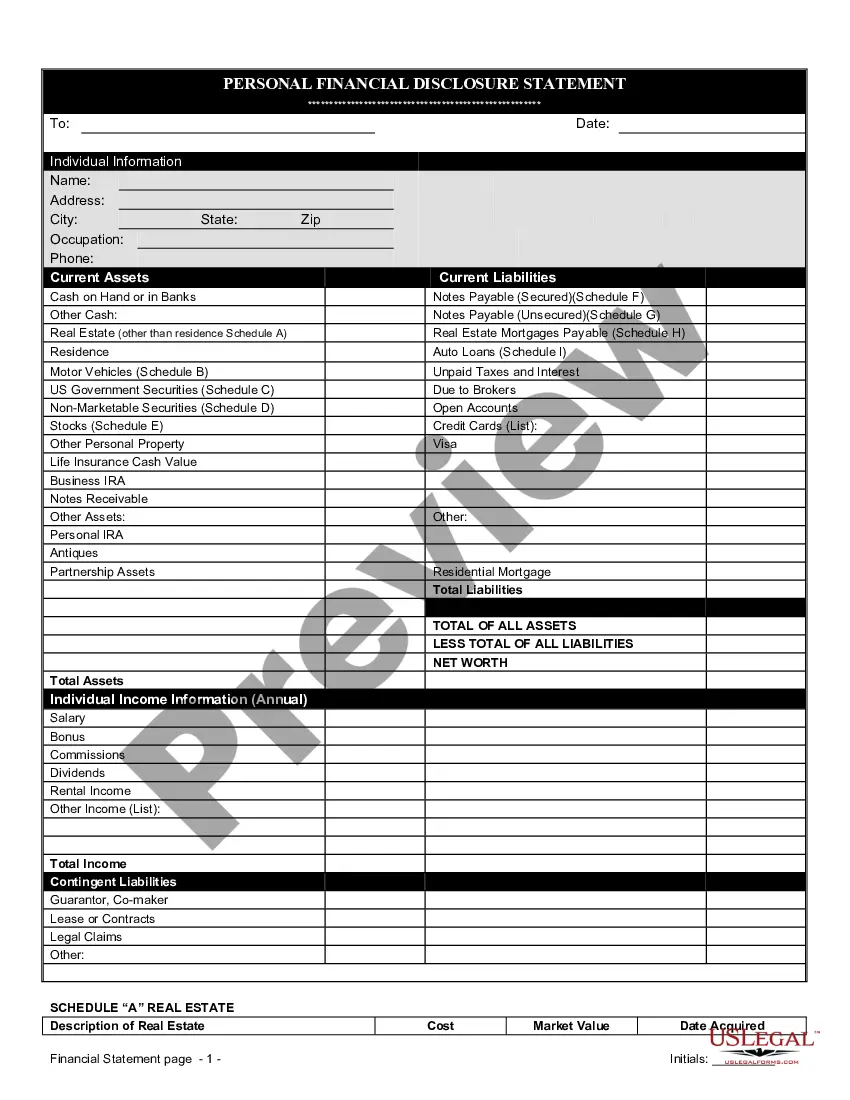

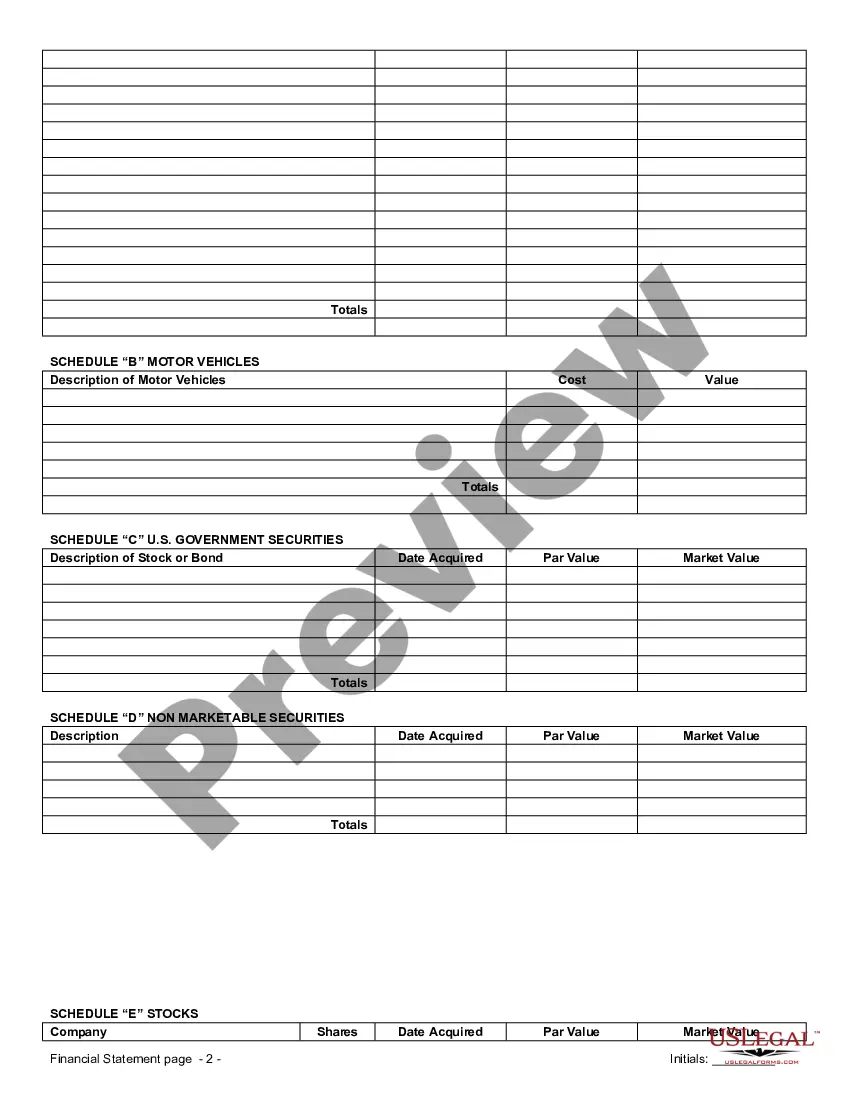

