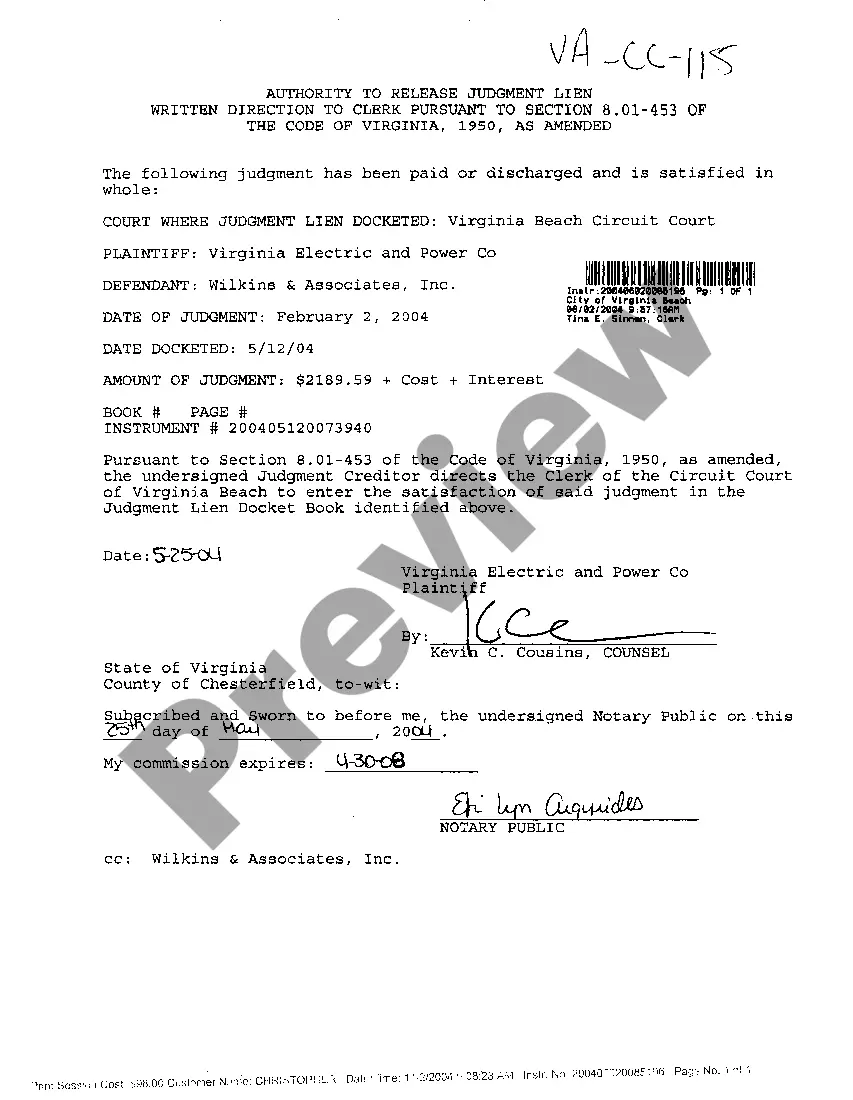

Fairfax County, located in Virginia, has specific guidelines and procedures in place for the Authority to Release Judgment Lien. A judgment lien occurs when a court grants a creditor the right to claim a debtor's property in case of non-payment. Once the debt is settled, the creditor must file for a release of the judgment lien to free the debtor's property from the claim. The Fairfax Virginia Authority to Release Judgment Lien process outlines the necessary steps to cancel or release the judgment lien on a property. This procedure ensures that the debtor's property rights are protected and that the lien no longer encumbers their assets. To initiate the Fairfax Virginia Authority to Release Judgment Lien, the creditor must file a release form with the Fairfax County Circuit Court. The release form requires essential information such as the names of the creditor and debtor, the case number, and a detailed description of the property subject to the lien. It is vital to accurately provide this information to expedite the release process. Within the Fairfax County Circuit Court, there are various types of Fairfax Virginia Authority to Release Judgment Lien: 1. Real Property Authority to Release Judgment Lien: This type of release is specific to judgment liens placed on real estate or properties owned by the debtor in Fairfax County. The release ensures that the property can be freely transferred or sold without any encumbrance from the judgment lien. 2. Personal Property Authority to Release Judgment Lien: In cases where the judgment lien is on personal property, such as vehicles, boats, or other assets, the creditor must follow the Fairfax Virginia Authority to Release Judgment Lien for personal property. This release allows the debtor to regain full control and ownership of the personal property being held as collateral. 3. Bankruptcy Authority to Release Judgment Lien: If the judgment lien is related to a bankruptcy case, there may be additional steps involved in obtaining the Fairfax Virginia Authority to Release Judgment Lien. The debtor must comply with bankruptcy laws and regulations to have the lien released. It is crucial to consult with an attorney or legal professional specializing in judgment liens to ensure compliance with Fairfax Virginia's specific requirements. Filing for the Authority to Release Judgment Lien promptly and accurately will help resolve any disputes and allow the debtor to restore their property rights.

Fairfax Virginia Authority To Release Judgment Lien

Description

How to fill out Fairfax Virginia Authority To Release Judgment Lien?

