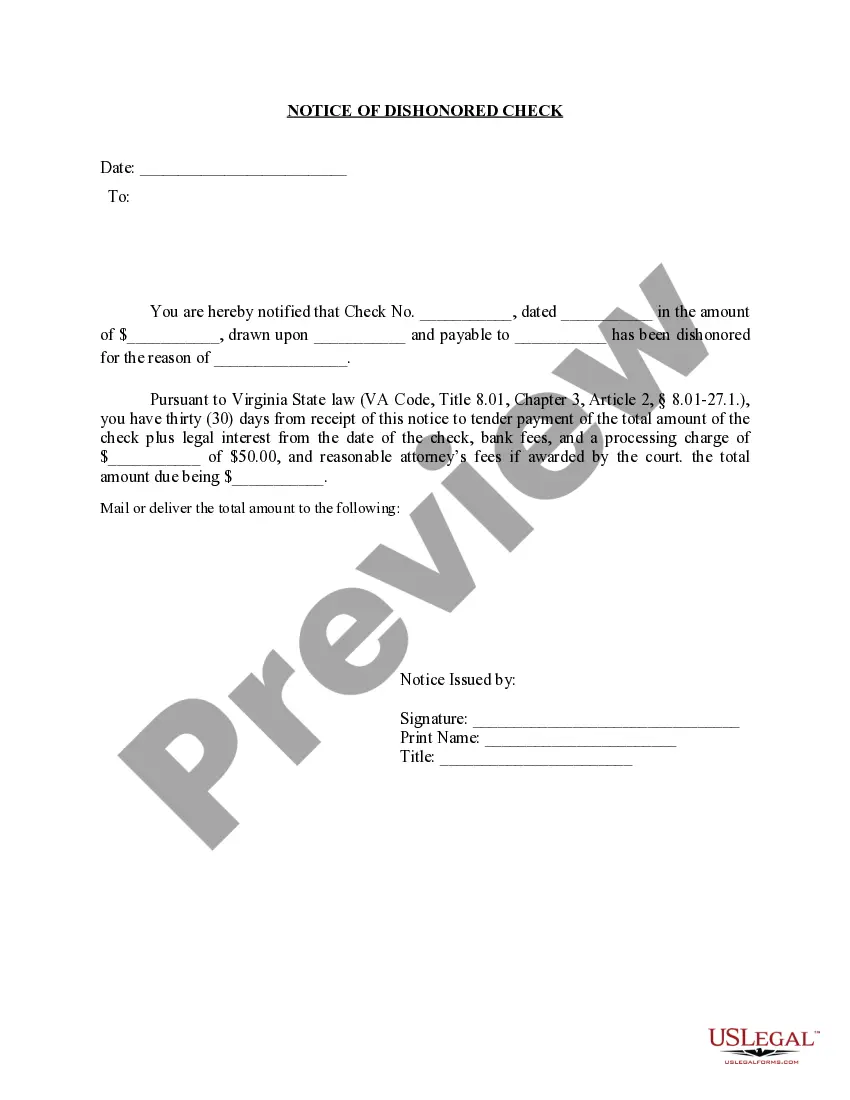

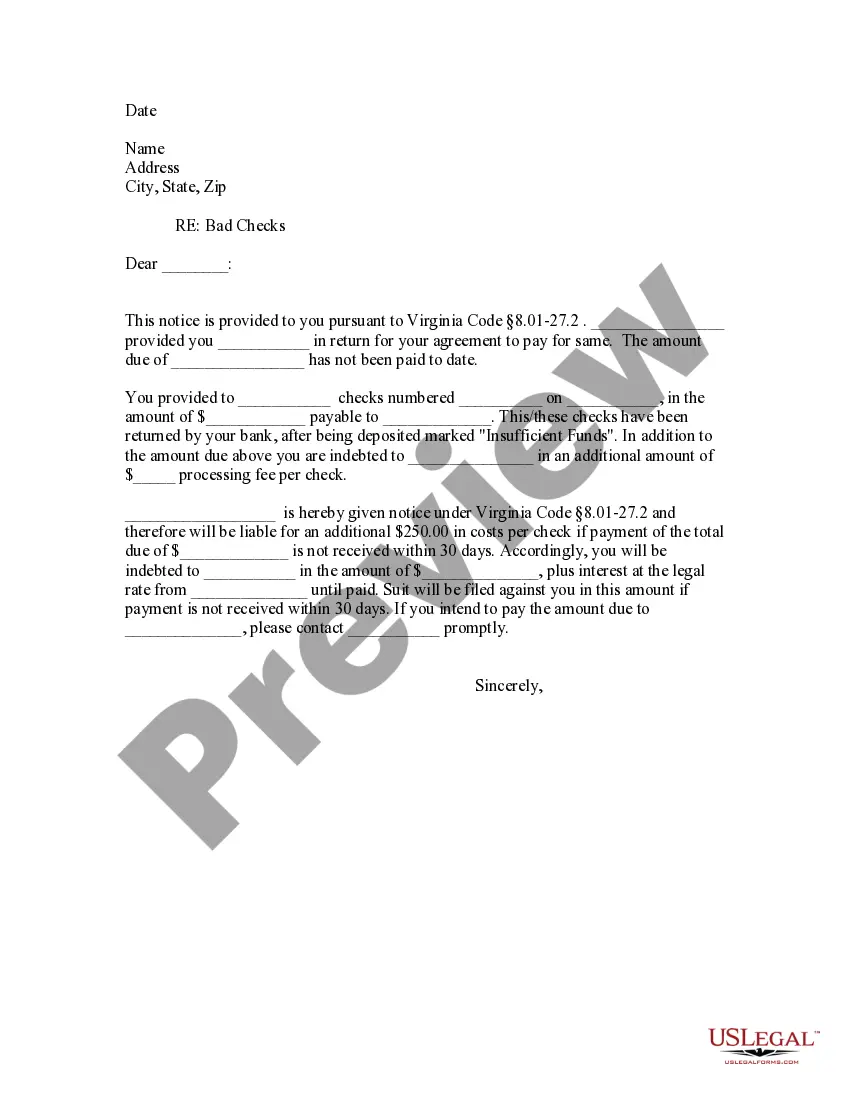

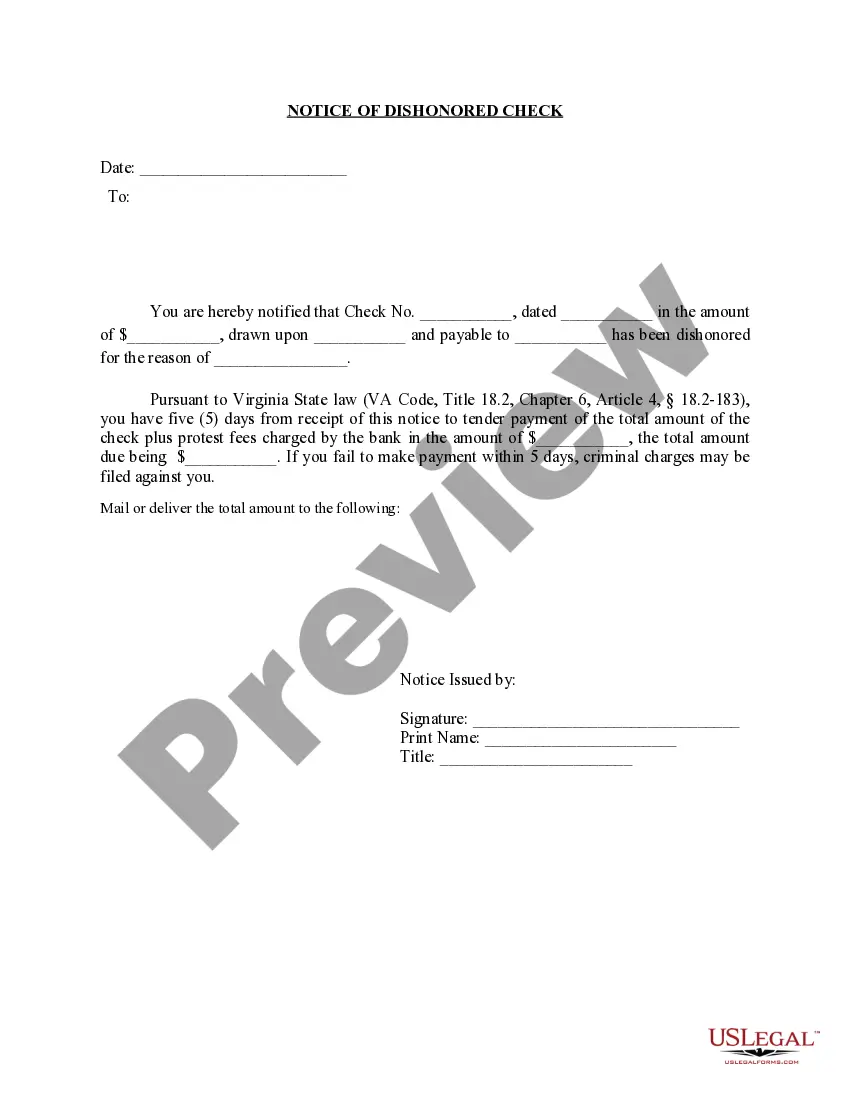

This is a Complaint - Warrant for Dishonored Check - Criminal. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding Fairfax Virginia Notice of Dishonored Check — Criminal Proceedings Introduction: In Fairfax, Virginia, the issuance of a bad check or a bounced check is considered a serious offense. When a check is dishonored due to insufficient funds or any other reason, the recipient has the right to take legal action. This article will provide a detailed description of the Fairfax Virginia Notice of Dishonored Check — Criminal, explaining the implications, legal consequences, and different types of bad checks that may be encountered. 1. What is a Bad Check? A bad check, also known as a dishonored check, refers to a check that has been returned unpaid by the bank due to insufficient funds or other prohibitory reasons. 2. Understanding a Notice of Dishonored Check — Criminal: When a check is dishonored in Fairfax, Virginia, the recipient may choose to initiate criminal proceedings against the issuer. In such cases, a Notice of Dishonored Check — Criminal is typically sent by mail or delivered personally to inform the check writer of the following: a. Legal implications: The recipient notifies the issuer of the potential criminal charges they may face for issuing a bad check. Such charges can carry penalties including fines, restitution, probation, or even imprisonment, depending on the severity and prior history of the offender. b. Demand for payment: The notice usually includes a demand for the check amount, along with any additional fees or penalties incurred due to the dishonored check. c. Timeframe for payment: The check writer is typically given a period (e.g., 10 days) to remedy the situation by making immediate payment or making arrangements. 