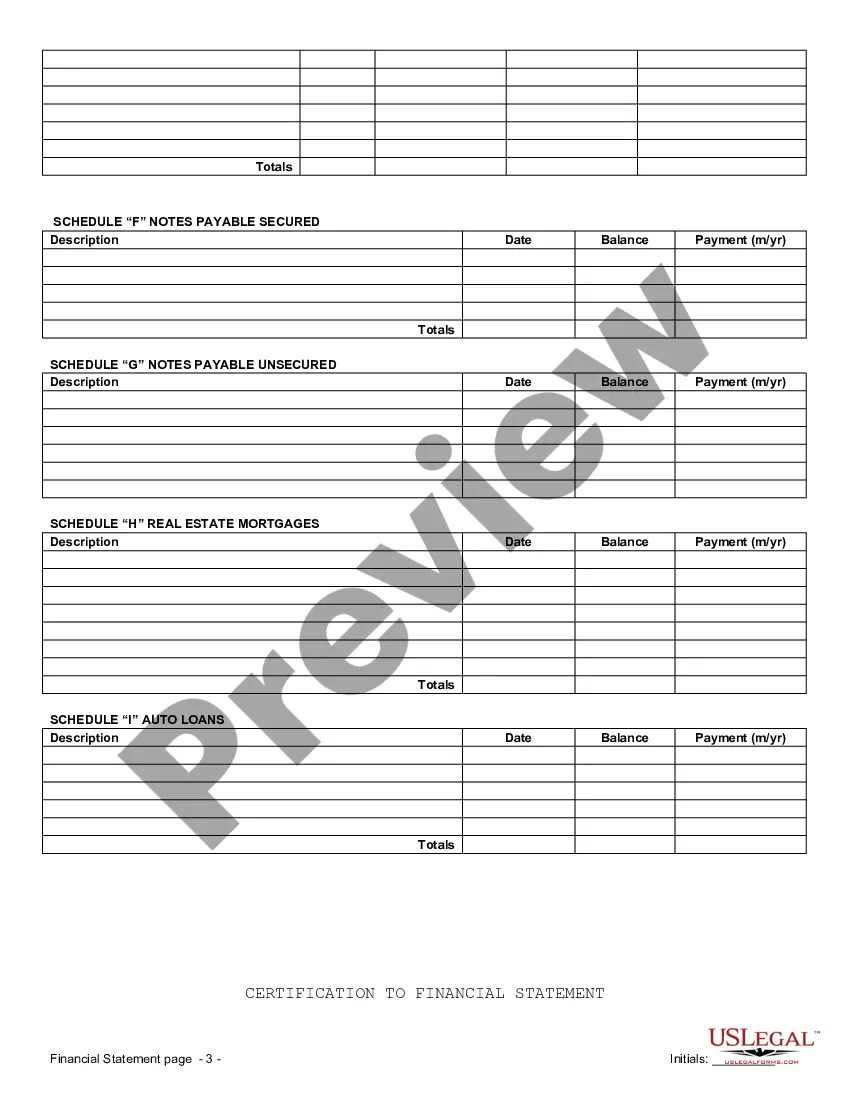

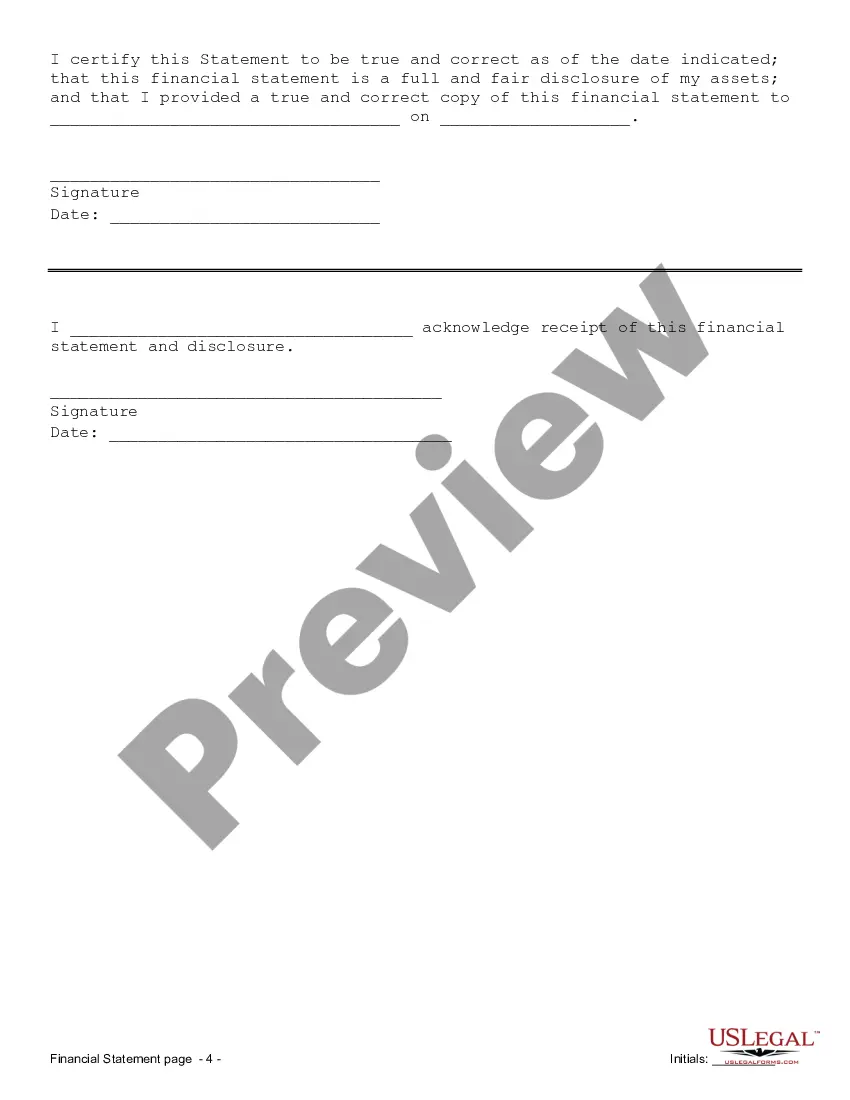

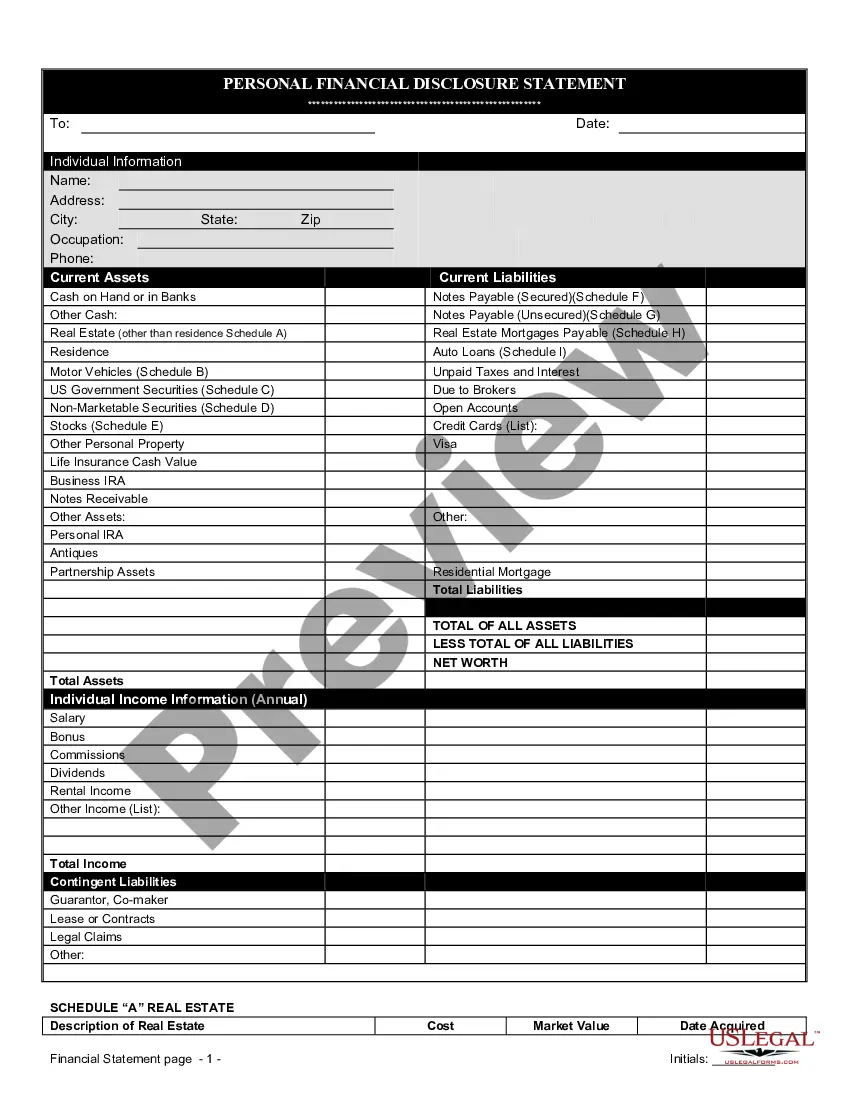

