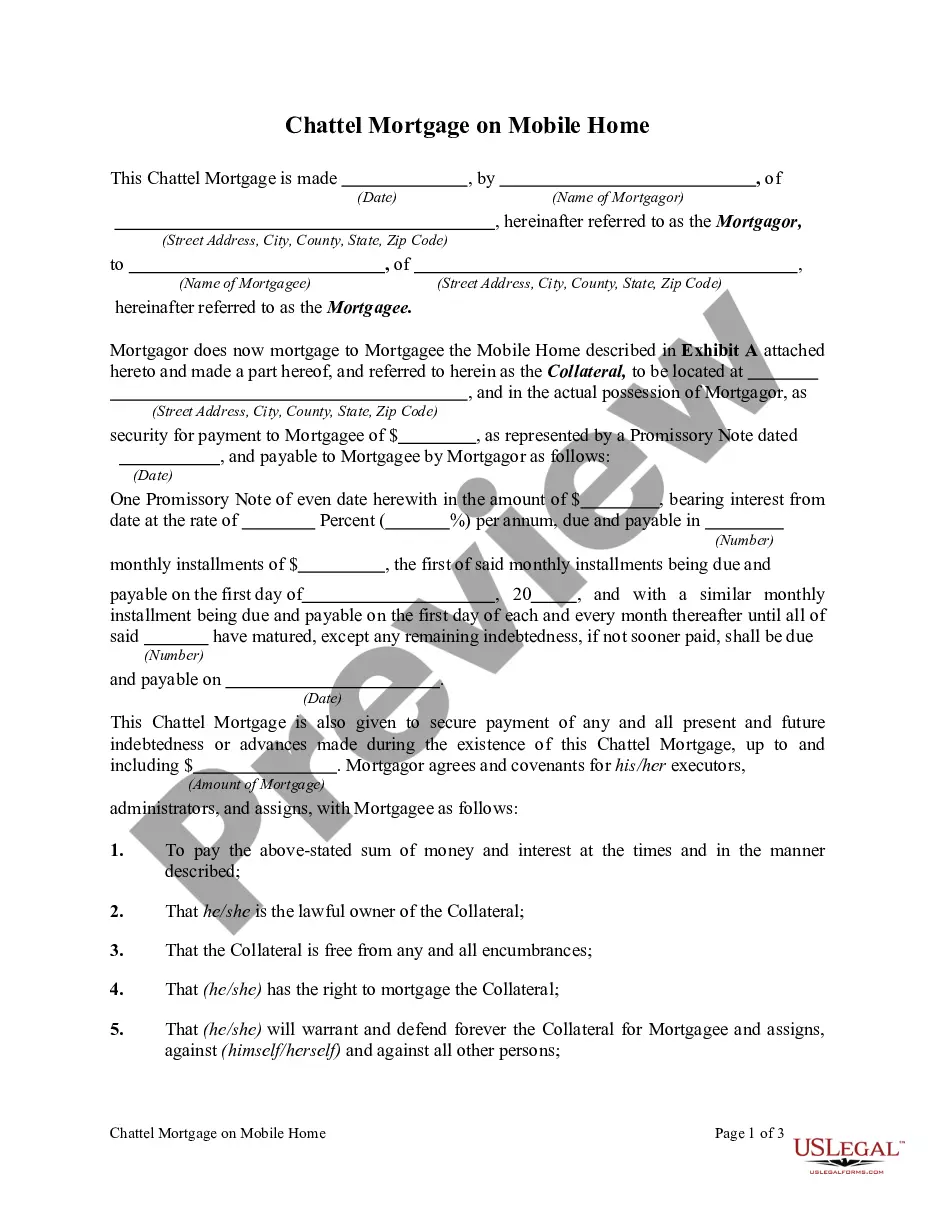

Fairfax Virginia Chattel Mortgage on Mobile Home: A Detailed Description A Chattel Mortgage is a type of loan that allows individuals in Fairfax, Virginia to secure financing against a mobile home. This type of mortgage differs from a traditional mortgage on real property, as it specifically applies to movable assets like mobile homes. In Fairfax, Virginia, there are different types of Chattel Mortgages available to residents, including: 1. Traditional Chattel Mortgage: This refers to a standard Chattel Mortgage in which the mobile home serves as collateral for the loan. The lender holds a security interest in the mobile home until the loan is fully repaid. The borrower retains ownership and possession of the mobile home, making it a viable option for individuals who don't want to part with their property while seeking financing. 2. Purchase Money Chattel Mortgage: In Fairfax, Virginia, this type of Chattel Mortgage is commonly used when purchasing a new mobile home. The lender provides the funds necessary for the purchase, and the mobile home itself serves as collateral. The borrower then repays the loan over a specific period, typically with fixed monthly installments. 3. Refinancing Chattel Mortgage: Homeowners in Fairfax, Virginia who already have existing loans on their mobile homes may opt for a refinancing Chattel Mortgage. This allows them to obtain more favorable loan terms or secure a lower interest rate by replacing their current mortgage with a new one. 4. Home Equity Chattel Mortgage: Fairfax residents who have built up equity in their mobile homes can utilize a home equity Chattel Mortgage. By borrowing against the equity, homeowners can access additional funds for various purposes, such as debt consolidation, home improvements, or other financial needs. 5. Chattel Mortgage for Manufactured Homes: This type of Chattel Mortgage specifically caters to manufactured homes, which are factory-built structures designed to be transported to a specific location. In Fairfax, Virginia, residents can obtain a Chattel Mortgage for manufactured homes, regardless of whether they are permanently affixed to a foundation or remain mobile. When applying for a Fairfax Virginia Chattel Mortgage on Mobile Home, individuals will typically need to provide information such as their credit history, income verification, the mobile home's details (e.g., year, make, model), and insurance coverage on the property. The lender will assess the applicant's eligibility based on these factors before finalizing the loan terms. In summary, a Fairfax Virginia Chattel Mortgage on Mobile Home allows individuals to secure financing against their movable property. With different types of Chattel Mortgages available, residents in Fairfax have various options to choose from, depending on their specific needs, whether it's purchasing, refinancing, or leveraging existing equity.

Fairfax Virginia Chattel Mortgage on Mobile Home

Description

How to fill out Fairfax Virginia Chattel Mortgage On Mobile Home?

Take advantage of the US Legal Forms and have instant access to any form you need. Our useful platform with thousands of templates makes it easy to find and get almost any document sample you will need. You can export, complete, and sign the Fairfax Virginia Chattel Mortgage on Mobile Home in just a couple of minutes instead of browsing the web for hours looking for a proper template.

Utilizing our collection is a great strategy to improve the safety of your document filing. Our experienced attorneys regularly check all the records to make sure that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the Fairfax Virginia Chattel Mortgage on Mobile Home? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: check its title and description, and make use of the Preview option when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Select Buy Now and select the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Pick the format to get the Fairfax Virginia Chattel Mortgage on Mobile Home and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the web. Our company is always ready to assist you in any legal process, even if it is just downloading the Fairfax Virginia Chattel Mortgage on Mobile Home.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!