3. Types of Bad Checks: There are different types of bad checks that can lead to a Fairfax Virginia Notice of Dishonored Check — Criminal: a. Insufficient Funds: The most common type occurs when the issuing bank account does not have enough funds to cover the check amount. b. Closed Accounts: When the check writer's bank account has been closed or is no longer active, all the checks associated with it become bad checks. c. Post-Dated Checks: If the check was post-dated (dated for a future date) and presented for payment before the specified date, it may be considered a bad check. d. Forgery: If the check was forged or issued without the account holder's knowledge or consent, it is considered a fraudulent or counterfeit check. Conclusion: Receiving a Fairfax Virginia Notice of Dishonored Check — Criminal can have serious consequences for the issuer, including potential legal charges, fines, restitution, and even imprisonment. It is essential for individuals to vigilantly ensure they have sufficient funds in their bank account before issuing checks, safeguard their checks to prevent forgery, and promptly resolve any discrepancies to avoid criminal proceedings.Title: Understanding Fairfax Virginia Notice of Dishonored Check — Criminal Proceedings Introduction: In Fairfax, Virginia, the issuance of a bad check or a bounced check is considered a serious offense. When a check is dishonored due to insufficient funds or any other reason, the recipient has the right to take legal action. This article will provide a detailed description of the Fairfax Virginia Notice of Dishonored Check — Criminal, explaining the implications, legal consequences, and different types of bad checks that may be encountered. 1. What is a Bad Check? A bad check, also known as a dishonored check, refers to a check that has been returned unpaid by the bank due to insufficient funds or other prohibitory reasons. 