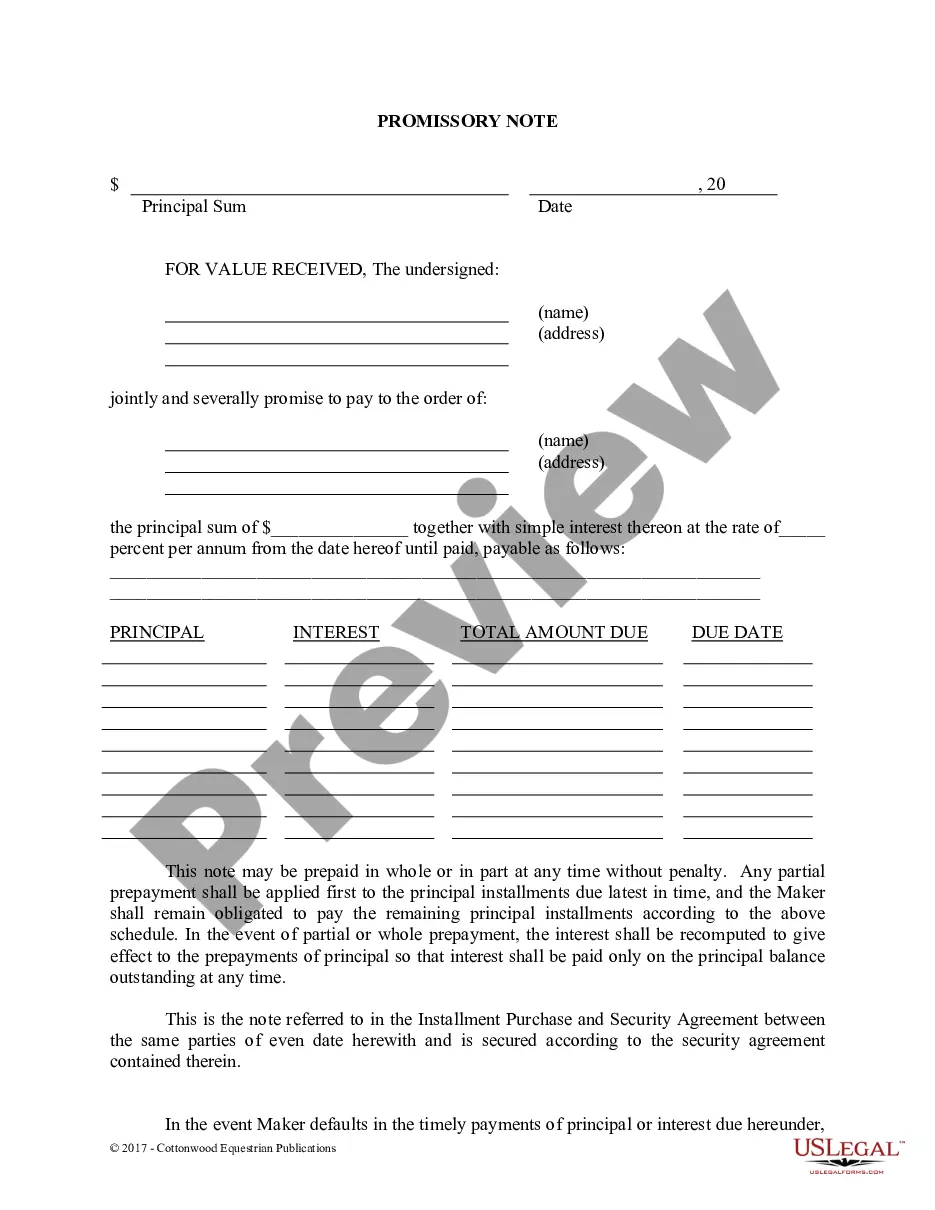

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Fairfax Virginia Promissory Note — Horse Equine Forms A Fairfax Virginia Promissory Note — Horse Equine Form is a legal document used in the state of Virginia for loan transactions involving horses or equine assets. This specific promissory note is designed to outline the terms and conditions of a loan agreement between a lender and a borrower within the Fairfax jurisdiction. The Fairfax Virginia Promissory Note — Horse Equine Form is crucial as it helps to establish a clear and formal agreement between the parties involved. It lays out the loan amount, interest rate, repayment schedule, and any additional terms or conditions relevant to the loan transaction. This document ensures that both the lender and borrower are on the same page, reducing the risk of misunderstanding or potential disputes. There are various types of Fairfax Virginia Promissory Note — Horse Equine Forms available to cater to different needs and situations: 1. Standard Promissory Note — Horse Equine Form: This is the most common and basic type of promissory note used for horse or equine loans in Fairfax. It includes all the essential terms and conditions necessary to protect both parties. 2. Secured Promissory Note — Horse Equine Form: This form includes a security provision that allows the lender to claim certain assets, such as the horse or other equine-related collateral, in case of default by the borrower. By providing collateral, the borrower may be able to negotiate a lower interest rate or secure a larger loan amount. 3. Installment Promissory Note — Horse Equine Form: This form outlines a loan repayment plan in regular installments over a specific period. It specifies the amount of each installment, its due date, and any penalties for late payments. 4. Balloon Promissory Note — Horse Equine Form: This note permits the borrower to make smaller payments over a set period, with a larger “balloon” payment due at the end of the loan term. This type of note is useful for borrowers who expect a significant financial inflow or sale of the horse in the future. In conclusion, Fairfax Virginia Promissory Note — Horse Equine Forms are essential legal documents used in loan transactions involving horses in the Fairfax area. They ensure that all parties involved understand and agree to the terms and conditions of the loan, reducing the potential for disputes. Various types of promissory notes are available, including standard, secured, installment, and balloon notes, each serving different purposes based on the borrower's