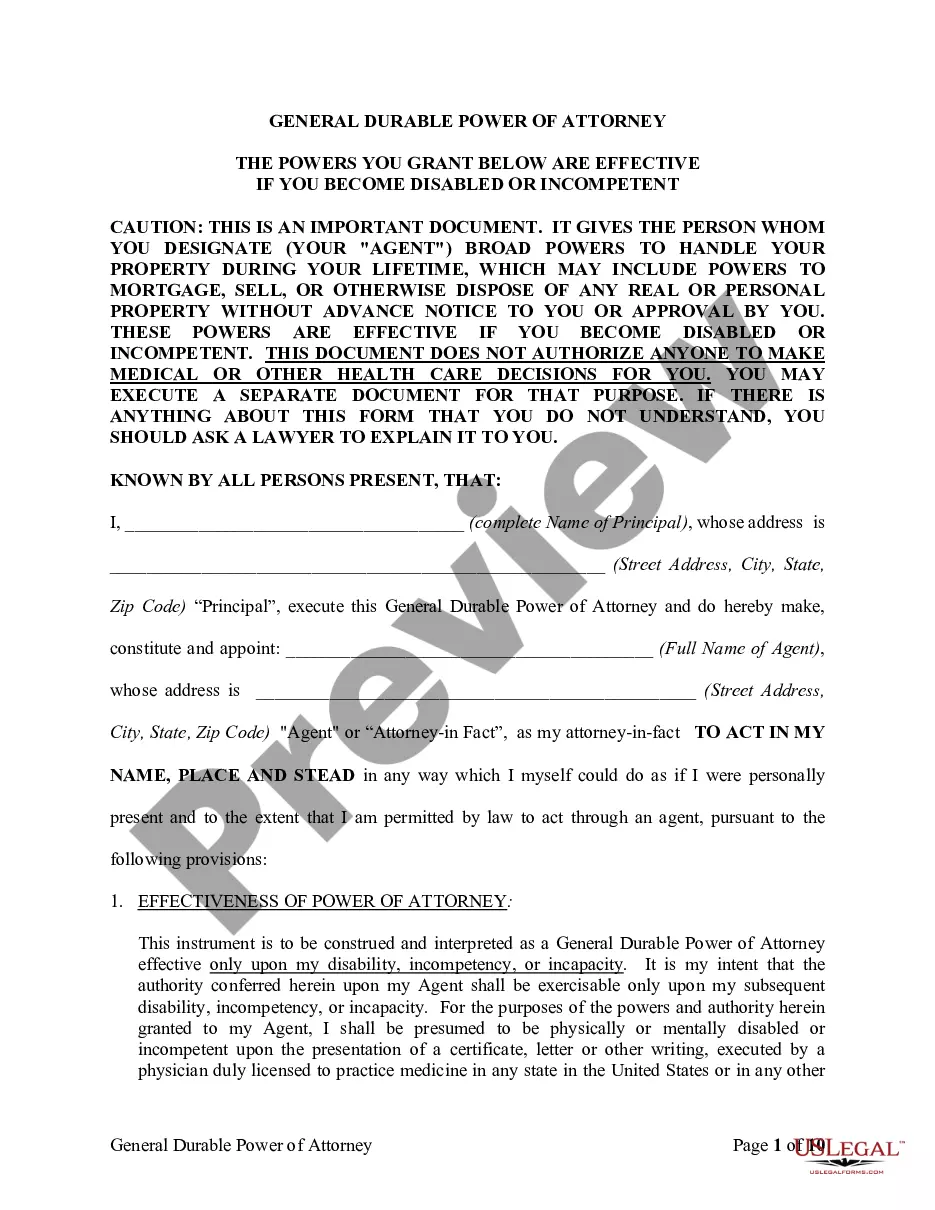

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Fairfax Virginia Authority To Release Judgment Lien or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Fairfax Virginia Authority To Release Judgment Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Fairfax Virginia Authority To Release Judgment Lien would work for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

If a judgment has been entered against you, there are a few options available to you. These include paying the judgment, appealing the case, or filing a motion to rehear. If you fail to act, a number of other actions initiated by the Judgment Creditor may occur.

Copies or Search for UCC/Tax Lien Filings Requests must be made on the Information Request Form (UCC11). To ascertain the number of pages in a document and determine the proper amount of payment for your request, contact the Clerk's Office at (804) 371-9733 or toll-free in Virginia at 1-866-722-2551.

To collect on the judgment, you must complete the following three tasks: Locate the debtor's assets (as many as possible) Attach the judgment to the assets by placing a lien on the assets (called a ?judgment lien?) Obtain the assets to satisfy the judgment (the process of liquidation or foreclosure).

To collect on the judgment, you must complete the following three tasks: Locate the debtor's assets (as many as possible) Attach the judgment to the assets by placing a lien on the assets (called a ?judgment lien?) Obtain the assets to satisfy the judgment (the process of liquidation or foreclosure).

The new law is contained in Virginia Code section 8.01-251. Virginia law allows a judgment creditor to sue to compel sale of real estate owned in whole or in part by the judgment debtor in order to pay the judgment.

Under the new Virginia law that became effective January 1, 2022, judgments entered in a Virginia circuit court after July 1, 2021, have a 10-year limitations period and may only be extended up to two additional 10-year periods, for a maximum limitations period of 30 years.

No execution shall be issued and no action brought on a judgment dated on or after July 1, 2021, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 10 years from the date of such judgment or domestication of such judgment, unless the period is extended as

How long does a judgment lien last in Virginia? A judgment lien in Virginia will remain attached to the debtor's property (even if the property changes hands) for ten years.

If a judgment has been entered against you, there are a few options available to you. These include paying the judgment, appealing the case, or filing a motion to rehear. If you fail to act, a number of other actions initiated by the Judgment Creditor may occur.

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.