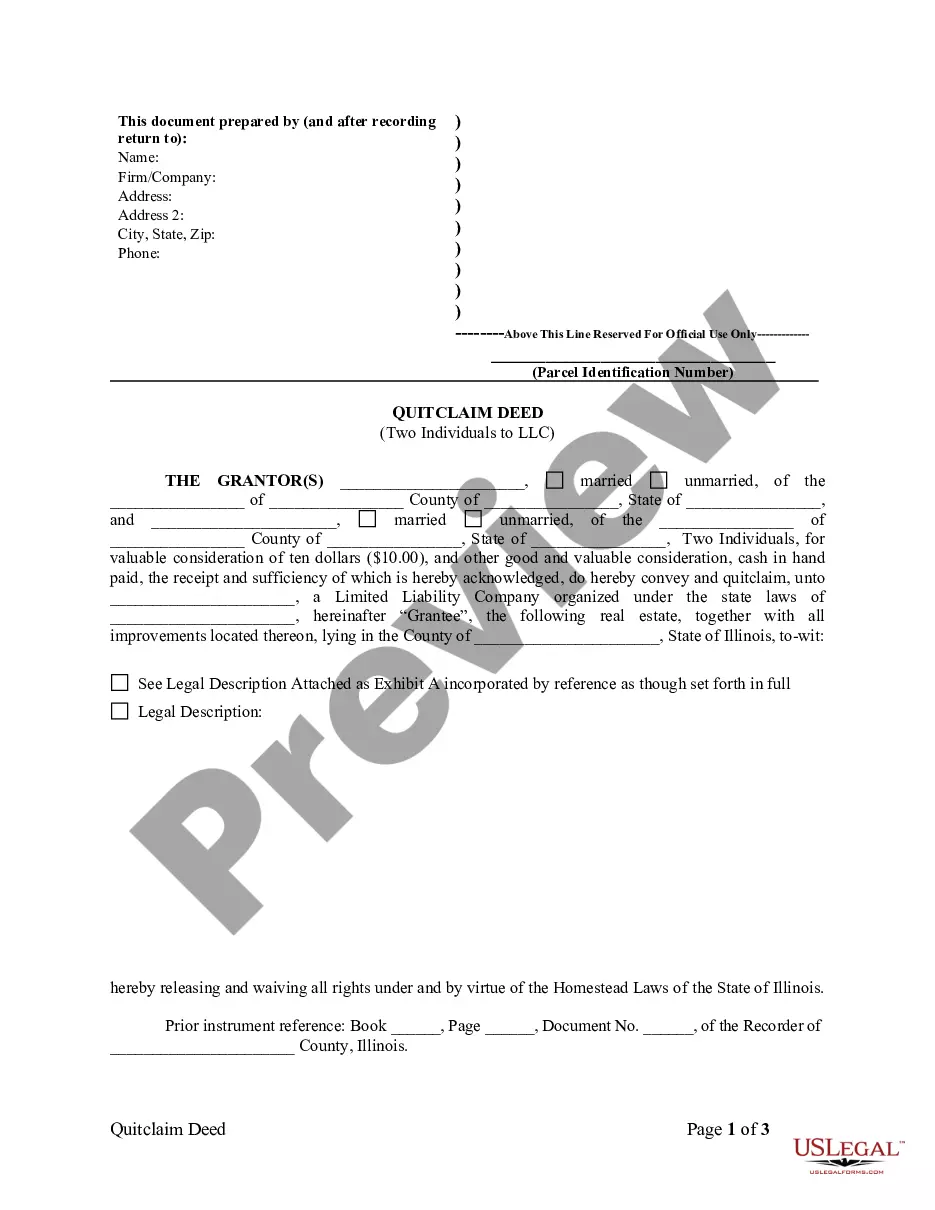

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Fairfax Virginia Quitclaim Deed from Corporation to LLC

Description

How to fill out Virginia Quitclaim Deed From Corporation To LLC?

If you are looking for a pertinent form template, it’s unattainable to discover a more suitable platform than the US Legal Forms site – likely the most extensive online repositories.

With this repository, you can obtain a significant number of form examples for business and personal use by categories and regions, or keywords.

