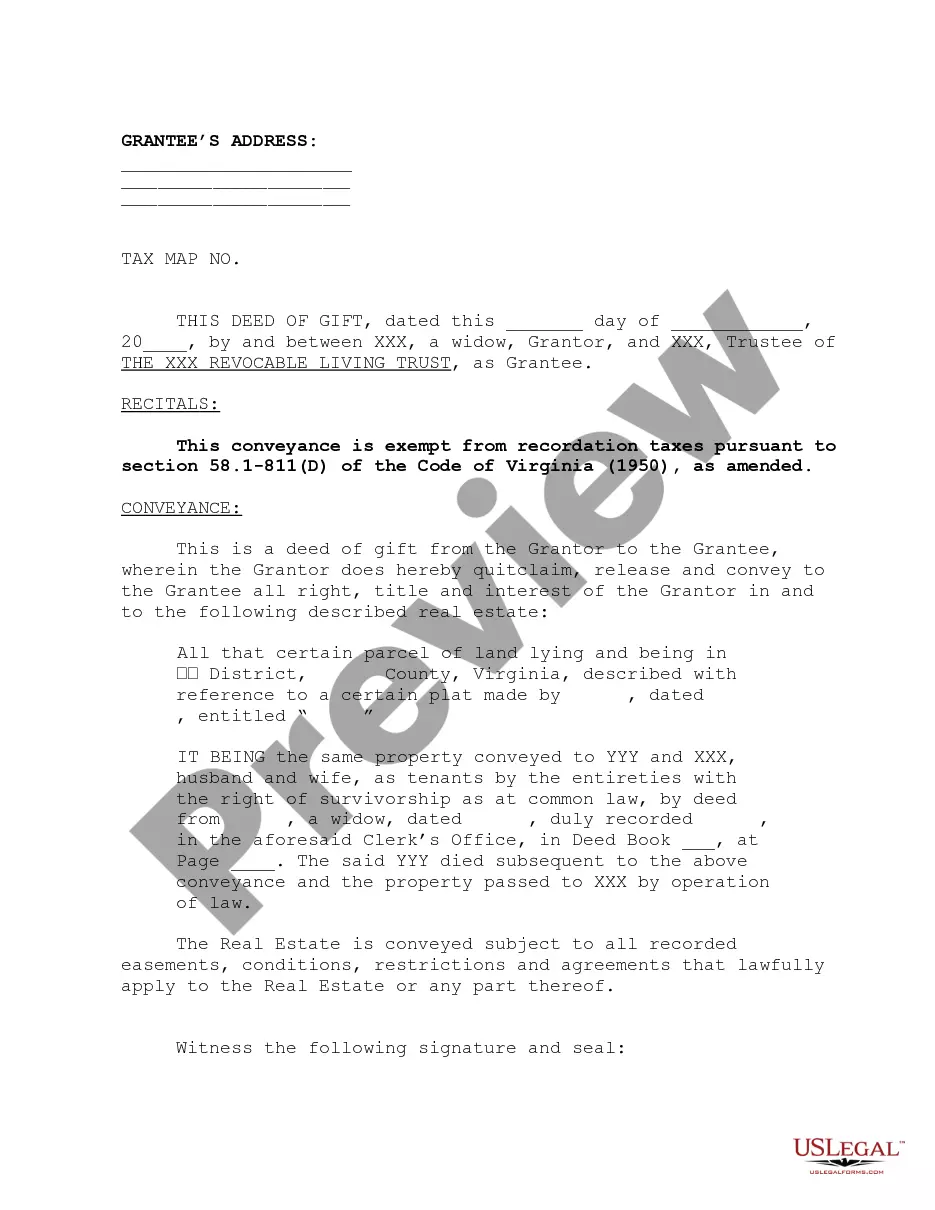

This is a form for a deed of gift of property from a single widow to Trustee of Revocable Living Trust.

A Revocable Living Trust is designed to allow a Settlor (person establishing the Trust) to ensure that his/her estate does not require court-supervised probate.

