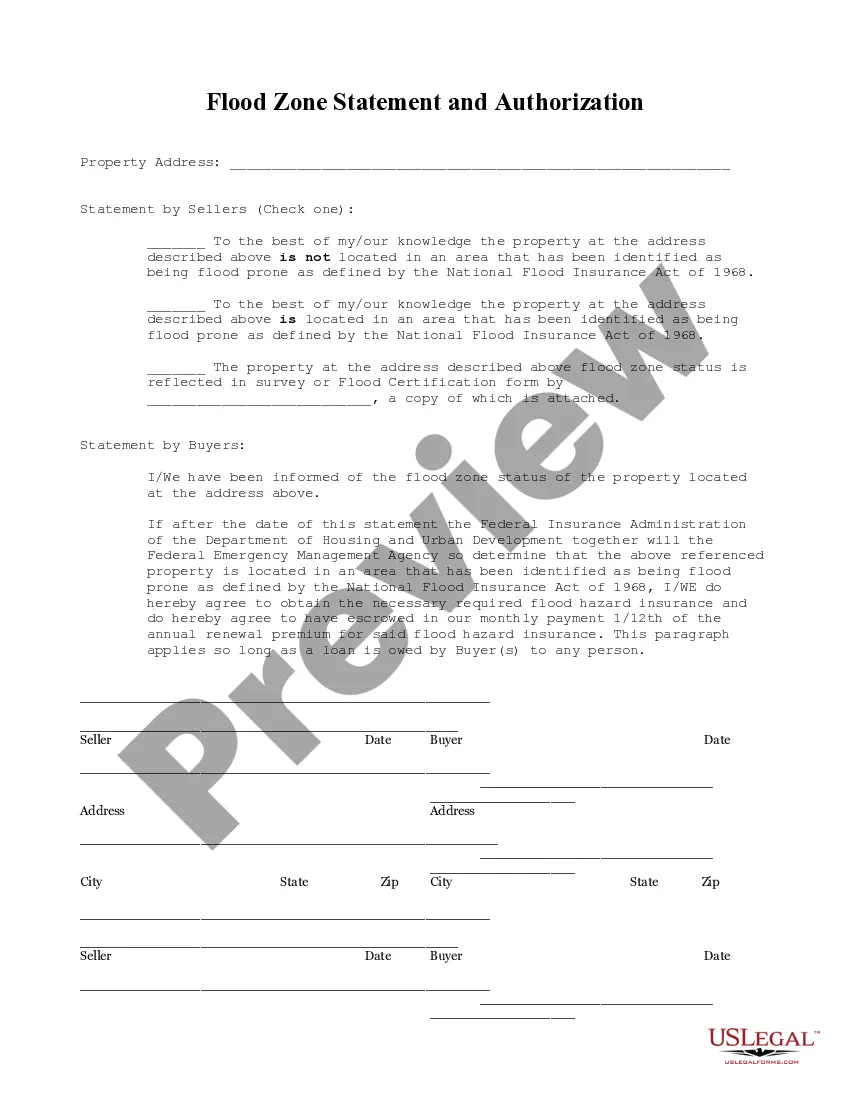

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

The Fairfax Virginia Flood Zone Statement and Authorization is a legal document issued by the Fairfax County government to provide information related to flood zones within the county. This statement and authorization is of utmost importance for property owners, potential buyers, insurance agencies, and lenders as it determines the level of risk associated with flooding in a specific area. The Fairfax Virginia Flood Zone Statement and Authorization provides an in-depth analysis of flood-prone areas within the county and provides valuable information regarding the potential impact on properties located in these zones. It includes details on the floodplain maps, flood hazard areas, and identifies if a property is located in a Special Flood Hazard Area (FHA). The SFH As are areas with a higher risk of flooding and are therefore subject to more stringent building regulations, insurance requirements, and potential financial impacts. The statement and authorization also highlights the flood zone classifications, such as Zone A, Zone AE, or Zone X, to indicate the likelihood and severity of flooding. This information is used by property owners and buyers to evaluate the need for flood insurance coverage, assess the potential impact on property values, and make informed decisions. There are several types of Fairfax Virginia Flood Zone Statement and Authorization, each catering to specific needs and purposes. These include: 1. Flood Zone Determination: This type of statement identifies the flood zone designation for a specific property, indicating the level of flood risk associated with that location. 2. Elevation Certificate: An elevation certificate is a specific type of statement and authorization that provides information on the elevation of a property's lowest floor, its relation to the base flood elevation, and other relevant elevation data. It is often required by insurance companies to determine flood insurance premiums. 3. Letter of Map Amendment (COMA) or Letter of Map Revision-Based on Fill (LORD): These statements and authorizations involve the property owner or affected party requesting a revision or amendment to the floodplain map due to changes in topography, mitigation measures, or other factors that may reduce the flood risk for a specific property. Obtaining the Fairfax Virginia Flood Zone Statement and Authorization is crucial for anyone involved in real estate transactions, as it provides indispensable information about flood risks and associated requirements. By understanding flood zones and their classifications, stakeholder scan make informed decisions regarding insurance coverage, property development, and overall risk assessment, ultimately ensuring the safety and well-being of their investments and livelihoods.