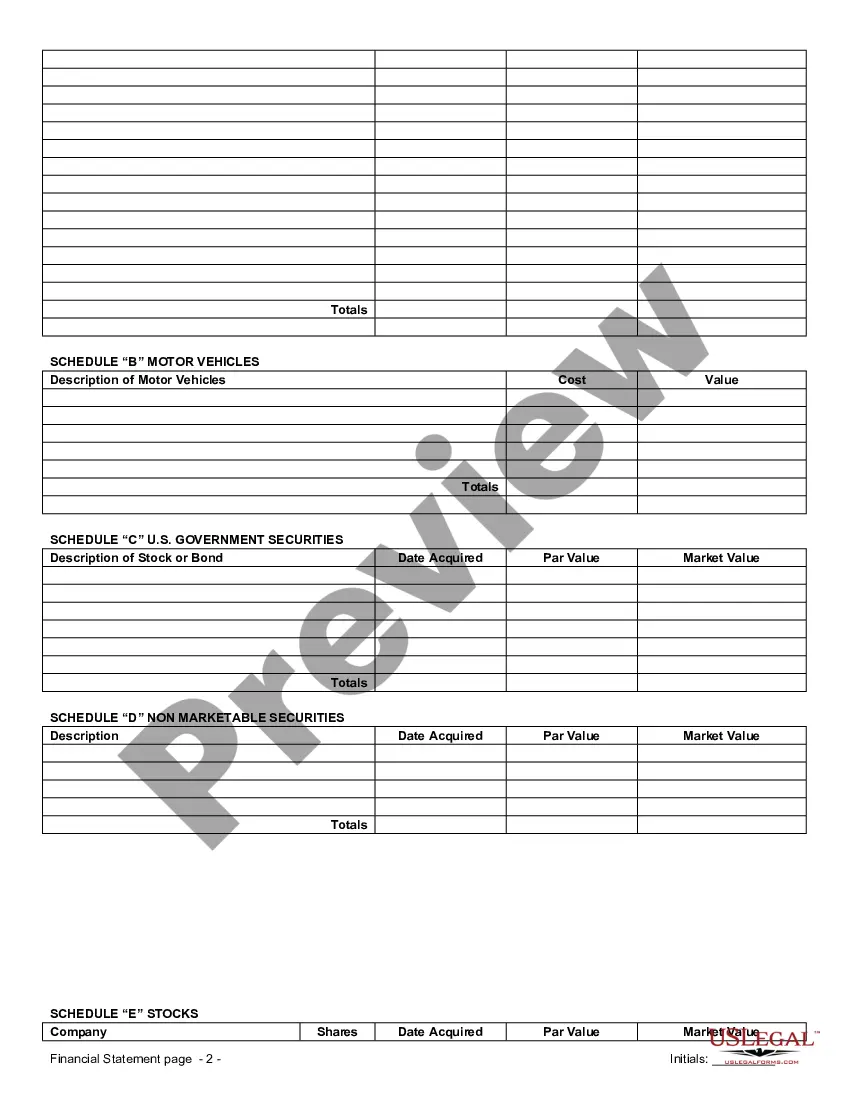

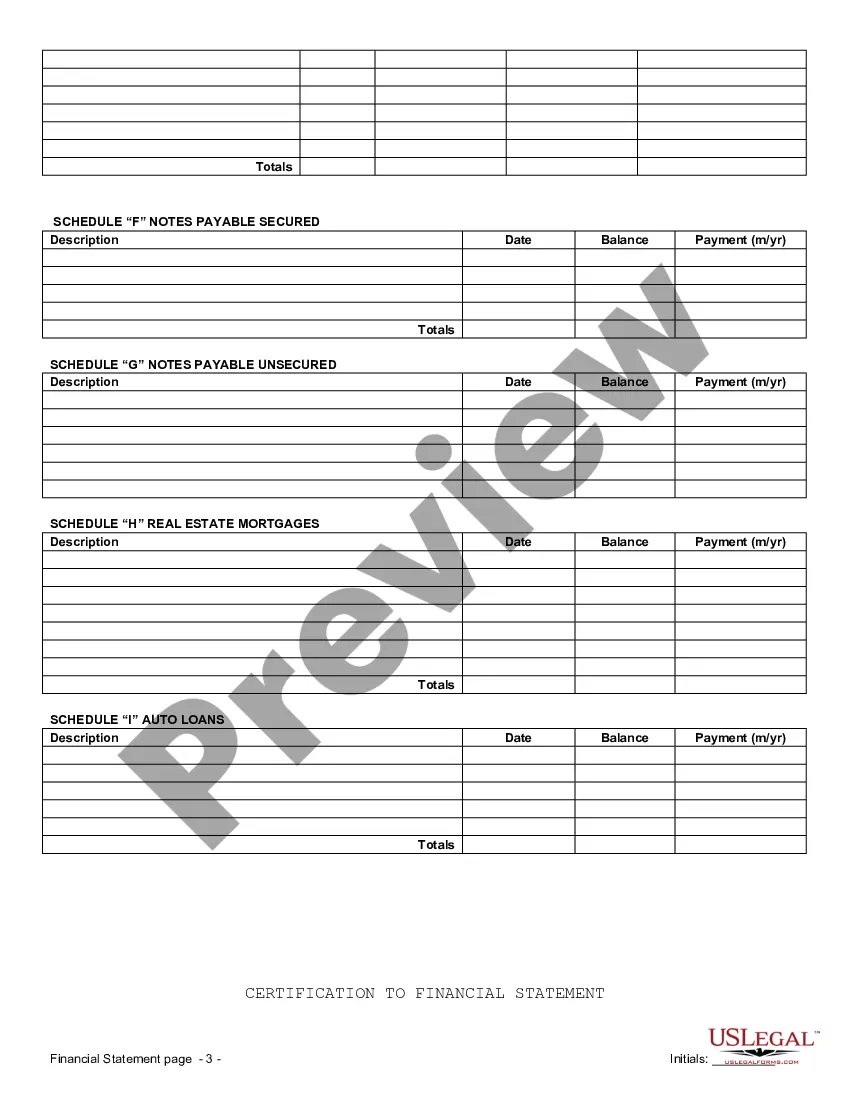