The Fairfax Virginia Deed of Gift to Trust by Single Widow is a legal document that outlines the transfer of property or assets from a single widow to a trust. This deed serves as a way to protect and manage the widow's assets while ensuring their distribution according to her wishes. By creating a trust, the widow can provide for her beneficiaries, such as children or other family members, while maintaining control over the assets during her lifetime. Keywords: Fairfax Virginia Deed of Gift, Trust, Single Widow, Property, Assets, Transfer, Legal document, Protection, Management, Distribution, Beneficiaries, Control, Lifetime. There are different types of Fairfax Virginia Deed of Gift to Trust by Single Widow that can be tailored to meet specific needs and circumstances. Here are a few examples: 1. Revocable Living Trust: A revocable living trust allows the single widow to maintain full control and ownership of the assets while she is alive. She can modify or revoke the trust at any time, and upon her death, the assets are distributed to the beneficiaries as specified in the trust documents. 2. Irrevocable Trust: An irrevocable trust transfers ownership and control of the assets to the trust permanently. Once the assets are placed in the trust, the widow no longer has the power to modify or revoke the trust. This type of trust provides more asset protection and potential tax benefits but may limit the widow's control over the assets. 3. Testamentary Trust: A testamentary trust is established through the widow's will and takes effect upon her death. This type of trust allows the widow to include specific provisions and instructions regarding the distribution of assets to her beneficiaries. Unlike living trusts, testamentary trusts do not provide immediate asset management during the widow's lifetime. 4. Special Needs Trust: If the widow has a disabled or special needs' child, she may choose to create a special needs trust. This type of trust safeguards the child's eligibility for government benefits while still providing supplemental support and care from the trust's assets. 5. Charitable Remainder Trust: A charitable remainder trust allows the widow to donate assets to a chosen charity while retaining an income stream from the trust during her lifetime. Upon her death, the remaining assets are distributed to the designated charity. These different types of Fairfax Virginia Deed of Gift to Trust by Single Widow provide flexibility and options for individuals to protect and manage their assets while ensuring the well-being of their loved ones and favorite causes. It is essential to consult with an experienced estate planning attorney to determine which type of trust aligns best with the single widow's goals and circumstances.The Fairfax Virginia Deed of Gift to Trust by Single Widow is a legal document that outlines the transfer of property or assets from a single widow to a trust. This deed serves as a way to protect and manage the widow's assets while ensuring their distribution according to her wishes. By creating a trust, the widow can provide for her beneficiaries, such as children or other family members, while maintaining control over the assets during her lifetime. Keywords: Fairfax Virginia Deed of Gift, Trust, Single Widow, Property, Assets, Transfer, Legal document, Protection, Management, Distribution, Beneficiaries, Control, Lifetime. There are different types of Fairfax Virginia Deed of Gift to Trust by Single Widow that can be tailored to meet specific needs and circumstances. Here are a few examples: 1. Revocable Living Trust: A revocable living trust allows the single widow to maintain full control and ownership of the assets while she is alive. She can modify or revoke the trust at any time, and upon her death, the assets are distributed to the beneficiaries as specified in the trust documents. 2. Irrevocable Trust: An irrevocable trust transfers ownership and control of the assets to the trust permanently. Once the assets are placed in the trust, the widow no longer has the power to modify or revoke the trust. This type of trust provides more asset protection and potential tax benefits but may limit the widow's control over the assets. 3. Testamentary Trust: A testamentary trust is established through the widow's will and takes effect upon her death. This type of trust allows the widow to include specific provisions and instructions regarding the distribution of assets to her beneficiaries. Unlike living trusts, testamentary trusts do not provide immediate asset management during the widow's lifetime. 4. Special Needs Trust: If the widow has a disabled or special needs' child, she may choose to create a special needs trust. This type of trust safeguards the child's eligibility for government benefits while still providing supplemental support and care from the trust's assets. 5. Charitable Remainder Trust: A charitable remainder trust allows the widow to donate assets to a chosen charity while retaining an income stream from the trust during her lifetime. Upon her death, the remaining assets are distributed to the designated charity. These different types of Fairfax Virginia Deed of Gift to Trust by Single Widow provide flexibility and options for individuals to protect and manage their assets while ensuring the well-being of their loved ones and favorite causes. It is essential to consult with an experienced estate planning attorney to determine which type of trust aligns best with the single widow's goals and circumstances.