Fairfax Virginia Tax Assessment Real And Personal Property refers to the process by which the Fairfax County government determines the value of both real estate and personal property for taxation purposes. The assessment is carried out annually and helps the county government in determining the amount of property taxes that individuals and businesses need to pay. Real Property Assessment: Real property refers to land and any structures built on it, including residential, commercial, and industrial properties. In Fairfax County, the real property assessment is conducted by the Department of Tax Administration (DTA). The assessment takes into account various factors such as property size, location, condition, and market sales data. The DTA employs licensed appraisers who use advanced valuation techniques to determine the fair market value of each property. All real property is assessed at 100% of its fair market value. Personal Property Assessment: Personal property includes all movable assets that individuals or businesses own, such as vehicles, machinery, equipment, and furniture. Fairfax County also assesses personal property to levy taxes on these assets. Personal property assessment helps in ensuring that taxes are levied on all taxable assets, including those not fixed to real property. The personal property assessment is also conducted by the Department of Tax Administration. Different Types of Fairfax Virginia Tax Assessment Real And Personal Property: 1. Residential Property Assessment: This type of assessment is specific to residential properties like single-family homes, townhouses, and condominiums. Residential property assessments are based on factors such as property size, location, condition, and recent sales of similar properties in the area. 2. Commercial Property Assessment: The assessment of commercial properties, including offices, retail stores, and industrial properties, involves the evaluation of factors such as location, size, land use, building condition, and income potential. The fair market value of the commercial properties is determined using industry-specific valuation techniques. 3. Personal Property Assessment: Personal property assessment covers all movable assets, including vehicles, boats, recreational vehicles, business equipment, machinery, and furnishings. The Department of Tax Administration determines the value of personal property based on factors such as age, condition, and market depreciation. It is important for property owners in Fairfax County to understand the tax assessment process and the various factors considered ensuring accurate and fair property taxation. Property owners should review their property assessments each year to verify their accuracy and may file an appeal if they believe the assessment is incorrect. The revenue generated from property taxes plays a vital role in funding essential public services and infrastructure within Fairfax County.

Fairfax Va Real Estate Tax Assessment

State:

Virginia

County:

