions, including the appointment of a healthcare proxy and instructions for end-of-life care. 6. Distribution of Assets: Here, individuals can outline their desired distribution of assets, specifying beneficiaries, percentages, and any specific instructions or conditions that should be followed. 7. Charitable Giving: This section enables individuals to express their philanthropic goals by identifying charitable organizations or causes they wish to support through their estate plan. 8. Financial and Legal Professionals: Individuals can provide contact information for their financial advisors, attorneys, accountants, and other professionals involved in their estate planning process. Different types of Salt Lake Utah Estate Planning Questionnaire and Worksheets may include additional sections or be tailored for specific estate planning objectives such as trusts, wills, powers of attorney, or special needs planning. These specialized worksheets cater to the unique and intricate aspects of each planning area, ensuring a comprehensive and customized approach to estate planning. In conclusion, the Salt Lake Utah Estate Planning Questionnaire and Worksheets are indispensable tools that guide individuals and families in organizing and planning their estate arrangements. By utilizing these documents, individuals can collaborate effectively with estate planning attorneys, ensuring that their wishes are properly articulated and appropriately addressed in their estate plans.Salt Lake Utah Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in organizing and planning their future financial and legal arrangements. These documents serve as a roadmap for estate planning attorneys and their clients to gather vital information, establish goals, and customize estate plans tailored to the specific needs and wishes of the individual or family. The Salt Lake Utah Estate Planning Questionnaire and Worksheets cover various aspects of estate planning, including: 1. Personal Information: This section captures basic personal details such as full name, contact information, marital status, and number of dependents. 2. Assets and Liabilities: Individuals using these worksheets will provide a detailed overview of their assets, including real estate properties, bank accounts, investments, retirement plans, business interests, and personal belongings. They will also document their liabilities such as mortgages, loans, and debts. 3. Beneficiary Designations: This section addresses the designation of beneficiaries for life insurance policies, retirement accounts, and other assets requiring beneficiary designation. 4. Guardianship Designations: For individuals with minor children, this area allows them to specify their preferred guardians for the care of their children in case of their incapacity or death. 5. Healthcare Directives: This portion focuses on the individual's preferences regarding healthcare decisions, including the appointment of a healthcare proxy and instructions for end-of-life care. 6. Distribution of Assets: Here, individuals can outline their desired distribution of assets, specifying beneficiaries, percentages, and any specific instructions or conditions that should be followed. 7. Charitable Giving: This section enables individuals to express their philanthropic goals by identifying charitable organizations or causes they wish to support through their estate plan. 8. Financial and Legal Professionals: Individuals can provide contact information for their financial advisors, attorneys, accountants, and other professionals involved in their estate planning process. Different types of Salt Lake Utah Estate Planning Questionnaire and Worksheets may include additional sections or be tailored for specific estate planning objectives such as trusts, wills, powers of attorney, or special needs planning. These specialized worksheets cater to the unique and intricate aspects of each planning area, ensuring a comprehensive and customized approach to estate planning. In conclusion, the Salt Lake Utah Estate Planning Questionnaire and Worksheets are indispensable tools that guide individuals and families in organizing and planning their estate arrangements. By utilizing these documents, individuals can collaborate effectively with estate planning attorneys, ensuring that their wishes are properly articulated and appropriately addressed in their estate plans.