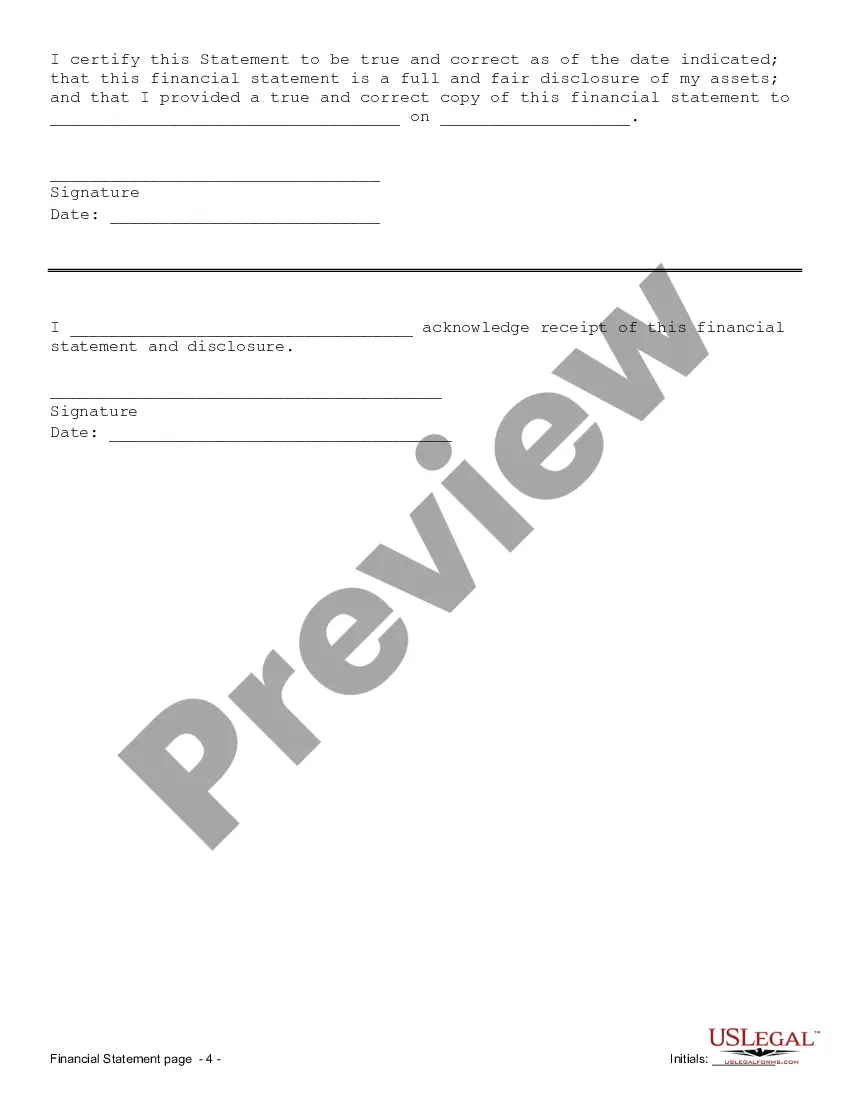

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Virginia Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Irrespective of one’s social or occupational position, filling out legal documents is an unfortunate obligation in today’s society.

