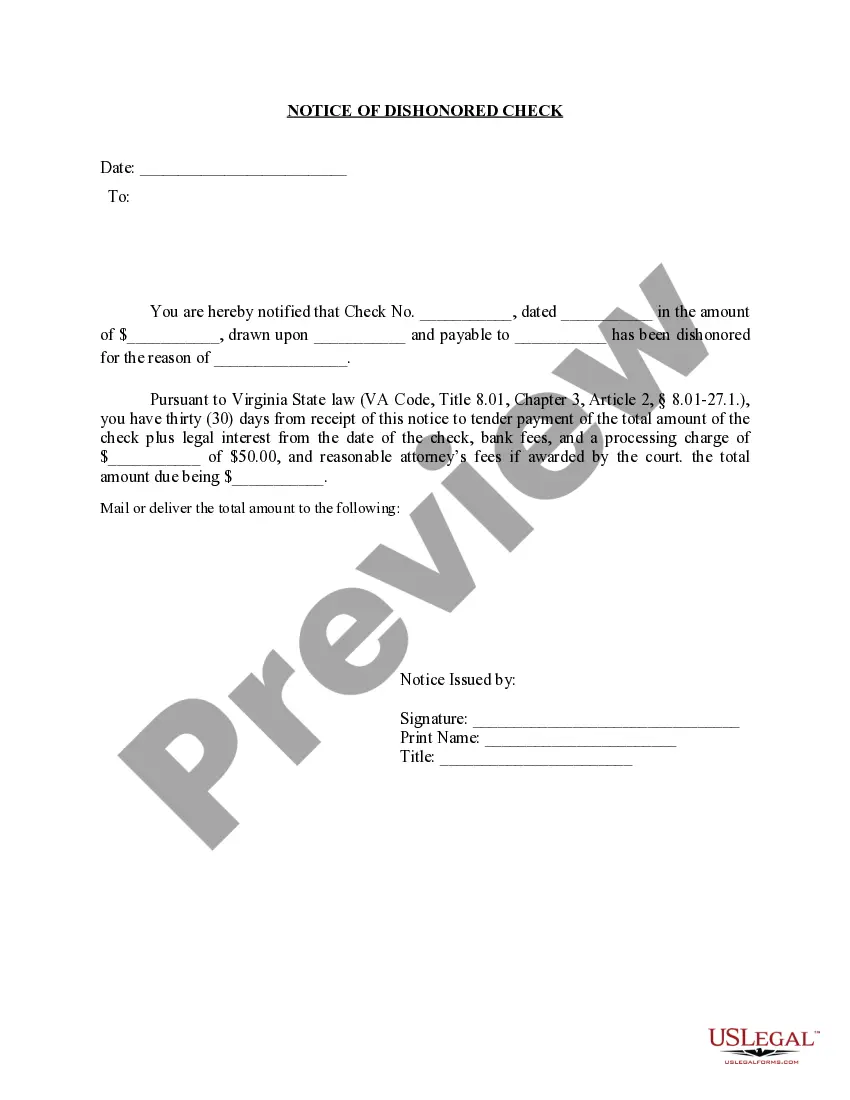

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Fairfax Virginia Notice of Dishonored Check — Civil A bad check or a bounced check is a commonly encountered issue that can have legal implications. If you reside in Fairfax, Virginia, it is important to understand the Fairfax Virginia Notice of Dishonored Check — Civil. This notice is sent to individuals or entities who have issued a check that has been returned by the bank due to insufficient funds or any other reason. A bad check, also known as a bounced check, occurs when the check is presented for payment but cannot be processed due to insufficient funds in the account. It can also happen if the account has been closed or if the check has been post-dated. In such cases, the recipient of the check has the right to pursue legal action to recover the owed funds. In Fairfax, Virginia, the Notice of Dishonored Check — Civil is a way for recipients of bad checks to initiate legal proceedings. The notice serves as an official communication to the check issuer, notifying them that their check has been dishonored and providing an opportunity to remedy the situation. Different types of Fairfax Virginia Notice of Dishonored Check — Civil may include: 1. Initial Notice: This is the first communication sent to the check issuer after their check has been returned. It informs them of the dishonored check and requests immediate payment to avoid further legal action. 2. Demand Letter: If the initial notice goes unanswered or the payment is not made, a demand letter may be sent. This letter emphasizes the seriousness of the situation and demands full payment, including any additional fees incurred due to the bounced check. 3. Legal Complaint: If the check issuer fails to respond to the demand letter or refuses to make the required payment, the recipient of the bad check can file a legal complaint in court. This complaint outlines the details of the bounced check, the amount owed, and the damages incurred. 4. Court Summons: A court summons is sent to the check issuer, notifying them of the legal proceedings initiated against them. It specifies a date and time for them to appear in court and defend themselves against the allegations. 5. Judgment: If the court decides in favor of the recipient of the bad check, a judgment will be issued against the check issuer. This judgment legally binds the check issuer to repay the amount owed, along with any additional fees, penalties, or interest as determined by the court. It's crucial to take the Fairfax Virginia Notice of Dishonored Check — Civil seriously. If you receive such a notice, it is recommended to seek legal advice to understand your rights and obligations. Similarly, if you have issued a check that has been dishonored, it is essential to address the situation promptly to mitigate any legal consequences and resolve the matter amicably.Fairfax Virginia Notice of Dishonored Check — Civil A bad check or a bounced check is a commonly encountered issue that can have legal implications. If you reside in Fairfax, Virginia, it is important to understand the Fairfax Virginia Notice of Dishonored Check — Civil. This notice is sent to individuals or entities who have issued a check that has been returned by the bank due to insufficient funds or any other reason. A bad check, also known as a bounced check, occurs when the check is presented for payment but cannot be processed due to insufficient funds in the account. It can also happen if the account has been closed or if the check has been post-dated. In such cases, the recipient of the check has the right to pursue legal action to recover the owed funds. In Fairfax, Virginia, the Notice of Dishonored Check — Civil is a way for recipients of bad checks to initiate legal proceedings. The notice serves as an official communication to the check issuer, notifying them that their check has been dishonored and providing an opportunity to remedy the situation. Different types of Fairfax Virginia Notice of Dishonored Check — Civil may include: 1. Initial Notice: This is the first communication sent to the check issuer after their check has been returned. It informs them of the dishonored check and requests immediate payment to avoid further legal action. 2. Demand Letter: If the initial notice goes unanswered or the payment is not made, a demand letter may be sent. This letter emphasizes the seriousness of the situation and demands full payment, including any additional fees incurred due to the bounced check. 3. Legal Complaint: If the check issuer fails to respond to the demand letter or refuses to make the required payment, the recipient of the bad check can file a legal complaint in court. This complaint outlines the details of the bounced check, the amount owed, and the damages incurred. 4. Court Summons: A court summons is sent to the check issuer, notifying them of the legal proceedings initiated against them. It specifies a date and time for them to appear in court and defend themselves against the allegations. 5. Judgment: If the court decides in favor of the recipient of the bad check, a judgment will be issued against the check issuer. This judgment legally binds the check issuer to repay the amount owed, along with any additional fees, penalties, or interest as determined by the court. It's crucial to take the Fairfax Virginia Notice of Dishonored Check — Civil seriously. If you receive such a notice, it is recommended to seek legal advice to understand your rights and obligations. Similarly, if you have issued a check that has been dishonored, it is essential to address the situation promptly to mitigate any legal consequences and resolve the matter amicably.