specific needs and financial circumstances.Fairfax Virginia Promissory Note — Horse Equine Forms A Fairfax Virginia Promissory Note — Horse Equine Form is a legal document used in the state of Virginia for loan transactions involving horses or equine assets. This specific promissory note is designed to outline the terms and conditions of a loan agreement between a lender and a borrower within the Fairfax jurisdiction. The Fairfax Virginia Promissory Note — Horse Equine Form is crucial as it helps to establish a clear and formal agreement between the parties involved. It lays out the loan amount, interest rate, repayment schedule, and any additional terms or conditions relevant to the loan transaction. This document ensures that both the lender and borrower are on the same page, reducing the risk of misunderstanding or potential disputes. There are various types of Fairfax Virginia Promissory Note — Horse Equine Forms available to cater to different needs and situations: 1. Standard Promissory Note — Horse Equine Form: This is the most common and basic type of promissory note used for horse or equine loans in Fairfax. It includes all the essential terms and conditions necessary to protect both parties. 2. Secured Promissory Note — Horse Equine Form: This form includes a security provision that allows the lender to claim certain assets, such as the horse or other equine-related collateral, in case of default by the borrower. By providing collateral, the borrower may be able to negotiate a lower interest rate or secure a larger loan amount. 3. Installment Promissory Note — Horse Equine Form: This form outlines a loan repayment plan in regular installments over a specific period. It specifies the amount of each installment, its due date, and any penalties for late payments. 4. Balloon Promissory Note — Horse Equine Form: This note permits the borrower to make smaller payments over a set period, with a larger “balloon” payment due at the end of the loan term. This type of note is useful for borrowers who expect a significant financial inflow or sale of the horse in the future. In conclusion, Fairfax Virginia Promissory Note — Horse Equine Forms are essential legal documents used in loan transactions involving horses in the Fairfax area. They ensure that all parties involved understand and agree to the terms and conditions of the loan, reducing the potential for disputes. Various types of promissory notes are available, including standard, secured, installment, and balloon notes, each serving different purposes based on the borrower's specific needs and financial circumstances.