2. Understanding a Notice of Dishonored Check — Criminal: When a check is dishonored in Fairfax, Virginia, the recipient may choose to initiate criminal proceedings against the issuer. In such cases, a Notice of Dishonored Check — Criminal is typically sent by mail or delivered personally to inform the check writer of the following: a. Legal implications: The recipient notifies the issuer of the potential criminal charges they may face for issuing a bad check. Such charges can carry penalties including fines, restitution, probation, or even imprisonment, depending on the severity and prior history of the offender. b. Demand for payment: The notice usually includes a demand for the check amount, along with any additional fees or penalties incurred due to the dishonored check. c. Timeframe for payment: The check writer is typically given a period (e.g., 10 days) to remedy the situation by making immediate payment or making arrangements. 3. Types of Bad Checks: There are different types of bad checks that can lead to a Fairfax Virginia Notice of Dishonored Check — Criminal: a. Insufficient Funds: The most common type occurs when the issuing bank account does not have enough funds to cover the check amount. b. Closed Accounts: When the check writer's bank account has been closed or is no longer active, all the checks associated with it become bad checks. c. Post-Dated Checks: If the check was post-dated (dated for a future date) and presented for payment before the specified date, it may be considered a bad check. d. Forgery: If the check was forged or issued without the account holder's knowledge or consent, it is considered a fraudulent or counterfeit check. Conclusion: Receiving a Fairfax Virginia Notice of Dishonored Check — Criminal can have serious consequences for the issuer, including potential legal charges, fines, restitution, and even imprisonment. It is essential for individuals to vigilantly ensure they have sufficient funds in their bank account before issuing checks, safeguard their checks to prevent forgery, and promptly resolve any discrepancies to avoid criminal proceedings.