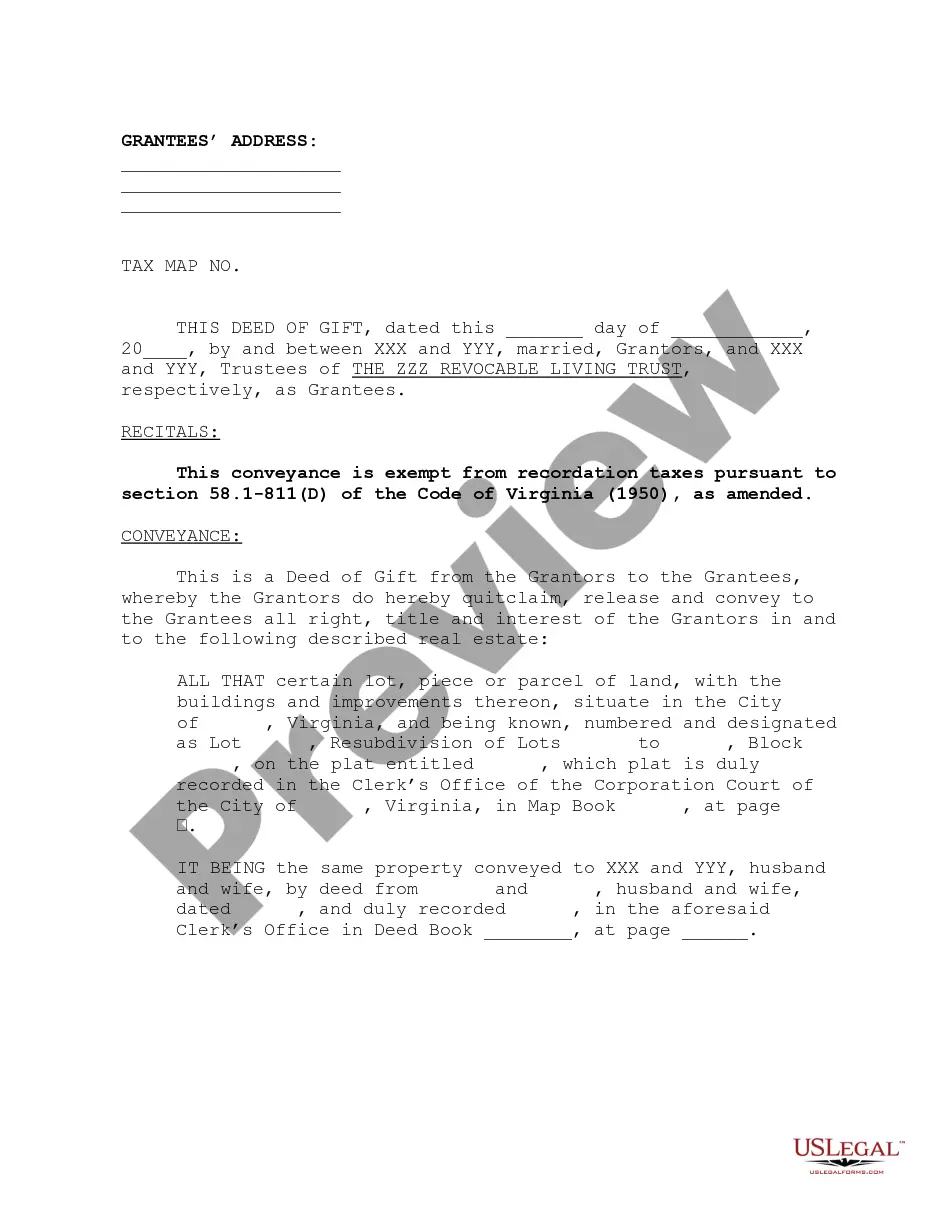

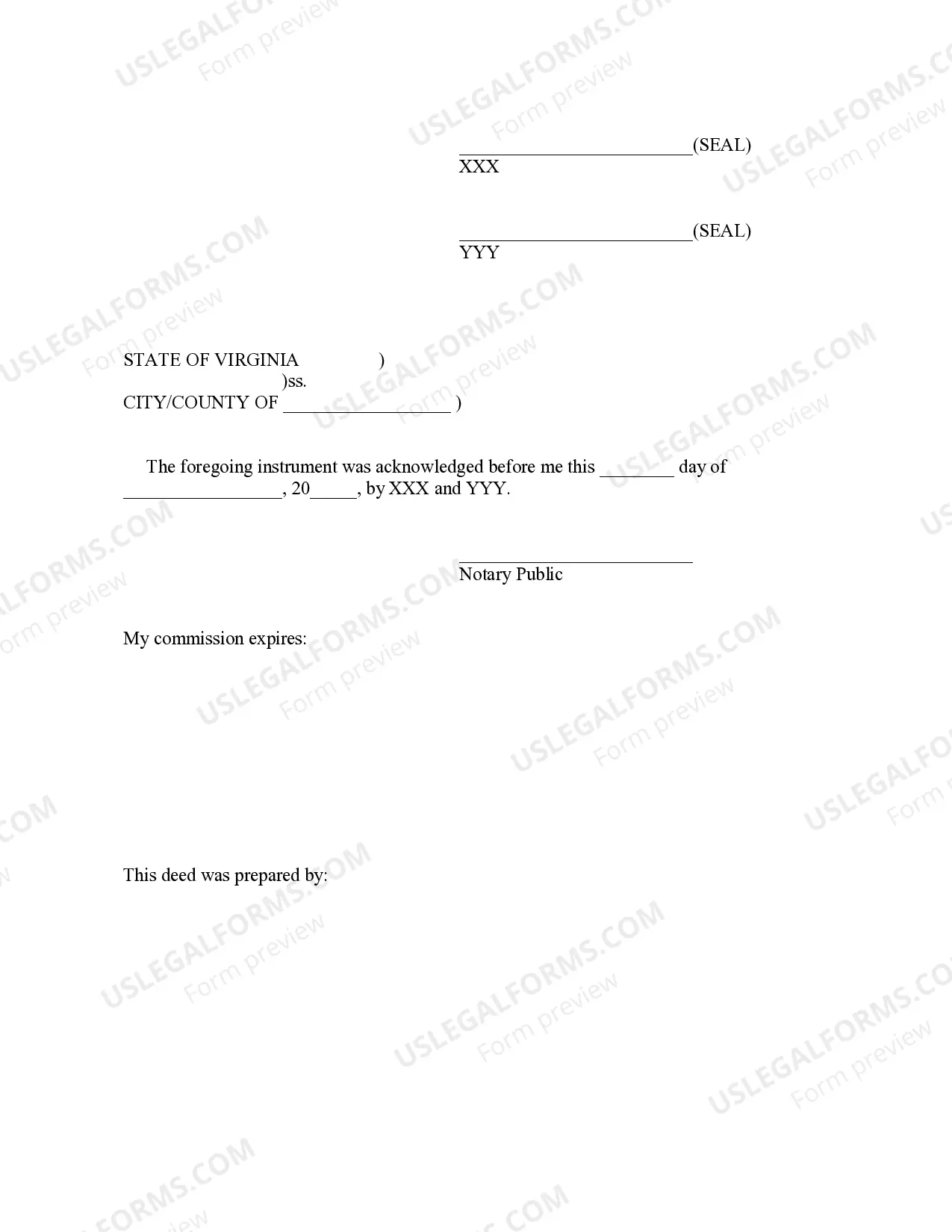

This is a form for a deed of gift from a married couple to Trustees of Revocable Living Trust. A Revocable Living Trust is designed to allow a Settlor (person establishing the Trust) to ensure that his/her estate does not require court-supervised probate.