Fairfax

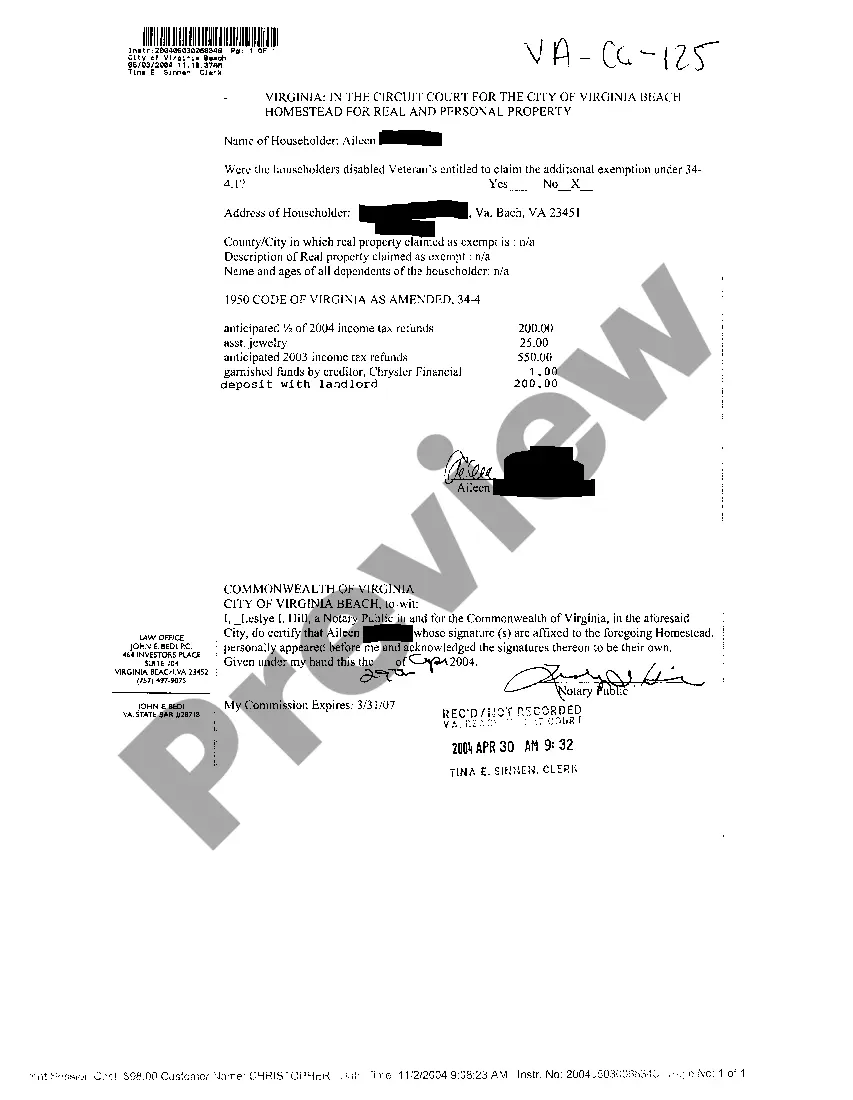

Control #:

VA-CC-125

Format:

PDF

Instant download

This form is available by subscription

Description fairfax city personal property tax

Tax Assessment Real And Personal Property

Fairfax Virginia Tax Assessment Real And Personal Property refers to the process by which the Fairfax County government determines the value of both real estate and personal property for taxation purposes. The assessment is carried out annually and helps the county government in determining the amount of property taxes that individuals and businesses need to pay. Real Property Assessment: Real property refers to land and any structures built on it, including residential, commercial, and industrial properties. In Fairfax County, the real property assessment is conducted by the Department of Tax Administration (DTA). The assessment takes into account various factors such as property size, location, condition, and market sales data. The DTA employs licensed appraisers who use advanced valuation techniques to determine the fair market value of each property. All real property is assessed at 100% of its fair market value. Personal Property Assessment: Personal property includes all movable assets that individuals or businesses own, such as vehicles, machinery, equipment, and furniture. Fairfax County also assesses personal property to levy taxes on these assets. Personal property assessment helps in ensuring that taxes are levied on all taxable assets, including those not fixed to real property. The personal property assessment is also conducted by the Department of Tax Administration. Different Types of Fairfax Virginia Tax Assessment Real And Personal Property: 1. Residential Property Assessment: This type of assessment is specific to residential properties like single-family homes, townhouses, and condominiums. Residential property assessments are based on factors such as property size, location, condition, and recent sales of similar properties in the area. 2. Commercial Property Assessment: The assessment of commercial properties, including offices, retail stores, and industrial properties, involves the evaluation of factors such as location, size, land use, building condition, and income potential. The fair market value of the commercial properties is determined using industry-specific valuation techniques. 3. Personal Property Assessment: Personal property assessment covers all movable assets, including vehicles, boats, recreational vehicles, business equipment, machinery, and furnishings. The Department of Tax Administration determines the value of personal property based on factors such as age, condition, and market depreciation. It is important for property owners in Fairfax County to understand the tax assessment process and the various factors considered ensuring accurate and fair property taxation. Property owners should review their property assessments each year to verify their accuracy and may file an appeal if they believe the assessment is incorrect. The revenue generated from property taxes plays a vital role in funding essential public services and infrastructure within Fairfax County.

How to fill out Fairfax Virginia Tax Assessment Real And Personal Property?

If you’ve already utilized our service before, log in to your account and save the Fairfax Virginia Tax Assessment Real And Personal Property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Fairfax Virginia Tax Assessment Real And Personal Property. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!