This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fairfax Virginia Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Virginia Living Trust For Husband And Wife With Minor And Or Adult Children?

If you’ve previously utilized our service, Log In to your account and save the Fairfax Virginia Living Trust for Husband and Wife with Minor and/or Adult Children on your device by selecting the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your file.

You have continuous access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

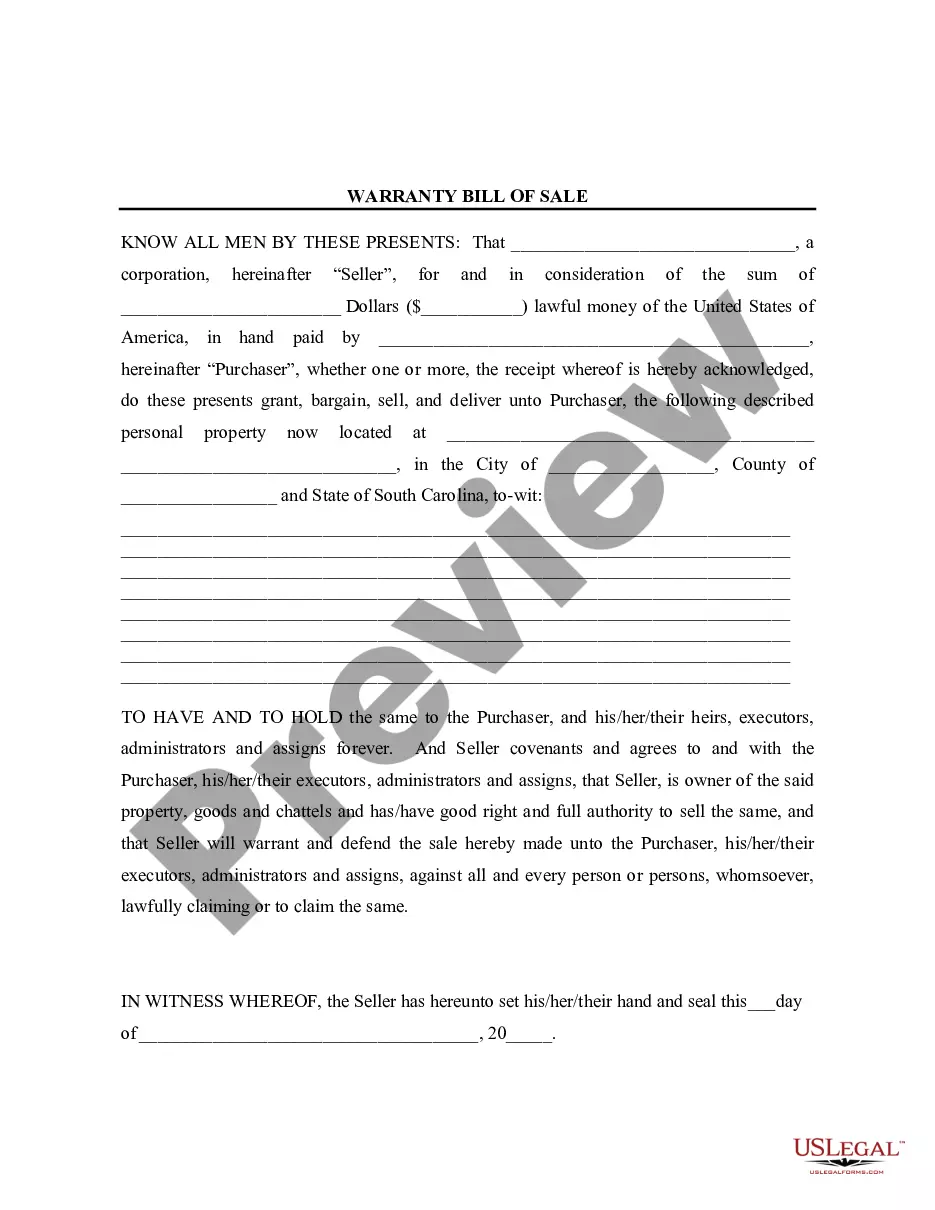

- Ensure you’ve identified a suitable document. Browse the description and use the Preview option, if available, to determine if it fulfills your needs. If it doesn’t suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize a payment. Use your credit card information or the PayPal option to complete the transaction.

- Obtain your Fairfax Virginia Living Trust for Husband and Wife with Minor and/or Adult Children. Select the file format for your document and save it onto your device.

- Complete your form. Print it or make use of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Setting up a trust account in Virginia involves selecting a bank or financial institution that offers trust services. Furthermore, you will need the trust document and identification to initiate the account. If you create a Fairfax Virginia Living Trust for Husband and Wife with Minor and or Adult Children, it is wise to have a trusted financial advisor assist you with this process. By using USLegalForms, you can find templates and guidance to facilitate establishing your trust account.

To file a living trust in Virginia, you generally need to prepare the trust document, which outlines the terms, beneficiaries, and trustees. You will need to sign the document in the presence of a notary to make it legally binding. If you establish a Fairfax Virginia Living Trust for Husband and Wife with Minor and or Adult Children, you should also transfer assets into the trust after its creation. Utilizing platforms like USLegalForms can help simplify the document preparation process.

In Virginia, any individual who is involved in an estate or the administration of a living trust can file a list of heirs. This typically includes the executor or administrator of an estate, but it can also involve family members or legal representatives. If you have a Fairfax Virginia Living Trust for Husband and Wife with Minor and or Adult Children, you may need to include your heirs for proper distribution. It's crucial to ensure that all heirs are accurately identified to avoid complications.

A living trust in Virginia is an estate planning option that allows you to place your assets in trust while continuing to use and control them. The trust passes the assets to your beneficiaries after your death. A revocable living trust (inter vivos trust) offers unique control and flexibility.

Which Assets are Not Considered Probate Assets? Life insurance or 401(k) accounts where a beneficiary was named. Assets under a Living Trust. Funds, securities, or US savings bonds that are registered on transfer on death (TOD) or payable on death (POD) forms. Funds held in a pension plan.

A will can't distribute assets unless there is a probate court. Thus, a trust saves taxpayers time and money in the long run. You can avoid probate in any state if you own property and have a trust. Virginia has a small estate procedure if you own under $50,000 worth of property in the state.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.

Living Trusts In Virginia, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Living Trusts In Virginia, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate assets can include vehicles, real estate, bank and brokerage accounts, and personal belongings (for example, jewelry, home furnishings, artwork, and collections). Life insurance proceeds that are payable to the estate (not a named beneficiary) are also probate assets.