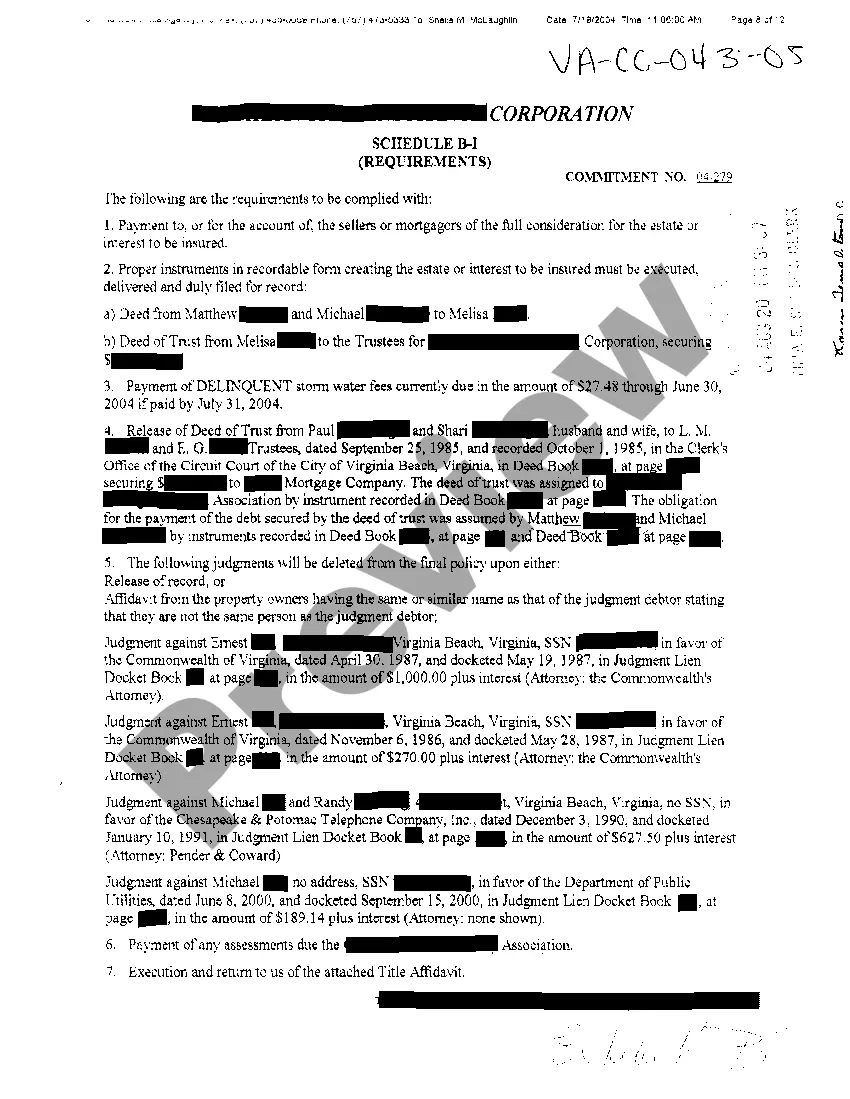

Fairfax Virginia Schedule B-I Mortgage Compliance Requirements encompass a specific set of regulations that mortgage lenders and borrowers in Fairfax, Virginia must adhere to during the mortgage lending process. These requirements aim to ensure the transparency, accuracy, and legality of mortgage transactions within the jurisdiction. Here are the different types of Fairfax Virginia Schedule B-I Mortgage Compliance Requirements: 1. Loan Application Documentation: Lenders operating in Fairfax, Virginia need to obtain and verify specific documents from borrowers when processing mortgage loan applications. These documents typically include income verification, credit history, employment records, tax returns, and property-related information. 2. Disclosure Requirements: Lenders must comply with disclosure regulations, providing borrowers with comprehensive information about loan terms, interest rates, potential fees, and closing costs. These disclosures enable borrowers to fully understand the terms and conditions of their mortgage before making a binding commitment. 3. Truth in Lending Act (TILL): Fairfax Virginia Schedule B-I Mortgage Compliance Requirements also encompass TILL provisions, which mandate lenders to disclose the Annual Percentage Rate (APR), repayment terms, and other loan costs to borrowers accurately. TILL aims to prevent predatory lending practices and promote fair lending. 4. Equal Credit Opportunity Act (ECO): ECO prohibits lenders from discriminating against borrowers based on race, color, religion, national origin, sex, marital status, or age. Compliance with ECO ensures that all mortgage applicants in Fairfax, Virginia receive equal treatment in the loan approval process. 5. Fair Housing Act (FHA): The FHA is a federal law governing fair housing practices, intending to prevent discrimination in the housing market. Lenders must adhere to FHA guidelines to avoid any discriminatory practices during the mortgage lending process. 6. Appraisal Requirements: Fairfax Virginia Schedule B-I Mortgage Compliance Requirements also include adherence to appraisal regulations. Lenders need to engage licensed appraisers to determine the fair market value of the property being financed. This ensures the accuracy and reliability of property valuations. 7. Consumer Financial Protection Bureau (CFPB) Regulations: Lenders must comply with various CFPB regulations, such as the Know Before You Owe rule (RESPA-TILA Integrated Disclosure Rule) and the Loan Originator Compensation Rule. These regulations aim to protect consumers by promoting transparency, preventing deceptive practices, and ensuring fair compensation for loan originators. By complying with Fairfax Virginia Schedule B-I Mortgage Compliance Requirements, mortgage lenders and borrowers can navigate the mortgage lending process with confidence, knowing that they are adhering to local, state, and federal regulations. It is essential for lenders to stay up-to-date with changes in these requirements to maintain compliance and foster a fair and transparent mortgage industry in Fairfax, Virginia.

Fairfax Virginia Schedule B-I Mortgage Compliance Requirements

Description

How to fill out Fairfax Virginia Schedule B-I Mortgage Compliance Requirements?

If you are looking for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms site – one of the most considerable online libraries. With this library, you can get a large number of document samples for organization and individual purposes by types and states, or keywords. With the high-quality search option, finding the most recent Fairfax Virginia Schedule B-I Mortgage Compliance Requirements is as easy as 1-2-3. In addition, the relevance of each and every file is proved by a team of professional attorneys that on a regular basis check the templates on our platform and update them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Fairfax Virginia Schedule B-I Mortgage Compliance Requirements is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have found the sample you require. Check its explanation and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to get the needed file.

- Affirm your selection. Choose the Buy now option. Next, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Pick the format and save it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Fairfax Virginia Schedule B-I Mortgage Compliance Requirements.

Each form you save in your user profile does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you need to get an additional copy for modifying or creating a hard copy, feel free to return and export it once more anytime.

Take advantage of the US Legal Forms extensive collection to gain access to the Fairfax Virginia Schedule B-I Mortgage Compliance Requirements you were looking for and a large number of other professional and state-specific templates in one place!