Too frequently, it’s nearly unattainable for an individual without legal training to create such documents from scratch, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms proves beneficial.

Make sure the form you have located is appropriate for your region considering that the regulations of one state or area may not apply to another.

Preview the document and review a brief summary (if available) of scenarios for which the paper can be utilized.

- Our service offers an extensive catalog containing over 85,000 ready-to-use state-specific forms that cater to nearly any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to conserve time with our DIY documents.

- Whether you need the Fairfax Virginia Financial Statements solely in relation to a Prenuptial Premarital Agreement or any other document applicable in your jurisdiction, everything is within reach with US Legal Forms.

- Here’s how you can efficiently obtain the Fairfax Virginia Financial Statements specifically associated with a Prenuptial Premarital Agreement using our dependable service.

- If you’re already a subscriber, feel free to Log In to your account to access the needed form.

- However, if you’re new to our collection, please follow these steps prior to downloading the Fairfax Virginia Financial Statements solely in connection with a Prenuptial Premarital Agreement.

Form popularity

FAQ

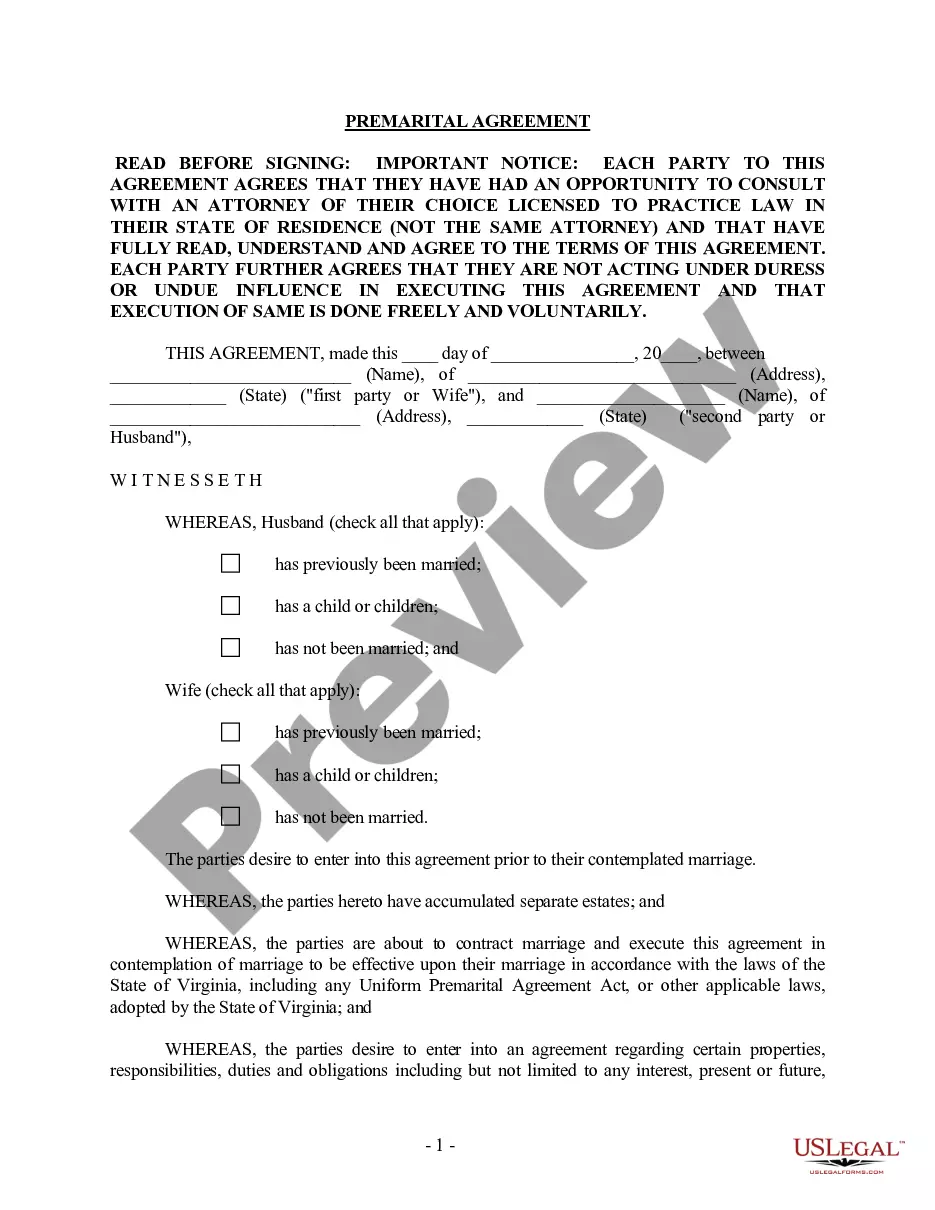

You can draw up your own prenuptial agreement, but you must ensure it complies with Virginia's legal requirements. A carefully drafted prenup will clearly outline terms regarding finances, ownership, and assets. By utilizing Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement, you can create a robust agreement that addresses your specific financial needs.

Yes, you can write your own prenup and then get it notarized in Virginia. Notarization adds an extra layer of authenticity and can help in validating the document later in court. Including Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement in your document ensures that your financial rights are well-defined and protected.

In Virginia, you are allowed to write your own prenuptial agreement, but it must meet specific legal standards to be enforceable. You should clearly detail asset distribution, financial responsibilities, and any relevant terms. Using Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement helps in forming a well-structured document that meets these standards.

Yes, you can write a prenup without a lawyer, but it is important to understand the legal requirements in your state. While drafting your own agreement might save on legal fees, having a professional review is advisable to ensure its validity. Incorporating Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement can facilitate a smoother process.

