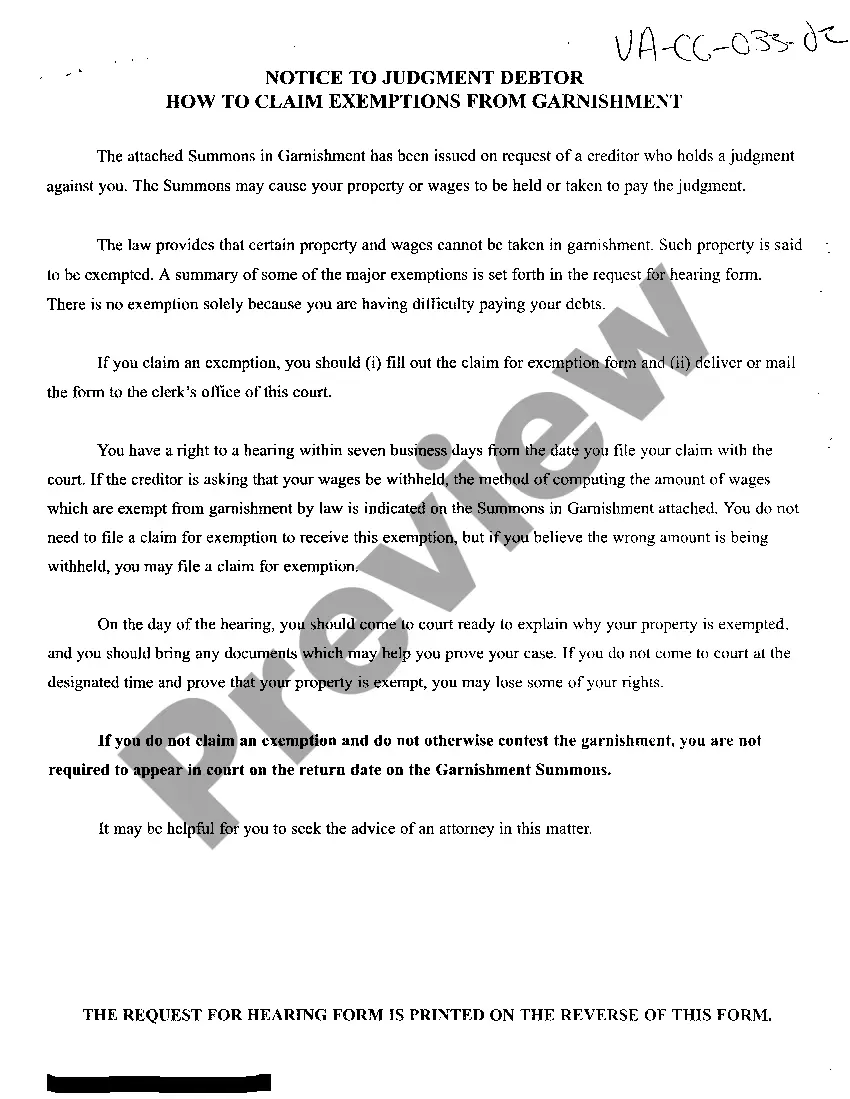

The Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment is an important legal document that provides information to individuals who have had a judgment entered against them in the Fairfax County court system. This notice informs the judgment debtor of their rights and options for protecting certain exemptions from garnishment. A judgment debtor is an individual who has been found liable for a debt or financial obligation by a court of law. Once a judgment is entered, the judgment creditor (the party owed the money) may legally attempt to collect the debt through various means, including wage garnishment. However, the judgment debtor does have certain rights and protections under Virginia law, and the Notice of Judgment Debtor How To Claim Exemptions From Garnishment explains these rights. The notice outlines the procedure for the judgment debtor to claim exemptions from garnishment, which are specific assets or income that are exempt from being taken to satisfy the debt. These exemptions vary depending on the individual's circumstances and Virginia state law. Some common exemptions in Fairfax, Virginia may include: 1. Homestead Exemption: This exemption protects the judgment debtor's primary residence up to a certain value from being subject to garnishment. 2. Personal Property Exemptions: Certain personal property, such as household furnishings, clothing, and tools of trade up to a certain value, may be exempt from garnishment. 3. Vehicle Exemption: The judgment debtor may be eligible for an exemption to protect a vehicle up to a certain value. 4. Income Exemptions: Some types of income, such as certain public assistance benefits, social security benefits, and retirement income, may be exempt from garnishment. It is crucial for the judgment debtor to carefully review the Notice of Judgment Debtor and understand their options for claiming exemptions. Failure to properly claim exemptions may result in the loss of protected assets or income. To claim exemptions from garnishment, the judgment debtor must typically complete specific forms provided by the court system and submit them within a specified timeframe. It is advisable to seek legal advice or assistance when navigating this process to ensure proper understanding and protection of their exemptions. In conclusion, the Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment provides vital information and guidance for individuals facing garnishment of their assets or income. Understanding and properly utilizing the available exemptions is essential to safeguarding one's rights and protecting essential assets.

Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment

State:

Virginia

County:

Fairfax

Control #:

VA-CC-033-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Notice of Judgment Debtor How To Claim Exemptions From Garnishment

The Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment is an important legal document that provides information to individuals who have had a judgment entered against them in the Fairfax County court system. This notice informs the judgment debtor of their rights and options for protecting certain exemptions from garnishment. A judgment debtor is an individual who has been found liable for a debt or financial obligation by a court of law. Once a judgment is entered, the judgment creditor (the party owed the money) may legally attempt to collect the debt through various means, including wage garnishment. However, the judgment debtor does have certain rights and protections under Virginia law, and the Notice of Judgment Debtor How To Claim Exemptions From Garnishment explains these rights. The notice outlines the procedure for the judgment debtor to claim exemptions from garnishment, which are specific assets or income that are exempt from being taken to satisfy the debt. These exemptions vary depending on the individual's circumstances and Virginia state law. Some common exemptions in Fairfax, Virginia may include: 1. Homestead Exemption: This exemption protects the judgment debtor's primary residence up to a certain value from being subject to garnishment. 2. Personal Property Exemptions: Certain personal property, such as household furnishings, clothing, and tools of trade up to a certain value, may be exempt from garnishment. 3. Vehicle Exemption: The judgment debtor may be eligible for an exemption to protect a vehicle up to a certain value. 4. Income Exemptions: Some types of income, such as certain public assistance benefits, social security benefits, and retirement income, may be exempt from garnishment. It is crucial for the judgment debtor to carefully review the Notice of Judgment Debtor and understand their options for claiming exemptions. Failure to properly claim exemptions may result in the loss of protected assets or income. To claim exemptions from garnishment, the judgment debtor must typically complete specific forms provided by the court system and submit them within a specified timeframe. It is advisable to seek legal advice or assistance when navigating this process to ensure proper understanding and protection of their exemptions. In conclusion, the Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment provides vital information and guidance for individuals facing garnishment of their assets or income. Understanding and properly utilizing the available exemptions is essential to safeguarding one's rights and protecting essential assets.

How to fill out Fairfax Virginia Notice Of Judgment Debtor How To Claim Exemptions From Garnishment?

If you’ve already utilized our service before, log in to your account and save the Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Fairfax Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!