With the enhanced search feature, locating the latest Fairfax Virginia Quitclaim Deed from Corporation to LLC is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the format and save it onto your device. Make modifications. Fill out, edit, print, and sign the acquired Fairfax Virginia Quitclaim Deed from Corporation to LLC.

- Furthermore, the pertinence of each document is validated by a team of expert attorneys who periodically review the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Fairfax Virginia Quitclaim Deed from Corporation to LLC is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have found the form you need. Review its details and utilize the Preview feature to examine its contents. If it doesn’t satisfy your needs, use the Search option at the top of the page to find the correct document.

- Confirm your selection. Click the Buy now button. After that, select the desired pricing plan and enter your details to create an account.

Form popularity

FAQ

In Virginia, a quitclaim deed must include specific elements to be valid. You need the names of the parties involved, the legal property description, and the notarized signature of the grantor. Additionally, the deed should be recorded in the locality where the property is located. For those considering a Fairfax Virginia Quitclaim Deed from Corporation to LLC, using a trusted platform like US Legal Forms can simplify the process and ensure all necessary documentation is correctly prepared.

To place your property in an LLC, begin by forming the LLC and obtaining a Fairfax Virginia Quitclaim Deed from Corporation to LLC. Then, execute the quit claim deed to transfer ownership of the property to the LLC. After signing and notarizing the deed, file it with the land recording office in your county to finalize the transfer. This method protects your personal assets while managing your property effectively through the LLC structure.

In Virginia, any individual can prepare a quit claim deed, but it is wise to seek assistance from a legal professional to ensure accuracy, especially in cases like a Fairfax Virginia Quitclaim Deed from Corporation to LLC. Lawyers or licensed title companies can help draft the deed to meet state requirements. Using uslegalforms can also simplify this process, offering templates and guidance to help you create a legally sound document.

To transfer the deed of a house to an LLC, you first need to obtain a Fairfax Virginia Quitclaim Deed from Corporation to LLC. This deed allows you to officially transfer ownership from the corporation to the LLC. Fill out the necessary information, sign it in front of a notary, and then record the deed with your local land registry office. This process ensures that the LLC is recognized as the legal owner of the property.

Filling out a quitclaim deed form requires basic details about the property and the parties involved. Start by entering the current owner's name and the LLC's name accurately. Include a precise description of the property's location and boundaries. If you need assistance, using US Legal Forms can simplify this process, providing step-by-step guidance for a smooth completion of the Fairfax Virginia Quitclaim Deed from Corporation to LLC.

To quitclaim a deed to an LLC in Fairfax, you first need to ensure the corporation owns the property. Next, obtain a quitclaim deed form, which you can easily find on platforms like US Legal Forms. Fill in the details, including the current owner's name, the LLC's name, and a description of the property. Finally, sign the form in front of a notary, and file it with the Fairfax County Clerk's Office to complete the Fairfax Virginia Quitclaim Deed from Corporation to LLC.

To transfer a deed to an LLC, start by preparing a quitclaim deed, like the Fairfax Virginia Quitclaim Deed from Corporation to LLC. Fill it with specific details about the property and the LLC. After signing, file it at your local county clerk's office to finalize the transfer. This process not only simplifies ownership transfer but also provides legal protections for your assets.

Yes, you can quitclaim deed property to an LLC, such as through a Fairfax Virginia Quitclaim Deed from Corporation to LLC. This method is a straightforward way to transfer ownership while keeping the property within a business framework. Just ensure all required information is complete on the deed. This transfer safeguards your assets under the LLC's legal protections.

You should file a quitclaim deed at the local county clerk's office where the property is located. In Fairfax, Virginia, this is essential for the Fairfax Virginia Quitclaim Deed from Corporation to LLC to be legally recognized. Make sure to bring the completed deed along with any required fees. Filing it correctly ensures the transfer is effective and public.

To transfer your property to an LLC in Virginia, start by obtaining a Fairfax Virginia Quitclaim Deed from Corporation to LLC. This legal document allows you to transfer ownership effectively. Next, complete the deed with correct information about the property and your LLC. Finally, ensure you file the deed with the appropriate county clerk's office.