A prenuptial agreement for separate finances is a legal document that outlines how assets and debts will be managed during marriage and in the event of divorce. This agreement specifies each partner's financial responsibilities, ensuring clarity and protection for individual assets. By including provisions related to Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can navigate financial matters with confidence.

The financial statement of a prenuptial agreement is a document that outlines the assets, liabilities, and income of both parties. This information is vital for creating Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement that accurately reflects each individual's financial standing. This transparency helps maintain fairness and can strengthen the enforceability of the prenup, especially during divorce proceedings.

Yes, prenups, or prenuptial agreements, are legally enforceable in Virginia if they meet certain criteria. It is essential that both parties fully disclose their financial information, utilizing Fairfax Virginia Financial Statements only in Connection with Prenuptial Premarital Agreement. Working with a knowledgeable attorney can help ensure your agreement is valid and recognized by the court, safeguarding your interests.

In Fairfax Virginia, you can include various provisions in a prenuptial agreement, but they must adhere to legal standards. While you have a degree of flexibility, certain stipulations, like waiving child support, are generally not enforceable. Therefore, it’s wise to focus on realistic terms that reflect your financial situation accurately. Using US Legal Forms can help you navigate these details and create comprehensive financial statements only in connection with a prenuptial premarital agreement.

Prenuptial agreements in Fairfax Virginia are mainly designed to protect assets you possess before marriage, but they can also account for assets obtained during the marriage. A well-crafted prenup can define the treatment of these assets, ensuring clarity and agreement between both parties. Your financial statements only in connection with a prenuptial premarital agreement will play a key role in establishing these protections. Thus, prenups serve as a comprehensive financial management tool.

While a prenuptial agreement primarily addresses premarital assets, it can also cover future earnings and assets acquired during the marriage. It allows couples to outline their rights regarding income and property during and after the marriage. In Fairfax Virginia, understanding how your financial statements only in connection with a prenuptial premarital agreement apply can offer valuable insights. This flexibility makes prenups a useful tool for future planning.