Fairfax Virginia Deed of Gift to Trust by Husband and Wife is a legal document that allows spouses in Fairfax, Virginia, to transfer their assets into a trust for various purposes. This instrument is based on the principles of property ownership, estate planning, and asset protection. By employing a Fairfax Virginia Deed of Gift to Trust, couples can efficiently manage their assets and ensure their preservation for future generations. Keywords: Fairfax Virginia, Deed of Gift to Trust, Husband and Wife, legal document, transfer assets, trust, property ownership, estate planning, asset protection, manage assets, preservation, future generations. There are different types of Fairfax Virginia Deeds of Gift to Trust by Husband and Wife, including: 1. Revocable Living Trust: A revocable living trust allows spouses to transfer ownership of their assets to the trust while maintaining control and the ability to alter or revoke the trust during their lifetimes. Upon the death of the last spouse, the trust becomes irrevocable and beneficiaries are designated to receive the assets. 2. Irrevocable Trust: An irrevocable trust is a more permanent form of trust where the assets contributed by the husband and wife cannot be altered or taken back without the consent of the beneficiaries. This type of trust can offer various tax advantages and asset protection benefits. 3. Medicaid Asset Protection Trust: This type of trust is specifically designed to protect assets while meeting the requirements for Medicaid eligibility. By transferring assets to this trust, spouses can potentially safeguard their wealth from being depleted due to long-term care costs, while still qualifying for Medicaid benefits. 4. Charitable Remainder Trust (CRT): A CRT allows spouses to contribute assets to a trust and receive a stream of income during their lifetime. After their passing, the remaining assets are distributed to the designated charitable organizations. This type of trust offers tax benefits and allows couples to support causes they care about. 5. Special Needs Trust: A special needs trust is established to protect the assets of a disabled spouse while allowing them to qualify for government benefits such as Medicaid or Supplemental Security Income. This trust ensures that the individual's financial needs are met without jeopardizing their eligibility for crucial assistance programs. 6. Qualified Personnel Residence Trust (PRT): A PRT allows couples to transfer their primary residence or vacation home into a trust while retaining the right to live in it for a specified period. This type of trust can provide estate tax benefits and enable the passing on of a property without incurring excessive taxes. By choosing the appropriate Fairfax Virginia Deed of Gift to Trust by Husband and Wife, couples can effectively protect and manage their assets while achieving their specific financial objectives and ensuring a smooth transition of wealth for future generations.Fairfax Virginia Deed of Gift to Trust by Husband and Wife is a legal document that allows spouses in Fairfax, Virginia, to transfer their assets into a trust for various purposes. This instrument is based on the principles of property ownership, estate planning, and asset protection. By employing a Fairfax Virginia Deed of Gift to Trust, couples can efficiently manage their assets and ensure their preservation for future generations. Keywords: Fairfax Virginia, Deed of Gift to Trust, Husband and Wife, legal document, transfer assets, trust, property ownership, estate planning, asset protection, manage assets, preservation, future generations. There are different types of Fairfax Virginia Deeds of Gift to Trust by Husband and Wife, including: 1. Revocable Living Trust: A revocable living trust allows spouses to transfer ownership of their assets to the trust while maintaining control and the ability to alter or revoke the trust during their lifetimes. Upon the death of the last spouse, the trust becomes irrevocable and beneficiaries are designated to receive the assets. 2. Irrevocable Trust: An irrevocable trust is a more permanent form of trust where the assets contributed by the husband and wife cannot be altered or taken back without the consent of the beneficiaries. This type of trust can offer various tax advantages and asset protection benefits. 3. Medicaid Asset Protection Trust: This type of trust is specifically designed to protect assets while meeting the requirements for Medicaid eligibility. By transferring assets to this trust, spouses can potentially safeguard their wealth from being depleted due to long-term care costs, while still qualifying for Medicaid benefits. 4. Charitable Remainder Trust (CRT): A CRT allows spouses to contribute assets to a trust and receive a stream of income during their lifetime. After their passing, the remaining assets are distributed to the designated charitable organizations. This type of trust offers tax benefits and allows couples to support causes they care about. 5. Special Needs Trust: A special needs trust is established to protect the assets of a disabled spouse while allowing them to qualify for government benefits such as Medicaid or Supplemental Security Income. This trust ensures that the individual's financial needs are met without jeopardizing their eligibility for crucial assistance programs. 6. Qualified Personnel Residence Trust (PRT): A PRT allows couples to transfer their primary residence or vacation home into a trust while retaining the right to live in it for a specified period. This type of trust can provide estate tax benefits and enable the passing on of a property without incurring excessive taxes. By choosing the appropriate Fairfax Virginia Deed of Gift to Trust by Husband and Wife, couples can effectively protect and manage their assets while achieving their specific financial objectives and ensuring a smooth transition of wealth for future generations.